Menu

Trading Justice Newsletter

Trading Justice Newsletter

Dear Trading Justice newsletter readers, this is the last newsletter of 2019.

Instead of writing a piece of copy talking about the mistakes made on 2019 as a trader or my perspective for 2020, or, going even further, a piece of copy containing bits and pieces of advice for the new trading year, I’ve decided to write a collection of thoughts about the one thing that caught my attention the most during this year.

No, not the Trade War, Trump impeachment or the Brexit neverending-battle, but negative interest rates and negative yields. Some of you could argue that a negative number is just a number and that we should take care of our lives instead of writing about it, but that is definitely not the case.

Since the New Great Market Depression, the 2008 market crash, central banks around the world have slowly but surely decreased their interest rates. Like a contagious disease without any vaccine researched, mass-produced or tested, it is spreading like wildfire, reaching far corners of the planet, like Brazil, for example. And it changes everything.

That whole approach of saving now so you can have more in the future is now upside down: Spend now and … have nothing in the future. Because you now are paying money to invest, the more you leave your hard-earned money in the bank, the less you will have as time continues to move forward. Couple it with inflation, and you have the best withering-wealth formula ever invented.

What a time to be alive! Get all you know about Intertemporal Choice and the teachings on interest rates from the Austrian School of Economics and throw it in the trash. And while doing so, spend as much money as you can. No saving for rainy days, hardships, children’s education or retirement, just burn the cash.

How not to love Central Banks? With such an abundance of free money with zero or negative interest rates, who would be crazy enough not to use it in unfruitful projects?

Us.

Before you jump into the collection, however, let me tell you something: we are not trying to convey a negative message in the last newsletter of the year. Consider it a warning, not a guide. Once we are aware of the dangers such monetary policies can bring to our money, we can take action to protect it. However vast the darkness, we must supply our own light, as wisely stated by Kubrick.

I remember being young, really young and finding myself thinking about death out of nowhere. From that moment on, I’ve always felt the urgency of doing as many things as I could because life is a miracle and time is a scarce asset.

Time, in my deepest thoughts, was always against me, though. From a very young age, mortality, money and the pressures of life populated my brain together with the tales of bravery from Prince Valiant while my mind was set free to meander the full potential of being whatever I wanted to be.

“I was 29 years old before I suddenly realized that this was life and it was happening and it was not a preparation for something. […] It must have been around that same time I suddenly realized that this was not a rehearsal but this was life happening now. One should grasp the nettle.”

— Roger Waters on the song “Time” in “Pink Floyd: The Making of The Dark Side of the Moon” (2004) —

Traders and investors buy and sell time. Money is just a vehicle. Risk is the bridge connecting both. They trade seconds, minutes, hours. Elongate to days, weeks, months, and years. Pave their way to decades and centuries. Men playing God created money and time as a single entity, and both their own image. Money can grow or wither; it can have intrinsic or extrinsic value; it can go from paper to digits; it can be worth something or nothing, it can be stretched or shrunk, saved or spent, born or die; it can become gold or ether, glow or blow. It is the arrow of time who determines what money was, is and can be.

Time is always there, either with or against us. The sooner we begin, the friendlier time is to our money. However, it is and will always be indifferent to us, like the Universe itself, “[…] but if we can come to terms with this indifference, then our existence as a species can have genuine meaning. However vast the darkness, we must supply our own light.”. Thanks, Mr. Kubrick.

In short: was born, live, soon die. Let’s talk about TIME, then.

“And then one day you find

Ten years have got behind you.

No one told you when to run,

You missed the starting gun.”

We are still in January 2020. Eleven more months and a huge amount of water to run under the bridge before saying goodbye to 2020. Ten more years until we say goodbye to another decade.

What began as laid-back conversations with friends during 2 weeks in the last Christmas, turned out to be extremely thought proking ones. And I am still thinking about them.

We’ve already extensively talked about the “Omelet & The Eggs” and “How chicken nuggets are made” problems. Both generated two long newsletters last year. Still, I don’t think this topic will ever be covered in its entirety, especially when served together on the same plate. Almost all my friends, if not all, are LOSING money, consistently, year in, year out, with their hard-earned money parked in horrible funds composed of an unnamable and indescribable plethora of bad assets paying obscene fees to deliver horrible returns. LOSING I said, and they are STILL thinking they have to do something about it but they are afraid to take action and LOSE money.

I can’t make head or tails of it. Even in my wildest dreams, I would never imagine having such a conversation during Christmas time. They are losing but are afraid of losing. Quite paradoxical.

Time is not on their side anymore it seems. We’ve just started 2020 and they are still holding on to ships that are leaking water through a hole in the bottom. Some of them since the 70s. That is how bad things can get.

In a 2007 interview at the D5 Conference, Steve Jobs quoted Apple former CEO, Gil Amelio, as having a saying:

“Apple is like a ship with a hole in the bottom, leaking water, and my job is to get the ship pointed in the right direction.”

Replace “Apple” for “My investments” or “My savings” and you can listen to my friends speaking about their money during Christmas.

Do you know the difference between stock and flow? Sounds silly but most people don’t.

In short:

Flow is a movie.

Stock is a photograph.

To become truly wealthy, turn the movie into a photograph over time.

The flow variable is time-dependent. Earning $500/month looks awful, per hour looks great and per minute looks like the Empyrean itself. However, it can be deceiving. For example, earning $500,000/year can easily trick you into thinking that you are rich when you are not.

The stock variable is a picture you take from all your assets. Time is frozen here. This is the true expression of financial freedom, especially if they generate robust cash flow and appreciate over time.

This entire intro leads us to the main topic: the ex-NFL player curse. Here are some salary figures from the NFL (source: CNBC):

There are many reasons why athletes go broke, and getting into their personal struggles is not something we desire. The point here is the need to make the distinguishment between flow and stock. People imprisoned into the illusion of being rich due to a robust flow, usually don’t plan their stock.

There is a vast literature out there from real investment books to self-help gibberish that teaches people how to become wealthy. The formula to avoid the ex-NFL player curse is simple, though:

Keep your expenses lower than your income. With the excess cash, buy assets that appreciate over time and generate cash flow.

I tried to sell it as a book but the publishers refused to print a book that’s only one sentence.

Across America, with Mega Jackbox it’s Mega Millions!

What’s up, America! I am John Crow it’s [insert date] and tonight’s Mega Million jackpot is an estimated annuitize [insert amount]. […] Now let’s see if I can make you a millionaire tonight.

Lottery is an institution. It’s been present in the four corners of this planet since the dawn of greed and hope. Change the country, the address, name, and branding but never the people frolicking around the TV set waiting to be the next millionaire overnight.

The most interesting thing about this worldwide lottery-game culture is not the size of the jackpot or the 1 in 258,890,850 probability of winning, but the fact that EVERYBODY, from the girl in the cashier to the Uber driver, has a thorough plan on what to do with it after becoming a millionaire. More or less, this is it:

Their plan is always modest, it seems. I’ve never heard anything like:

“I have this idea that I will turn into a business. It will transform people’s lives, generate billions in revenue every year, help millions of employees and their families all over the globe and become the next 1-trillion market cap company.”

Or

“I am going to grow 130 million dollars into 1 billion in 7 years.”

Or

“I want to be the next Jeff Bezos and build an empire.”

Never. Have you? Their plans always meander gently through the realms of spending (giving away; buying) and blocking income (stop working).

No wonder such stories tend to end in a similar way: from the finest tablecloth to the cheapest mop cloth overnight.

Being a millionaire overnight is not the problem here. It is how you choose to use time in this case: 100 years at 10 mph or 10 years at 100 mph. It’s up to you.

And I guess I lost my way

There were oh so many roads

I was living to run and running to live

Never worried about paying or even how much I owed

Against the wind

A little something against the wind

I found myself seeking shelter against the wind

Time is like gravity in the sense that you can feel its presence everywhere and you also have to employ a great effort to keep yourself into one piece in order to survive their almighty and omnipresent power.

Time depreciates things. It corrodes us and our money, little by little. Insert Central Banks and mutual funds into the same bow and arrow and you have the perfect formula to crash your wealth through time: inflation, Theta (Time Decay), negative interest rates, and obscene fees. All four slowly turning your money into a pile of ashes.

There is an old saying that goes like this: “paper money always returns to its intrinsic value which is zero”. Very true.

If you are one of the regular readers of this free newsletter, inflation is no stranger to you at all. The October 2018 edition was entirely dedicated to this topic, specifically hyperinflation.

Paper money is the money transacted by us on a daily based referred to as fiat currency in technical jargon. Fiat currencies are depreciating assets by nature, with no intrinsic value. They are established as money by a government or central bank regulation. Simply put, our money only has value because the government maintains its value.

Or not.

This is where inflation and hyperinflation kick in.

It’s not because the United States didn’t experience a case of hyperinflation that it won’t happen in any capacity.

Notice in the next chart how steep the U.S. Dollar devaluation becomes short after the creation of the Federal Reserve (1913). In 1971, Richard Nixon put the final nail in the coffin, ending the gold standard, burying the Bretton Woods pretty deep, making the U.S currency a full-fledged fiat currency worth ZERO in terms of intrinsic value.

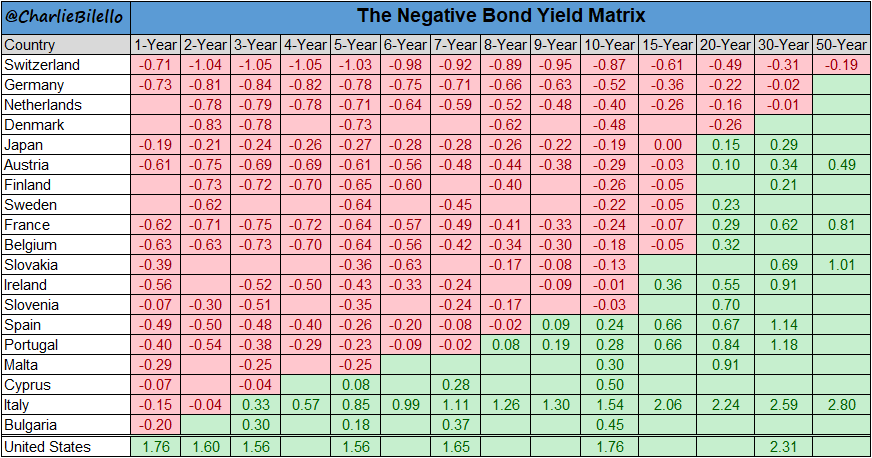

The major central banks have been flooding the markets with easy money for over a decade, expanding their balance sheets from a mere $5 trillion to something around $22 trillion. Their newest weapon is negative interest rates. Last time I’ve heard, something like 20% of the total sovereign bonds issued around the world (≈$ 12.5 trillion) is in negative yield territory. Take a closer look at the following red tide (click to enlarge it):

Three years ago, James Rickards released the book “The New Case For Gold”. Right in the first pages, he lays out the case against Gold in six bullet points. Number five reads “Gold has no yield”. That is a true statement. Gold is money and money has no yield because it has no risk. In fact, this is one of the strongest arguments in favor of Gold.

Sometimes truth is stranger than fiction, though. Now that bond yields are starting to dabble into the realms of negative numerals and the red tide is taking over, Gold is almost becoming a natural carry trade against them. A zero yield can look highly profitable depending on your perspective.

Well I’m older now and still running

Against the wind

Dualism is present in all sectors of our lives, including our own personality and behavior. The Yin and Yang from Ancient Chinese philosophy describe exactly that: how opposite forces may work together, interconnected to shape everything we know in the Universe. Too much order and you create rigid structures that evolve too little over time. Too much chaos and you degenerate into nihilism. Evolution requires balance. Balance requires energy.

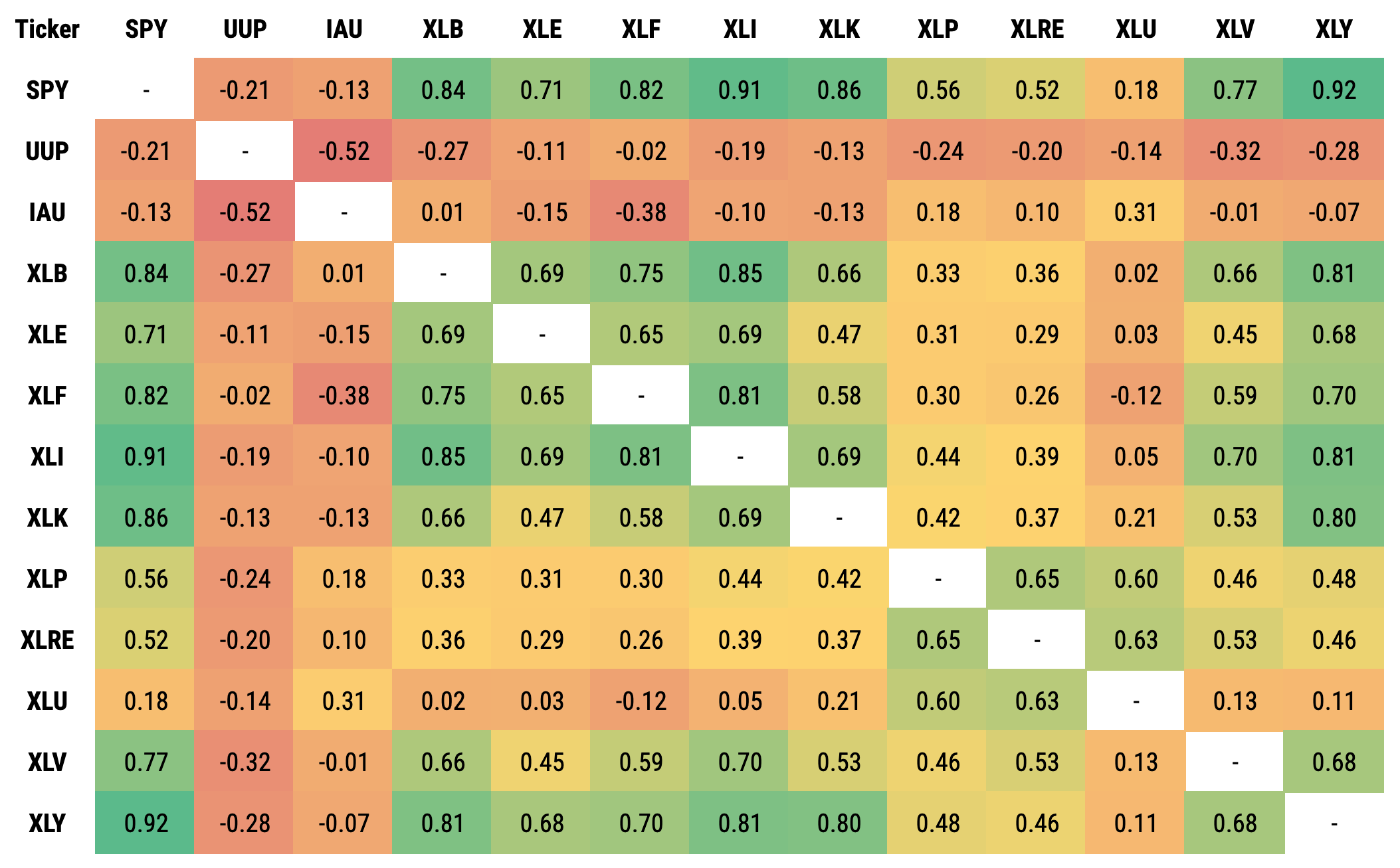

Duality is also omnipresent in the financial markets. There we find aggressive vs. defensive sectors, positive and negative correlations between stocks and the SPY and also between broad market sectors and other vehicles like US Dollar and Gold, for example.

Please, take a closer look at the heatmap below. It depicts the correlation between broad market sectors ETFs, the SPY, UUP, and IAU. The reddish, the lower the correlation; the greenish, the higher.

By definition, correlation describes the relationship that exists between two assets and their respective price movements.

Notice how IAU correlates negatively with almost all other ETFs. Usually considered a safe haven, it’s natural to consider it a lifeline when all other ETFs fail.

That is when we had problems last year:

SPY in 2019: +30.84%

IAU in 2019 +17.88%

You buy Gold to protect your portfolio against economic stupidities and receive an unexpected plus: it becomes #BFF with the broad market. You go aggressive SPY/defensive Gold and both go aggressive.

Diversification is the last free lunch available, I suppose.

“And I saw from the cathedral

You were leaving me

So take my time

And take my lies

‘Cause all the others

They want to take my life”

Isn’t it true that some of us simply can’t avoid making resolutions for the next year while also look back at the year that is now vanishing and think about successes and failures?

Inevitable, I guess.

Let me list below 4 things that are, in my estimation, pretty useful for your next decade. These are timeless principles for new traders. If this list will make you stop to think about your future as a trader and the mistakes you made in the past, our goal was achieved.

It’s impossible to not start with the mindset. Your ego is your worst enemy. Do not try to impose your convictions, opinions, and perfectionism at any cost. Let the data, the method, the trading structure guide you in this business, not the other way around.

Learn how to err simply because you are going to anyways. Just make sure to incur in the type 2 error that is to accept a false null hypothesis. The Type 1 error can lead you to ruin while Type 2 will only make you lose an opportunity in the markets. Learn how to deal with the FOMO too (Fear of Missing Out). That will be pretty useful.

If you don’t trade, you won’t make money. Sounds logical but most new traders are so afraid of making mistakes that they will never graduate from the paper account. Expose yourself to the markets with structure and method. Learn how to lose money, keep your zen and stay in the game.

“When you combine ignorance and leverage, you get some pretty interesting results.”

Warren Buffet is right. Get a $5,000 account to manage some $100,000 and you will be cooking with gas right away. The problem is that you can get burned and blow your account before you notice. Have strict rules and do not use “milk money” but “Caipirinha money”.

Note: For those who were not yet presented to this Brazilian exquisite delicacy here’s the Wikipedia definition:

“Caipirinha is Brazil’s national cocktail, made with cachaça, sugar, and lime. Cachaça, also known as caninha, or any of a multitude of traditional names, is Brazil’s most common distilled alcoholic beverage.”

I couldn’t have said it better myself. Remember this definition when you fund an account to go crazy with leverage trading.

At what point in the process of analyzing equities to build a portfolio can one person distinguish geniuses from the common folks? And where exactly lies one’s EDGE in this business?

When Buffett started to follow Graham’s footsteps there were just a handful of people devouring books filled with tiny little numbers. He could spend an entire week looking at corporate reports to find an EDGE. And he certainly did so.

Nowadays, not only Google has built geniuses overnight but we are competing with real geniuses and algos from all over the world in this craft of picking stocks to compose a long term, durable, game-changer portfolio.

That is when having gray hair (or no hair at all) becomes the EDGE.

While young, we arrogantly believe in reason and idolize precise calculations like they are Data Gods. We don’t want to hear anything else, just “show me the data”. Long Excel.

As we grow old, we turn ourselves to philosophy and fiction. Less numbers, more books, and long conversations. We humble ourselves, read and listen a lot. Long Word.

With 70+ years of experience and 40+ annual letters written, individuals like Buffett can be considered an encyclopedia, almost the financial markets’ Akashic records. The absence of color in his hair shows how long does it take to achieve such wisdom.

Apart from the US-China trade tensions (not over yet) and Middle-East tensions (millennia-old), and a few other tensions that will certainly popup during 2020, there is one event that will surely shape the markets no matter what, from here until the end of time: the 2020 United States Presidential Election. Not only the markets, but it will also shape the social media landscape and future meetups with friends and family.

Trading is, above all, an exercise of humility. We know the events are com‐ ing, we cannot escape them, still, we don’t know what is going to happen, who will win or lose, the aftermath and the market’s reaction.

This leads us to pick our favorite strategies for 2020. Me, particularly, Vega and Theta. With volatility spikes here and there and the shaken prices due to flammable news, these are my picks.

— “Jesus, aren’t you embarrassed by saying something so obvious? I am really disappointed.”

Look, in soccer, a goal scored with a rocket free-kick is worth the same as a goal scored with a gorgeous, picture-perfect bicycle kick. The former is simpler, the latter will lead you to the Soccer Players Pantheon, but both scored. Furthermore, a free-kick has a higher probability of scoring, whereas 9 in 10 bicycle kicks go wrong.

Do you want to make it to the Traders Pantheon or do you want to make money?

In a year that will be particularly sensitive to news, there is nothing wrong with trading simple and profitable strategies against the same vehicles over and over again.

Remember: the stock market is a huge machine that transfers money from the arrogant to the humble trader.

If being obvious in trading makes you feel uncomfortable it’s OK, trade it, make money, just don’t tell anyone.

Each end of the year I dream of snow and food, two of my favorite for this time of year. And while my inbox and feeds are always SWAMPED with hot stock lists for the year to come and also analysts embarrassing themselves with some dreadful market and economic forecasts, I always catch myself thinking about my portfolio between drops of plans for the future and dreams of a prosperous life.

For many people, having only 10 more trading days left in a year is a relief. These traders have been suffering all year long with news from the front. The opening bell is like a call to the slaughterhouse. For the past 242 trading days, they have experienced nothing but strong emotions.

To the wise trader and investor, the consolidated portfolio is what matters in the end. Some positions perished, some flourished and some just sat on the spreadsheet doing nothing but aging. Tweets, trade war, currency devaluation, FED meetings, job reports, oil inventory and the like, if they were not trading them to make money, they didn’t care about them at all. A solid and diversified portfolio with proper risk management worked wonders for their peace of mind.

“What about your portfolio for 2030?”, you might ask.

Then I answer you back with a question: “Why it should be different from my portfolio for 2020 or any other year?”

If building wealth is a long term plan, we have to be the best investors we can possibly be no matter what year it is we are living.

If inside our portfolio lives our trust, the future of our family, our horizon line should be stretched to the next 20, 30, 40 years. That’s the Endowment Fund mentality most investors refuse to adopt.

The 10,000-year Clock. Image: Rolfe Horn/The Long Now Foundation

Long-term thinking is essentially gone. Extinguished. The faster/cheaper mentality replaced the slower/better a while ago.

In The Dao of Capital, Mark Spitznagel talks about the depth of field, a concept that helps us focus on the temporal side of things. The seen—visible and immediate—is easily grasped. The yet unseen, coming next as a consequence of the seen can become the foreseen. Once we extend our depth of field from the immediate to the intermediate and beyond we are able to build this time sequence bridge, from seen to unseen, making the future a little bit clearer, although still opaque and unpredictable.

The Clock of the Long Now, also known as the 10,000-year clock, was a project conceived by Danny Hillis in 1986. According to Wired Magazine, nobody actually started building a full-scale 10,000-year clock until Jeff Bezos put up about $42 million in the project.

Instead of focusing on the amount of resources and work such a project will consume until finished, let’s get to the design principles, clear and concisely laid out by The Long Now Foundation on their own website:

With occasional maintenance, the clock should reasonably be expected to display the correct time for the next 10,000 years.

The clock should be maintainable with bronze-age technology.

It should be possible to determine the operational principles of the clock by close inspection.

It should be possible to improve the clock with time.

It should be possible to build working models of the clock from table-top to monumental size using the same design.

It looks like a successful trading system design, doesn’t it? It should. The same principles can be applied to your trading and investing journey through time. Pave your way. Elongate your depth of field. Embrace time.

Happy New Decade.

© 2019 Trading Justice. All rights reserved.