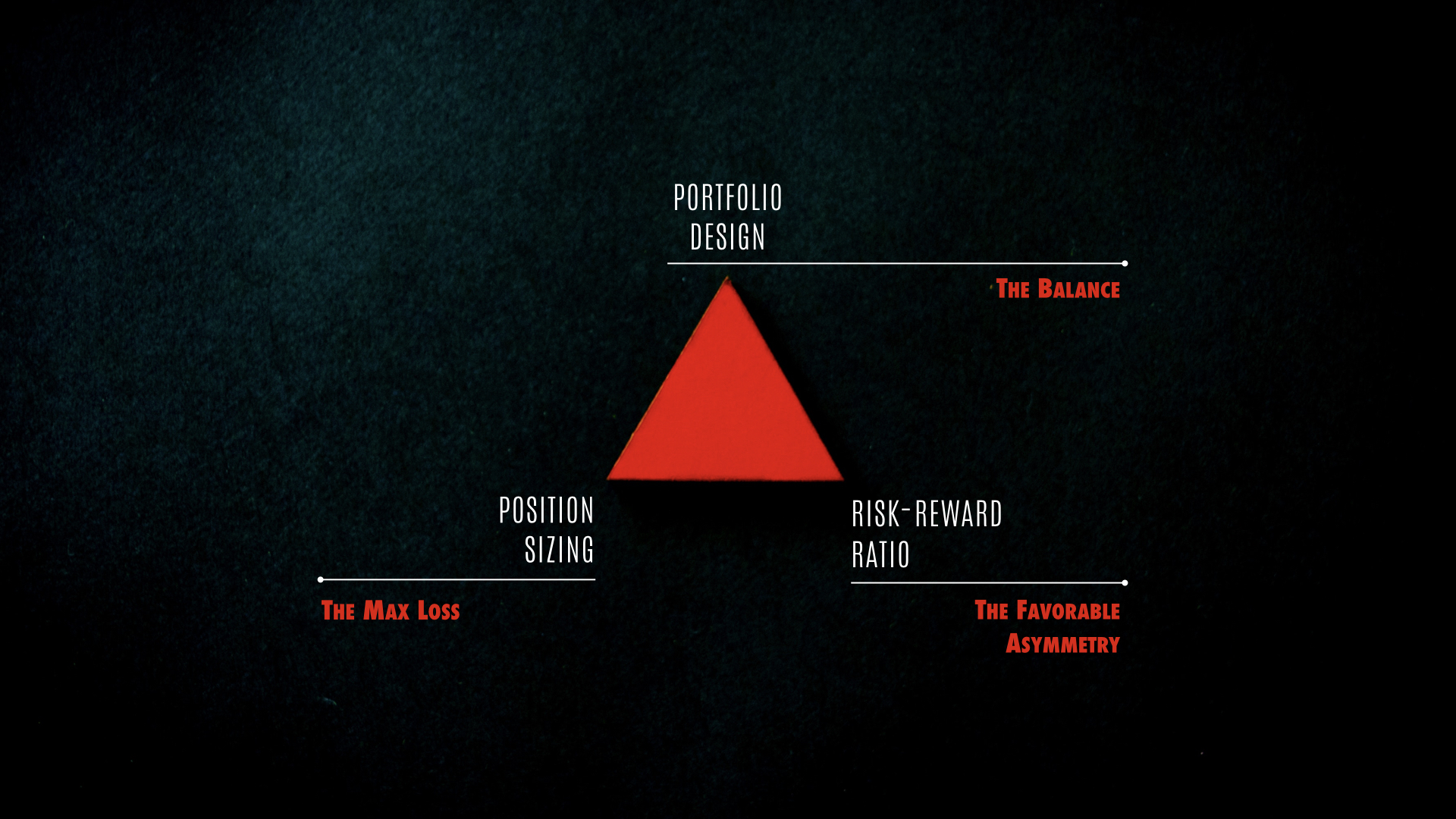

“Portfolio Design, Position Sizing, and Risk-Reward.

Master the Holy Trinity of Trading and you shall succeed.”

— Tackle daily email: January 9th, 2019 —

A Whole New World

A new fantastic point of view

No one to tell us no

Or where to go

Or say we’re only dreaming

If you search for Holy Trinity on the internet you will find quite an impressive number of resources, ranging from religious texts to the Matrix, from marketing to investing.

However, we’ve got our own version:

The same way that if you go to Google and search for Portfolio Design, Position Sizing (or Money Management) and Risk-Reward Ratio (or Reward to Risk Ratio) you will be swamped, drowned, flooded with references.

We agree that discussing Portfolio Design, Position Sizing and Risk-Reward Ratio for three consecutive editions can be extremely boring and that’s not what we want. Instead, we are here to talk about these topics in the Trading Justice way, that is, more like a light-hearted, philosophical, humorous conversation between friends. Instead of going full pain-in-the-ass, do-this-do-that, we want to share a whole new world with you.

Here’s the Holy Trinity of Trading game plan for our readers:

Portfolio Design represents the balance inside the Trinity. This is the topic we’ll be discussing in this edition (February 2019).

Position Sizing (also called Money Management) represents the max loss inside the Trinity. This topic will be discussed in the March 2019 edition.

Risk-Reward Ratio (also called Reward to Risk Ratio) represents the favorable asymmetry inside the Trinity and is reserved for the April 2019 edition.

In the beginning

In the beginning, there were the financial markets. People would stare at them and start reasoning about what to do with them. Then, one-by-one, they decided to try and invest, trade, buy and sell. Some got broken along the way and promised never to go back there again. Some did succeed by having the momentary companion of Lady Fortune, after which, they got broke and promised never to go back there again.

But some strived and succeeded. And continued. And succeeded again. And stumbled upon a large number of obstacles. And learned from their mistakes. And succeeded again, over and over again.

These individuals became legends. From legends, they became myths. And as myths, they made it to the eternal Investors Hall of Fame.

What are these individuals? Geniuses? Beings from another dimension? Robots disguised in human flesh? What do they eat? How did they survive the elements?

In the video “Warren Buffett’s First Television Interview – Discussing Timeless Investment Principles”, available on YouTube, when asked what did he consider the most important quality for an investment manager, Warren shoots:

– It’s a temperamental quality, not an intellectual quality. You don’t need tons of IQ in this business. I mean, you have to have enough IQ to get from here to downtown Omaha but you do not have to be able to play three-dimensional chess or be in the top leagues in terms of bridge playing or something of a sort. You need a stable personality. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd. Because this is not a business where you take pools, it’s a business where you think and Ben Graham would say that you’re not right or wrong because a thousand people agree with you. And you’re not right or wrong because a thousand people disagree with you. You are right because your facts and your reasoning are right.

Yes, you don’t need any extraordinary math skills or the highest IQ—that’s what one of the legends that became myth said. You just have to have a soul of steel. In the center. Neither falling off of a cliff when you lose, neither popping champagne on every single winning. Stable. Serene. The discipline of a Shaolin monk. The spectator of your own ego. Charity, not vanity. Your convictions and structure will be tested by the markets sooner than later. Like Antaeus, son of Poseidon and Gaia, as long as you remain with both feet in contact with your mother, the Earth, you will win, otherwise, the markets will defeat you with their Herculean powers.

Hércules luchando con Anteo (Hercules fighting with Antaeus) by Francisco de Zurbarán (1598–1664)

It’s not that this is something new to Tackle Traders. In our System Development 101 video series we’ve talked about the System-Thinking Approach:

[…] The mindset behind a trading system is everything. You can have the best system in the world, backed up by the best idea there is, taught by the best trader available. Without the proper mindset backing up a proper execution, you will fail epically.

[…] When a given system depends on us to execute it, we fail to deliver what it needs. We think too much, contextualize too much, hesitate too much, feel too much, analyze too much,fear too much, hope too much. No wonder why computers are so fast: they just execute the rules inside the system they were built to be running. This is what computers do. We don’t.

But we can. Just like computers, we can run the rules without hesitation.

This is what we call The “System-Thinking” approach. It consists of a mindset that neutralizes our feelings and emotions. Fear, greed, hope, and despair—although part of our innate set of evolutionary capabilities—are bad for trading systems. The “System-Thinking” approach brings order to this chaos, removing the (too much) human part from trading.

. . .

I can hear these words echoing out there in the ether and coming back with the following reasoning:

— OK, I have a soul of steel, I am in the center, I am the spectator of my own ego. With that said, I want a balanced portfolio, I want to be a trader and a long term investor. Do you have some guidance? How should I design my portfolio?

The answer is simple: it depends.

It depends

~ If I had all the answers how great and dull life would be.

When I was new to trading I got the same questioning consuming my spirit. Instead of keeping it to myself, I took a step further and sent an email to Tim Justice—he was my Mentor at that time—hoping my Monday Morning Mailbag would become a video. Fortunately, it did.

Now I don’t feel I need to scratch that itch anymore but at that time—not even a trader for an entire month, let me be very clear on that—, I couldn’t even sleep without learning upfront how to design my portfolio.

“He who has a why to live for can bear almost any how.” ― Friedrich Nietzsche

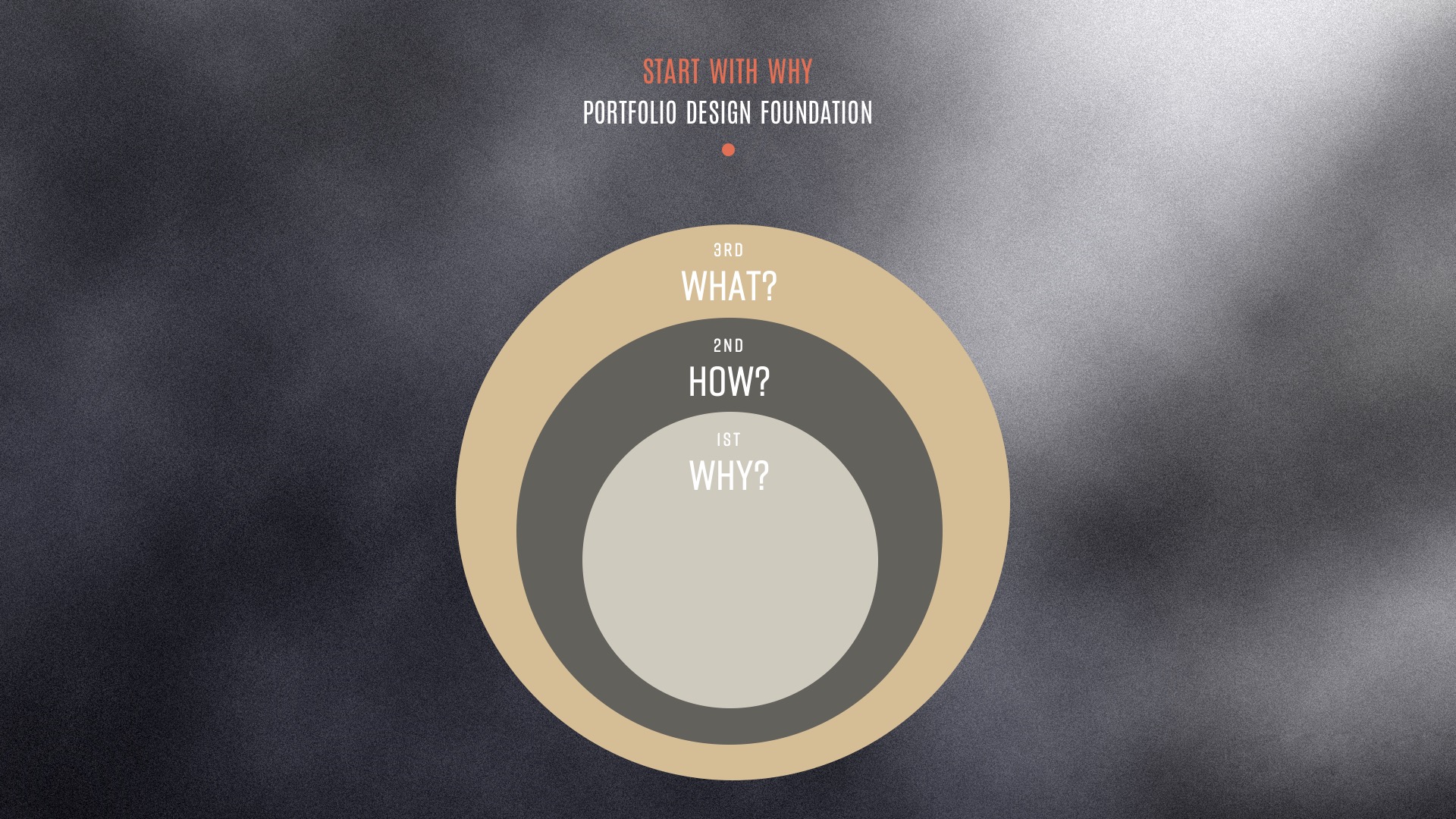

The Portfolio Design must start a philosophical questioning: WHY. There is no such thing as a perfect one-size-fits-all portfolio design out there because each one of us possesses a different WHY. That is when you need some guidance and the most appropriate will only come from a Mentor. We’ve also covered this topic in great details in the System Development 101 series. Sit down with a Mentor and set your goals.

- What drives you to become a successful trader/investor?

- What do you want as a trader/investor?

- What are your goals for this year/this month/this week/today?

- Are your goals feasible?

So, in order to start designing your portfolio, or, at least, start thinking about designing your portfolio, we recommend you have at least four things:

- Whys and Goals

- A Mentor

- The right mindset

- Capital

Once you take a hold of these you will inevitably be led to the Trilemma.

The Trilemma

“Every choice is a renunciation. Indeed. Every choice is a thousand renunciations. To choose one thing is to turn one’s back on many others.”

― Ronald Rolheiser —

Our life is full of trade-offs. We, humans, want a pack with 100 gold coins and life gives us 100–(x), where (x) is the number of coins we have to earn during a lifespan through hard work, choices, and renunciations.

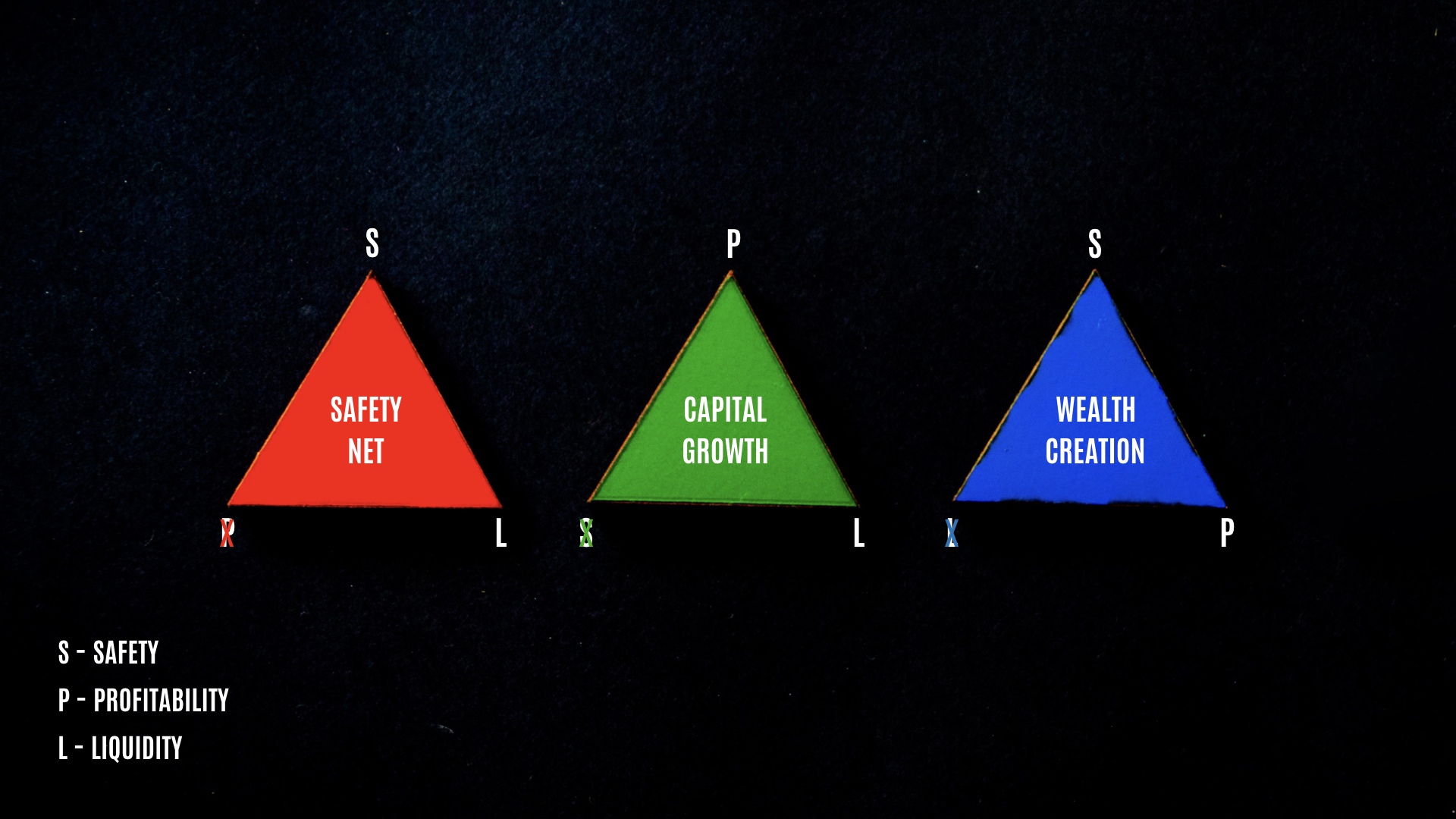

There is not a single investment or trading strategy that encompasses all the virtues we want: Profitability, Safety, and Liquidity. The investing Trilemma is clear: choose two, let one go.

1. If you want a safety net, prioritize Safety and Liquidity. Let go of Profitability. This is your safeguard against a possible hardship.

2. If you want capital growth, prioritize Profitability and Liquidity over Safety. To accomplish this goal, you will take more risks. Most traders belong to this group.

3. If you want long-term wealth creation, you will marry Profitability with Safety. Liquidity stays on the sidelines. Think about someone who invests in art, properties, and precious metals.

One is not better than the other. In fact, we can run all three scenarios during our lifetime as the whys will naturally change.

The extension of oneself

Your portfolio must be an extension of yourself. Let me develop it:

You are a drummer. Try to sound like John Bonham. His legacy is there, I am sure in a great remastered stereo mix that is so good, so clear, so vivid, that you can probably hear the sound of him breathing together with his triplets. Learn every move, every groove, every beat, every intro, every fill. Purchase the same drum kit. Now, go ahead and try to sound like him. Why nobody can? Because his sound, his groove, his feeling, his touch, his emotions and the way he approaches his drum kit could only come from him. His drumkit and the sounds he extracted from it were an extension of himself. He had the drum sounds in his head and had to hone his craft to the point that he could translate to the physical world what was in his head.

You are a guitarist. Try to sound like Kurt Cobain.

You are a saxophonist. Try to sound like John Coltrane.

You are an investor. Try to be George Soros.

You get the point. Grabbing the SEC filings from someone like Soros won’t make you the next George Soros.

What’s in your head in terms of investment? What’s in your head in terms of trading? What do you want? Your portfolio must be an extension of yourself. Translate what’s in your brain into words. Words into action. Learn, hone and master the craft so the translation is perfect and your portfolio is the very extension of yourself.

The Midnight Rider

We tend to choose instant gratification over long-term responsibility. We want to make money now so we don’t work over long stretches of time until, despite our cries, time is stretched for us and, at some point, we will have to embrace it: in order to build wealth, we must forego expediency.

That means we must take the winding road less traveled, meander, take the roundabouts of the financial markets, which bends our perception of time. Taking the right in order to reach the left and vice-versa. In a sense, we must love losing money in order to make it.

As once stated by Dr. Van Tharp, we don’t trade the markets themselves but only our perception of them. Therefore, the markets, and by mere logic, the strategies we use to approach them, are not a plug-and-play solution to make money (for some, still more like a plug-and-pray).

Mind comes before action. Reasoning and thinking are paramount. Action becomes pointless and baseless without them. While everyone in their hungriness takes the shortcut, we travel by midnight.

And the road goes on forever.

And I’ve got one more silver dollar.

But I’m not gonna let them catch me no

Not gonna let them catch the midnight rider.

Risk is Relative

“Investing is an activity in which consumption today is foregone in an attempt to allow greater consumption at a later date. “Risk” is the possibility that this objective won’t be attained.”

— Warren Buffet in his 2017 Letter to Shareholders —

Investors buy risk. Traders buy risk. Risk, although at the very core of our business, is a relative measure. A well-balanced portfolio can make this seven-headed beast look like a teddy bear. Let’s check some examples on the relativeness of risk:

Iron Condors are risky

It depends. A portfolio that is 100% composed of Condors is one thing. A 20% allocation on Condors balanced with other non-range bound cash flow strategies and also delta strategies is completely different.

Cryptocurrencies are risky

It depends. A portfolio that is 50% composed of Cryptos is one thing. Another thing entirely different is allocating 1% on them just as an explosive directional bet.

Bonds are safe

It depends. What if the Government defaults? What if they move the interest rates to negative ground? What if inflation outpaces the interest paid on your investments? A portfolio entirely composed of government bonds is one thing. Allocating something like 50% is completely different.

Low VIX = no risk

It depends. Absence of evidence is not evidence of absence. It’s not because the financial market agents, makers, and participants do not perceive the risk that it’s not there at all. The complete absence of volatility, as we saw in 2017, is even more dangerous as it reveals complacency towards risk, implicating in more risk taking and leveraging. This opens the doors to unknown risks, the ones we are not even aware of and, therefore, not prepared.

Paranoid

Take a closer look at the picture below:

The Bovespa Index (Ibovespa, São Paulo, Brazil), from 2007 to 2019.

The Bovespa Index is the flagship index of the Brazilian stock exchange. The index includes 68 of the 370 companies listed on the exchange. The Brazilian exchange has a market capitalization of about $1.1 trillion (the 10th biggest in the world) and a trading value of $1 trillion a year, making it the largest emerging market exchange outside of China.

— Source: nasdaq.com —

This is a very interesting chart to illustrate the point. Let’s discuss the three moments highlighted on the chart.

1: The U.S 2008 sub-prime crisis.

Although at that time the government said Brazil was bulletproofed against the American meltdown, we can attest that they were wrong.

– Top: 73920.30 points

– Bottom: 29435.11 points

– Crash: –60.18%

– Duration: 5 months

2: The biggest recession in the Republican era.

The socialist labor party took office for a third and a fourth time and started to follow the socialist’s economy playbook to the letter. A series of economic experiments and interventions led Brazil to the biggest recession in its Republican history.

– Top: 73103.28 points

– Bottom: 37046.07 points

– Crash: –49.32%

– Duration: 64 months

3: Truck drivers strike

Brazil still relies heavily on road freight transportation. On May 2018, the truck drivers started a major strike throughout the country. Brazilians, with their peculiar sense of humor, called that week the “Venezuela week”, as basic products were already lacking on the shelves.

– Top: 86678.21 points

– Bottom: 69068.77 points

– Crash: –20.31%

– Duration: 1 month

What those three events had in common? Nobody saw them coming. The message here is that a little bit of paranoia can go a long way in helping you design your portfolio.

- What if the U.S. Dollar crumbles?

- What if the U.S. Dollar loses its reserve status?

- What about a global full-scale war?

- What if they shut down the market for the next 10 years?

- What about dishonest people?

- What if you die?

You don’t foresee these coming in the near future, do you? But what if…?

— “I only have 10 long positions going on, so, I don’t have a portfolio.”

The problem with this mindset is that YES, indeed you DO have a portfolio, you just don’t know it yet and that can be dangerous. Financial markets belong to the Extremistan world, as wisely stated by Nassim Taleb. They move in big jumps and crashes.

Again, in the System Development 101 series, we’ve talked about hedging like an onion: our suggestion is that you start small, thinking about hedging a single position. Then you amplify your studies to a group of positions (a system) and then to your entire portfolio. Then you extrapolate to external factors such as currency devaluation, crooked people, and inflation. Then you start to think of extreme events like a market shutdown and your own death.

. . .

All we’ve talked about so far makes no sense at all if not put into practice. Ideas without exposition are worth zero. They only begin to gain some intrinsic value when submitted to the harsh reality.

Getting pragmatic: Tales of diversification

“Don’t put all your eggs in one basket.”

— Grandma —

The day Buffet and Taleb meet is the day Concentration meets Diversification:

— Buffett: “Dear Taleb, I think we greatly disagree with one another on this point. I firmly believe that diversification is protection against ignorance. It makes little sense if you know what you are doing. If you really know businesses and you can identify six wonderful ones, that is all the diversification you’ll need. Don’t you think?”

— Taleb: “You have good arguments and I greatly respect you, but the problem is that, normally, we don’t know what we are doing. We think we know. That makes understanding a poor substitute for convexity and I’d shoot for the latter. Systems that lack redundancies tend to blow up. Although my studies greatly differ from those of Markowitz, he nailed the point: Don’t put all your eggs in one basket.”

If we have a screenplay writer among our readers, please, step forward and write a scene with these two meeting. My popcorn is ready.

Grandma is right, as usual. We should never put all the eggs in one basket. What she forgot to tell us, though, is that there are literally hundreds of approaches to accomplish that same goal.

Although Warren Buffett preaches concentration, if you grab Berkshire’s SEC filings you will come to the conclusion that there’s more diversification there than in most portfolios you will ever encounter down the road. He is heavily concentrated on business that he perfectly understand, and that’s quite a diversification strategy.

Nassim Taleb’s approach is also very simple: “If you know that you are vulnerable to prediction errors, and accept that most “risk measures” are flawed, then your strategy is to be as hyper-conservative and hyper-aggressive as you can be instead of being mildly aggressive or conservative.”. His Barbell Strategy is utterly simple: nothing in the middle, like a barbell. On one end, hyper-conservative assets, like Treasury Bonds, for example. On the other end, the hyper-aggressive assets like stocks and derivatives.

With the Paradox of Higher Returns with Lower Risk (available on YouTube), Mark Spitznagel puts dynamic hedging in the spotlight. The Tail Hedge system he developed based on his studies in the Austrian School and market interventions by Central Banks, allows his clients at the Universa Investments to be hyper-aggressive by protecting their portfolios from fat-tail events, the ones that usually happen during excess of liquidity and artificially low volatility environments. This approach provides room for a much substantial allocation on high-risk assets than the common 60-40% method.

Getting pragmatic: The Curator

~ Your portfolio is not a warehouse.

Curators are responsible for assembling, cataloging, managing, and displaying artistic and cultural collections.

Imagine you’ve been hired as the curator of the Miles Davis definitive exhibition. You’re responsible for assembling, cataloging, managing, and displaying his powerful and everlasting body of work, produced during a career that spanned some 47-year period. According to Wikipedia, his major discography consists of at least 51 studio albums, 36 live albums, 35 compilation albums, 17 box sets, 4 soundtrack albums, 57 singles, and 3 remix albums. You have to decide what comes in and what goes out. Packing his entire work into a single room is like turning the exhibition into a warehouse.

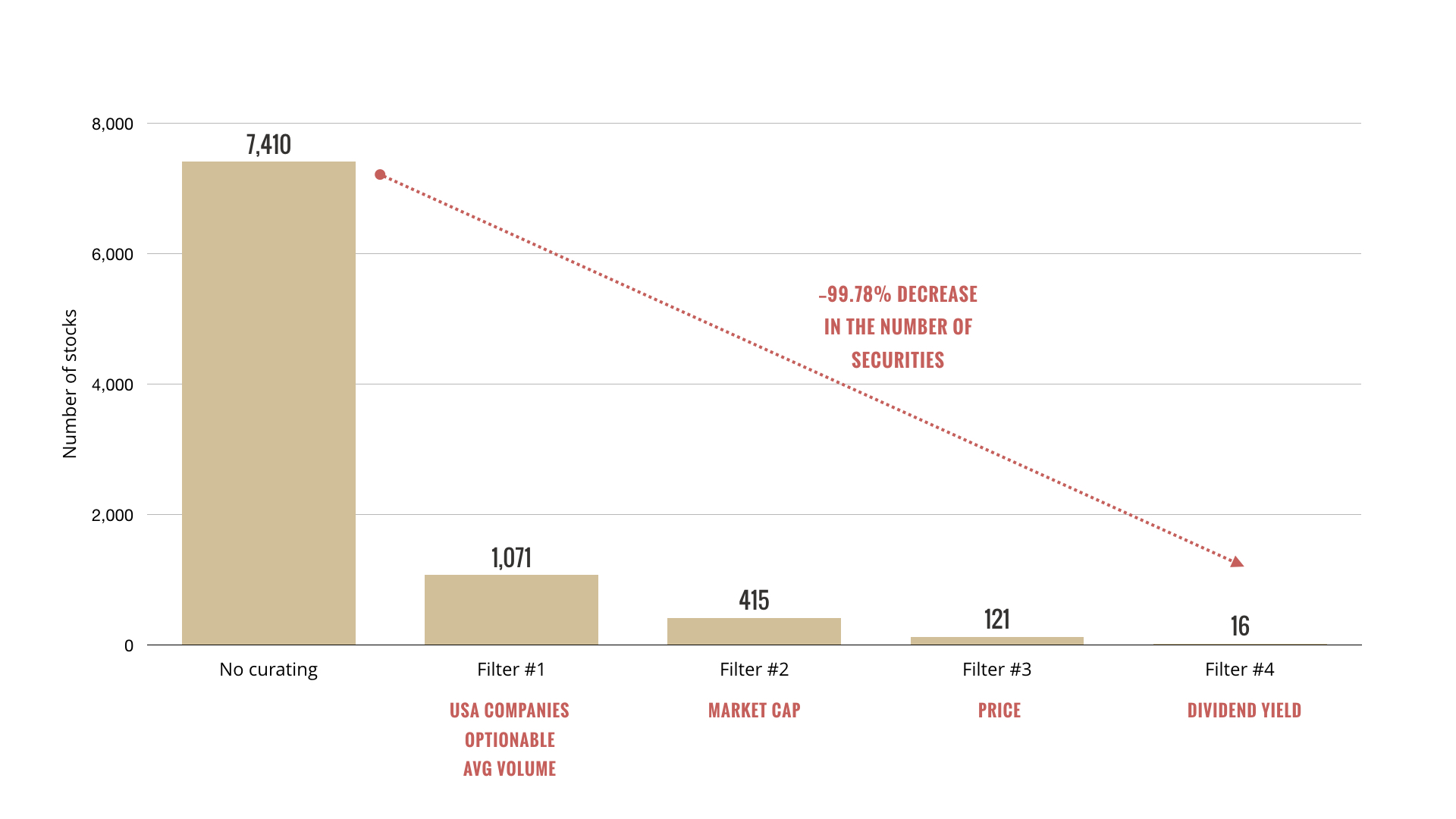

The New York Stock Exchange (NYSE) is the world’s largest stock exchange by market capitalization of its ≈2,400 listed companies at US$21.3 trillion as of June 2017 (Wikipedia, again). Finviz has 7,410 securities listed on its screening tool.

The point we’re trying to make here is that your job as a trader is exactly that of a Miles Davis’ curator. You will be selecting a handful of securities to compose your portfolio. You have to decide what comes in and what goes out and what to do with each one of the selected. Packing dozens of securities together is like turning your portfolio into a sinkhole that will drain your money and time out.

Think of yourself as a curator. The curator’s job is to say no. Yours too.

Learn to say no.

Say you want to build a cashflow portfolio. Your plan is to sell puts to buy the stocks at a discount and then sell calls against them. On top of that, you want to receive nice dividend payments. How to build such a portfolio on a small account when there are 7,410 stocks available on the Finviz screening tool? That’s an important skill you have to develop as a trader: being a curator.

Getting pragmatic: Silos

~ From macro to micro

There are many ways you can structure a portfolio:

- Stocks vs. Bonds;

- Safe Haven vs. Risk;

- Risk vs. Insurance;

- Cash Flow vs. Directional;

- Growth vs. Insurance;

- etc.

Although it all boils down to personal preferences, here at Trading Justice we preach and teach the following approach:

Cash Flow – The name says it all: money flowing. The Greek is Theta. The classical approach to this silo is to allocate money into option-selling strategies such as Naked Puts, Covered Calls, and Iron Condors, i.e., strategies that benefit from time passing.

Growth – Typically, this is the Warren Buffett/Peter Lynch silo where you will allocate part of your capital in growth assets. This way, you will get exposure to both the market and the corporate cycles. This is a low volatility silo where the fundamentals play a major role. A few examples would be stocks that pay dividends or even companies that have great fundamentals but are undervalued by the market. You can include in this silo the Covered Call strategy as its compounding-return nature can greatly benefit the growth of your portfolio.

Speculation – Directional positions, explosive bets. This silo is composed of assets and strategies that will greatly benefit from a directional movement (up or down). The Greek is Delta. Virtually any asset can be allocated here: stocks, options, currencies or cryptocurrencies as long as the goal is to benefit from directional movements. Volatility plays also fit very well in here.

Hedge – This silo is composed of assets and strategies which sole purpose is protection, not profit (see Paranoid section). You can go even deeper and subdivide it into:

– Classic Hedge – Currencies and precious metals.

– Dynamic Hedge – Out-of-the-money puts (OTM).

Cash – Money that is sitting on the sidelines either for protection or to jump into opportunities that will inevitably show up.

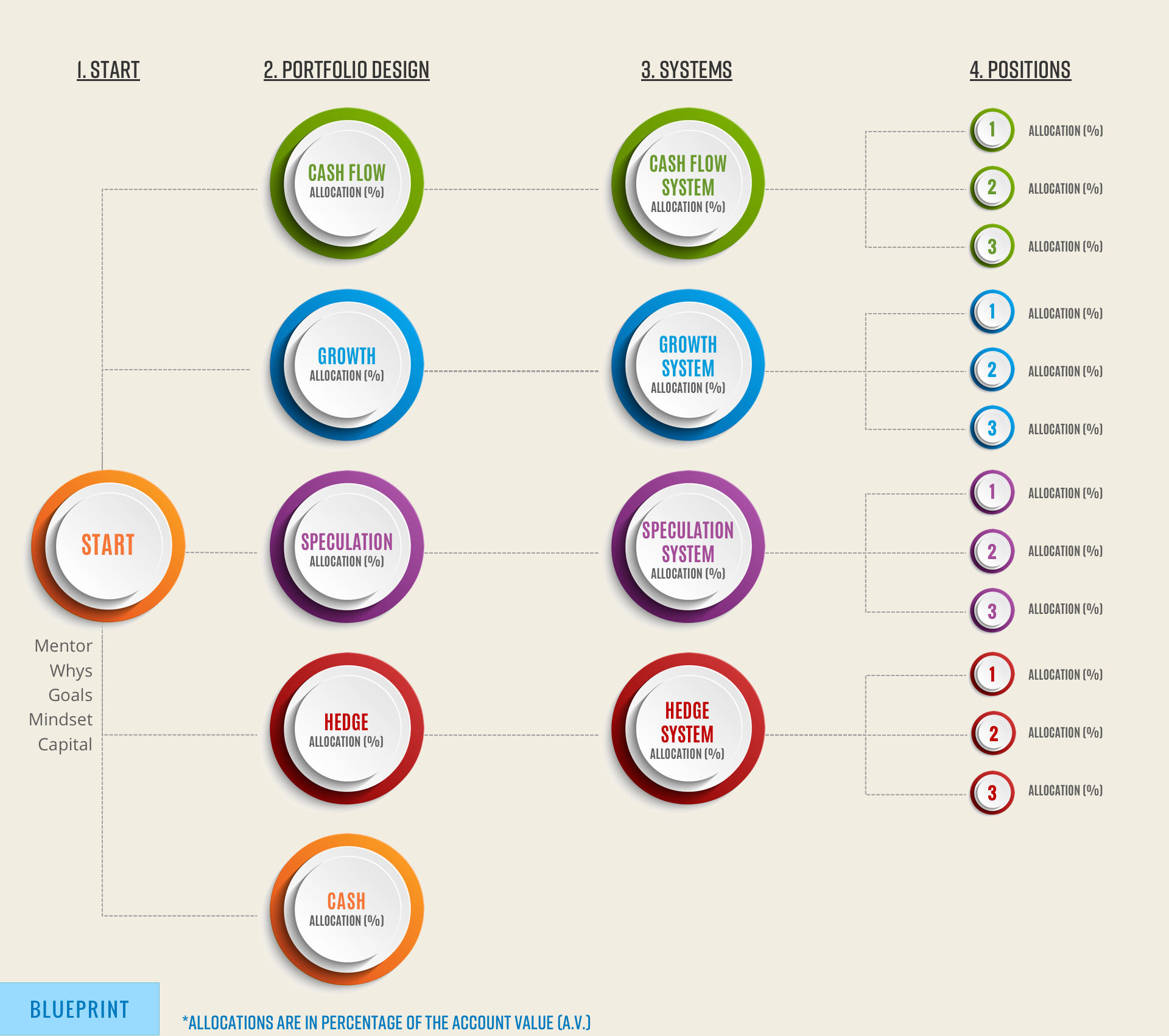

You don’t have to have all four silos in your personal portfolio. Anyway, visually, the silos would look like this:

You’ve certainly noticed that each circle has an allocation percentage. This will be the topic discussed on the next month’s edition of the Trading Justice Newsletter, The Holy Trinity of Trading Part II: Position Sizing, one of the most important skills a trader

You’ve also noticed that Step #3 consists of systems, in this case, one for each silo (could be two, three or even more than that). This is our approach at Tackle Trading: trade the strategies within a system. Your trading business will greatly benefit from this approach.

Once you’ve split the capital, start allocating. That will be as easy as clicking buttons.

Getting pragmatic: Sherlock Holmes

~ Data, data, data, I cannot make bricks without clay.

If you’re not a data-driven individual, at a certain point you will find it hard to design and manage your portfolio. But not only that, you’re going to see for yourself that for both Position Sizing and Risk and Reward Ratio you will need some basic data-collecting and data-analyzing skills.

On September 2018 we had the good fortune of reading a post shared by one of our members in the Clubhouse, David Ciporkin. From that masterpiece of trading wisdom, we want to highlight two parts that stood out for us:

1) The use of words that every new trader needs to include in their personal trading dictionary right from the start:

– “Trading plan”

– “Baseline Reward/Risk Ratio”

– “Money Management”

– “Forward tested, backtested, and stress tested”

– “Trader Psychology”

2) “[…] if you want to get to the next level and improve and be consistent, then you have to have rules, and you have to keep statistics and record EVERYTHING you can in the beginning. Make a monster Excel sheet. Learn from your WINNERS. See what all the big winners had in common, and add that as a rule. […] This will maximize your “Reward”. Now, look at what your big LOSERS have in common, and add a rule to your trading plan which will eliminate those. Now you have optimized your “Risk.”

Sherlock Holmes is an inspirational character in many ways. David, in this particular case, is like Mr. Holmes: he wants to investigate all the details in his positions. He wants to discover what works and doesn’t. He wants to gather all the available evidence to explain why his winners are winners and losers are losers. He wants to build a story that makes sense. And for that, he needs data.

You too.

Data, data, data, you can’t make bricks without clay.

Getting pragmatic: Current vs. Ideal

~ Balance, rinse, repeat.

Capital allocated, data collected, broken and analyzed. Done!

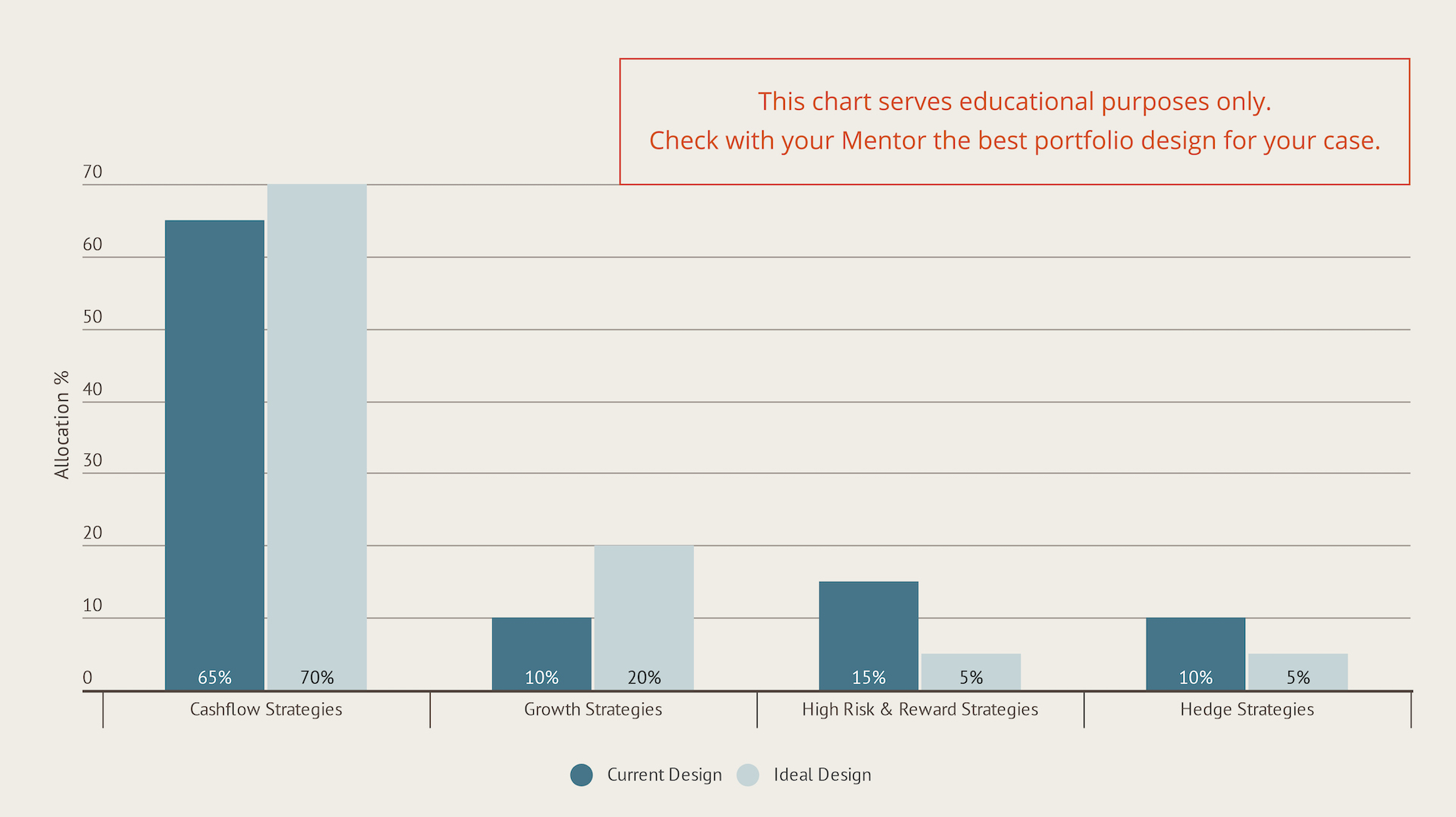

Calm down, we’re almost there. The last step is rebalancing the portfolio. As positions keep coming and going, the amount of capital allocated on each system and on each position starts to move, skewing the percentages from the original design. That’s normal, bear in mind.

We recommend you keep it simple: the chart below depicts a fictitious example. It compares the current capital allocation against the ideal one inside the four major groups of strategies we’ve designed on the silos section. This is a simple chart you can easily develop from the journals available at the Tackle Trading store.

How successful traders and investors are born?

The first step is mastering Portfolio Design. A well-balanced and well-thought-out portfolio can work wonders. Like flowers in a garden, individual positions will perish. The contrary is also true and some positions will blossom and bloom in wonderful profits. The consolidated result counts much more than individual positions. A skilled trader is also a skilled gardener of his/her own portfolio.

See you in the next edition, where we will be discussing Position Sizing, also called Money Management.