This month’s message takes us into journaling and equity curves. We’ll explore the process of recording your trades and tracking the returns of your various systems. Doing so over time creates an equity curve that reveals much about your trading system’s personality. By internalizing its strengths and weaknesses, you will better understand how and why it’s profitable. Of course, if it doesn’t turn a profit, you’ll find out and be able to pivot to better strategies.

Let’s begin.

Importance of Journaling

“When performance is measured, performance improves. When performance is measured and reported, the rate of improvement accelerates.”

Thomas S. Monson

Intelligent business owners track their income and expenses. They don’t just know if they’re making or losing money. They know why. If they sell a product that they can’t consistently turn a profit on, they stop selling it. They can tell you which product generates the best sales and adds the most to their bottom line.

Can you do the same with your trading business? If you can’t, you need to start using a journal such as the Tackle Trading Trade Journal.

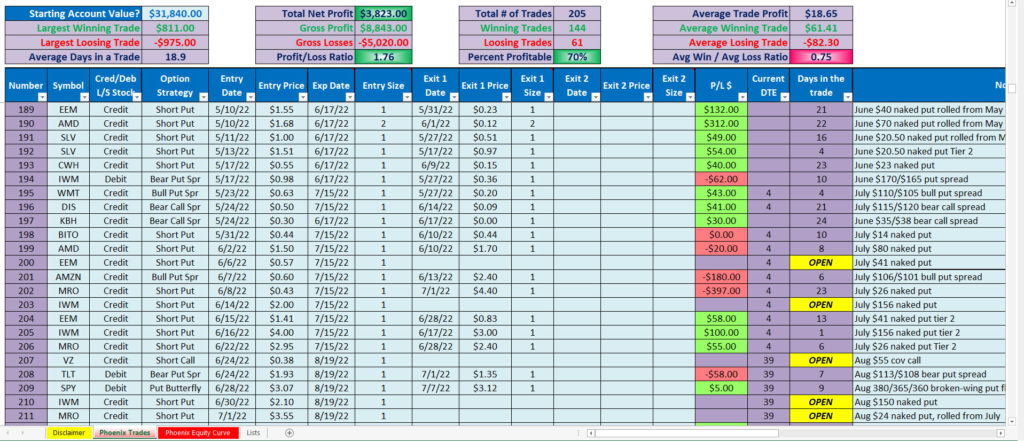

It’s easy to fill out and auto-calculates vital variables that help you analyze your performance. Consider the following journal that includes practice trades taken in the Team Phoenix Trading Lab at Tackle Trading over the past year.

There are well over 200 trades, giving a significant sample size to draw conclusions from. Randomness reigns in a small data set, so building a collection of 50+ transactions will allow for more meaningful takeaways. It also helps to test your strategy and systems over various market conditions. It provides a more realistic view than if you were to only look at how you fared during favorable conditions. For instance, the Team Phoenix journal above encompasses July 2021 to July 2022. The first six months saw a strong bullish market, and the last six months saw a volatile bear market.

Many rookie traders pass judgment too quickly and with too small a sample size. They learn a bullish system in a bull market and think it’s bulletproof. Then a bear arrives and destroys them. Or, they learn a bullish system when we’re in a raging bear market and conclude it’s a terrible strategy before seeing how it behaves over an entire cycle.

The ideal test involves a large sample size over bullish, bearish, and neutral conditions.

Top Trading Metrics

The top of the Tackle Trading Journal shows key trading metrics for whatever system or set of systems you’re tracking. Let’s review each.

Largest Winning & Losing Trade

This helps set expectations and understand the range of outcomes for your system. You need to ensure that you’re sizing correctly so that you can emotionally and financially handle the typical swings in performance. Knowing the range of outcomes can also help you spot when you lucked into a big win that should be locked in. For instance, with the Phoenix journal above, the largest winning trade was $811. If I keep my sizing similar and enter a future position that captures $900 to $1,000, I would probably exit swiftly and avoid getting greedy because I know it is rare.

Average Days in a Trade

The usual trade length will vary depending on the type of system of trader. If you’re selling 60-day options, your duration will be much longer than someone swing trading. In addition, the result will be influenced by your trading rules. Do you take profits early or ride trades to expiration? By cross-referencing this metric with your average trade result, you can better understand how much money you might make over time—more on that in a moment.

Total Net Profit

As the name suggests, this is the total profit (or loss) you’ve accumulated from all trades. To state the obvious, you want this to be a positive number. And the bigger, the better.

Gross Profit

This adds up all the winning trades.

Gross Loss

This adds up all the losing trades.

Profit/Loss Ratio

Gross profit/Gross Loss. I don’t find this metric that useful.

Total # of Trades

Running tally of how many trades you’ve recorded so far. The higher the number, the larger the data set. The larger the data set, the more legitimate the takeaways.

Winning Trades/Losing Trades

Tallies the number of winning and losing trades so far.

Percent Profitable

This is an extremely valuable number. High probability strategies like condors, credit spreads, and naked puts should have a reading well above 50%. Directional strategies like stock plays or long calls and puts will likely hover at or below 50%.

Average Trade Profit

This divides the total net profit by the total number of trades. Using the Phoenix journal for instance: $3,823 / 205 = $18.65. You want this to be a positive number. Otherwise, you’re losing money over time. Any system that generates an average trade profit is said to have a positive expectancy or an edge.

As long as adding more trades doesn’t blunt the edge, you’re incentivized to place as many trades as possible. You can also use this number to make a more realistic profit forecast. For instance, if your average trade profit is $18.65 and you’re placing around 30 trades a month, then it’s entirely possible to generate approximately $560 in monthly gains.

Creating more profits is either a function of increasing the number of trades or size. For example, the Phoenix journal purposely assumes we used a single contract per trade. If the account was large enough to do two contracts a trade, the average profit suddenly doubles from $18.65 to $37.30. Simultaneously, $560 in monthly profits doubles to $1,020.

Focus on acquiring a positive expectancy or positive average trade profit first. Then you can make bigger bucks by doing more contracts.

Average Winning Trade

This is calculated by adding up all the winning trades (gross profit) and dividing by the number of winning trades. With the Phoenix example above, the Gross profit is $9,038, and the number of winning trades was 145, yielding an average winning trade of $62.33.

Average Losing Trade

This calculation mirrors the average winning trade. The formula is gross losses divided by the number of losing trades. With Phoenix, the gross loss was $5,183, and the number of losing trades was 62, yielding an average losing trade of $83.60.

Comparing the average winning to average losing trades can tell you a lot about how well you’re doing with trade management. If you’re a directional trader using strategies like long/short stock, long calls/puts, or bull calls/bear puts, then your average winning trade better be larger than your average loser because your win rate is less than 50%.

Expectancy and Usual System Metrics

You can also use the expectancy formula to calculate your average trade profit. Here is the formula:

(average winner x probability of profit) – (average loser x probability of loss)

Here’s an example of a successful directional trading system.

- Win rate 45%

- Average win: $175

- Average loss: $110

- Expectancy Formula = ($175 x 0.45) – ($110 x 0.55) = 78.75 – $60.50 = $18.25

Even though the win rate is only 45%, the trader still prints profit over time because they keep their average winners much larger than their average losers.

Here’s a successful cash flow trading system. This might apply to an iron condor or naked put system.

- Win rate 80%

- Average win: $100

- Average loss: $250

- Expectancy Formula = ($100 x 0.80) – ($250 x 0.20) = $80 – $50= $30

Here we see a system where the average loss is 2.5x larger than the average gain. Nonetheless, the system makes money because the win rate is high enough to overcome such a lopsided payout.

The Phoenix lab metrics (so far!) are:

- Win rate: 70%

- Average win: $62.33

- Average loss: $83.60

- Expectancy Formula = ($62.33 x 0.70) – ($83.60 x 0.30) = $43.63 – $25.08 = $18.55

Our win rate is slightly less than you’d expect for a pure options selling portfolio. This is because we mix in more directional trades from time to time and sometimes exit losing positions quicker than usual. But the benefit of lowering the win rate is our average loss is far lower than you’d expect relative to our average win. Instead of the average loser being 2 to 3 times larger, which is typical for naked put/condor/credit spread systems, it’s only 1.3x larger.

While past is not always prologuie, keeping a journal and internalizing how your trading systems perform over time will provide insight into how and why you’re making or losing money. You’ll discover the strengths and weaknesses of your approach and fine-tune the management to enhance your win rate, maximize gains, and minimize losses as much as possible.

Behold, the Equity Curve

The statistics of your trading performance aren’t the only benefit of the Tackle Trading Journal. It also auto-creates an equity curve or picture of how your account value has changed over time. Here is the equity curve of the Team Phoenix lab over the past year. It reveals the results of 205 trades placed over one year, including a bull market (2nd half of 2021) and bear market (2022). This created a large enough sample size to test the efficacy of our systems adequately:

There are all sorts of important questions you can answer using this graph, such as:

- Am I making or losing money over time?

- What is the typical drawdown or decline in account value?

- What is the worst drawdown I’ve experienced (max adverse excursion)?

- How does my performance compare to the S&P 500?

- Here are the answers using the above equity curve.

Am I making or losing money over time?

Making. This confirms that our average outcome is positive and that we’ve successfully recovered from all portfolio drawdowns. This type of equity curve drives my confidence in the systems that Team Phoenix is deploying. They don’t work every time. They work over time. And that’s the key. Knowing the history of our trading provides the confidence needed to keep trading despite whatever setbacks interrupt us along the way. With a good system, all drawdowns are temporary.

What is the typical drawdown?

We’ve had four noteworthy drawdowns: -$300, -$462, -$1,482, -$760. To place the dollar amounts into context, let’s convert them into percentages. The account value started around $32,000 and has since grown to approximately $35,600. Thus, the four drawdown percentages were: -1%, -1.5%, -4.6%, -2.4%.

The declines may have been worse, but the equity curve only captures the realized losses. Thus we may have had positions move even deeper into negative territory before they came back, and we exited at a smaller loss.

At any rate, tracking the typical (and worst) drawdowns can help you understand the types of hits you might suffer along the way. You need to make sure it’s a price you’re willing to pay so you don’t panic, sell everything during a crisis, and blow your chances of recovery to smithereens.

How does the performance compare to the S&P 500?

It’s helpful to know how you fared versus the broad market because it helps you better assess your performance. For instance, if we ignore any unrealized gains/losses, the Team Phoenix practice trade portfolio has grown $3,855, or about 12% over the past year. If you told me the market was up 25%, I probably wouldn’t feel that great about the performance. But that’s not the case. The S&P 500 is actually down 10% over the same time frame. And most other indexes are down even more. So, if outperformance was the goal, then it’s been achieved.

You’re now equipped with a better understanding of why journals like the one available at Tackle Trading are so helpful. If you haven’t been as consistent in using one, commit to do better. It will accelerate your progress.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.