The breadth of the financial markets is both a blessing and a curse. Think of it. You have a handful of asset classes to play with: stocks, options, bonds, commodities, currencies, real estate, cryptocurrencies, art, NFTs, and so on. It’s an ever-growing stable with something new arriving regularly enough that it’s impossible to keep track of everything. Even if trading is your full-time gig. That’s the curse. The sheer number of choices can be paralyzing. Many a trader has lost focus and drowned in opportunity.

The buffet of choices means there’s something for everyone, with offerings running the gamut from super conservative to ultra-aggressive. Technology has democratized investing while driving costs to zero. If only accessibility guaranteed success. But it doesn’t. Sure, it gets you in the game, but how you conduct yourself while on the court is what ultimately matters.

We’ve designed this month’s newsletter to help you in the behavior department. Smart traders develop routines and habits that increase the odds they make the right decisions at the right time. But there are other benefits to creating daily routines:

- They make your approach more consistent and structured.

- They drive you to create rules for short-cut analysis and snap judgments.

- They increase the return on the time that you invest into your craft.

Have you ever wondered why horses wear blinders?

“Horses wear blinders to reduce their field of vision and stay focused on their tasks. When pulling loads or racing, horses are easily distracted. Horses that pull wagons in cities need blinders to keep their attention focused straight ahead and block out the distractions around them.”

Source: Why Do Horses Wear Blinders? 4 Primary Reasons

You and I are like horses. We need blinders to stay focused. Routines and rules are our blinders.

I’ve been trading for fifteen years, and my process has naturally evolved. These days it’s extremely simple. I focus on far less than you’d think. Leonardo da Vinci had it right when he said, “Simplicity is the ultimate sophistication.” I pay attention to the few things that matter and largely ignore everything else.

My Daily Checklist

I wake up about thirty minutes before the market opens, head down to my office, and fire up my computer. I launch my trusty Thinkorswim platform and Discord to check in with Team Phoenix – my trading lab. Then, I start my checklist.

First: Analyze the Broad Markets – /ES, /NQ, /RTY

Did stocks move overnight or not? If so, does it change the bias I had yesterday? Usually, it doesn’t. I use technical analysis as my guide. Making money as an active trader is very much about timing. And technical analysis offers the best timing tools known to man.

There are a lot of charts you could analyze, but I focus on the main three broad market indexes. S&P 500 (/ES) for a well-diversified view. The Nasdaq (/NQ) for a tech-centric view. And the Russell 2000 Index (/RTY) to assess what riskier issues like small caps are doing. If they’re in uptrends, then I’m bullish and playing offense. I’m a big fan of the 50-day moving average if you want an easy guide for identifying the trend. If we’re above it, then the path of least resistance is higher. Break below it, and I turn defensive.

Once I’ve got my bearings on the overall market, I can better manage my positions and know what to look for with new trades. The broad market colors everything I do from a trading perspective. It sets the tone.

Second: Manage open positions

Now that I’ve got my bearings, it’s time to manage my open trades. Really all I’m doing here is trading my plan. I have rules for how to handle every strategy I employ. If I haven’t hit my target or stop loss, I’m letting the position ride most of the time. One reason for deviating from this simplified management could be to reduce exposure because of a change in market conditions. This is particularly true if I have a lot of positions and am pushing my exposure limits.

After going through each of my open positions and managing them according to plan, it’s time to look for new ideas.

Third: Look for new trades

When I first started trading, most of my time was spent searching for trades. Now, I hardly have to spend any time with this. Chalk it up to experience, but it’s also because I’ve defined exactly what I’m looking for and have systems where I do the same thing every month.

For instance, I sell condors every month on an Index as taught in the Cash Flow Condors course. Because I trade the same underlying, there’s no need to scan for candidates. Another example is the ETFs that I own and cash flow month to month with naked puts and covered calls. Again, I already know where my money is going because I’m employing the same strategy on the same tickers.

It’s only the portion of my portfolio that’s allocated toward more active systems like swing trading that requires me to go hunting. I’ve assembled a customized watchlist of the most liquid stocks and ETFs. I go through them one-by-one until I find a pattern that qualifies for my rules. One of those rules, by the way, is that the stock can’t have earnings between now and the expiration date of the options I’m using. If I’m trading stock, earnings must be scheduled for at least ten days away.

Once I’ve nailed down the ticker and options strategy, I place the trade.

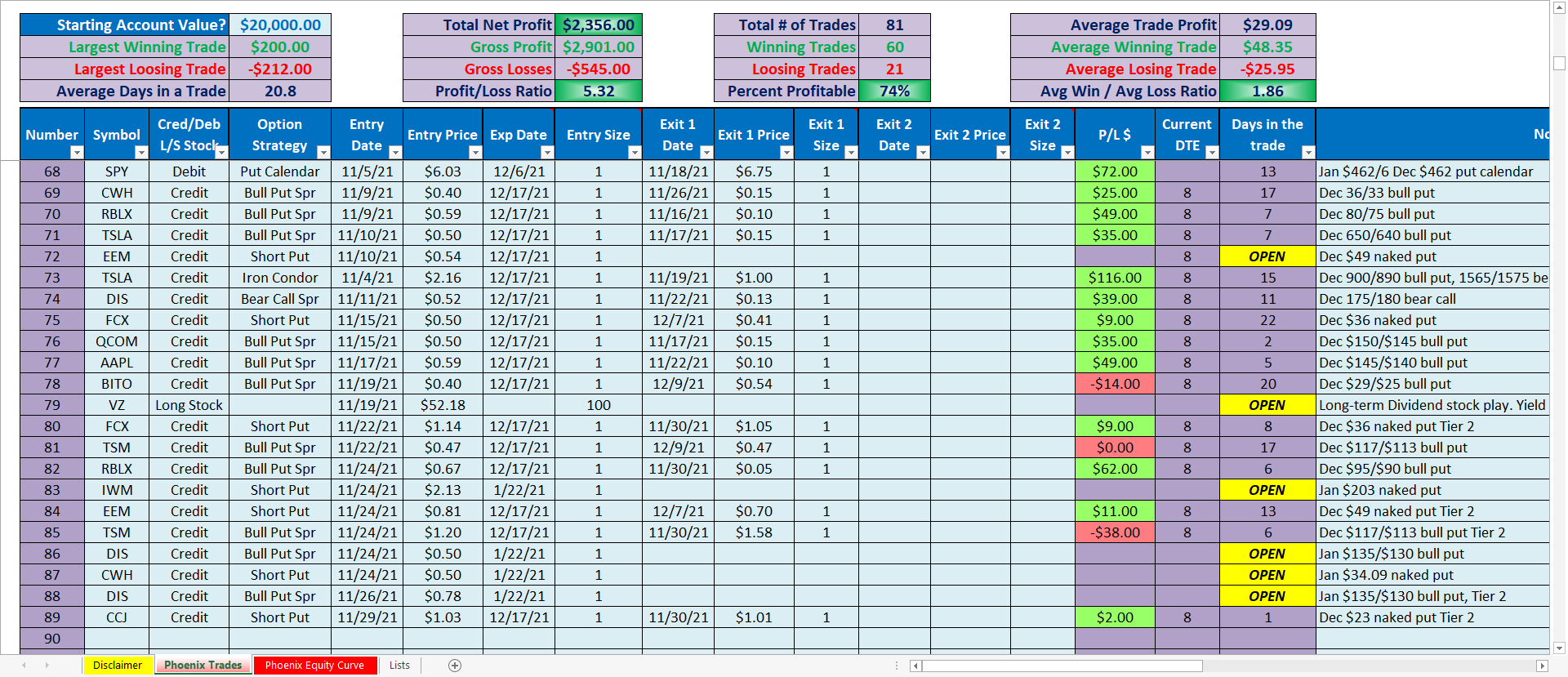

Fourth: Journal the trades

I love the Tackle Trading Journal. It simplifies journaling by auto-calculating a variety of metrics. It allows me to track my portfolio’s value over time and understand why I’m making or losing money. In addition, I can compare systems and strategies to get a better idea of what’s working and what’s not. But all of these goodies are only available if I input the data.

Some traders journal once a week or once a month. I’ve found that simply taking a few minutes each day to add updates is quicker and easier while things are fresh on my mind. Spend too much time between updates, and it will take you twice as long.

Fifth: Study & Practice

It’s essential to continue learning. Technology is constantly changing, and the financial markets are evolving. There are books to be read, websites to peruse, and educational videos to watch. Our archived blogs and newsletters here at Trading Justice, as well as the repository of articles, videos, and classes at Tackle Trading, should keep you busy for months.

When time permits, I spend a fair bit of my daily routine doing the above.

That’s it. That’s my daily routine. Five steps. Each deserves a dedicated newsletter, and I was scant on details, but I hope this provides a birds-eye view of how I spend my day.

Now that I’ve told you about my daily checklist let me show you. Here is a video of my routine on the morning of December 10th, 2021.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.