Introduction

Here’s an oft-referenced exchange between two titans of industry that reveals something about compounding. The conversation took place between Jeff Bezos and Warren Buffett:

Jeff Bezos: “[I asked Warren Buffett,] your investment thesis is so simple… you’re the second richest guy in the world, and it’s so simple. Why doesn’t everyone just copy you?”

Warren Buffett: ” Because nobody wants to get rich slow.”

Humans aren’t designed to think in multi-generational time frames, let alone multi-decade. It’s all about the here and now. We want quick ways to wealth. And it’s not that such shortcuts don’t exist. It’s that the numerous ideas that are pitched as a way to get rich quick have such a low chance of success. The most obvious example is buying a lottery ticket.

One of the reasons it’s so difficult to copy Buffett is the massive amount of distraction thrown at investors every day. Wall Street is a high-stakes carnival with the best salesmen on the planet. They know human nature inside and out. They push products that appeal to your fear and greed. If that weren’t enough, the financial media is there to throw gasoline on your emotional fire. The insanity that takes place on the airwaves during a market downturn is harmful to naïve investors. Instead of calmly stating the stock market is experiencing yet another in a long line of garden-variety corrections, pundits rant and rave about the end of the world.

If you find the distraction and fear peddling overwhelming, then, turn off the TV and avoid the news. After that, take time to learn about the stock market’s bulletproof history of overcoming all obstacles, no matter how severe.

As for the greed side of the equation, well, we’re living in a golden age with seemingly everyone making a mint by speculating on cryptocurrency. To those gripped with FOMO (fear of missing out), learning of survivorship bias can help.

Survivorship Bias

Wikipedia defines survivorship bias as “the logical error of concentrating on the people or things that made it past some selection process and overlooking those that did not, typically because of their lack of visibility. This can lead to some false conclusions in several different ways.”

Media outlets cling to outliers. And when it comes to investing and the financial markets these days, their stories lean heavily toward the extraordinary outcomes. Particularly when it comes to crypto. It makes it seem like everyone who is throwing money into digital currencies is striking it rich. Take the much-talked-about boom in Shiba Inu, a once little-known meme coin that exploded in value this year. Because of the meteoric run, one lucky investor saw their investment soar from $8,000 to $5.7 billion – yes, that’s Billion – in a little over a year.

If such an unbelievable stat doesn’t tug at your inner greed, even just a little, then you’re probably not human.

But for every lucky duck finding treasure in the wild west of crypto, there are legions of others who are losing money or only seeing small-dollar gains. But you don’t hear about them! They are, as the Wikipedia definition of survivorship bias suggests, invisible.

Now that we’ve discussed a few ways to deal with fear, greed, and distraction, let’s take a closer look at what compounding is and why Warren Buffett is the poster child for it.

What is Compounding?

Renaissance man Benjamin Franklin quipped, “Money makes money. And the money that money makes, makes money.” Such is the nature of compounding. It’s a virtuous cycle.

The effect of compounding is to accelerate the growth of an asset. It’s like sprinkling miracle grow on a plant. To illustrate, consider the following two paths:

The Linear Path

An investment that matures linearly plods steadily along, churning out gains at a constant rate. For example, suppose you placed $10,000 in an account that delivers a 10% return each year. Further, you are required to withdraw the gains every December 31st. If the investment operates as expected, you will grab $1,000 of profit each year. Not bad! But the rate of profit won’t change. Since you can’t reinvest the gains, the account will only grow by $1,000 each year. It’s steady and consistent, to be sure, but lacks the potential for explosive, hockey stick growth. Here is how your investment will behave over the next decade.

Year 1: $10,000 principle: $1,000 gain Year 2: $10,000 principle: $1,000 gain Year 3: $10,000 principle: $1,000 gain Year 4: $10,000 principle: $1,000 gain Year 5: $10,000 principle: $1,000 gain Year 6: $10,000 principle: $1,000 gain Year 7: $10,000 principle: $1,000 gain Year 8: $10,000 principle: $1,000 gain Year 9: $10,000 principle: $1,000 gain Year 10: $10,000 principle: $1,000 gain

The Exponential Path

Imagine instead that our $10,000 investment grew at a compounded rate of 10% annually. Rather than taking out the $1,000 profit after the first year, you reinvest it. And you continue to do so for each year thereafter. Here is how the first ten years stack up.

Year 1: $10,000 principle: $1,000 gain Year 2: $11,000 principle: $1,100 gain Year 3: $12,100 principle: $1,210 gain Year 4: $13,310 principle: $1,331 gain Year 5: $14,641 principle: $1,464 gain Year 6: $16,105.10 principle: $1,610.51 gain Year 7: $17,715.61 principle: $1,772.56 gain Year 8: $19,487.17 principle: $1,948.72 gain Year 9: $21,435.89 principle: $2,143.59 gain Year 10: $23,579.48 principle: $2,357.95 gain

The accompanying graphic shows both growth paths taken to the twentieth year.

Notice how the paths don’t diverge much in the first few years. It’s not until the end of the chart that the power of compounding is manifest.

There are three pre-requisites required for compounding to work.

- First: Invest in an asset with a positive growth rate.

- Second: Reinvest the gains.

- Third: Let time pass. Preferably lots of it!

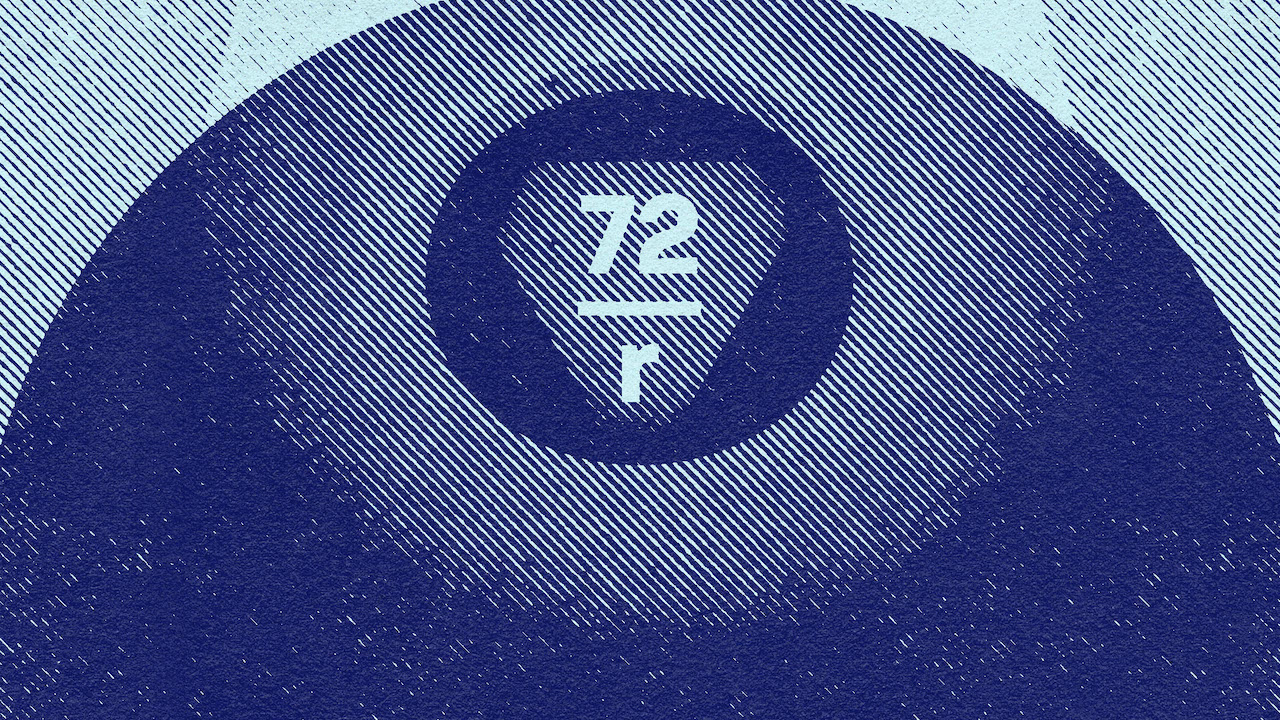

Rule of 72

The higher the interest rate or growth of an investment, the more dramatic the compounding. The so-called rule of 72 provides the back-of-the-envelope math needed to calculate the time required to double an investment. All you have to do is divide 72 by the annual rate of return. For example, if you throw your money into a safe but low-yielding asset like a Certificate of Deposit (CD) that pays 2% a year, it would take approximately 36 years to double in value. Even for a patient, forward-looking investor, that’s a long time. Alternatively, if you invested in the U.S. stock market and it proceeded to grow 10% a year, it would only take 7.2 years to double your dough.

Consider Probability

In considering ways to build wealth, you must ask yourself if you want to travel a high probability path or a low probability one. Warren Buffett is one who walked the high odds road. To Bezos’ point above, Buffett’s path was simple – deceptively so. He created his wealth slowly, not suddenly. His formula had a few simple ingredients, but three stand supreme: time, patience, and discipline.

Time

The time component may be the most overlooked secret to Buffett’s wealth. Yet, it is undoubtedly what allowed him to tap into the unparalleled power of compounding. My favorite explanation of this comes from Morgan Housel’s must-read book The Psychology of Money. It was published in 2020.

“As I write this Warren Buffett’s net worth is $84.5 billion. Of that, $84.2 billion was accumulated after his 50th birthday. $81.5 billion came after he qualified for Social Security in his mid -60s.

Warren Buffett is a phenomenal investor. But you miss a key point if you attach all of his success to investing acumen. The real key to his success is that he’s been a phenomenal investor for three quarters of a century. Had he started investing in his 30s and retired in his 60s, few people would have ever heard of him…

Buffett began serious investing when he was 10 years old. By the time he was 30 he had a net worth of $1 million, or $9.3 million adjusted for inflation…

Effectively all of Warren Buffett’s financial success can be tied to the financial base he built in his pubescent years and the longevity he maintained in his geriatric years. His skill is investing, but his secret is time. That’s how compounding works.”

You can find the entire story in Chapter 4 of his book.

The true magic of compounding manifests itself on the tail end of your investing life cycle, not the beginning. In case you missed the gravity of Buffett’s story, $84.2 billion of his $84.5 billion net worth (that is 99.6%) came after the age of 50! Said another way, only 0.04% of his net worth came in his first 50 years of life. It wasn’t that he was unlucky before 50 and lucky afterward. It’s that the most explosive growth with compounding always comes toward the end. And, besides, 0.04% of $84.5 billion is still $300 million, so it’s not as if he hadn’t amassed a small fortune by age 50.

Want to unlock the power of compounding in your life? Invest early, invest often, and never stop. If you’re a more seasoned reader in the twilight years of life, you may feel like the clock is against you. Perhaps. But you can always pay the knowledge forward to your children and grandchildren. You may not have 50 years, but they surely do.

Patience & Discipline

Do you know how many crashes Buffett has had to live through to amass his wealth? Dozens. Can you imagine how different his story would be if he abandoned his investments during each downturn, spooked by whatever crisis was haunting investors at the time?

Fortunately, he had the discipline and patience to stay the course regardless of how painful it seemed.

Consider one of the best anecdotes of all time, highlighting how much the Oracle of Omaha “lost” during the 1998 market crash. This gem comes from Nick Murray’s book, Simple Wealth, Inevitable Wealth:

“$6,200,000,000

Yes, that’s right, it’s six billion two hundred million dollars. A very large sum of money, wouldn’t you say? Now, what, you ask, does it represent?

It is roughly how much Warren Buffett’s personal shareholdings in his Berkshire Hathaway, Inc. declined in value between July 17 and August 31, 1998. And now for the six billion-dollar question. During those forty-five days, how much Money did Warren Buffett lose in the stock market?

The answer is, of course, that he didn’t lose anything. Why? That’s simple: he didn’t sell.”

A lesser investor would have viewed this as a loss and likely jumped ship to avoid potentially sacrificing billions more. But wise man Buffett understood the difference between volatility and loss. And, ultimately, his ability to look past the short-term noise prevailed. The 1998 bearish episode proved temporary like all its predecessors and every other crash that’s struck since.

Remember this next time the market drops and your diversified stock portfolio takes it on the chin.

Saying you want to invest for decades is one thing. Living through the countless corrections which will tempt you to abandon ship along the way is quite another. To allow compounding to work, you must have the discipline to hold fast and the patience to wait for the inevitable market recovery. Never interrupt the compounding!

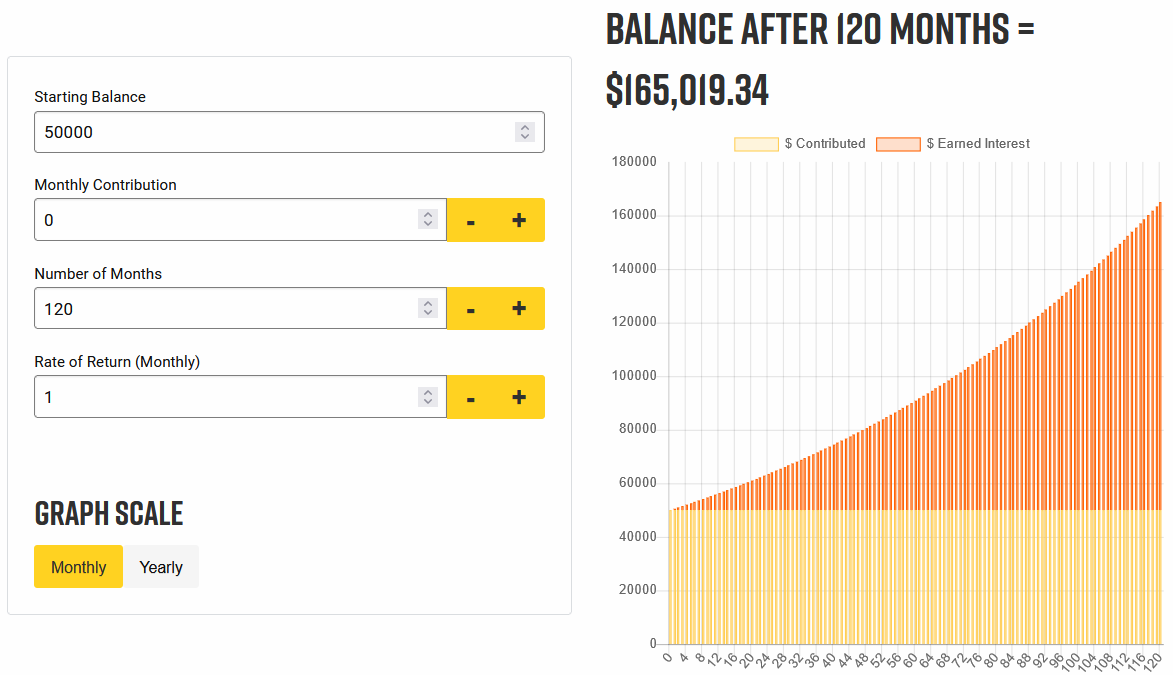

The Compounding Gains Calculator

If this newsletter has piqued your interest in the power of compounding, then I highly recommend spending some time using the Compounding Gains Calculator at Tackle Trading. It allows you to conduct various what-if scenarios to see how different savings rates and growth rates can accelerate your wealth building.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.