Most magicians keep their tricks hidden and undisclosed. It keeps the wonder and mystery of magic alive in the eyes of the audience. Reveal too much and what was extraordinary becomes pedestrian. “Oohs” and “aahs” turn into indifference. And nobody wants that.

Unless, of course, you are training to become a magician yourself. In that case, bring on the revelations! Unveil the steps. Show me how it’s done, Houdini!

Today I am donning the role of the master magician. And you, dear readers, are my budding pupils. My task is to disclose precisely how an active trader manages a portfolio using beta weighted delta. Paragraph by paragraph, your understanding will build, and what was once mysterious will become ordinary and incredibly useful. You will depart well-equipped to manage your portfolio.

Let’s begin.

What Kind of Investor Are You?

Context matters significantly to today’s topic. Before I dive into the details, we must get on the same page regarding our understanding of the different types of traders. Fundamentally, there are two classes of people playing on Wall Street. One is passive; the other active. The former group doesn’t concern itself with the day-to-day gyrations, nor the month-to-month machinations. Whether the market finds itself in a short-term uptrend of downtrend matters little, if at all, to these stoic participants. It’s the long run that concerns them, and the last thing they’re going to do is let the disease of short-termism infect their carefully crafted portfolio.

This is not the group I’m addressing in today’s newsletter. I welcome them, of course. I am one of them – at least with part of my capital. But, ultimately, the tantalizing topic of beta weighted delta and portfolio management is most relevant for the second cohort – the active acrobats.

The time frame of most relevance to these quick-triggered traders is the here and now. Their portfolio is also carefully crafted, but it’s based on their short-term outlook. To be more specific, if their analysis reveals the market is bullish, then they will bet on higher prices. A few days later if the market cracks support and turns bearish, then they will rapidly reduce exposure to minimize the damage.

How about a puppy analogy to drive the point home?

The trend of the market is the dog; your active portfolio is the tail.

If the S&P 500 is trending higher, then my portfolio will be bullish. I will make sure the number and types of trades I have in my account are such that my overall portfolio is bullish.

In highfalutin greek speak, that means my beta weighted portfolio delta is positive. More on that later.

Conversely, if the S&P 500 is trending lower, my portfolio will be bearish (my beta weighted portfolio delta is negative).

Do you notice the underlying assumption in this approach? It is that you care about the trend of the market. That it, above all else, is the signal that drives your outlook. If you believe in the power of technical analysis and the trend’s supremacy, then surely you see the wisdom in this.

Of Gap Bridging and Logic Chains

Let’s take things one step forward. I’m a fan of logic chains and creating models that bridge the gap between theory and practice.

The following chain illustrates the bedrock beliefs that undergird the model we’ll create.

One: Though not perfect, price analysis is superior to any other alternatives (fundamental research, emotions, news, astrology, reading chicken entrails, etc.)

Two: Price trends are the most critical input in determining my market bias.

Three: Trading with the trend gives me the best chance of success as an active trader.

Four: Therefore, I want my active trading account posture to be in harmony with the trend of the S&P 500.

To expand on the first belief, I will borrow and modify the following Winston Churchill quote from 1947.

“Many forms of Government have been tried and will be tried in this world of sin and woe. No one pretends that democracy is perfect or all-wise. Indeed, it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time.”

And now for the technician’s version:

Many forms of market analysis have been tried and will be tried in this world of sin and woe. No one pretends that technical analysis is perfect or all-wise. Indeed, it has been said that technical analysis is the worst form of market analysis except for all those other forms that have been tried from time to time.

Beliefs > Rules > Actions

From these beliefs, we can craft a set of rules that will drive our actions as traders. From belief spring rules that guide our actions.

To keep things simple, I can think of two rules that fit the previously outlined beliefs. In fact, I already revealed them.

Rule One: If the S&P 500 is trending higher, my portfolio should be bullish.

Rule Two: If the S&P 500 is trending lower, my portfolio should be bearish.

Identifying when an uptrend morphs into a downtrend can be tricky, and opinions vary among traders regarding the best signals to use. My favorite method and the one I suggest you start (and potentially end) with is the 50-day moving average. To wit:

Rule Three: When the S&P 500 is above the 50-day moving average, the trend is up.

Rule Four: When the S&P 500 is below the 50-day moving average, the trend is down.

Here’s how this would have played out in the market throughout 2020.

As you can see, the signal isn’t perfect. Sometimes (like in Sep & Oct), the market falls below the 50-day moving average and generates a bearish signal, only to rise back above the 50-day and flip back to bullish a few days later. This whipsaw is a necessary evil, though. Eventually, a trend will take root, and the 50-day will keep you on the right side of it for months on end. That’s where big money is made.

Now, I’ll hasten to add that most traders (at least the sane ones) find downtrends far more challenging to trade than uptrends. They’re riddled with gaps and high volatility. As such, I’m not opposed if someone wants to modify Rule Two to say:

Modified Rule Two: If the S&P 500 is trending lower, I will have minimal bullish exposure. Perhaps I neutralize my exposure completely, but I don’t necessarily have to flip aggressively bearish.

In other words, I play defense in downtrends by reducing exposure and pulling in the horns when the S&P 500 breaches the 50-day.

The Directional Bias Spectrum

Now that we have the fundamental bull/bear dichotomy in place let’s expand our understanding of animal biology. It’s oversimplistic to settle on the terms “bull and bear” to express our directional bias. There’s no nuance, no precision. Sure, you can say you’re really bullish or somewhat bullish, but even that’s too fuzzy. What do you mean by “really bullish?”

To provide more specificity for articulating the exact type of bull or bear, we’ve developed a number spectrum.

Bearish is split into three tiers: Aggressively Bearish (-3), Moderately Bearish (-2), Mildly Bearish (-1)

Bullish is also split into three tiers: Aggressively Bullish (+3), Moderately Bullish (+2), Mildly Bullish (+1)

Neutral is representing by a zero (0).

When we put them all together, it looks like this: -3,-2,-1,0,+1,+2,+3

Equipped with this tool, two traders can now converse more intelligently about their respective outlooks. This is particularly helpful when choosing from the vast array of available options strategies. For example, there are over a dozen bullish strategies. How do you decide which one to use if you think a stock will rise in value? The answer could depend on your degree of bullishness. If you’re only mildly bullish (+1), something like a covered call or naked put might be appropriate. If you’re aggressively bullish (+3), then a long call or bull call spread is the way to go.

The same benefit applies when picking from the handful of bearish strategies available.

This brings up a crucial question that I’m asked every single time I introduce the numbering scheme. How do you know if a stock is a +3 versus a +1? In other words, how do you determine if your outlook is mildly bullish or aggressively bullish?

There isn’t one right answer. And no one knows for sure if a stock will end up rising a little or a lot. Or if it will rise at all, for that matter. There’s a certain degree of subjectivity that enters the equation when forecasting price movement. Let me share a few of my best practices.

One: I like using the 50-day moving average as the line in the sand for delineating when a stock turns from bullish to bearish and vice versa. When we’re above the 50-day, my bias will generally be +1, +2, or +3. When we’re below the 50-day, my bias will become -1,-2, or -3.

Two: Breaking resistance is bullish and typically merits increasing my outlook. For example, let’s say a stock recently started an uptrend and has a +1 rating. Then, it breaches a critical resistance zone signaling a continuation and even a strengthening of the trend. I would upgrade my rating to +2 as a result.

Three: Breaking support is bearish and warrants becoming more defensive/bearish. For example, let’s say a stock just broke the 50-day moving average and formed a lower pivot low in the process. It’s in a downtrend and has a -1 rating. Then, it breaches a critical support zone signaling a continuation and even a strengthening of the downtrend. I would downgrade my rating to -2 as a result.

Let’s take a renewed look at the SPY chart from above, but this time we’ll consider it from a directional bias perspective.

Notice how every time support broke (SB), our bias shifted less bullish/more bearish. And, every time resistance broke (RB), our bias turned less bearish/more bullish. I purposely left out any neutral readings to make the chart less cluttered. Typically, when moving from -1 to +1, there will be a period where our outlook is neutral (0).

Having a rules-based process removes much of the guesswork and emotions that would otherwise bring randomness to our forecasting.

Let’s move into how this model might help with portfolio management.

Beta Weighted Delta

The metric used by professional traders to measure portfolio exposure is beta weighted delta. You’ll recall that delta reflects how much your position will make/lose if the underlying stock rises $1. If you have an AAPL trade with a +50 delta, then you’ll gain $50 per $1 increase in the stock.

But that +50 delta is specific to a $1 move in Apple.

Suppose you also had a bullish MSFT trade with a +20 delta. That means you’ll make $20 per $1 increase in Microsoft stock.

But that +20 delta is specific to a $1 move in MSFT.

You can’t add 50 AAPL deltas to 20 MSFT deltas. It’s apples and oranges. A $1 move in AAPL is not the equivalent of a $1 move in MSFT for two reasons.

One: They have different stock prices, so $1 represents different percentages.

Two: Even if they had the same stock price, they don’t have the same volatility. Maybe AAPL moves 1% a day while MSFT moves 1.5%.

To overcome these differences, we need to find a common denominator to restate the deltas in like terms.

That common denominator is the S&P 500. By analyzing the historical relationship between AAPL and SPY, we can translate the AAPL deltas into SPY deltas.

Let’s say the 50 AAPL deltas are the equivalent of 30 SPY deltas. So your Apple trades beta weighted SPY delta is +30. That means if SPY rises $1 tomorrow, you will make $30 on your AAPL trade.

Suppose further that the 25 MSFT deltas equate to 20 SPY deltas. That means if SPY rises $1, you will make $20 on your MSFT trade.

Now that we’ve stated both positions in like terms (SPY deltas) we can add them together:

AAPL Trade: AAPL Deltas +50, aka SPY deltas +30MSFT Trade: MSFT Deltas +25, aka SPY deltas +20

Portfolio Beta Weighted SPY Deltas = +50

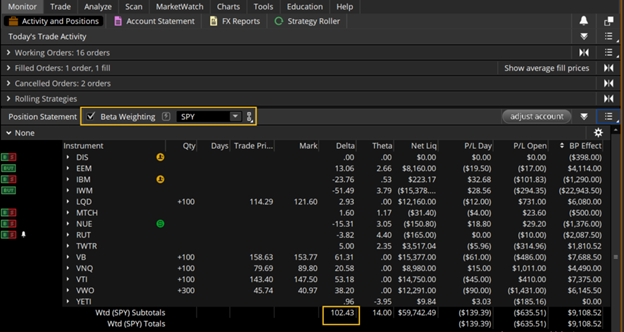

ThinkorSwim will display your portfolio’s Beta Weighted SPY deltas on the Monitor tab if you click the right button. Here’s a screenshot:

Now that we know how to calculate the overall exposure, we need to figure out how much exposure you are comfortable with.

What is an Okay Portfolio Delta?

Coming up with the appropriate range for your exposure involves three simple steps. Before I get into them, let me mention one important takeaway. There isn’t one right way to do this. You could use a variety of metrics to determine an appropriate amount of exposure. My preference is to focus on your willing daily fluctuation of the account value. Think of it as how much movement you’re ready to stomach in your portfolio’s value each day.

Step One: Determine your willing daily fluctuation in dollar terms

Step Two: Find the Average True Range (ATR) of the S&P 500 ETF (SPY)

Step Three: Divide the willing daily fluctuation by the ATR

The final number is the max beta weighted delta appropriate for your account. If you don’t already have Average True Range as an indicator on your chart, you should be able to add it to your charting platform.

Case Study

If you read the three steps and grasped everything on the first pass, congratulations. You’re smarter than the average bear. For everyone else (like me), an example will help. We’re going to assume you have a $30k account and are comfortable seeing it rise or fall 2% ($600) a day.

Step One: Willing daily fluctuation = $600

Step Two: SPY ATR = $3.21

Step Three: $600 / $3.21 = 187

187 is the magic number. That’s the max delta you want to have in your portfolio. And, to be clear, we’re talking about the SPY beta weighted delta. If you let it creep above 187, you will likely see greater than +/- 2% fluctuations in your account. Also, remember that the ATR is the average day. That means the average trading session should deliver a gain/loss of 2% to your portfolio. Days boasting more volatility than normal will likely see greater than 2% swings in your account value.

Here would be the appropriate range for my $30k account:

Max bullish: +187 delta

Neutral: 0 delta

Max bearish: -187 delta

When I’m aggressively bullish (+3), I could let my account delta push towards, but not beyond +187 deltas. When I’m aggressively bearish (-3), I could let my account delta drift towards -187.

Final Takeaways

When the ATR changes, the appropriate delta changes. Maxing out your delta exposure in a low ATR environment is more dangerous than doing so in a high ATR environment. Remember, ATR is mean-reverting, which means low readings eventually give way to high readings. That can cause what was initially an acceptable delta to become too high quickly.

Once you’ve discovered your max delta, you can better use the directional bias matrix I introduced earlier. Here’s an example expanding on the above case study.

Max bullish (+3) : +187 delta

Moderately bullish (+2): +100 delta

Mildly bullish (+1): +50 delta

Neutral: 0 delta

Mildly bearish (-1): -50 delta

Moderately bearish (-2): -100 delta

Max bearish (-3): -187 delta

Directional Bias + Proper Deltas = Magic

You might differ on the exact delta you use for each bias, but the idea of a stronger directional opinion warranting more delta exposure should be consistent among all traders.

We conclude with two marching orders designed to empower and elevate your trading. First, systematize your process for determining market bias. If you want to adopt the rules laid out in today’s newsletter, then do so. Second, use the steps we introduced to calculate your acceptable portfolio delta range and corresponding levels (for -3 to +3). Pay attention to it daily, and you’ll start exercising greater control over just how much fluctuation your portfolio experiences.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.