Ask any stock trader how to make money, and he’ll respond with the obvious: “buy low, sell high.”

Simple? Yes.

Easy? Not so much.

But there’s a way to at least make it easier if you’re adventurous and willing to learn. Today’s newsletter introduces you to the path you must follow. It leads deep into the options realm but spits you back out a great deal wiser than you began. You’ll return with two new shiny tools in your belt.

The first helps you buy low.

The second helps you sell high.

By properly using both, you’ll increase your probability of profit while decreasing portfolio volatility. If that doesn’t incentivize you to begin the trek, you need your head examined.

Of Payments & Promises

Limit orders allow stock investors to express their willingness to buy at a lower price. For example, say the stock is $50, and you want to buy it when it drops to $45.

Simply place a buy limit order at $45 that is good-till-canceled, and voila, you’re officially on the hook for purchasing shares if they ever fall to $45. Since $45 is 10% cheaper than $50, I think we can agree you’re setting yourself up to buy low.

The principal drawback I see is that if the stock fails to fall to $45, you’ll never acquire shares. Thus, no potential payday; no opportunity to sell high later. I can think of few things worse than watching a stock fly to the moon while you’re patiently waiting for a dip with a limit order.

Here I am, loitering beneath the stock, waiting to take a bite – and she never dips. Boy, I wish I could get paid for my willingness to buy. At least then I’d be making something!

Musings of a dip buyer left behind

Well, my dear friend. The arrangement you just described –being paid for making a promise to buy – is precisely what selling put options entails.

Limit orders can also be used to express your willingness to sell a stock at a higher price. For example, suppose you own shares of a $50 stock and want to unload it if prices rise to $55. You could place a sell limit order at $55 that is good-till-canceled. Now, kick back, relax, and root for said stock to climb.

But what if it doesn’t?

What if the stock meanders for months, never rising to your willing sell price? Well, you’ll never cash in.

Here I am, twiddling my thumbs while my stock slumbers. I’m a willing seller at $55, but she lacks the lift to get there. Boy, I wish I could get paid for my willingness to sell. Then I’d be cashing in while prices dither.

Musings of a rally seller when no rally comes

What a worthy wish! Lucky for you, it’s not a fantasy. The idea of being paid for making a promise to sell is exactly what selling call options is all about.

Quick vocabulary lesson before we move on. Selling a call is also known as a short call. Selling a put is also known as a short put. Promising to buy (sell) stock is the same as saying you’re obligating yourself to buy (sell) stock.

Traders willing to engage in options selling strategies like short puts and covered calls are enhancing stock ownership by getting paid every month. If it sounds too good to be true, it’s not. But as in all efficient markets, you aren’t getting something for nothing. There is a trade-off—namely, limited reward.

The Link Between Reward and POP

When thinking of the various bets in the financial markets, you must remember there is someone on both sides of the transaction. For every buyer, there is a seller and vice versa. Consider their arrangement a zero-sum game where one’s reward is the other’s risk. Moreover, the probability that one party will win is identical to the likelihood that the other will lose.

Here’s an example of a trade between Trader A and Trader B.

- Trader A is risking $1 to make $3 with a 30% chance of success.

- Trader B is risking $3 to make $1 with a 70% chance of success.

Note the following:

- Trader A is risking a little to make a lot.

- Trader B sits on the other side of the transaction and risks a lot to make a little.

You have to ask yourself what would incentivize Trader B to accept such a lopsided risk vs. reward.

In this case, as in all cases, the answer is the probability of profit. It’s a great deal higher for Trader B than A. Thus, he willingly accepts the lower payout because he knows that the odds of winning are high.

Herein lies the point: Probability of Profit and Reward lie on two ends of a teeter-totter. Raising one will necessarily lower the other.

Now, this is how it applies to naked puts and covered calls. Both allow you to get paid each month for your willingness to buy and sell stock. They carry a higher probability of profit than a long stock position. This means, per the eternal rule outlined above, that your potential reward must be less than long stock.

And, indeed, it is. Owning stock carries unlimited reward. The naked put and covered call have limited reward. Such is the requisite cost for boosting your odds of success.

Naked Put = Get Paid to Buy

There are two common ways to use naked puts. The first is a higher-probability substitute for other bullish trades such as a long call or stock. When used this way, traders typically treat it as a short-term play and get stopped out if prices move adversely. The second path involves entering with the intent to buy shares if the put sits in the money at expiration. The boomerang trade assumes you follow the second route.

Here are the base rules for a naked put.

Position Sizing

Because the original margin required for a naked put can be far less than the stock cost, it’s tempting to sell more contracts to capture more profit. However, to properly execute the boomerang system, you must acquire 100 shares of stock for each put contract sold. So don’t sell too many! For example, if I’m using a $50-strike put, I would sell one for every $5,000 I was willing to allocate toward the stock.

Expiration

Most traders use one-month (30-day) options as the default when selling naked puts. If you use shorter-term options (such as Weeklys), it is more aggressive and could generate higher profits, but you won’t be able to go as far out-of-the-money.

Strike Price

Which delta you sell depends on where you’re willing to buy the stock. Just remember the following trade-off.

-Lower Delta = Higher Probability of Profit, but Lower Reward

-Higher Delta = Lower Probability of Profit, but Higher Reward

The default rule is to sell a delta around 20 or less, but you can use a higher number if you’re comfortable with the price level you have to buy the stock at.

Let’s look at an example using Devon Energy (DVN), an oil stock trading for $48.

Instead of purchasing shares outright, suppose we sold to open the 32 day, $42 strike put for 90 cents. It has a delta of 19. Here are the trade metrics:

- Max Reward: $90 per contract

- Max Risk: $4,110 per contract

- Probability of Profit: 81%

The maximum risk may sound like a lot, but DVN would have to fall to zero. Moreover, if we purchased 100 shares now at $48, our max loss would be $4,800, so the naked put carries far less risk than long stock.

Here’s how to think of it. We are getting paid 90 cents per share for our willingness to acquire 100 shares at $42. However, because of the premium received, our actual cost basis goes down to $41.10. That’s approximately a 14% discount from the current price.

Covered Call = Get Paid to Sell

We’ve taught covered calls extensively in a previous newsletter (see here). If the following condensed version doesn’t suffice, then take a trip to the other post and return when you’re done.

The strategy involves buying 100 shares of stock and selling a call option. You get paid a premium for your willingness to sell the stock at the call’s strike price.

Here are the base rules:

Position Sizing

Sell one call option for every 100 shares of stock you own. If you sold more than one call, it would be considered naked and completely changes the trade dynamics.

Expiration

Most traders use one-month (30-day) options as the default. Using shorter-term options is more aggressive. Longer-term is more conservative.

Strike Price

Simply put, sell the strike price you’re willing to sell your stock at. Our default rule is to sell a delta around 30 or 40, but you can shift it higher or lower depending on if you want more premium or more upside in the stock.

Remember, lower delta calls (such as 40) pay you more, but cap your gain in the stock quicker.

Let’s look at Devon Energy again, but build a covered call this time.

Suppose we bought 100 shares for $48 and sold the 32-day, $51-strike call for $1.80. It has a delta of 38.

Here are the trade metrics:

- Max Reward: $480

- Max Risk: $4,620

- Probability of Profit: 38%

Take a moment and compare these numbers to those of the naked above. You should notice a few critical differences.

First, the max reward is far higher on the covered call.

Second, the probability of profit is far less on the covered call.

Third, the max risk is slightly higher on the covered call.

These three facts point back to the lessons learned above on the link between probability of profit and reward.

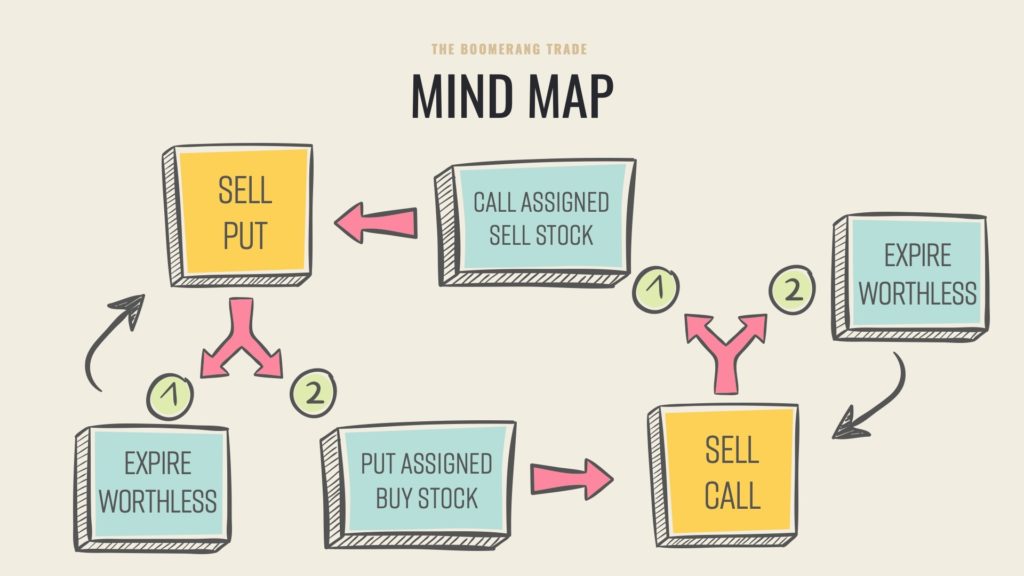

Building the Boomerang

With a proper understanding of short puts and calls as substitutes for buy and sell limit orders, you’re now ready to learn the boomerang strategy.

It’s simple and involves rotating from selling puts to selling calls, month after month.

- Sell a put option.

- If it expires worthless, sell another.

- If assigned, buy stock and sell a call.

- If the call expires worthless, sell another.

- If assigned, sell stock and revert to step one.

Consider the stark difference between someone with 100 shares of stock and someone who seeks to enhance ownership through the systematic use of the boomerang.

The boomerang thrower will enjoy an increased probability of profit and less volatility. This will come at the cost of limiting the reward. Thus, the equity holder will come out ahead in times of extreme bullishness. But in all other times, the boomerang should deliver steadier returns.

And if you want to, you can tweak the boomerang to become more like long stock in times of extreme bullishness. Sell higher delta puts to juice the premium received and when assigned, sell lower delta calls to allow for more upside.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.