It is late on a Saturday night; my kids are at their mothers and I have poured a cold glass of my favorite adult beverage. I feel alone and isolated with what I am about to do, and I wish I could ask a friend over for moral support. However, what I am going to engage is too shameful to do in the presence of others. There are societal norms after all, and I am about to go on a multi-hour binge which would make me a social pariah in almost every reputable circle of decent people. I cannot help it…the urge is too strong…I must dive deep into the world of bear and doom porn.

Yes, I feel the finger pointing and shouts of “unclean” in my direction as I write. The market is so rabidly bullish that whenever anyone has the audacity to point out the slightest bearish argument, they are severely rebuked by the mob. Phrases like “good luck losing money,” “would you rather be right or make money?” “you are unpatriotic,” “you just don’t get it for (insert rationale here),” “you are just mad because others are making money and not you” are thrown out without a seconds thought only to be loudly supported and cheered on by the rest of the mob. While rapid, the bulls are also highly creative. They have created the phrases “bear porn” and “doom porn” to castigate and shame anyone who would question the validity of what has been the best 100-day stretch in the history of the markets.

The mere utterance of the phrases “bear porn” or “doom porn” instantly attempts to invalidate any argument that an individual is attempting to make. Regardless of the facts, logic, or reason used, accusing someone of engaging in “bear porn” dismisses their rationale as according to the bulls, these bears are only bringing up their bearish arguments to titillate their senses and get aroused by a heaping dose of negativity. Bear porn accuses the person of making their arguments simply because they have a dark, twisted fetish rooting for what might go wrong.

You can see why I feel dirty and isolated with what I am about to write. Perhaps I will shower afterwards to wash the uncleanness from my body. However, on this late Saturday night I cannot help myself as the urge is simply too strong. Please forgive me for what I am about to do.

Below (in no particular order) are various arguments that I have gathered from different articles and blogs over the last couple of months pointing to areas that one might/should be concerned with in regard to the bullish market. Obviously, the thinkers and writers of such content are sick and twisted individuals but often are extremely intelligent and present well thought out arguments. This is likely just a coincidence. This is your last warning, turn back now unless you want to feel filthy and unable to pull the trigger on a bullish position after what you are about to read.

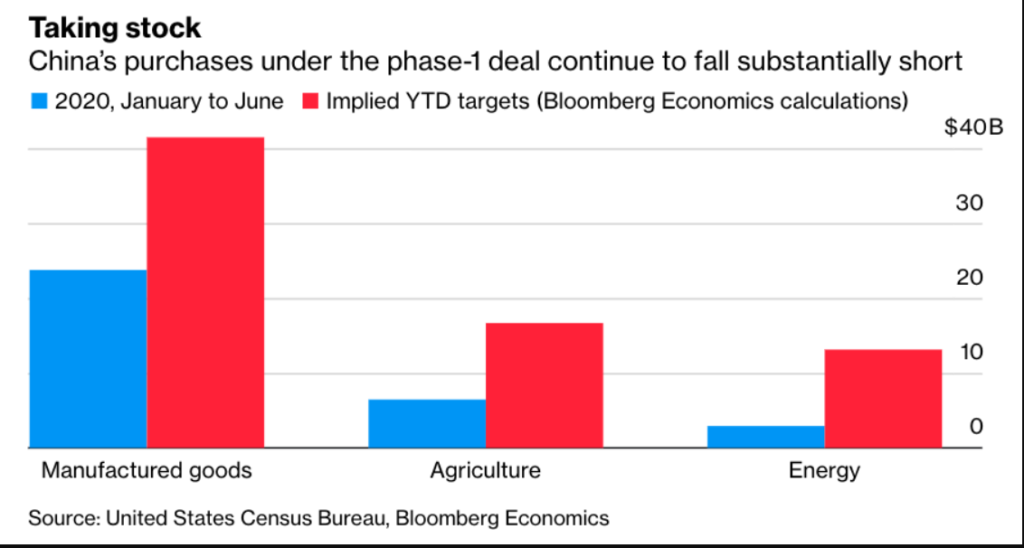

Bear Argument #1 – China

To list out all the events and analysis over the last few months would be a 10,000-word article. To sum it up, relations between the Untied States and China are at a multi-decade low. The closing of consulates, enflamed rhetoric and sanctions on companies and individuals does not even scratch the surface of what is going on between the two countries. The tension appears to be sharply escalating. Heck, in just the last couple of days Taiwan officially signed a deal to purchase F-16 fighter jets from Lockheed Martin, President Trump nullified a waiver that allowed US. Companies to sell products to Huawei and signaled more Chinese companies were targets for punitive action after recent action against WeChat and TikTok.

The market is currently treating the escalation of tensions as a non-story. There is a complacency from the Trade War days that none of this will go beyond rhetoric. The problem with that complacency is that recent patterns suggest the President will continue to increase pressure on China ahead of the general election. Outside of harsh rhetoric from state run media operations, China’s response has been measured. If China ever takes a hard stance which the Trump administration responds to, it could result in a nasty domino chain that the market simply could not ignore anymore. The market will ignore China until the day it cannot and on that day, watch out below.

Bearish Argument #2 – No Fundamental Conviction

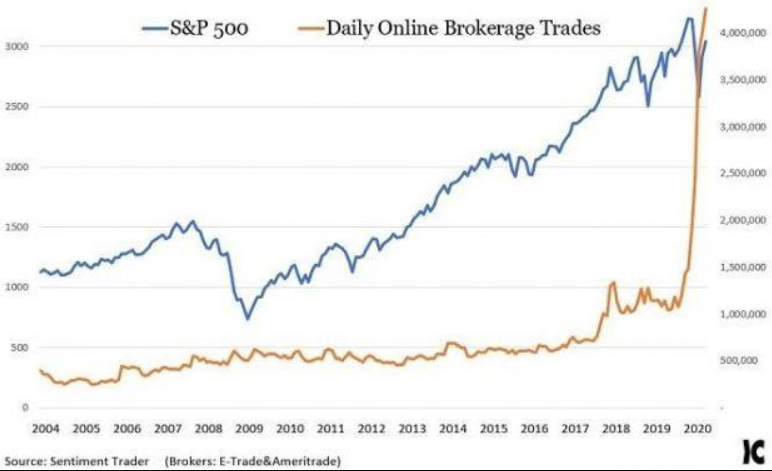

Davey Day Trader loves to pound into the heads of his mass following that “stocks only go up” but none of his legion of followers has a deep and unwavering conviction on the matter. Sure, they might believe on a five- or ten-year horizon that is the case, but it is unlikely few, or any, are thinking from a long-term perspective.

Fundamental conviction in an investment will keep you in the investment even if short-term price movement goes against you. We are not talking about sitting through a two- or three-day pullback either. If a real-life world catalyst (or a simple technical sell off) creates a significant retracement, then a lack of fundamental conviction could exacerbate the downward pressure. A 5-10% decline in the market at any given time is a normal occurrence. In today’s market it would likely feel like a tsunami. This could create a much deeper sell off based on the lack of fundamental conviction by many participants.

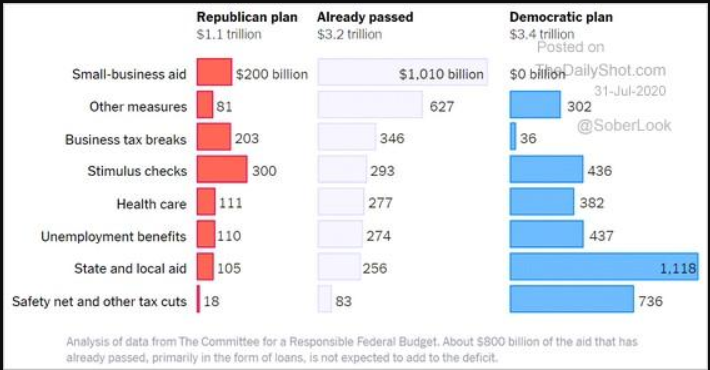

Bearish Argument #3 – Stimulus Concerns

From a bullish perspective, there have been signs that the federal government money taps might not be unlimited. One of the primary bullish arguments up to this point in the pandemic is that the federal government would spend whatever it took to keep the economy afloat during the duration of the health care crisis. Up to this point that has indeed been the case.

While robust fiscal stimulus is still almost assured, it is far from a certainty at this point. Talks between the two sides have broken down and while many market analysts expect a deal to occur in September, with each passing day we get closer to the November elections. The closer we get the more likely one side will simply determine that the best course of action is to wait post-election.

The term fiscal cliff is used to describe what will occur if more stimulus is not provided. The economy simply needs the extra push to speed up any return to a pre-Covid level of normalcy. Bears would also point out that even if a bill is passed, it will be less than previous amounts which will impede the rate of the economy recovery and resulting company earnings results.

Bearish Argument #4 – The Covid-19 Wildcard

So, let me get this straight, bulls are saying that the effects of a virus that has:

- Resulted in a global pandemic

- Continues to spread throughout the world

- Has mutations that scientists are continually learning new information about

Is priced in? Good one. The virus continues to spread and reopening of small businesses, schools and the economy remains in a constant state of flux. Oh, and there is the whole out-of-vouge to discuss 2nd wave of the virus in the winter that remains a legitimate threat.

Covid-19 is likely here with us for a long while which leads us to the next bearish argument….

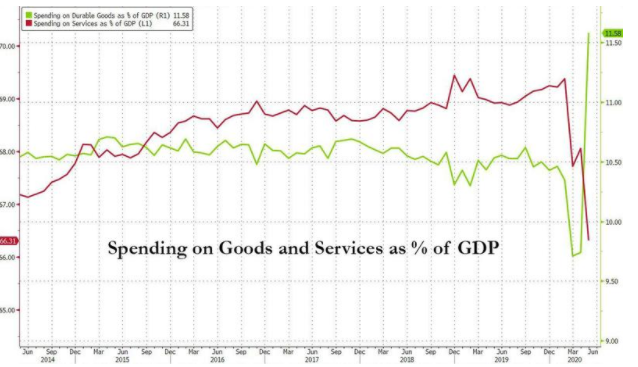

Bearish Argument #5 – A Radical Shift in Consumer Behavior

Even as stay-at-home restrictions are lifted bears argue that you are likely see a dramatic shift in consumer behavior. Life is simply not going to be normal as we know it as the vulnerable are afraid to go out and innovation slows. As the economy contracts and unemployment remains high, noticeable changes to consumer behavior will occur as Covid/Recession will be a nasty one-two punch to the consumer psyche. As Jeff Gundlach argues “Saving money and having a net economically productive skill will be the new cool.”

The shock and aftereffects of Covid-19 could be lasting. Behavioral economists have pointed out that much smaller shocks than Covid-19 have caused lasting effects in how consumers behave. The United States economy is largely driven by consumer spending and even moderate reversals in spending patterns could have a material impact on corporate earnings.

At a minimum, some industries could be permanently impacted. Airbnb CEO Brian Chesky recently said the global travel and tourism industry might never fully recover from the virus-induced economic downturn. Invest accordingly.

Bearish Argument #6 – Suspension of Buybacks

Well, hasn’t this been all sunshine and roses to this point! Well we have not even gotten to the heavy and graphic stuff yet. Let us take a short break in this marathon of a newsletter to discuss a few of the more nuanced bearish arguments. Do not worry, I will be back to depress the bulls and heighten the senses of the bears momentarily.

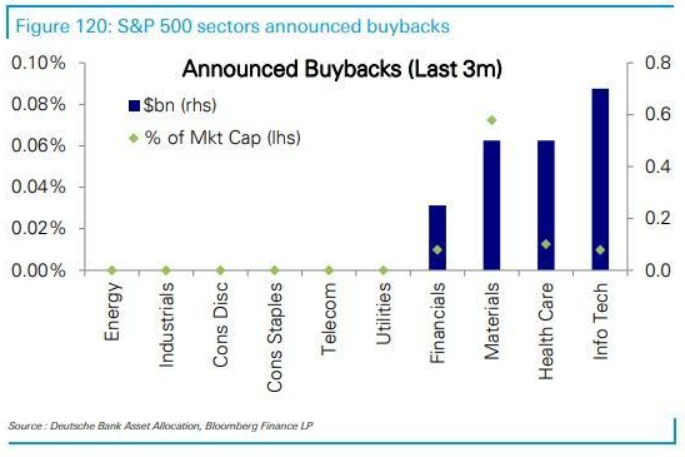

Buybacks have been argued to be one of the biggest catalysts of the upwards price movement in recent years. There are statistics pointing that corporate buybacks have far exceeded demand from all other investor categories combined since 2010. As more and more companies are suspending buybacks this potentially takes out a huge source of demand for stocks and the support they have provided to EPS growth.

Bearish Argument #7 – Ad Revenues

Ad spending metrics are down across the board. Aside from being a potential troubling sign for the overall health of businesses, this could have particularly troublesome implications for tech giants such as Facebook and Google. Because of their weight within indices, this could have larger market implications as well.

Bearish Argument #8 – Justifying Current Prices on 2022 or 2023 Earnings – WTF!

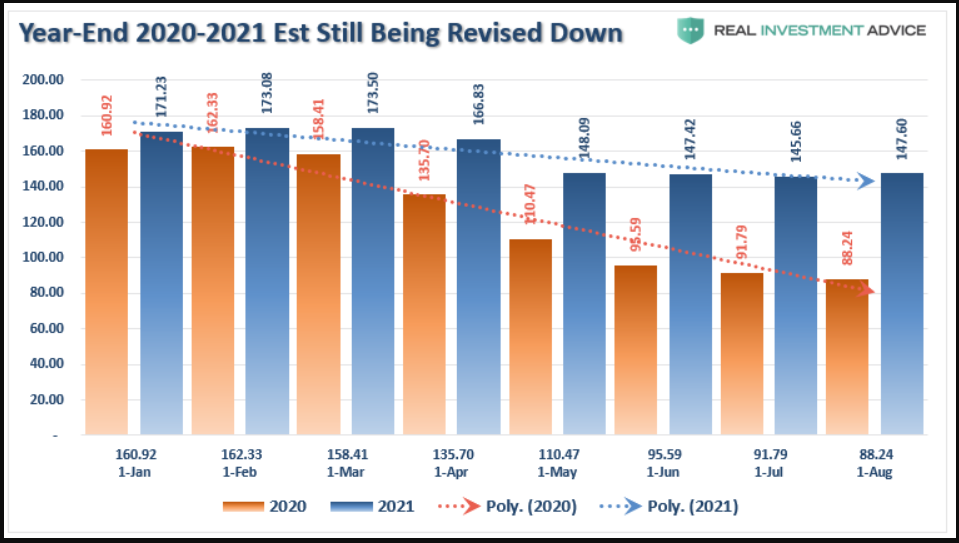

Somehow the powers that be have convinced not only the novices, but nearly every talking head on CNBC, that buying stocks at valuation levels in this current environment is justified because we are using hypothetical earnings estimates two years in the future. How in the hell they pulled that off I have no idea!

Ok, fine, let us play along for a moment. I suppose that if hypothetically everything goes perfect over the next couple of years it does not seem as utterly insane. However, a few problems with this line of thinking include:

- That is a heck of a lot of perfection priced into one of the most uncertain economic environments we have ever faced.

- Even based on 24-month earnings estimates, stocks are ridiculously expensive.

- When is the last time Wall Street Analysts correctly predicted estimated forward earnings, let alone with so little forward visibility?

- When does the madness end? In 2022 are we supposed to pay for 2025 earnings estimates?

Other than those simple reasons, cool.

Bearish Argument #9 – Insider Selling

Recent data shows that corporate executives and officers selling their shares have been outpacing similar individuals buying by a ratio of 5-to-1. Bloomberg notes that only twice in the past three decades has the sell-buy ratio been higher. Probably nothing to see here right?

Bearish Argument #10 – When It Happens, It Will Happen Fast

You now have had a minute to catch your breath with simple buyback, insider selling and ad revenue issues. Those are more like a PG-13 movie then anything resembling true bear porn. Time to take the gloves off as this is not Winnie the Pooh’s nighttime story hour. You need to prepare for the possibility of a very wicked bearish stretch that could likely occur. The market is currently in a grinding upward tract, seemingly unwilling to even contemplate the possibility of having a down day. That true down stretch is coming and when the selloff starts it will not be the mild two- or three-day pullback we have seen occasionally over the last few months. It will be a vicious unrelenting downward spiral that claims many victims along its path.

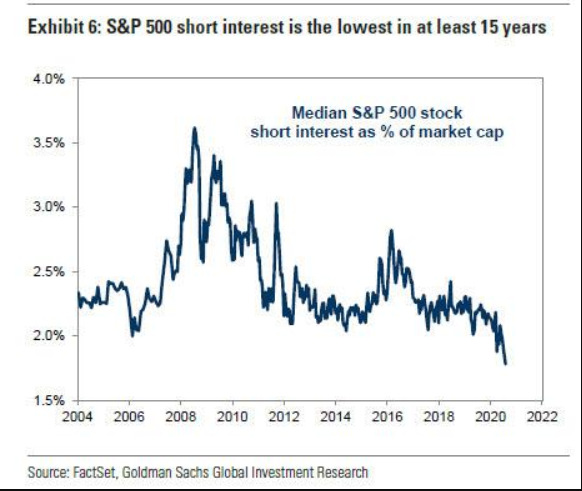

Robot trading algorithms have zero mercy nor preference for market direction. They methodically send the market higher and unmercifully pressure prices downward when true selling starts. In an environment with no true conviction (amongst retail traders or investment managers) at some point someone will blink. When this happens (whether through a news catalyst or a technical selloff) everyone will start to rush for the exit and the algos will magnify the sea of red as they turn bullish to bearish creating a firestorm in their path.

As algos and conviction less traders “smash the sell button,” margin calls will be triggered across the globe. The margin calls will prompt more selling and a chasm will be created in bid-ask spreads on option chains. There will be a very narrow window to head for the exits. Over leveraged traders will sit nearly helpless on the sidelines as Max Loss rides in on his fiery black stallion as these neophyte traders reap the whirlwind. Position size accordingly.

Bearish Argument #11 – This Time is Different

The four most dangerous words from bulls in the English language:

- This

- Time

- Its

- Different

When fundamentals become detached from reality there are always excuses bulls find to justify current valuation. All these excuses are some version of “This time its different.” It never is. Its only a question of what the event is that reverts markets to some semblance of normalcy.

Bearish Argument #12 – This Unknown Event Exacerbates Current Problems

Things will be better in 2022, 2023 or in some year in the future so it is unlikely that bad economic data or earnings in the short-term will have any negative impact on the market. However, these economic and structural problems are widely known and if an unknown/black swan event were to occur right now it could not happen at a worse time.

If this were to occur, money managers around the world would simply shrug their shoulders and tell their clients “hey, who could have seen that coming?” The financial mainstream will echo similar sentiments. Unknown events are always a risk. With today’s economic backdrop, they are a potential nightmare.

Bearish Argument #13 – Overbought and Overextended Conditions

When markets are in overextended and overbought conditions bad things tend to happen. When they are also tremendously deviated from longer-term moving averages even worse things tend to happen. But hey, I am sure there is nothing to worry about. This time is different after all.

Bearish Argument #14 – Banking Problems Present Massive Risk

Nobody saw Covid-19 coming. Nobody saves for a rainy day anymore either. Commercial banks coming into the Covid-19 crisis were in better shape than in 2008 but they still had massive leverage and their exposure to bad debts could potentially lead to a cyclical banking crisis.

Banks earnings reports and commentary have been swept under the rug (along with every other worry in 2020) but they were genuinely concerning and very telling. Some of the comments from Jamie Dimon, CEO of JP Morgan were particularly somber:

- “This is not a normal recession. The recessionary part of this you’re going to see down the road. You will see the effect of this recession. You’re just not going to see it right away because of all the stimulus.”

- Regarding what will happen in the economy – “We simply don’t know,” Dimon added, “and, by the way, we’re wasting time guessing.”

- He explained that governments cannot keep supporting the business community financially, so “you’ll start seeing a lot more default, which in turn means that you’ll start seeing the problems spill over to the financial sector.”

- “We’re just guessing, we are prepared for the worst case.”

Banks are preparing for the worst with massive amounts set aside for loan defaults they expect in the coming quarters. They have also tremendously increased borrowing standards as a defensive measure. In addition, banks have been spared from a massive consumer default situation with mortgage forbearance and stimulus money that have left consumers surprisingly well off. The piper must be paid one day, and that day is rapidly approaching.

Bearish Argument #15 – Upcoming Consumer Defaults

There is going to be a wave of consumer defaults due to Covid-19 and the resulting recession. It is only a question on how big it is going to be. Banks and credit card companies are preparing for significant defaults and starting to make credit harder to obtain. This is a nasty one-two punch for the profitability of these companies moving forward and a significant drag on the economy if credit (on both an individual and business level) is harder to acquire.

The financial pain has only been delayed due to forbearance programs and unemployment benefits. It is far from cancelled. How bad will it be when the bill comes due? We will soon find out.

Bearish Argument #16 – Good News Will Be Bad News

Let’s speculate for a moment that none of the dire predictions bears obsess about come true and the economy starts to genuinely rebound. In that scenario we are still left with extreme valuations and a Fed that might be less dovish. At least the market would be constantly fretting that the Fed would become less dovish as we enter a “Good News is Bad News” phase of the market. These periods have occurred frequently in recent years as positive economic data creates worries that the Fed may become more hawkish as the economy improves. In these periods, the markets become very jittery as it realizes that a liquidity driven, Fed supported market period could be coming to an end and the market will have to rely on fundamentals. This is never a good thing in modern markets.

Bearish Argument #17 – Fundamentals

The fundamentals of the market remain too optimistic. This is the understatement of this newsletter. Ultimately economic fundamentals prevail, they always do, and that is particularly terrifying considering where fundamentals currently reside. At a minimum, history teaches us in these situations that when you have extreme divergences, low returns in the market can be expected in upcoming years. In worst case…well, see bearish argument #10.

Bearish Argument #18 – The Limits of the Fed Put

The Fed Put hypothetically creates a market floor at some price point but that does not prevent stocks from realigning to some level of fundamental reality. A Fed Put may mean prevent an utter collapse of the market but it certainly does not prevent the real possibility of a significant correction.

Bearish Argument #19 – State and Local Economic Revenues

State and local tax revenues have taken a sizeable hit this year and there seems to be genuine resistance from the Republican party to providing them stimulus money to offset these losses. Budget cuts have already started in many states which will exacerbate the economic fallout from the crisis and the length of time until we reach any level of economic normalcy.

Bearish Argument #20 – Fractured Society

For a variety of reasons our society is fractured right now. In a lead up to and after the election, an intensification of protests and potential violence could occur, which certainly can shake investor confidence. It 2010 this would have been an unthinkable statement. In 2020 few dismiss its possibility.

If we want to get into the doom porn arguments, then the possibility of outright revolution exists leading to a populist overthrow of Wall Street and wealth/income inequality policies. You think bear porn heightens the senses? It is nothing compared to intelligent authors writing about these scenarios. I will spare you…for now.

Bearish Argument #21 – Election Risk

The most universal bearish argument around the election centers around a Democratic sweep of the Oval Office, House, and Senate. If this occurs, a rollback of the corporate tax cut (which was used primarily in buybacks to boost EPS numbers) is almost assured and has significant negative ramifications for the market. There are also arguments centered around a potential wealth tax and higher individual taxes on upper income brackets if a Democratic sweep were to occur.

In the “take it with a grain of salt” portion of this newsletter, there are also arguments about the Deep State’s plan to torpedo Trump’s re-election chances by crashing the stock market melt-up in late October. Hey, I do not write the bear porn, I just consume it.

Bearish Argument #22 – Higher Taxes are Inevitable

There is a separate line of bearish thinking (bulls smash the buy button, bears work through scenarios) that regardless of who wins the election, corporate taxes will be moving higher. This is the inevitable result of the spending orgy that we have undertaken in the last few months. With populist movements on both sides picking up supporters every year, the appetite to let corporations off the hook consequence free after endless bailouts appears to be waning. Taxpayers should demand corporations pay more in the way of “insurance premiums” during the good years for the inevitable bailout that is coming down the road. Or so the argument goes.

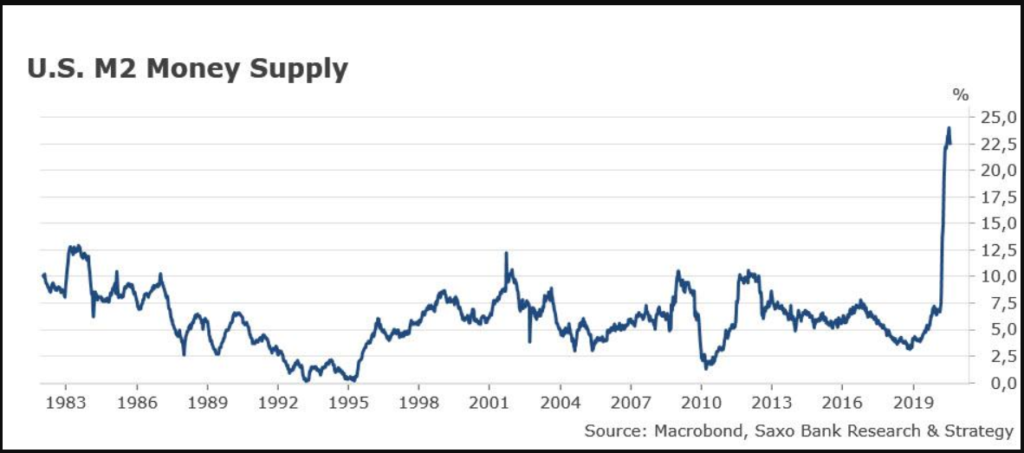

Bearish Argument #23 – Inflation

Monetary inflation is almost a certainty in a world where the Fed has promised unlimited monetary stimulus to both consumers and businesses. While we might be living through a short-term deflationary shock, inflation in 2021 could be significant. If significant inflation breaks out it means one of two outcomes:

- The Fed must get aggressive with monetary policy which would be disastrous for the markets

- Inflation spirals out of control which would be disastrous for everything.

There are detailed inflationary arguments that would make a wonderful topic for an upcoming newsletter. For now, let’s just say there might be a reason Buffett just took a position in GOLD.

Bearish Argument #24 – The Markets Are Being Propped Up Solely by Liquidity

Larry Kudlow is the last person on planet earth who disagrees with this statement.

Bearish Argument #25 – Commercial Real Estate Crisis

There is the potential for a genuine commercial real estate crisis occurring in this country. The Fed has been very blunt on this subject. They have noted that this is the sector of the market where the next crash might occur stating that “price declines could be especially pronounced in areas where valuations have remained high and where asset values are sensitive to the pace of economic activity.” Sounds like a scenario occurring in a lot of big cities to me.

This situation is likely to get worse before it gets better. There is a massive shift to a “remote work” culture occurring which will reduce the need for office space in the future. Small business and notably restaurants are closing, or projected to close, at alarming rates. Many cities are reporting high percentages of businesses unable to pay rent. Covid-19 has sped up the Retail Apocalypse that was already occurring and thousands of retail stores have already closed in 2020.

Prices in commercial real estate have started to decline in many areas of the country and there is a real fear that delinquencies could create a chain reaction in the financial system. Further lockdowns or outbreaks of Covid-19 will only make an already untenable situation even worse. To sum it up, not good.

Bearish Argument #26 – Residential Real Estate Crisis

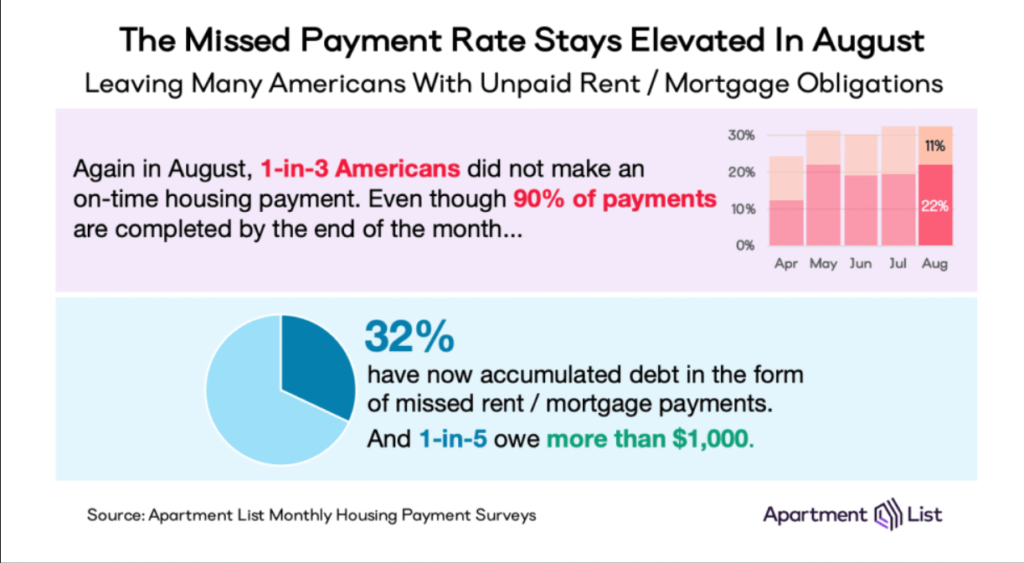

Housing data to this point has been terrific. Naturally, this has been aided by record low mortgage rates and trillions of dollars of stimulus to help prop up the economy. Even with that positive backdrop of stimulus and rates, millions of loans are currently in forbearance. Estimates show that the total amount of loans in forbearance is just under one trillion dollars.

If unemployment remains high and the forbearance program ends, this could, in the words of one bear porn writer, “unleash hell on the real estate market by 2021.” A surge of defaults and foreclosures could be in the future. During the ongoing crisis, a survey was conducted and over half of respondents say they are worried about making future mortgage payments.

How bad will this get? We really do not know. However, the number of loans in forbearance is truly staggering and if unemployment remains high, the short-term rosy housing numbers might quickly become a thing of the past. Just two days ago the FHA reported that the share of delinquent FHA loans rose to 15.7% in the second corner and the highest level in records dating back to 1979. This crisis could come out of nowhere sooner than later.

Bearish Argument #27 – 2000 Deja Vu

The retail speculative euphoria was a defining characteristic of the 2000 bubble with trader’s hyper focused on short-term profits. Valuations were sky high, it was all about the future, traders felt invincible, and “this time it is different” was shouted from the trading rooftops. Sound familiar? Yet stocks kept going higher in 2000…until they did not. Someone blinked and it all came crashing down. Battlestar Galactica was right. “All this has happened before, and all this will happen again.” I guess in respect to the 2000 bubble it is again already.

Bearish Argument #28 – We Are in a Bubble

While we are on the subject of bubbles…come on, everyone knows we are in one by now. That does not mean every stock is in a bubble. Some are just ridiculously expensive and others you are simply paying for 2045 earnings. Hey, its all about the future man! However, without question many of the high-flying stocks recently are in bubble territory. It has gotten to the point that if you can convince yourself that some of these companies have earning growth stories that support their current price you can convince yourself of anything.

Talking heads on CNBC get quite agitated when the term bubble comes up and they quickly cherry pick some fact to point out that the current situation is not comparable to 2000. If Shakespeare were alive today, he likely would write “”The Cramer doth protest too much, methinks”

Bearish Argument #29 – Have You Listened to Your Average Retail Investor?

While not the most sophisticated argument, many bearish commentators snicker about the knowledge and comments made by the influx of new bullish retail traders. There has been an army of new traders join the markets in recent months and many of found instant success. Have you read the logic and rationale on message boards written by these new bullish traders? If so, you know that none of this ends well.

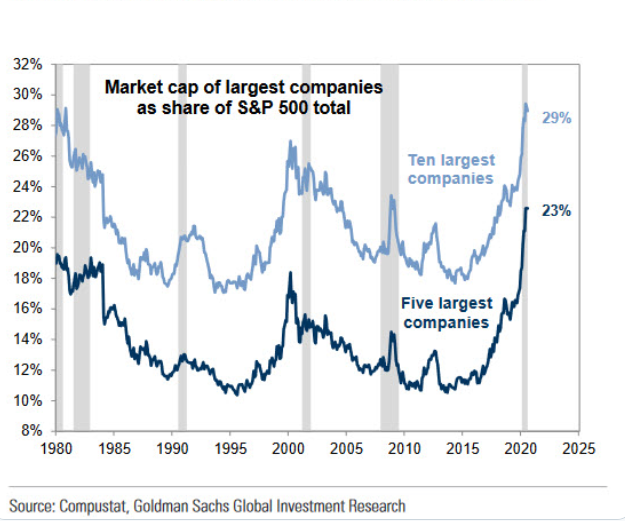

Bearish Argument #30 – Indices Overly Concentrated in a Few Names

Commentators have started to joke referring to the S&P 500 as the S&P 5 due to the extremely large percentage that Apple, Amazon, Alphabet, Facebook, and Microsoft make-up of the overall weight of the index. It doesn’t stop there as just a few names (Apple, Microsoft, Amazon, Facebook, Google, Nvidia, Tesla, Intel, Netflix, Adobe) make up almost half of the NASDAQ Composite’s market cap. Whenever the market historically has been concentrated in a few names it has always ended the same way…badly. The major market participants know this too and have been relentlessly trying to push up other cyclical parts of the market with limited success creating a “swing rotation” environment.

Bearish Argument #31 – Big Tech Problems

Since the concentration of big names in the previous argument are almost all in the spotlights of some government action/threat, it makes the market as a whole particularly susceptible to the government action that has been discussed in recent months/years. In addition, there has been no shortage of lawsuits against these companies and recently it was reported that the Justice Department and a group of state attorneys general are well into the planning stages and likely to file antitrust lawsuits against Alphabet’s Google. While nothing major has come out of this yet, an altering governmental action only has to happen once to send a major shockwave through the markets.

Bearish Argument #32 – Distressed Industries

Boeing is likely to survive no matter what occurs in the coming years due to their importance to national security. The same cannot be said for many other publicly traded companies. Boeing’s CEO made huge headlines a few months ago when he predicted a major US airline would most likely go bankrupt. Airlines are not alone in their struggle as lodging, entertainment, restaurants, retail, and non-residential real estate are all facing massive challenges. Aside from the risk of investing in this space, the drag that partial recoveries (let alone collapses) of these industries would have on the overall economy would be significant. Permanent job losses will be part of the effects felt unless a true economic miracle occurs.

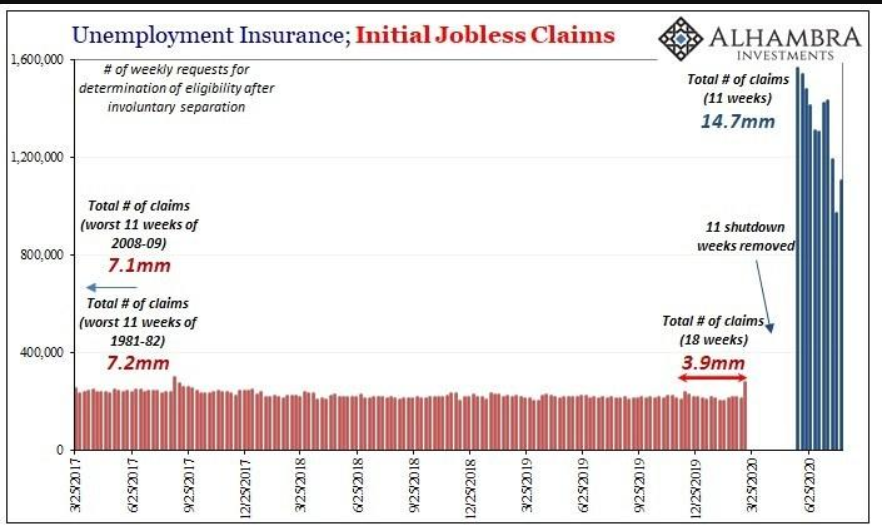

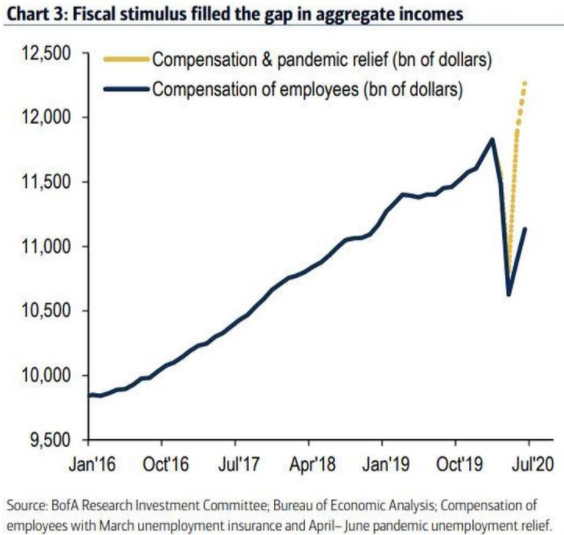

Bearish Argument #33 – Unemployment

Where the unemployment rate ends up over the next year is key. If we return to a relatively low unemployment rate in a reasonable time, so many of the previous and upcoming bearish arguments are negated. If we do not, the likelihood of many of the bearish arguments causing significant economic and market disruption increases. Not to be all doom-and-gloom (hey if you have read this far you are too deep to turn back now!) but there are troubling signs regarding unemployment popping up everywhere.

When we had the first wave of massive jobless claims there was a “to be expected” feel to the situation. The economy had locked down and high unemployment numbers were understandable as employees were “temporarily” laid off with the anticipation that workers would return to the payrolls as the lockdown measures subsided. In recent weeks we are still slightly above or below one million new jobless claims on a weekly basis. This is a staggering number five months into the pandemic. These job losses are not remotely like the ones at the start of the pandemic. Recent job losses reflect business service professionals such as including lawyers, architects, consultants, and advertising professionals. These jobs are not coming back in rapid order as they are not temporary layoffs. Businesses across most industries are simply cutting costs as is the norm in recessionary environments.

The impact of job losses on consumer spending have been 100% negated by generous unemployment benefits provided up to this point. Personal income has gone up in the pandemic. Unless one anticipates infinite high-level unemployment benefits to continue (which would increase bearish the potential impact of mega arguments surrounding the dollar and debt) then eventually the impact of unemployment will be felt on the bottom line of companies, the economy and markets themselves.

There is wide ranging guesswork to when we will come close to unemployment levels we enjoyed before the pandemic. Many reputable authors state that it will be many years. A study by the National Bureau of Economic Research was released that revealed that over 100,000 U.S. businesses (represented millions of jobs) have already permanently shut down during the pandemic. These jobs and millions of additional recent big corporation layoffs are not coming back, at least any time soon. The realization that jobs are not coming anywhere near February levels anytime soon may take some time to sink in. The ramifications of that fact even longer.

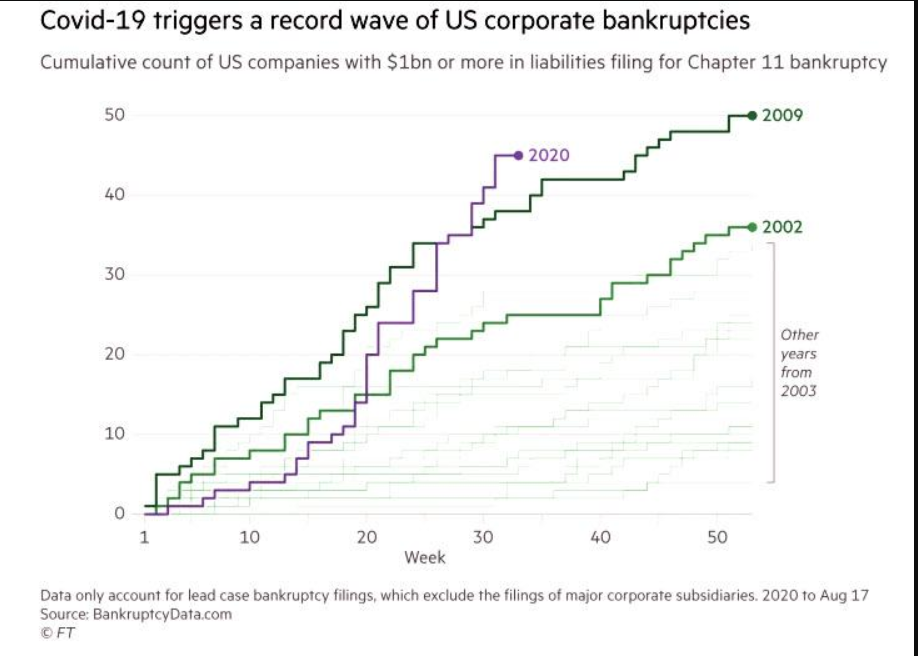

Bearish Argument #34 – Bankruptcies

One of the reasons unemployment benefits and stimulus are so critical is that there is a direction correlation between job losses and bankruptcies. This is also why this has been the most unique recession in American history. Normally, if individuals lose jobs, they have less money to spend which in turn decreases consumption and as a result the earnings for businesses. One of the results of the normal cycle is a higher level of bankruptcies. We have delayed this process completely at this point.

There are a lot of writers, commentators, and financial analysts I respect. There is no one I respect more than Mohamed El-Erian, the chief economic advisor at Allianz. I think the man is brilliant. Recently in a CNBC interview he stated that bankruptcies pose the current biggest threat to the equities rally.

“I think what derails this market isn’t more China-U.S. tension, isn’t more political differences — it would be if we get then large-scale bankruptcies,” he said. “That is what derails this market. Otherwise, you have a very strong technical supporting this marketplace.” He continued, “Bankruptcies go from short-term liquidity problems to long-term solvency problems…If you get that then unemployment becomes more problematic, and you get capital impairment. And Capital impairment is one thing that Fed money can’t fix.”

The already existing bankruptcy data is extremely troubling and is at multi-year highs and that is WITH unprecedented monetary policy support and fiscal stimulus. Just a few of the troubling data points include:

- Moody’s recently expanded its “B3 Negative and lower list” which soared to its highest tally ever — 311 companies.

- Blackrock’s CEO Larry Fink said that bankers told him they “expect a cascade of bankruptcies to hit the American economy.”

- Yelp has stated that 41% of all business closures on its platform are permanent closures.

- Numerous known names such as J.C. Penney, Neiman Marcus Group, Hertz, Drontier, Diamond Offshore and 24-Hour fitness have joined 1000s of smaller and mid-sized businesses to already declare bankruptcy.

- A survey from the Society for Human Resource Management found that 52% of small businesses expect to be out of business within six months.

Will this become a biblical wave of bankruptcies like many are predicting? I do not know. It does scare me that we are on pace for records this year even with the fiscal and monetary policies that have been put in place. It concerns me that banks have set aside such large figures for defaults and the commentary from bank CEOs paint less than a rosy picture of the situation. It makes me extremely nervous to think of the destructive dominos that would fall if a huge wave of bankruptcies were to occur If Mohamed El-Erian is correct in stating that capital impairment is the one thing Fed money can’t fix then it could shake what has been an unwavering faith in the ability of The Fed to fix all structural problems. A loss of faith in the Fed perhaps is the most graphic bear argument of them all.

Bearish Argument #35 – Smart Names

A Lot of extremely successful and intelligent investors such as Jeremy Grantham, Mike Novogratz, David Tepper, Stanley Druckenmiller, and Howard Marks have stated that this market is in a bubble and warned investors to get out or be extremely careful. Jim Cramer claims they are just “speaking their book” to lower stock prices so they can buy. Dave Portnoy (Jim Cramer’s new idol) picks his stocks out of random letters pulled from a Scrabble bag and screams “stocks only go up.” You decide who you want to believe.

Bearish Argument #36 – How in the Hell Can the Market Ignore the Cumulative Risks?

I cannot write this better, so I am pulling this directly from Rabobank to sum up the current cumulative risks facing the market just over the past two weeks:

“The global architecture is at risk of collapse as we see realpolitik trump the ‘liberal world order’, huge explosions, warnings of war, political polarization, dubious constitutionality, warnings of election fraud, sanctions, tariffs, and now the arrest of press barons. You know, the perfect environment for markets to keep rising.”

Bearish Argument #37 – Greed is Not Sustainable

Bloomberg’s Fear-Greed indicator recently surpassed the March 2000’s peak to reach its highest peak ever. ‘Nuff said.

Bearish Argument #38 – Economic Reality

While a short of general synopsis of many of the other arguments, the frequency at which bears scream on message boards that the market is “detached from economic reality” warrants its own space in the list of arguments. If you want to sum this entire article up to your family members and close friends, please feel free to just use this point as it summarizes the current insanity succinctly. If you do not like “detached from economic reality” use “totally divorced from reality” instead.

Bearish Argument #39 – Hertz

The price action on Hertz was quite insane for a two-week period and was widely mocked. CNBC had to do a few segments explaining to investors that investing in a company that had declared bankruptcy was not a prudent course of action. Some bears have argued that the retail euphoria and algorithmic price action displayed in Hertz is simply symbolic of the price action in the entire market over the last few months.

Bearish Argument #40 – Extreme FOMO

Simple argument – extreme levels of FOMO (fear of missing out) is a sign of a market top.

Bearish Argument #41 – Distribution

A more cynical and nefarious bear porn argument is that what is occurring right now is simply distribution. The basic tenets of this argument go as follows:

- In low volume markets powerful insiders cannot dump all their overvalued shares to unsuspecting retail traders or risk stock plummeting in this environment.

- To get top dollar, distribution games are played. Sell a little each day on upticks. Buy enough back if support levels are threatened to maintain support only to keep the process going as stocks are consistently unloaded at higher prices.

- When distribution is complete, then price can collapse and insiders can purchase at much, much lower prices.

Do you want to be the insider or the bagholder?

Bearish Argument #42 – Gear up for the Impending Financial Apocalypse

I think it is especially important that as the financial systems of society are starting to implode to start to prepare to protect your family and make sure your basic needs are covered. Water, food shelter, resources, health, and safety materials…wait a second, I was just thinking that and didn’t mean to write it. I apologize, move along, nothing to see here.

On a completely unrelated note here is a list of 50 items that one should have in available to them in case of economic or societal collapse courtesy of Michael Snyder via TheMostImportantNews.com:

- #1 A Generator

- #2 A Berkey Water Filter

- #3 A Rainwater Collection System If You Do Not Have A Natural Supply of Water Near Your Home

- #4 An Emergency Medical Kit

- #5 Rice

- #6 Pasta

- #7 Canned Soup

- #8 Canned Vegetables

- #9 Canned Fruit

- #10 Canned Chicken

- #11 Jars of Peanut Butter

- #12 Salt

- #13 Sugar

- #14 Powdered Milk

- #15 Bags of Flour

- #16 Yeast

- #17 Lots Of Extra Coffee (If You Drink It)

- #18 Buckets Of Long-Term Storable Food

- #19 Extra Vitamins

- #20 Lighters Or Matches

- #21 Candles

- #22 Flashlights Or Lanterns

- #23 Plenty Of Wood To Burn

- #24 Extra Blankets

- #25 Extra Sleeping Bags

- #26 A Sun Oven

- #27 An Extra Fan If You Live In A Hot Climate

- #28 Hand Sanitizer

- #29 Toilet Paper

- #30 Extra Soap And Shampoo

- #31 Extra Toothpaste

- #32 Extra Razors

- #33 Bottles Of Bleach

- #34 A Battery-Powered Radio

- #35 Extra Batteries

- #36 Solar Chargers

- #37 Trash Bags

- #38 Tarps

- #39 A Pocket Knife

- #40 A Hammer

- #41 An Axe

- #42 A Shovel

- #43 Work Gloves

- #44 N95 Masks

- #45 Seeds for A Garden

- #46 Canning Jars

- #47 Extra Supplies for Your Pets

- #48 An Emergency Supply of Cash

- #49 Bibles For Every Member Of Your Family

- #50 A “Bug Out Bag” For Every Member of Your Family

I mean if we are going to do some bear porn let’s go all the way! Preppers for the win!

Bearish Argument #43 – Oil Prices

While oil at $40 seems incredibly bullish compared to where it has been recently, there have been over 100,000 jobs lost in the Oil & Gas industry during the virus crisis. An entire sector in the S&P is under duress and if the recent asset write-downs from BP and Royal Dutch Shell are any indication, U.S. companies are looking at billions and billions in write-downs.There have numerous bankruptcies already and more are undoubtedly to come which could be another weight on banks with heavy loans to this sector.

Future significant rises in oil prices could be problematic with OPEC+ started to increase its production after its cut agreement expired at the end of July.

Bearish Argument #44 – Valuations

Market valuations on many levels are at or near record levels…inside a recession. I literally could write 3000 words on this subject. Let me summarize…valuations are so insane that market analysts are now attempting to come up with new methods of valuations since the old ways (you know like P/E, PEG, Free Cash Flow) can no longer be justified. In 2045 bear porn writers will reference 2020 quite often as a classic example showing why in 2045 “this time its different” still does not apply.

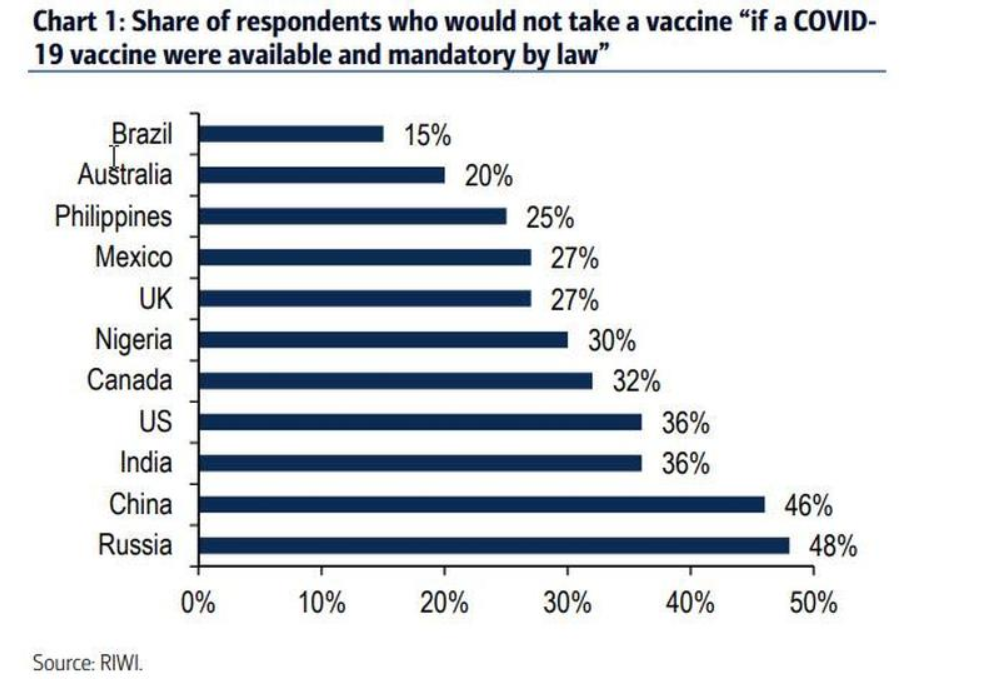

Bearish Argument #45 – Vaccines

Bears like to point out that there has never been a successful vaccine for the coronavirus. Even if one is developed, there is a large percentage of Americans who have recently indicated that they will not take it. Covid-19 and the economic ramifications are going to be with us for a long while.

Bearish Argument #46 – Reliance on Certainty – Pricing in Perfection

The markets are brushing aside all the bearish arguments that are being made. There is currently a “reliance on certainty” about future outcomes, which given the breadth of the problems the economy is facing seems foolishly hopeful at best and recklessly foolish at worst. Pricing in perfection, in a world in which we have almost no certainty, is quite the stance to take.

Bearish Argument #47 – Domino Effect

The entire economy is so interconnected that if something starts to go wrong it could have a significant rippling effect on the whole economy. If a few of the bearish arguments here occur simultaneously then it could cause a sentiment shock that sends a bubbly market bursting.

Bearish Argument #48 – V-Shaped Fantasy

The market is priced for one of two outcomes:

- A V-shaped recovery

- A trillion dollars a month in government stimulus

Neither are possible. The original illusion of a V-shaped recovery was based on the idea that the initial multi-trillion-dollar stimulus package would give the economy a huge adrenaline shot. In timely order companies would hire back workers, lending and spending would resume at previous levels, and tax revenues for states and local governments would return to pre-pandemic levels. This is off the table now.

Unless the economy does a miraculous V-shaped recovery, or the government commits to nearly a trillion a month in stimulus, upcoming earnings reports from companies are going to reflect a reality that the market simply cannot ignore anymore.

Bearish Argument #49 – No Plan B

If plan A does not work (Fed monetary and government fiscal support) there is no plan B. Plan A better work.

Bearish Argument #50 – Tighter Financial Conditions Would be Disastrous

It seems like a fantasy to assume that tighter financial conditions would occur until the crisis is over. It might be a fantasy to assume that the Fed will allow them to ever return. Some smart writers have speculated that fighter conditions in other parts of the world (for example China’s 10-year going above 3.5%) could pop the tech bubble.

Bearish Argument #51 – Fed is Running Out of Ammo

Interest rates are at zero, the Fed is buying bonds, QE infinity is currently in effect…the Fed is running out of bullets in its chamber. There is the ultimate wildcard of buying stocks outright but that would take an act of Congress and unlikely to occur unless the entire financial system was collapsing.

Bearish Argument #52 – Eventual Financial Collapse

There are so many theories on how current conditions will lead to the outright collapse of the financial system that I just do not have the heart to torture you at this moment. Maybe later in a future Doom Porn segment. I would however revisit bearish argument #42 just in case.

Bearish Argument #53 – The Next Credit Crisis Will Be Worse

After the global financial crisis of 2008, banks went through a process of de-leveraging. Today companies are doing the opposite. Ed Altman, described as the father of credit risk modeling, gave the commonsense warning that “When there is an increase in insolvency risk, what you do not need is more debt. You need less debt.” If we get through this crisis, we are even in worse condition for the next one around the corner.

Bearish Argument #54 – Government Debt

We all know that Jerome Powel makes the money printer go brrrrr. While we love to joke about this, there are eventually consequences to the levels of spending that have and are occurring as the U.S. debt reaches mind blowing levels based both on actual dollars and percentage of GDP.

Extreme arguments surrounding the consequences of this level of debt fall squarely in the doom porn camp and often revolve around sovereign risk. Other arguments surrounding debt point to a “Japanification” of the U.S. economy and markets. In this scenario the debt burden results in extremely low returns over an extremely long period of time. Others lack sophisticated arguments but commonsense causes them to scream “You cannot just print $3 trillion of fiat credit in just four months as the Fed has done and get away with it.”

Most people recognize this is a problem. Most people recognize that debt is only going to get bigger and bigger. A growing percentage of people are starting to believe that this debt will ever be serviced or repaid in the future. Debt is not a triggering event that will cause a short-term stock market correction. After all the market furiously goes up the more we spend. However, it is a long-term systematic issue which we should all be aware of as we plan for our financial future.

Bearish Argument #55 – Benjamin Graham said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

We all have heard the saying “the market can stay irrational longer than you can stay solvent.” However, the market cannot stay irrational forever. Something will prick the bubble, fundamentals and reality will realign, and a reversion to the mean will occur. It always does.

Final Thoughts

I will continue to “trade what I see” as I am first and foremost a student of technical analysis. “Do not fight the trend my friend” is always good advice and one that has made people money in the last few months. I also recognize that the Fed and powers that be cannot afford a sentiment crisis that a stock market crash would create and “The Team” will do everything in their power to prop up this market.

However, I believe we are in the midst of a historic asset bubble that could pop at any time. Maybe this week, maybe next month, maybe next year. I do not have a crystal ball on that one. Heck, maybe all of this really is just bear porn and there isn’t even a bubble and there is nothing to worry about! Probably not, but its 2020 so anything is possible.

As such, I trade bullish as the charts warrant it, but I am exercising prudence in my trading by not being overleveraged or having an overabundance of trades going on at any given time. I am happy making money in this environment as I am sure most of you are and while I could make more if I “put the petal to the metal” I think that would be reckless in this environment.

My trading plan is pretty set in stone. As far as my long-term investing plan? I am going to need a few days far away from bear porn before I can contemplate that. All I want to do after writing this article is “smash the short button” so I should probably decompress before tackling that subject.

.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.

jimbo

jimbo

August 24, 2020 at 5:34 PMI was expecting at least a Centerfold…