Welcome to the third and last installment of the System Design series. With the two previous parts in hand, the first being Demystifying Systems (July 2018) and the second being the MCO Framework (August 2018), you are good to take the first steps towards building your own successful system. In the first edition, we demystified systems in general and presented the System-Thinking Approach. On the second, we presented and taught you how to use the MCO Framework to put together a system, one that can easily be a core position inside your portfolio.

We are happy with the results so far, however, there are two things lacking: (1) wrapping everything up and (2) like our mothers always do, give you some (scary) warnings before you leave home. The world can be a dangerous place, but it is inside our heads that many of the battles we fight take place.

This is what the September edition of the Trading Justice newsletter is all about: The Four-Legged Chair & The Four Horsemen Of The Trading Apocalypse.

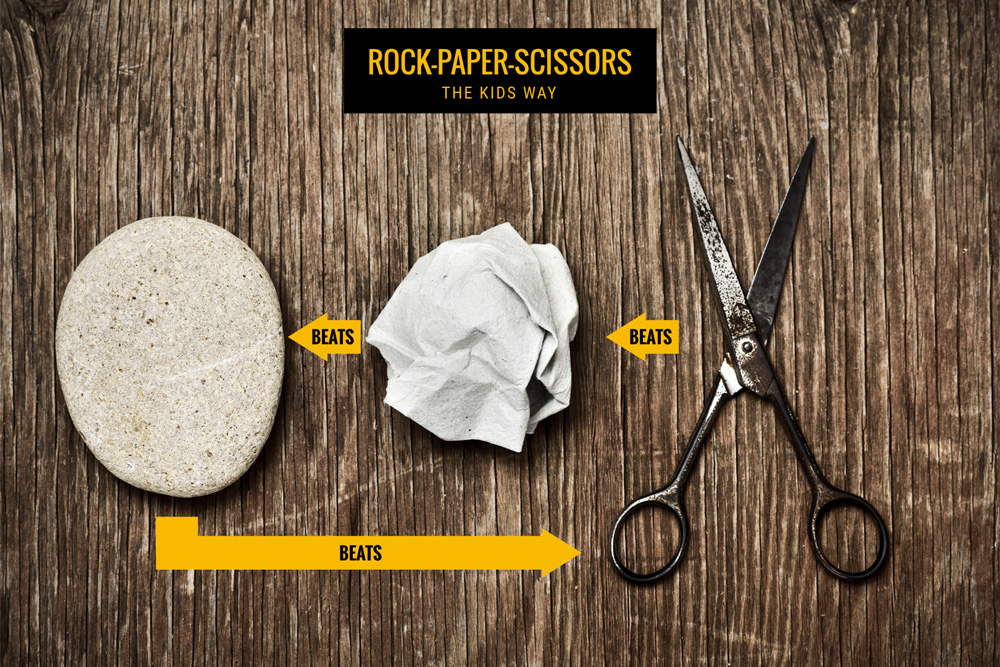

Rock–Paper–Scissors

Before we jump into explaining what the heck is “The Four-Legged Chair & The Four Horsemen Of The Trading Apocalypse”, let’s just say that they hate each other. They are not best friends by any stretch of our imagination. This strange relationship works pretty much like that game Rock–Paper–Scissors. Kids these days are all bits and bytes but old fellows like us used to play this sort of game. Although innocent at a first glance, it can teach us a lot:

There are three main differences between the Rock–Paper–Scissors and the Chair-Horsemen game:

- The Chair-Horsemen game is real. It is played in real life with real money, real investments, real trades.

- There are only two players and one beats the other.

- The key in this game is YOU. If the Horsemen burns your Four-Legged Chair to ashes, it is because of you. If the Chair crushes the Four Horsemen of the Trading Apocalypse, it is also because of you. As stated by Stephen King, “Monsters are real. Ghosts are too. They live inside of us, and sometimes, they win.”. It is what’s inside your mind that determines who defeats who.

This real-life tour de force will look more or less like this:

Now that you are acquainted with the bloody battle, let’s present the contestants.

The Four-Legged Chair

You can’t have a stable chair with only two legs. You can’t have a successful system by only having a good Mentor and a good Concept. The Outline should be the third piece of the puzzle.

Great ideas and great Mentors do not equal great systems. You can have the most creative and innovative Concept for a trading system worked together with the best available Mentor, however, if it lacks rules, it will tank. Outline equals Rules.

Take The Turtles as an example. Great Mentor, great Concept, great playbook all packed together with a great training. Looked promising from that perspective. Even so, most of the Turtles failed to make money. Why?

According to Curtis Faith in his book “The Way of the Turtle”:

“[…] These [the Turtles] were very intelligent people who had been taught by the most famous trader of that time. Several of them would be among the most successful traders in the world within a few years, yet they had failed to execute the plan during the practice trading period. Over the years I kept finding evidence that emotional and psychological strength are the most important ingredients in successful trading. This was my first exposure to that idea and the first time I had seen it in action.”

How good are rules without a perfect execution? The outcome will range from nothing to a disaster. That’s how we get to the last and most important leg of the chair: YOU and the System-Thinking Approach. Practice time, consistency, discipline, commitment, and diligence. The trading psychology foundations will only come from you.

Leg #1

Brings knowledge and experience about the financial markets. This leg is a shortcut that will lead you to an unimaginable pool of knowledge. This leg will hold you accountable and proactive; it will help you with your whys and goals. It has been there, done that.

This leg is the Mentor.

Leg #2

Narrows down all strategies, timeframes, and markets to the ones that are relevant for your trading system. It helps you stay on the right track and guides you when uncertainty plagues. It’s the Idea behind it all. It is the very Mission of your system; its heart and soul.

This leg is the Concept.

Leg #3

Kills randomness by bringing consistency and discipline to your trading business. It helps you leave your emotions outside the door and focus on what matters. It is your best trading partner, the one that will pinch your arm and make you stay with both feet on the ground.

This leg is the Outline.

Leg #4

It executes each and every rule with perfection. It follows all procedures with accuracy and never improvises. This leg keeps the Four Horsemen of Trading Apocalypse at bay. It has a strong commitment to the success of your trading business.

This leg is YOU.

…

Wrapping things up: CHECK. Now we’re moving on to Mommy’s advice. That do-not-hang-out-with-that-type-of-person kind of advice. We could even make a list out of it, as people seem to love lists, “The 4 Types of Friends You Should Avoid” or “4 Types of Friends You Should Get Rid Of Immediately”. They are The Four Horsemen Of The Trading Apocalypse.

“Four Horsemen of the Apocalypse” — Viktor Vasnetsov, 1887. (source: Wikimedia Commons)

The Four Horsemen of the Trading Apocalypse

Please to meet you, hope you guess my name.

These four men got one job and one job only: to plague you as a trader. They represent the wrong mindsets and behaviors that will make you incur in deleterious and, most of the times, irreversible actions.

Conversely, you got one job and one job only: avoid them at all times, at all cost. Don’t let them in. Beware of the darkness they bring. If they got in and took control of your trading business, your job will be leading them to the door out. Chair beats Horsemen.

For a better understanding of the roles they play, once they take over your mind and start guiding your actions and decision-making processes, we’ll be handling them once at a time.

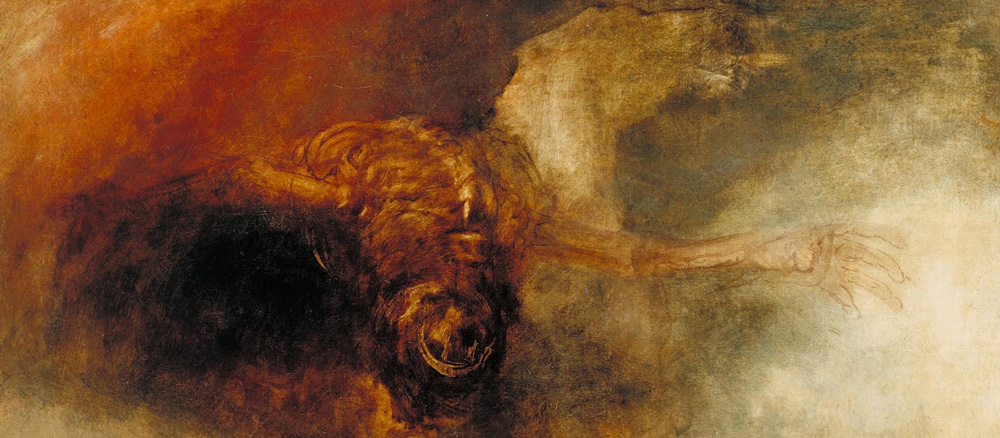

“Death on a Pale Horse” – Joseph Mallord William Turner, 1825. (source: Google Art Project)

The First Horseman: The “This time it will be different” mentality

- “The max loss in this position is $500. A hundred dollars more won’t make any difference.”

- “I found this opportunity of placing one more trade. Eleven positions won’t hurt because the probability of profit is very high.”

- “This contract is not very liquid but has excellent ROI when I run the numbers. I believe volume will kick in during the next couple of days.”

These are all WRONG mindsets!

The “This time it will be different” mentality is the first of the Four Horsemen of the Trading Apocalypse. As soon as you incur in this mindset you call the horseman. To defeat him, while choosing a candidate or running numbers as part of your pre-trading process, always ask this simple question:

– “Is it in accordance with the rules?”

If the answer is NO, then, NO. Either you dump the candidate or the trade. This time WON’T be different.

Quoting the Oracle of Omaha:

“Investing is an activity in which consumption today is foregone in an attempt to allow greater consumption at a later date. “Risk” is the possibility that this objective won’t be attained.” – 2017 Letter to Shareholders.

Be consistent and always follow the rules. Stay away from the edge of ruin.

“Death on a Pale Horse” – Benjamin West, 1796. (source: Wikimedia Commons)

The Second Horseman: The “Analysis Paralysis” trap

Analysis paralysis is the state of over-analyzing a situation so that a decision or action is never taken, in effect paralyzing the outcome.

Most beginners fall into this trap. They over-analyze a position and never move on to further pull the trigger, either to get in or out of a position. The analysis becomes an end in itself and no action is taken.

If you analyze a position too much, you’re probably feeling insecure. What that could mean is (1) you are not following the rules, (2) you don’t have rules at all, (3) you’re seeking the optimal or “perfect” solution upfront. The result is clear: fear of making any decision which could lead to erroneous results.

There is no such thing as a “perfect” solution. We are not perfect, systems are no perfect and we fail more often than we like to. The Analysis Paralysis trap is the second of the Four Horsemen of the Trading Apocalypse.

To defeat him, instead of not making any decision or taking any action, we suggest you take the following approach:

- Every time you feel paralyzed, check if you have clear rules on what is making you feel insecure.

- If not, lay out clear rules and execute them.

- If you have them and they are clear, execute them.

- Exhaustively practice going from rules to execution in a simulated environment (paper account).

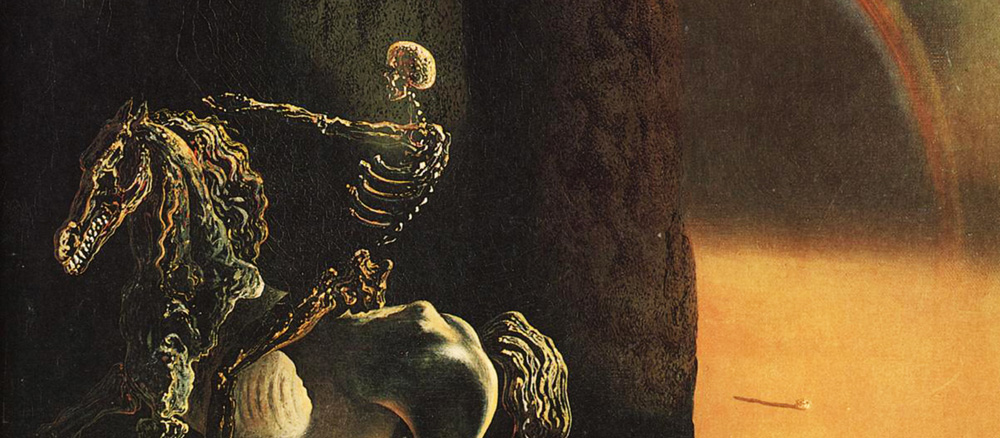

“The Horseman of Death” – Salvador Dalí, 1935. (source: Wikimedia Commons)

The Third Horseman: The “Button-clicking Phobia”

Just like the Analysis Paralysis trap, the Button-clicking Phobia is a commonplace among new traders. Simply put: they are terrified of doing something wrong and lose money.

Expanding this concept just a little bit we can encompass all pull-the-trigger phobias: a general fear of doing something wrong, therefore, never pulling the trigger. You’ve found a candidate, done a thorough analysis and ran the numbers. You’re confident about the position you’re about to get in. But there’s still something holding you back. It is the fear of clicking something wrong. A few examples could be:

- Fear of clicking BID instead of ASK and entering a naked instead of a long position;

- Fear of clicking anything while the market is opened;

- Fear of entering a DEBIT spread instead of a CREDIT one, therefore, trading in the wrong direction (trade Bull Call instead of a Bear Call, for example).

Sounds fair enough. We’ve all been there.

The bad news is: if you never click buttons/pull the triggers, you won’t get practice time. If you don’t get to practice, you won’t learn. You neither make nor lose money. You will stay where you are. You’re never gonna learn how to ride a bike by reading a book.

The Button-clicking Phobia is the third of the Four Horsemen of the Trading Apocalypse. To defeat him, our suggestion is you take the opposite approach. Put the pedal to the metal. If you’re working with a Mentor and he/she tells you to place two trades, place four. Doubling or even tripling the Mentor’s request will make you proactive and build momentum. This approach will turn your trading into a daily habit, a second nature. See how many trades you can handle at the same time and still be on top. Take advantage that you’re inside a simulated environment and get on the edge of chaos. Know your own limits.

“Death on the Pale Horse” — Gustave Doré, 1865. (source: Wikimedia Commons)

The Fourth Horseman: The “Wait, not now” behavior

If you have a plan set up and rules laid out, you don’t have to think much. You will act like a robot and leave no space for phobias or hesitations whatsoever. The System-Thinking Approach will instantly kick in.

The problem is that there are still two toxic behaviors that can lead you to serious problems.

- Reach the profit target and not exiting the trade because it can profit more. That’s greed.

- Reach the loss limit and not exiting the trade because eventually it will get back and you will lose less or even profit, thus, reverting the initial loss. You go from trading to praying; that’s hope.

Both are 100% WRONG!

Defeating the fourth horseman is simple: Never, ever stay on a trade after reaching your preset targets or limits. Close the trade immediately. Have an exit plan for both profits and losses and execute them.

The “Wait, not now” behavior, together with the “This time it will be different” mentality, the “Analysis paralysis” trap and the “Button-clicking Phobia”, are the Four Horsemen of the Trading Apocalypse.

Presenting the Four Horsemen of the Trading Apocalypse and teach traders how to defeat them with the Four-Legged Chair: CHECK.

…

Traders, this is it. The July, August and September editions of the Trading Justice Newsletter was quite a journey to the center of the trading systems with our readers. And we loved it! Time to say goodbye.

Or not!

We are very excited to announce that we are releasing in the near future a complete 101 series on how to develop your own trading system from scratch. Stay tuned!