Menu

Trading Justice Newsletter

Trading Justice Newsletter

Just like in the Omelet & the Eggs story—available here—, this newsletter was entirely inspired by a conversation I had with a friend over WhatsApp. I won’t say his name for obvious privacy reasons, but Anderson has not only been a friend of mine for almost 25 years, but we were also colleagues and co-workers in the veterinarian practice. We graduated from the same university, went through the same post-graduate program (Master’s Degree), became teachers in the same university, and we also quit being vets a long time ago. Although we live oceans apart today, we still keep in contact with each other. He even came to pay a visit to me here in Italy.

So, one evening we were sitting here at my dining table and he started asking a bunch of questions about the financial markets. He got excited about starting investing and as soon as he got back to Brazil he started studying.

— “It’s quite interesting this options thing. Can you teach me something really basic? How to profit? How do they work?”, he approached me once.

Taking a step back: “How to go really, really, REALLY basic with options?” I thought to myself. It is such a complex world: Greeks (Delta, Theta, Gamma, Vega, Rho), open interest, volume, bid/ask price, ITM, ATM, OTM, beta weight, DTE, GTC orders, contingent orders, calls, puts, assignment, exercise, rolling up, down, in and out, credit, debit, spread, calendar, vertical, LEAP, covered, naked, condors, butterflies, strike price, strangles and straddles, long, short, inverted, volatility, growth, speculation, portfolio design, risk management, contracts, rights, obligations, net liquidation, trade price, mark price.

Game over. Not gonna work. I will be damned, doomed and sink into oblivion.

So, how do you know you REALLY know something, in the first place? When you can teach something complex to anyone on their own terms. It doesn’t matter if it’s your 5-year-old daughter, your spouse or your long-time friend.

They know nothing › You know something › They ask if you can teach them › You teach them complex stuff in a simple way.

Options have so many concepts related to them that even working on a daily basis with them for the last 5 years I would never ever have the ability to put them all together in a WhatsApp conversation. Maybe in a book but definitely not over an IM app.

That’s when heuristics come into play.

By definition—and there are many around—a heuristic is “an approach to problem-solving, learning, or discovery that employs a practical method, not guaranteed to be optimal, perfect, logical, or rational, but instead sufficient for reaching an immediate goal.”

“Heuristics” is also used within the Cognitive Bias framework: “Cognitive heuristics are simple, efficient rules, hard-coded by evolutionary processes or learned, which have been proposed to explain how people make decisions, come to judgments, and solve problems, typically when facing complex problems or incomplete information.”

There you go. We couldn’t have said it better ourselves.

The concepts you are going to read in this edition of the Trading Justice newsletter are the ones I’ve taught my friend over the email.

In order to buy something, someone must sell it to you. In order to sell something, someone must buy it from you.

Before we jump into the various concepts that make Options trading so amazing, there are a few pre-trading concepts (we created this terminology ourselves) you must understand. They come before anything else and, unless someone changes the way things work, these Absolute Truths will remain absolute until we are all deceased.

An Absolute Truth, in our case, is something that is true at all times no matter the circumstances. With that said, we will begin with The Absolute Truth #1.

In Options trading, there will always be a BUYING and a SELLING activity to be performed inside your brokerage platform. It doesn’t matter if you are buying a digital contract sold by an algorithm-driven robot sitting inside someone’s hard drive on the other side of the planet. The counterpart must exist for the operation to succeed. Many would say THIS IS OBVIOUS!, but one of the most common errors new traders get in to is opening positions on illiquid assets. Remember: If there are no buyers, you can’t sell an asset; if there are no sellers, you can’t buy an asset. These assets are illiquid and you will get in trouble.

If you buy an option contract to open a position, you must sell it back to close it. If you sell an option contract to open a position, you must buy it back to close it.

Moving on to the Absolute Truth #2, on order basics:

Many new traders have a hard time to understand the mechanics behind opening and closing positions, especially when trading multi-legged option strategies, a situation where you simultaneously buy AND sell contracts. Take a look at the next infographic:

There are two basic option contracts: Call Options and Put Options. The possible combinations between them are virtually infinite.

What about Calls and Puts? This is what the Absolute Truth #3 is all about:

Although there are only two types of contracts, you can greatly expand the combinations between them by inserting other variables into the mixture. The ratio between the contracts and different expiration dates are just a few of many examples.

Speaking of different expiration dates, I got an interesting story to tell you:

Four years ago, it was a hot February in Rio de Janeiro (a.k.a. Hell de Janeiro), as usual, and I was about to attend a class taught by Micah Brooks. Anyone that has been his student can attest to the fact that he is a great educator.

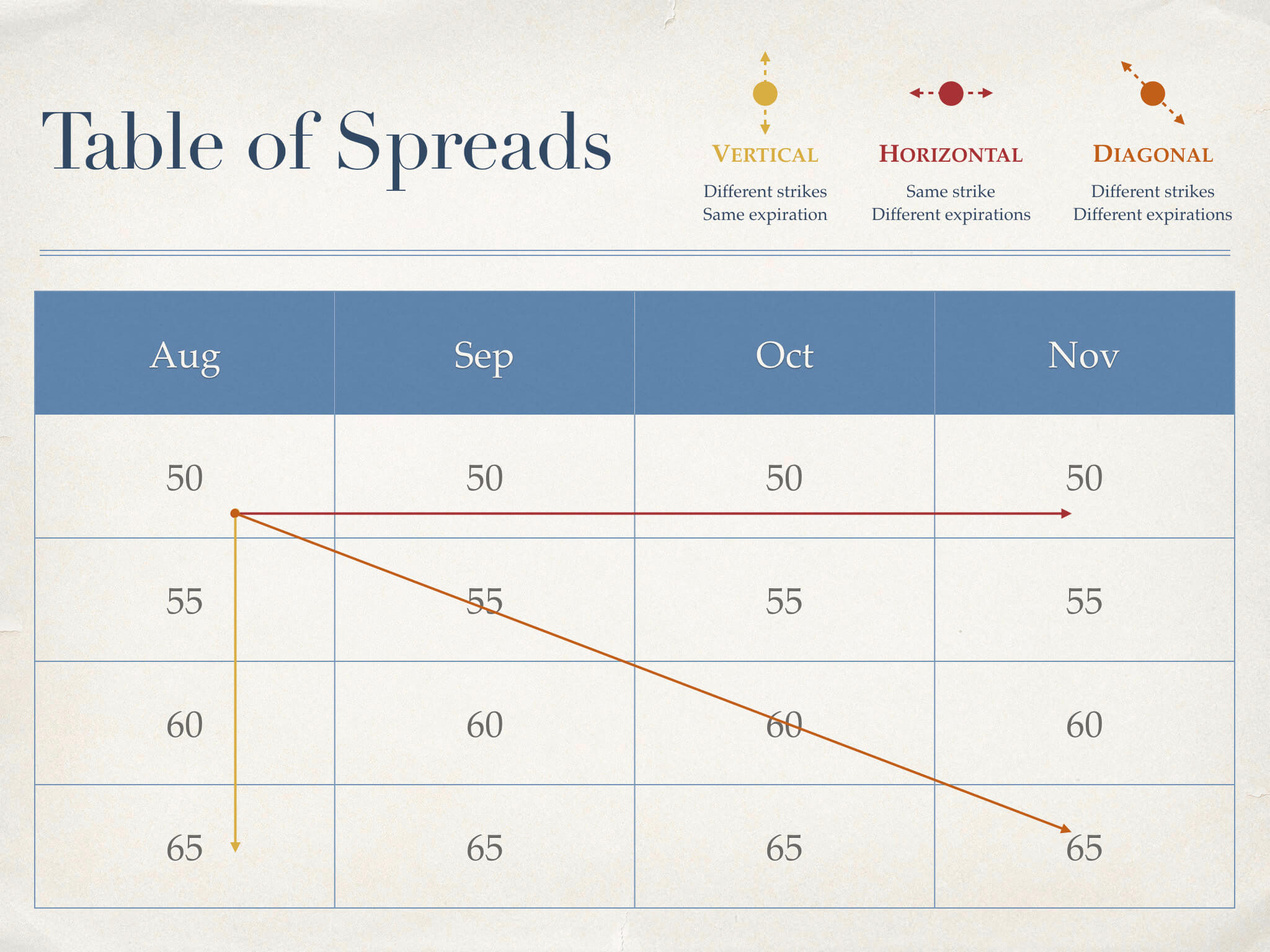

I was a struggling trader, still in diapers, and there was something still off for me: the difference between vertical, horizontal and diagonal spreads. Staring at an option chain, trying to figure out what the heck those spreads were, turned out to be a waste of time. Some individuals understand basic trading concepts through numbers. Others, through visuals. I’m included in the second group.

Then came Micah with one image. One single image, that saved me, possibly, hundreds of hours and millions of neuron cells. For those of you who struggle with the difference between the spreads, check the image below:

Options are multidimensional beings. Their price is determined by the current price of the underlying asset, strike price, volatility, time until expiration, and risk-free interest rate.

Absolute Truth #4 is about the nature of options. Although they are basically contracts and the only types available are calls and puts, appearances can be deceiving. They are derivatives, assets that derive their value from the performance of an underlying entity.

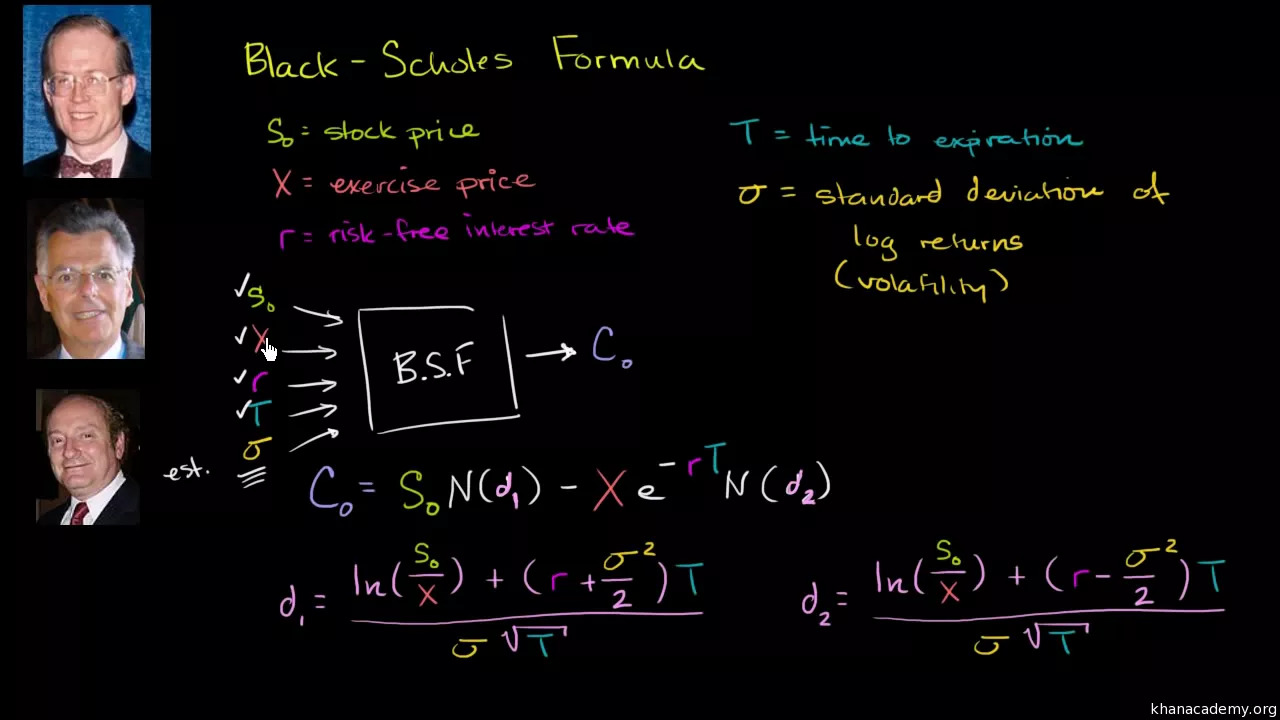

What that means is that for you to put a price tag on an option contract you will have to take into consideration not just supply and demand but many other variables. Options don’t belong inside the regular price definitions, instead, they are calculated by mathematical models, the most famous being the Black-Scholes, developed and introduced in 1973 by Fischer Black, Myron Scholes, and Robert Merton.

Don’t get too caught up in calculating the price of a contract, instead, try to focus on the influence that all variables we’ve cited previously have on options pricing. This is what will help you become a successful trader.

If you are interested in learning the Black-Scholes formula, I strongly recommend you watch the video below, from Khan Academy on YouTube.

Options are like any other contract in the sense that:

(1) they set the rules of the deal, and

(2) they have a date where they are not valid anymore.

This plays a major role in our trading business. The time between now and the expiration date influences the price of the option due to the amount of uncertainty that is built into it. If Time = Uncertainty, then more time, more uncertainty.

The price of an option contract is divided into Extrinsic Value and Intrinsic Value.

The last Absolute Truth naturally leads us to this one.

(Note: Extrinsic Value is also called Time Value)

Many beginners have a hard time grasping the concept due to how things are explained. Usually, the first thing they encounter on the web when searching for Time and Intrinsic Value is either a chart or some sort of calculation. If they are not a Maths person, the first reaction might be “Man, I’ll never learn this thing.” It is really simple, though.

Intrinsic Value is the *real value* of the option contract, whereas Extrinsic (Time) Value would be like a “fake value” so to speak, a value that is determined by the amount of time (thus, uncertainty) from now until the expiration date. Put in a simpler way, Intrinsic Value is more down-to-earth; Extrinsic Value is pure fugazi.

There is an interesting concept in options trading called moneyness which is pretty straight forward: it refers to the relative position of the current price of an underlying asset (stock, ETF, futures contract) with respect to the strike price of its derivative, in our case, the option contract.

If you want to master options trading, you have to master moneyness. Try to answer this: If the options you bought or sold, were to be exercised TODAY, would you be making or losing money?

If you don’t know the answer yet, moneyness is your weak spot.

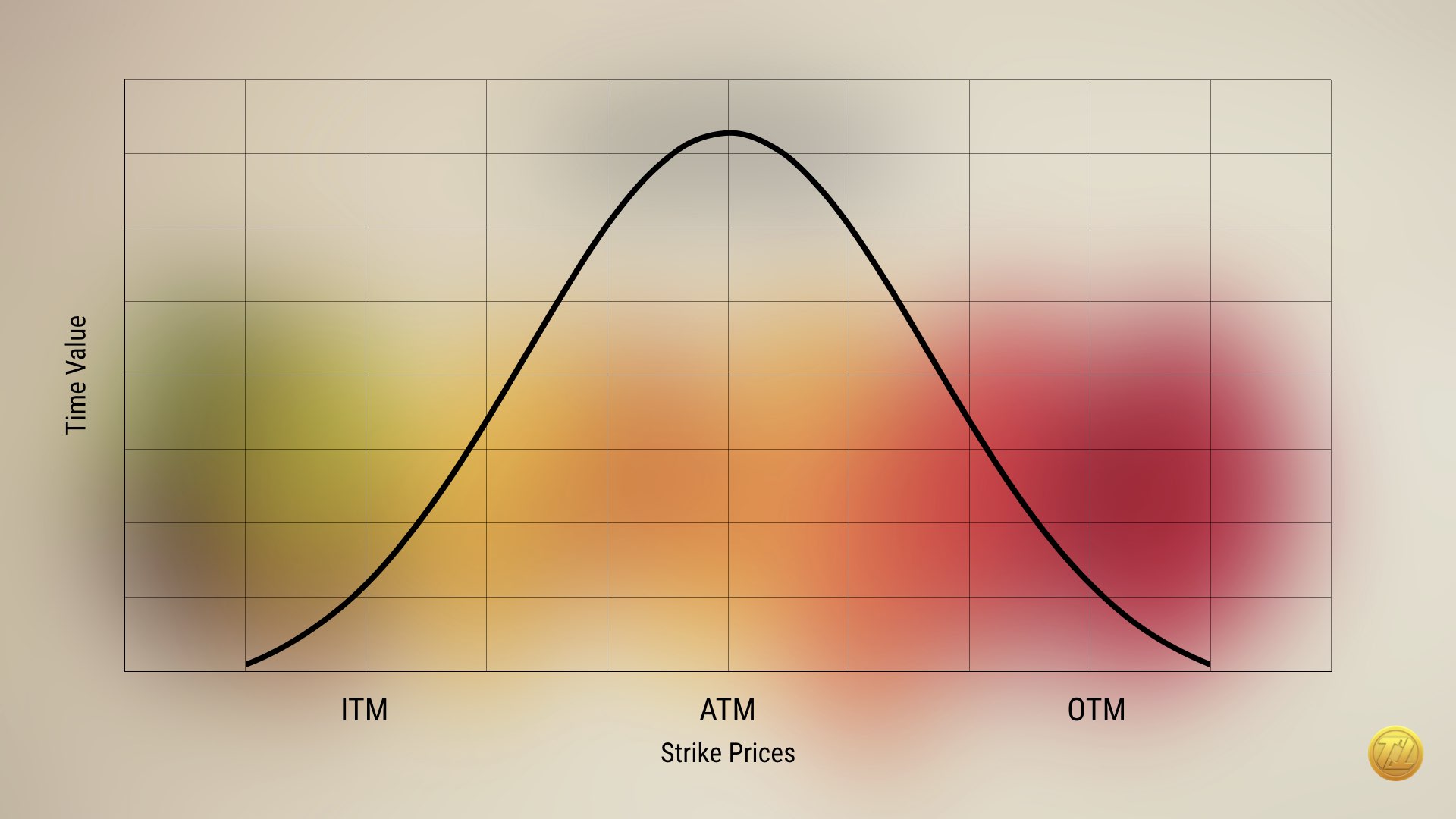

Saying an option contract is At-The-Money (ATM), In-The-Money (ITM) or Out-Of-The-Money (OTM) does not tell the complete story as it merely describes the relationship between the strike price and the current underlying asset’s price.

An option contract—either a call or a put—is said to be At-The-Money (ATM) if the strike price is the same, or nearly the same, as the current price of the underlying asset.

Generally, this is the strike price where you will find the highest trading activity (open interest and volume), the tightest bid/ask spread and also the highest implied volatility due to the amount of uncertainty baked into it.

It is the thin edge that separates intrinsic from extrinsic value. The battlefield where two different worlds stage a war for true or no value.

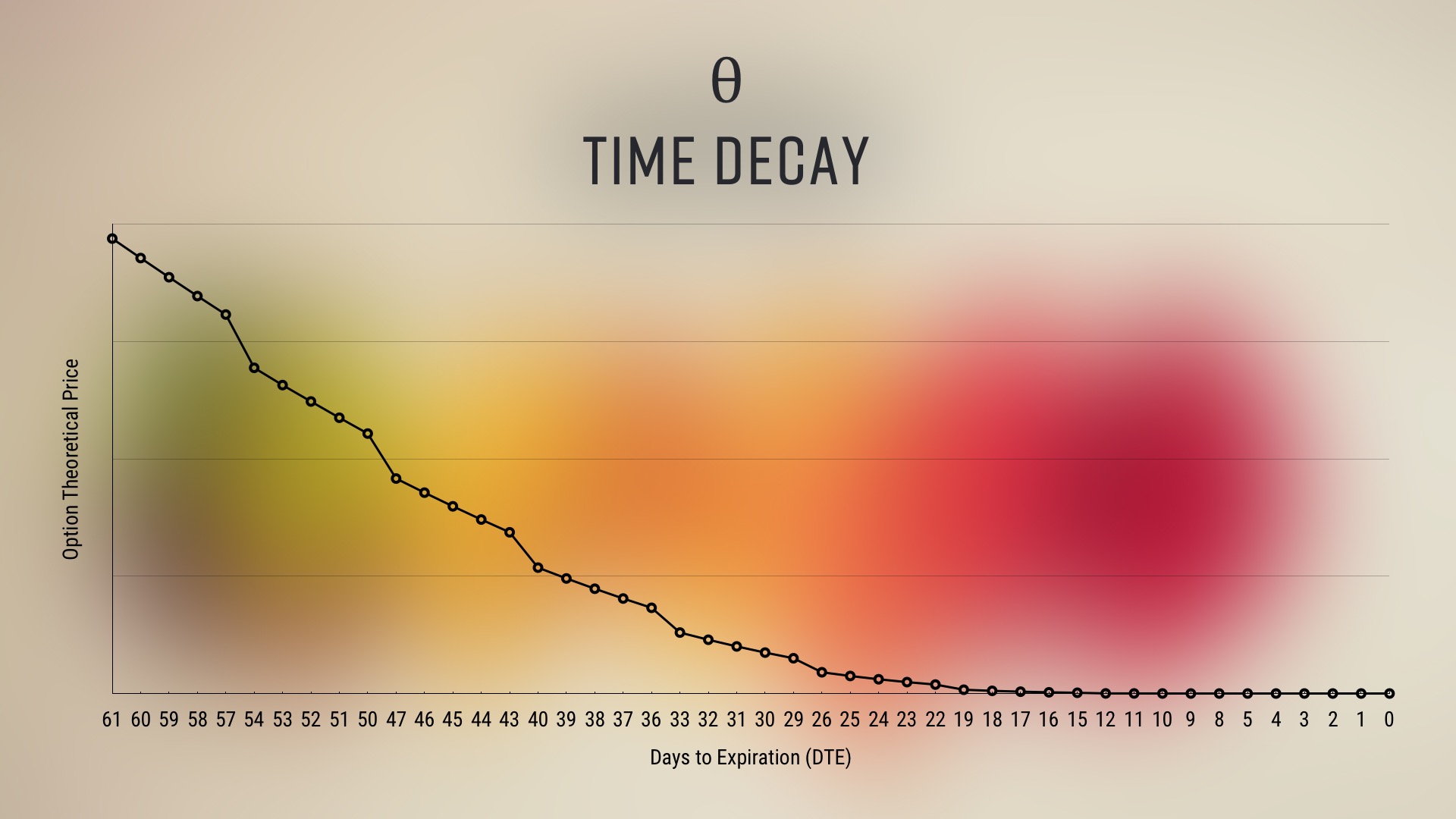

Time is the option buyers worst enemy and the option sellers best ally.

Let’s stage the scene:

Think about some of your monthly expenses like rent and insurance (health, home, car, etc.), for example. Month in, month out you incur in a debit. Month in, month out either the landlord or the insurance company incur in a credit. You are a buyer. They are sellers.

On the first day of the month, you have to pay. Thirty days later, guess what? You have to pay them again. So it’s like your contract is worth, say, $1,000 on the first day of the month and thirty days later it’s worth $0. Then you pay them again, again, and again. Time is against you, eroding the initial $1,000 into nothing.

Now stage the landlord or the insurance company. On the first day of the month, they sell you a contract that is worth, say, $1,000. Thirty days later it’s worth $0. Then they get paid again, again and again. Time is on their side, eroding the initial $1,000 into nothing.

Let’s keep it simple.

If you sell an option contract (a.k.a. naked position), either a call or a put, you incur some obligations. If the option gets in-the-money (ITM), at expiration date you will have to:

If you buy an option contract (a.k.a. long position), either a call or a put, you are entitled to some rights. If the option gets in-the-money (ITM), at expiration date you will have the right to:

To profit as an options buyer, you must buy low and sell high.

How to profit with options? Because they are multidimensional beings, and also because there are many possible strategies out there, new students find it hard to pinpoint exactly how profits are made.

When you enter an options trade, you are either a buyer or a seller. Even in more complex strategies involving, say, four options contracts, if you incur in a *net debit* to enter the position, you are a buyer (you are in a long position). On the other hand, if you incur a *net credit*, you are a seller (you are in a short position).

So how do options buyers profit?

This is as simple as it gets. It doesn’t matter if you are buying a single call, a single put or entering a Debit Condor. If you enter the position with a net debit of $1, for example, the only way to exit this position with a profit is if you sell the contract back for more than $1.

To profit as an options seller, you must sell high and buy low.

Again, this is as simple as it gets. If options buyers profit by buying low and selling high, options sellers profit by taking the opposite route.

It doesn’t matter if you are selling a single put or an entire Iron Condor. If you enter the position with a net credit of $1, for example, the only way to exit this position with a profit is if you buy the contract back for less than $1.

“But how the price of the contract will drop?”, you might ask.

Time. If you refer back to the Absolute Truth #7 you will see that time is your best ally as an option seller. You sell the contract for a price » time corrodes the price » you buy the contract back at a lower price » you pocket the profit.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

— Paul Samuelson —

Mr. Samuelson was an American economist, considered by many the Father of Modern Economics. He was also the first American to win the Nobel Memorial Prize in Economic Sciences.

For Theta traders, however, investing should be more like watching water evaporate.

Net Liquidation refers to how much of the net credit received from the option selling was already pocketed on the trade due to time decay.

Imagine the option premium is like the water inside a glass. As time passes, the value of the option gets corroded, like the water naturally evaporating from the glass into the atmosphere.

As a patient trader that you certainly are, you get to sit and witness the beautiful phenomena as it develops. The value of the contract evaporates and after a certain period of time you buy it back for a nickel. Or less. Or don’t buy it back at all. Ashes to ashes, dust to dust.

In our glass of water analogy, half a glass would be 50% net liquidation, i.e., you’ve made 50% of the total credit received from the option selling. The empty glass would be 100% net liquidation, meaning no value was left on the contract and you’ve pocketed the full credit sold.

Jonathan Ive with Steve Jobs in 2005 at Apple headquarters.

Every time I need to master complexity I look at my bookcase and see Steve Jobs staring at me. In fact, I see Steve Jobs & Jony Ive, soulmates at Apple:

“Why do we assume that simple is good? Because with physical products, we have to feel we can dominate them. As you bring order to complexity, you find a way to make the product defer to you. Simplicity isn’t just a visual style. […] It involves digging through the depth of the complexity. To be truly simple, you have to go really deep.”

— Jonathan Ive on “Steve Jobs” by Walter Isaacson —

Mastering the complexity of the financial markets is one of the keys to being a successful trader. As you bring order to complexity, you find a way to make the markets defer to you.

© 2019 Trading Justice. All rights reserved.