The drama playing out in the lumber markets over the past 18 months has been utterly fascinating to watch. But tracking the roller coaster hasn’t just been about entertainment – and it’s been oh-so-entertaining! It’s about enlightenment too. What happened to lumber provides an insightful case study on how markets work, pricing dynamics, and ultimately, why investing in equities is the best way to grow your wealth.

In this month’s newsletter, we’re going down the rabbit hole to discover the perfect storm that blew up the bubble and the needle that finally ended it.

How We Got Here

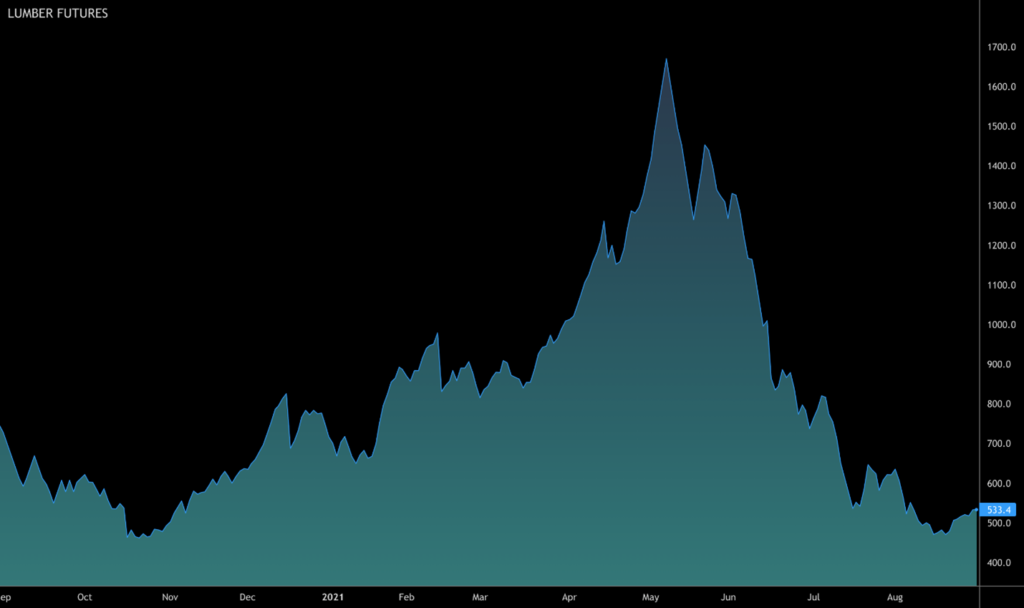

On March 30th, 2020, during the depths of the stock market crash, lumber prices stood at $296.50 per thousand board feet. They had fallen alongside equities as fear of an economic recession loomed large. The global pandemic was running roughshod over economies everywhere, and the impact of shutdowns and shelter-in-place orders remained a massive unknown.

Though investors and spectators wouldn’t have known it at the time, that sub-$300 print ended up being the low point for lumber and one of the best buying opportunities in a generation for speculators. While stock prices catapulted higher from their March lows, the gains had by lumber were otherworldly. Indeed, the eye-popping percentage gains made the commodity look more like a red-hot cryptocurrency. By May of this year, prices had reached over $1,700 – a rise of 473%.

Had the Dow Jones Industrial Average followed a similar path, it would have risen to over 100k!

But, of course, the jump in prices wasn’t permanent. As Jerome Powell, chairman of the Federal Reserve and the greatest monetary magician in all the land has so often squawked, the gains were transitory.

In a moment, we’ll get into what finally pricked the bubble and caused the great fall, but first, let’s outline what exactly caused lumber to skyrocket in the first place. It was, as I said, a perfect storm. In simplest terms, demand surged while supply slumped. And the balance was so one-sided that it took 14 months before supply caught up, and the pendulum swung back in the other direction.

Demand Surge

The potent formula driving lumber prices to the moon included the following ingredients:

1. Stuck at home consumers turning their focus away from vacations and restaurants to home renovations.

2. Stimulus checks and boosted unemployment benefits giving said consumers a hefty pay raise and the largest savings rate in decades.

3. An acceleration in the work-from-anywhere trend and demand for bigger houses.

4. A boom in home building, aided by basement-level interest rates.

These four pieces certainly paint a bullish picture for wood prices. But the elixir wouldn’t be complete without one more essential part: dwindling supply.

Supply Slump

Demand is only half the equation. Had supply risen commensurate with it, then prices wouldn’t have blasted off. But, alas, that’s not how it played out. Think back to what the world looked like last March. The stock market was crashing, and the economic engine was grinding to a halt. Workers were being laid off, and companies were battening down the hatches to survive the coming winter. Covid-19 became public enemy #1, and the economy’s health took a distant backseat on the priority scale.

If you were running a sawmill in such an environment, wouldn’t you have scaled back capacity? No doubt, your concern would have shifted from maximizing profits to minimizing losses. Forget thriving. Just try to survive.

Take this mindset, multiply it by around 3,000 (the estimated number of U.S. businesses in the sawmill and wood production industry), and what do you get? A massive gulf between supply and demand.

Here’s the money quote from Jerry Konter, Vice Chairman of the National Association of Home Builders:

“There is a disconnect between lumber supply and housing demand,” said NAHB First Vice Chairman Jerry Konter. “U.S. sawmill output increased 3.3 percent in 2020. But over the same period, single-family construction increased 12 percent to almost 1 million housing starts, and the remodeling market expanded 7 percent. We feel this mismatch between domestic production and rising demand for building materials is at the root of the unsustainable increases in lumber prices.”

Here’s what Lawrene Yun of the National Association of Realtors had to say about the matter. “There was a great fear among sawmills to prepare for a downturn. When home buying surged, they could not open up capacity quickly enough.”

And, by the way, when you (the sawmill owner) try to ramp back up to max capacity, your workers are slow to return your calls. They’re either sitting satisfied with their beefed-up unemployment checks, or they’re moving on to easier and better-paying jobs. In the post-pandemic era, power has shifted (however slightly) to the worker.

Were this the end of the story, it would be depressing indeed. But, as it turns out, the bubble did finally burst. Here’s how.

The Needle(s)

As is often the case, what ultimately popped the bubble was a multitude of factors. First and foremost, supply caught up. It turns out this is the one situation in the history of mankind where the commodity in question does, in fact, grow on trees. Once the sawmill supply bottleneck started to work itself out, prices retreated. At the same time, the world opened back up, and a slew of Covid-19 vaccines came to market. Cash flush consumers now have other pursuits vying for their attention instead of their dingy old deck that needed replacing. Finally, homebuilders appear to be slowing their building pace due to the long lead time for getting appliances and other construction materials.

These needles aside, I’d also like to point out that often the cure for higher prices is just that – higher prices. For each additional $10k added to the price of a home, a subset of buyers gets priced out. Even with rock-bottom interest rates, every buyer has a price at which a house becomes unaffordable. In this particular episode, it turns out that around $1,700 per thousand board feet was the price at which buyers said, “no mas!”

At the time of this writing (August 31st, 2021), lumber prices have returned to $533. That’s a 69% decline off the peak. So while prices may remain more volatile than before the pandemic, it’s fair to say the worst of the madness is over.

Now that we’ve explored the why and what of the lumber bubble, let’s review one lesson you must learn from the drama.

The Biggest Beneficiary to the Madness

Now that prices have returned to more sane levels, who do you think benefited most from the crash? Consumers that weren’t buying houses but instead using lumber from their local Home Depot should be happy. Their costs dropped dramatically. I wanted to do a few projects over the past six months but held off to await lower prices. Now, I have a green light.

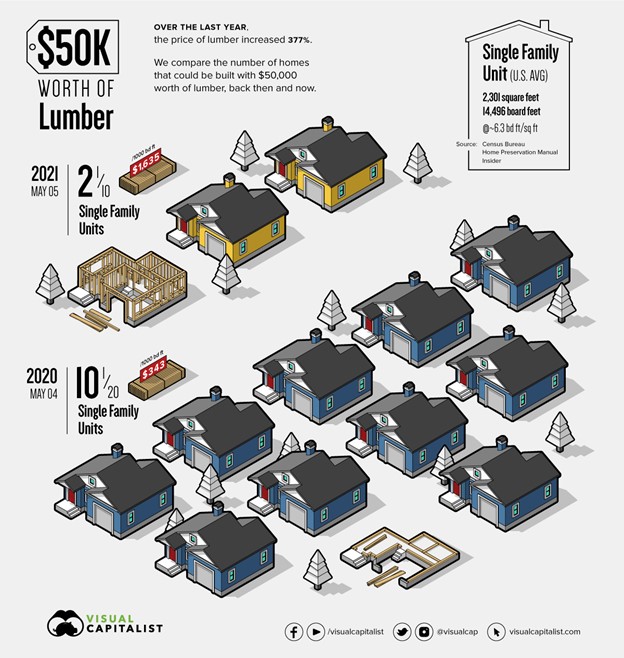

But what about those buying houses? As the lumber price bubble was inflating, the internet was littered with headlines saying the average cost of a home had increased from $30k to $40k. The Visual Capitalist presented the following graphic comparing “the number of homes that could be built with $50,000 worth of lumber” in May 2020 versus May 2021.

Homebuilders didn’t allow rising input costs to eat into their profit margins. Instead, like good little capitalists, they passed these rising costs onto consumers. And you shouldn’t blame them, by the way. These are for-profit corporations with a duty to maximize shareholder value. You would do the same if you were at the helm.

But while the phrase, “as goes lumber prices, so goes the cost of homes,” was true when lumber rose, the opposite was not true. In other words, homebuilders are not passing the entirety of the savings onto consumers, if they’re passing along any at all.

Consider the following excerpt from a CNBC article titled, Toll Brothers CEO says the drop in ‘crazy high’ lumber prices will save $40,000 per home.

“Doug Yearley, CEO of luxury homebuilder Toll Brothers, told CNBC on Wednesday that lumber prices coming off record highs will serve as a tailwind in the face of other “cost pressures.”

“Lumber is down $40,000 a home. We’re going to see the benefit of that in the second half of ’22,” Yearley said on “Mad Money.”” [Lumber] got crazy high. We knew it would come back,” he added. “We’ve been very happy with how quickly it’s come back. I think it’s going to stay down.”

In May, lumber prices hit an all-time high of over $1,700 per thousand board feet, an explosive surge from a pandemic low below $300 less than a year earlier. Lumber settled around $500 on Wednesday.

“The tailwind of lumber coming down is very comforting,” Yearley told CNBC’s Jim Cramer, a day after the company reported better than expected fiscal third quarter earnings. “It’s going to help us. It’s going to drive some margin. But I think it’s going to offset some of the other cost increases that we’re feeling.”

The most critical sentence in the entire four paragraphs was this: “It’s going to drive some margin.” Notice he didn’t say it’s going to save consumers $40,000 per home. No. It’s saving builders (the producers) $40,000 in cost per home. And what happens when your costs drop dramatically, but you can still sell the house for the same amount?

Your profit margins expanded.

That’s right, friends. The crash in lumber prices will provide a massive tailwind to the profitability of home builders everywhere.

On a side note, this is what gets lost in the whole “transitory” pitch made by central bankers using lumber as their poster child for the argument. While the Fed can certainly declare victory on lumber prices crashing back down to earth, those cost savings have not been passed onto the consumer. Are housing prices in your neck of the woods back to where they were 18 months ago? Have they even declined at all? To the public, surging home prices have been anything but temporary.

Now, the point of this isn’t to bemoan the fate of consumers. Nor is it to rail against the ravages and stickiness of price increases. Instead, it’s to make the unassailable argument that owning equities is the single best path to fighting inflation available to you.

The Greatest Inflation Hedge

In June’s Newsletter, I made the case for why the stock market allows everyday investors to outpace inflation by a mile. This month’s lumber discussion provides a perfect case study, an illustrative example of how the theory laid out in June manifests itself in the real world.

First, lumber prices and other building materials rose after the pandemic. Inflation, in other words, took the world by storm.

How did homebuilders respond? Did they see their sales stunted and outlook dimmed? Were they victims to inflation’s fury? Nay. Through their pricing power, they passed these rising costs onto consumers. In so doing, they maintained their profit margins while demand for their goods surged. The accompanying earnings increase boosted their share prices. Some companies, like KB Home (KBH), even raised their dividends and share buyback programs.

The S&P Homebuilder ETF (XHB) is up 228% from its March 2020 low.

I’ve already revealed the pièce de resistance of the lumber story, but allow me to repeat it. Though prices have crashed back down to earth, homebuilders have not had to return sales prices to where they were before the boom. First, they maintained their profit margins by rising sales prices alongside lumber. Then, their margins expanded further when lumber prices took a nosedive.

When you own equities, you get access to this phenomenon. It helps explain why the stock market has been so effective at hedging inflation over the long run. Let’s repeat the three key metrics left at the end of June’s newsletter:

- In 1960, the Consumer Price Index stood at 30. Now, it’s 267, or nearly nine times higher.

- In 1960, the S&P 500 was 58. Now it’s 4,200, or 72 times higher.

- In 1960, the dividend was $1.98. This year, it’s closing in on $60, or 30 times higher.

To be clear: the cost of living has grown 9x over the past 60 years. Meanwhile, stocks have gone up 72x, and the cash dividends they’ve paid investors have gone up 30x. Far from causing you to flee, inflation might be the most compelling reason why you should embrace equities.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.