– “Number one rule of Wall Street. Nobody… and I don’t care if you’re Warren Buffett or if you’re Jimmy Buffett. Nobody knows if a stock is gonna go up, down, sideways or in f*** circles. Least of all, stockbrokers, right? It’s all the fugazi. You know what a fugazi is?”

– “Fugayzi, it’s a fake.”

– “Yeah, fugayzi, fugazi. It’s a whazy. It’s a woozy. It’s fairy dust. It doesn’t exist. It’s never landed. It is no matter. It’s not on the elemental chart. It’s not f*** real.”

—The Wolf of Wall Street (2013)—

That is a dialogue between Mark Hannah, role played by Matthew McConaughey, and Jordan Belfort, played by Leonardo DiCaprio in the movie The Wolf of Wall Street, directed by Martin Scorsese.

That scene defines the whole movie. From that moment on, Jordan becomes corrupted, he feels attracted by the dark side of Wall Street. Speaking in terms of archetypes, Mark Hannah plays the snake in The Garden of Eden. He shows the apple to Adam (Jordan), introducing chaos inside his absolute order and naivety. It is such an iconic scene. If you take that scene out of the movie, who would be able to tell why Jordan became corrupted and addicted?

However, this month’s topic is not The Wolf of Wall Street movie. In fact, the whole 3-part series we are releasing today is not about the movie at all, nor we will be going full movie critics here.

This, as well as the following two editions of the Trading Justice Newsletter, will be about the whazy, the woozy, the fairy dust. The thing that doesn’t exist, that has never landed, that is no matter. The thing we all hold in our accounts but is not on the elemental chart.

Our money.

In this edition, in particular, we will be talking about Hyperinflation.

The Root Of All Evil

“Hyperinflation is a macroeconomic event that occurs as a result of a steep devaluation of a country’s currency that causes its citizens to lose confidence in it. When the currency is perceived as having little or no value, people begin to hoard commodities and goods that have value. As prices begin to rise, basic goods — such as food and fuel — become scarce, sending prices in an upward spiral. In response, the government is forced to print even more money to try to stabilize prices and provide liquidity, which only exacerbates the problem.”

—Hyperinflation on Investopedia—

Hyperinflation is generally considered to exist when prices rise by more than 50% in one month. In a hyperinflationary environment, unlike in a low inflation one, we see a rapid and continuing increase in the cost of goods, and also in the supply of money. This creates a vicious circle, requiring ever-growing amounts of new money creation to fund government deficits. When a government doesn’t have money, it’s hard to resist the unbearable temptation of hitting the rolling press PRINT button.

Please, pay a special attention to “steep devaluation of a country’s currency that causes its citizens to lose confidence in it” and “the government is forced to print even more money” We don’t need to be a Sherlock Holmes to discover Governments as well as their Central Banks fingerprints on each and every crime scene. A quick reverse engineering will draw us to The funding of government deficits » Increasing in the supply of money » Erosion of the real value of the currency. They print money like we print Disney drawings for our kids to color.

Back to the Fugazi, there is an old saying that goes around like this: “paper money always returns to its intrinsic value which is zero.”. Paper money is our money, your money, the fairy dust, called fiat currency in technical jargon.

Fiat currencies are depreciating assets by nature, with no intrinsic value. They are established as money by a government or central bank regulation. Simply put, our money only has value because the government maintains its value.

Or not.

This is where hyperinflation kicks in.

In a 2012 article, the website Gold Silver Worlds reveals some staggering figures. They analyzed 599 different forms of paper money that disappeared over the years and discovered that 156 of them (≈26%) were destroyed by hyperinflation, caused by over-issuance of paper money by governments and central banks.

There you go, the same perpetrators.

If you live in a country like today’s Venezuela, or in Zimbabwe during 2008, or in Brazil during the late 1980s/early 1990s, or in Germany during the late 1910s/early 1920s, or in Hungary after the World War II as well as in many other countries during the last century, you’d have had your skin in this game called Hyperinflation:

- Venezuela (Venezuelan Bolívar, symbol Bs.S.) estimated annual inflation rate by the end of 2018: 1,000,000%.

- Zimbabwe (Zimbabwean dollar, symbol Z$) monthly inflation rate on mid-November 2008: 79,600,000,000%.

- Germany (Rentenmark, symbol RM) monthly inflation rate in October 1923: 29,500%.

- Hungary (Hungarian pengő, symbol P) rate of inflation on July 1946: 41.9 quadrillion percent. We need scientific notation skills in this case.

- Brazil (Cruzado Novo, symbol NCz$, and Cruzeiro (3rd generation), symbol Cr$) annual inflation rate in 1990: 30,377% (by the way, Brazil changed its currency 5 times in less than 10 years. Those were the days, man. More details in the next section).

These are jaw-dropping numbers. On one day you have money and, while trading, you’re making plans to leave a legacy to your children, to retire for good or to reach your financial independence. The next day, you can’t even buy a comic book with your investments.

Your money has no real value.

Before we jump into the Brazilian case, bear in mind that it’s not because the United States didn’t experience such a case of currency serial killing that it won’t happen in any capacity. Some people use History as a warning, while others are more inclined to use it as a manual, a guideline on how to proceed in the present and plan the future.

Purchasing Power of the U.S. Dollar (1913 to 2013) (Source: Visually)

As you can quickly notice from the chart above, the U.S. Government might learn a thing or two about currency devaluation with their tropical counterparts (or was it the other way around?). Notice how steep the U.S. Dollar devaluation becomes short after the creation of the Federal Reserve. In 1971, Richard Nixon put the final nail in the coffin, ending the gold standard, burying the Bretton Woods pretty deep, making the U.S currency a full-fledged fiat currency worth ZERO in terms of intrinsic value. That’s what we call The Inverse Midas Touch.

The complete collapse of the U.S. Dollar is not a matter of IF but WHEN. Remember: we traders are not in the I-need-to-be-right-and-predict-the-future business but in the building-and-protecting-wealth business.

Now is the time for us to delight you with “The Curious Case Of A Currency Serial Killer”.

Brazilian 500 Réis (symbol Rs$) Treasury note from 1880. Source: Wikimedia Commons.

Brazil: The Curious Case Of A Currency Serial Killer

All sins are permitted below the Equator line, according to the popular wisdom. The Brazilian Central Bank took it to a whole new level. Allow me to extend a little bit the Brazilian hyperinflation case, previously mentioned in the preceding section.

The Brazilian Central Bank was established on December 31, 1964 (Happy New Year, poor creatures!). At that time, the currency in circulation was the 1st generation Cruzeiro, created in 1942, as a replacement for the 1st generation Brazilian Real (“royal” in English, see cover picture), in circulation since the colonial times.

In less than three years after its foundation, the institution started what would become a serial killing of currencies. Although the zero was invented independently by the Babylonians, Mayans, and Indians— and the Babylonians got their number system from the Sumerians, the first people in the world to develop a counting system— the Brazilian Central Bank repurposed its usage. They are the masters of zeros. Zeros to the left side, I should say.

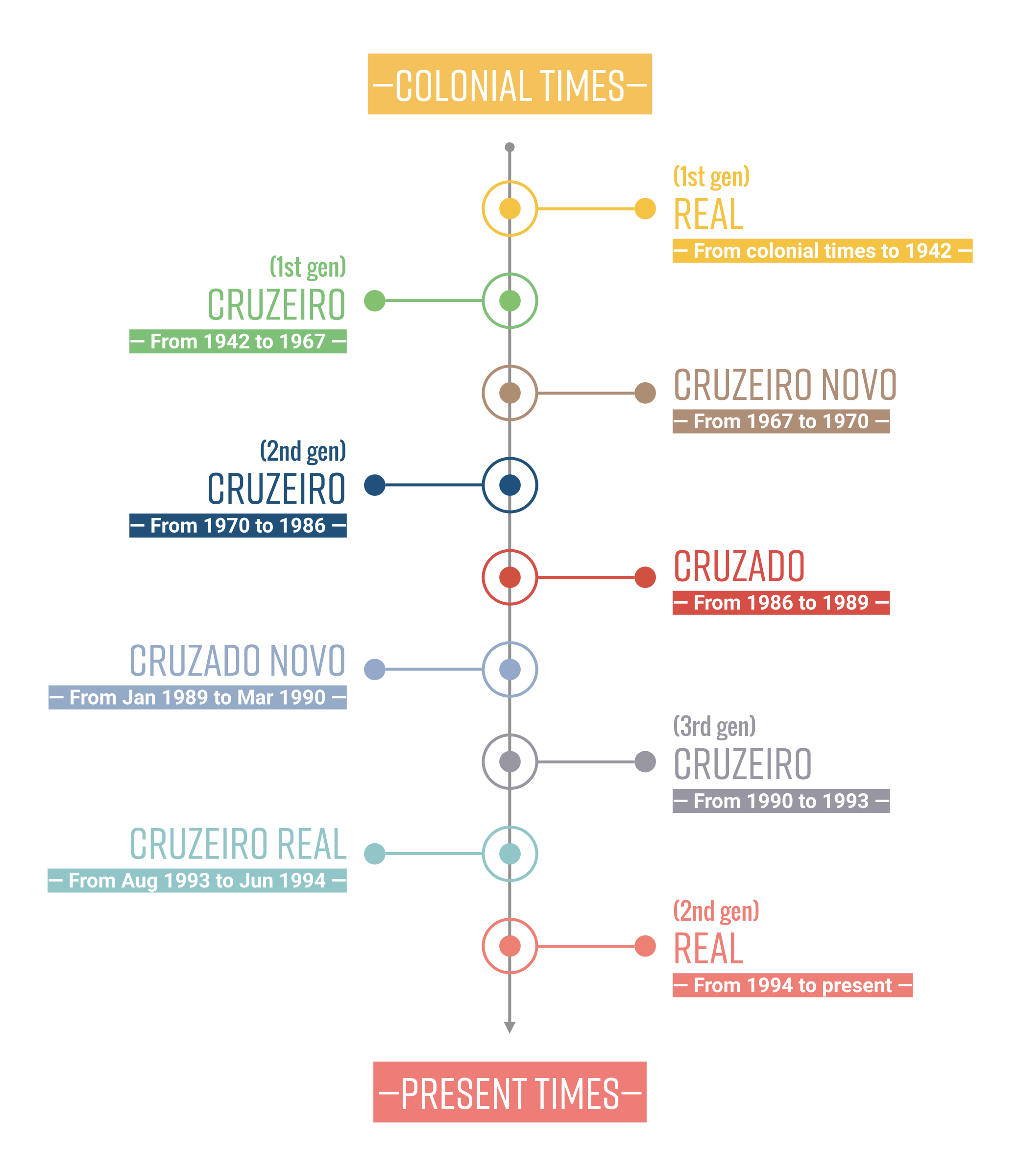

To illustrate this curious case, we developed the following timeline:

Gallery of the Brazilian dead currencies. May they rest in peace.

Although colorful, this infographic could be considered a gallery of dead currencies, a Central Bank Horror Exhibition, the timeline of a bitter History. We’ll be moving on to some calculations as to complement it and prove, once and for all, that the Brazilian Central Bank is, INDEED, a Master of Zeros. Zeros to the left, of course:

➊ Real

(1st gen – Rs$)

The first generation of the Brazilian Real, in circulation since the colonial times.

➋ Cruzeiro

(1st gen – Cr$)

Cr$ 1 = Rs$ 1,000. In 1967, less than 3 years after the establishment of the Central Bank, the guys in expensive suits dropped 3 zeros from the Cruzeiro. Now we have:

➌ Cruzeiro Novo

(NCr$)

Therefore, Cr$ 1 = NCr$ 0.001. This time, only the name changes and then you have: ➧

➍ Cruzeiro

(2nd gen – Cr$)

Therefore, NCr$ 1 = Cr$ 1. It lasted until early 1986 when the guys at the Brazilian FED dropped some 3 zeros, giving birth to:

➎ Cruzado

(Cz$)

Therefore, Cr$ 1 = Cz$ 0.001. Now things start to become fully bizarre if you realize that Cr$ 1 from the 1st generation corresponds to Cz$ 0.000001. The party didn’t end and they dropped even more zeros, creating:

➏ Cruzado Novo

(NCz$)

Now guess what? You’re absolutely right. Cr$ 1 (1st gen) is worth NCz$ 0.000000001. The Brazilian FED boys took a break, a deep breath, and maintained the zeros, changing only the name to:

➐ Cruzeiro

(3rd gen – Cr$)

This currency is now living its 3rd reincarnation. Like a tropical Jason Voorhees, it never dies. Everything stays the same and Cr$ 1 (1st gen) is worth Cr$ 0.000000001. But the 90s brought some fresh air of innovation into the Brazilian Central Bank lungs and now, guess what: the guys over there dropped more zeros giving birth to:

➑ Cruzeiro Real

(CR$)

The 1964, 1st generation Cruzeiro, the one that existed before the establishment of a Central Bank, is now a poor bastard, worth nothing: CR$ 0.000000000001. By now, the inflation in Brazil was skyrocketing (we wonder why) and a team of economists gathered together to solve the problem. Obviously, a new currency was created:

➒ Real

(R$, BRL)

This newly created currency, considered by many the Messiah of a new era, was pegged to an intermediate currency (URV) which, in its turn, was pegged to the U.S. Dollar. The URV was defined to be worth CR$ 2,750, which was the average exchange rate of the U.S. Dollar to the Cruzeiro Real on that day. Hence, one Real was worth exactly one U.S. Dollar when created.

After all this Monetary Carnival, what happened?

The inflation was tamed and people could finally buy a few pounds of chicken meat to cure their chronic starvation without worrying that they would eat nothing but air on the next day.

Our poor little bastard, the 1964 Cr$, is now worth R$ 0.000000000001 divided by 2,750. It got slaughtered. From 1964 to 1994, over a 30-year span, the Brazilian FED boys did all this magic with other people’s money. But the cherry on top comes now: we are not considering the accumulated inflation during that period, only the zeros dropped. “How to Kill Eight Currencies With One Stone”, or “The H8ful Eight: A Brazilian True Story”, screenplay, direction, and performance by The Brazilian FED Midwest Cowboys. Clap, clap, clap.

Now you can see how much harm people can make to others when they have no skin in the game whatsoever. Tinkerers of the dark side, they are the opposite of true innovators, brave people who, through tinkering, trials and errors, really lead the humankind towards the evolution.

“Bureaucracy is a construction by which a person is conveniently separated from the consequences of his or her actions.” — Thanks, Taleb, once again.

This poor writer here was born in Brazil, in 1976. Been there, done that. Unskilled, unaware, and financially illiterate as I was, being the son of an unskilled, unaware, and financially illiterate father, who gambled in the stock market and lost his shirts many times, I felt with my own skin and witnessed with my own eyes what it’s like to be in this game the Brazilian Government and its Central Bank played during many years. I was. Not anymore. Veni, vidi, vici, as Julius Caesar stated.

Doing the same thing over and over and expecting different results is one of the many definitions of insanity, isn’t it?

Clearly, Mark Hannah doesn’t know what a Fugazi is.

From Fugazi to Real Value: The First Step

At this point you might be looking at your account value and thinking: “Even worse than fugazi, my account holds only digital money. A single stroke on a DEL key can erase it all. What if they shut down the market? That’s worse than paper.”

Yes, this thought process leads us to a weird situation. We can’t remove the current currency system from any of our lives. However, that does not mean we will have to sit on our hands and do anything; we have to secure our wealth regardless of what happens digitally or physically to the currency. There is no such thing as a country that is immune to a hyperinflation because any country that is worth its salt, has a Government and a Central Bank filled with very creative people aiming the latest innovations in currency devaluation. Our mission is to protect our wealth from their innovation impetus.

The first thing you need is financial education. We can’t stress it enough. I know stories of traders that made a fortune in Brazil over that period when the common Brazilian folks were struggling to survive. Are those traders vulture birds, scavenging beings, feeding on dead animals and plant material present in its habitat? Not at all. They just knew what they were doing. They were building and protecting their wealth. According to Warren “The Sage of Omaha” Buffett, “Risk comes from not knowing what you are doing.”

If you are reading this newsletter while living in a country that has as weak/exotic currency, the easiest way to tap into the wonders of financial education is learning how to hedge your currency with another currency that is stronger than yours.

The chart above depicts the U.S. Dollar against the Brazilian Real. It shows monthly candlesticks, arranged over a 23-year span, since the inception of the latest Brazilian currency. Looks like a decades-long, giant cup-and-handle formation and it is. The U.S. Dollar just hit an all-time high against the Brazilian Real a couple of weeks ago. Guess what most traders and investors did from 1964 until 1994? Among other things, they bought U.S. Dollars. Guess what most traders and investors are doing now, as I write these few lines? Among other things, they are buying U.S. Dollars. They HEDGED and are still HEDGING against the craziness of their Central Bank with a strong currency.

Before continuing, let us be bluntly clear: we are not recommending you buy U.S. Dollars but merely illustrating how some basic Forex knowledge can go a long way in protecting your wealth. What is the cost of ignorance? Knowledge is true power. If building wealth is already a hard task on itself and usually takes a whole life to be accomplished, imagine protecting it. It’s even worse.

If you could build a system that protects your investments for 300 years, what would it be like? Food for thoughts.

We don’t get fooled again

With all that said, you will probably point out that we are sounding like exchanging six for half a dozen, a fiat currency for another fiat currency, a fugazi for another fugazi, and, in doing so, we are building a castle made of sand. Because you are now educated in the realms of the fairy dust you want more. Fair enough.

On the next edition of the Fugazi Series, we will be talking about The Man, his flaws and weaknesses. We will also be revealing what you can do in terms of wealth protection; the second step you can take towards being in control of the situation, instead of being a passive victim of the Fugazi. Stay tuned.

[…] not only good looking but he’s also got some awesome writing skills and if you haven’t read the October Trading Justice newsletter and listened to the Trading Justice podcast episode 289 you are in for a treat. His impersonation of […]