Menu

Trading Justice Newsletter

Trading Justice Newsletter

Dear Trading Justice newsletter readers, this is the last newsletter of 2019.

Instead of writing a piece of copy talking about the mistakes made on 2019 as a trader or my perspective for 2020, or, going even further, a piece of copy containing bits and pieces of advice for the new trading year, I’ve decided to write a collection of thoughts about the one thing that caught my attention the most during this year.

No, not the Trade War, Trump impeachment or the Brexit neverending-battle, but negative interest rates and negative yields. Some of you could argue that a negative number is just a number and that we should take care of our lives instead of writing about it, but that is definitely not the case.

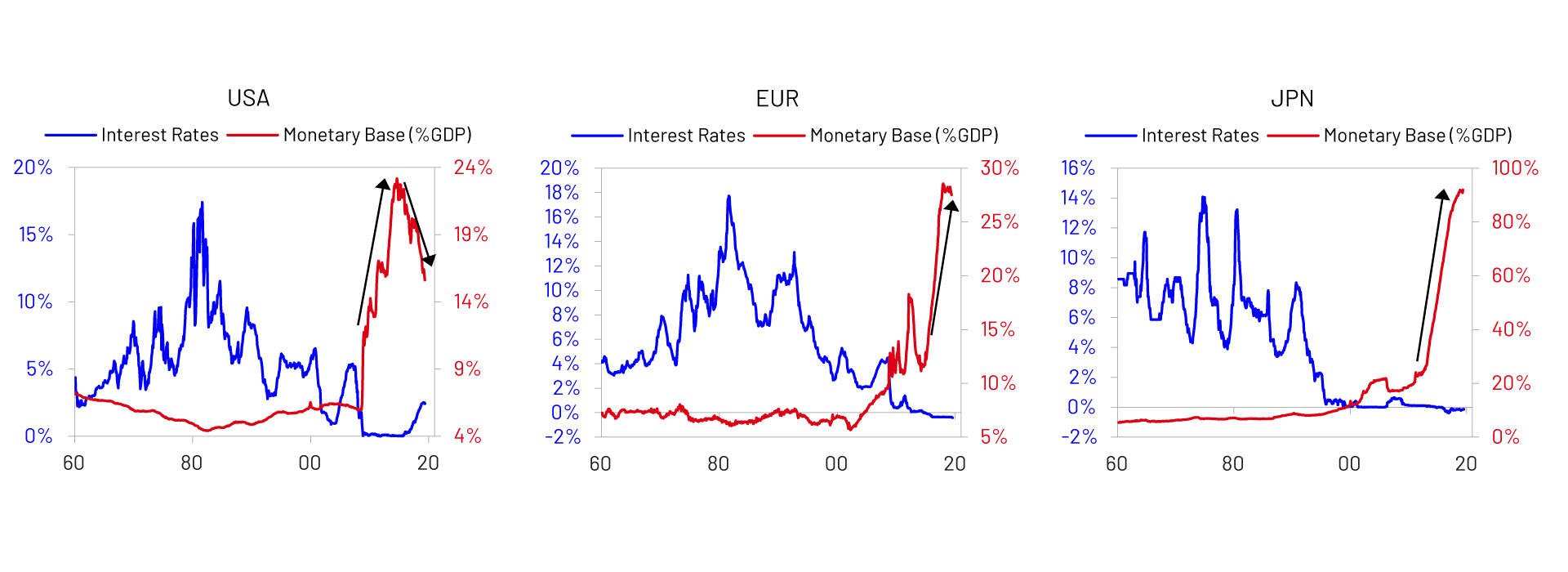

Since the New Great Market Depression, the 2008 market crash, central banks around the world have slowly but surely decreased their interest rates. Like a contagious disease without any vaccine researched, mass-produced or tested, it is spreading like wildfire, reaching far corners of the planet, like Brazil, for example. And it changes everything.

That whole approach of saving now so you can have more in the future is now upside down: Spend now and … have nothing in the future. Because you now are paying money to invest, the more you leave your hard-earned money in the bank, the less you will have as time continues to move forward. Couple it with inflation, and you have the best withering-wealth formula ever invented.

What a time to be alive! Get all you know about Intertemporal Choice and the teachings on interest rates from the Austrian School of Economics and throw it in the trash. And while doing so, spend as much money as you can. No saving for rainy days, hardships, children’s education or retirement, just burn the cash.

How not to love Central Banks? With such an abundance of free money with zero or negative interest rates, who would be crazy enough not to use it in unfruitful projects?

Us.

Before you jump into the collection, however, let me tell you something: we are not trying to convey a negative message in the last newsletter of the year. Consider it a warning, not a guide. Once we are aware of the dangers such monetary policies can bring to our money, we can take action to protect it. However vast the darkness, we must supply our own light, as wisely stated by Kubrick.

Consider this newsletter, above all things, a message of encouragement for the new upcoming year.

Two things are constantly fighting for my attention every single day: the truths about Life & Universe and bills to pay.

Recently, though, there is one other topic that wants to make it to the list: negative yields.

We all know that the major central banks have been flooding the markets with easy money for over a decade, expanding their balance sheets from a mere $5 trillion to something around $22 trillion. However, sovereign bonds with negative yields are stealing the thunder.

Last time I’ve heard, something like 20% of the total sovereign bonds issued around the world (≈$ 12.5 trillion) is in negative yield territory. Such a phenomenon is becoming mainstream in the corporate world too. On Q1 2019, LVMH Moët Hennessy – Louis Vuitton issued bonds yielding –0.17%.

Take a quick look at this data here, fresh from Bloomberg’s website (Bond | Yield):

Three years ago, James Rickards released the book “The New Case For Gold”. Right in the first pages, he lays out the case against Gold in six bullet points. Number five reads “Gold has no yield”. That is a true statement. Gold is money and money has no yield.

Sometimes truth is stranger than fiction, I guess. Now that bond yields are starting to dabble into the realms of negative numerals, Gold is almost becoming a natural carry trade against them. Its zero yield looks profitable from this perspective.

The main purpose of Physics is to understand how the Universe behaves. Through centuries, it turned out to be one of the most fundamental scientific disciplines, studying the matter, its motion, energy and force, and its behavior through space and time.

Then we have economists. Envious as they are of physicists, they simply do not care about the “obsolete” Austrian School and their “human behavior nonsense”. Simplicity is for Da Vinci and Steve Jobs; they want complexity.

Although there were various statements added by physicists during the centuries, the Second Law of Thermodynamics states, in its simplest form, that the disorder and randomness increase in an isolated system as more energy is added to it. This is an irreversible course as the arrow of time moves only forward and, as it proceeds and more energy is further added, the more random and disordered the system becomes. Entropy never decreases over time and the system’s original state is forever lost. In such systems, particles have no “future memory”, so everything in the future is pure conjecture.

Then we have Central Banks with their economists and policymakers. The tools they used—and are still using—to stabilize the world’s economy after the fateful market crash of 2008 added energy and increased the entropy of a system that was already too complex and damaged.

Because the particles in this system have no “future memory”, we can’t predict what is going to happen. The path that lies ahead is opaque.

More liquidity is added, negative interest rates spread like a disease and long strategies craving for easy money push the market to new highs. The system’s entropy only increases; the original state is forever lost.

The arrow of time and envy move only forward, never back.

“Hangman, hold it a little while

Think I see my friends coming”

Reality insists on knocking on our doors despite the specialists’ opinions. The vehicle once called ‘fixed income’ is now becoming ‘fixed loss’.

“Friends, did you get some silver?

Did you get a little gold?”

For this new investment vehicle, you can use whatever synonym you want:

Fixed deprivation

Fixed loss

Fixed dissipation

Fixed diminution

Fixed erosion

Fixed reduction

“What did you bring me, my dear friends,

To keep me from the gallows pole?”

Whatever you name it, the business stays the same: invest today, have less tomorrow. The intertemporal choice concept turned upside down.

“I couldn’t get no silver, I couldn’t get no gold

You know that we’re too damn poor”

Printing money.

Positive inflation.

Negative yield.

The buying power corrosion.

Central Banks all around the developed countries are running run out of ammo to deal with the deacceleration of their economies. If their only firepower is tweaking interest rates, what’s left to be done?

“Hangman, hold it a little while

I think I see my brother coming

Riding a many mile”

Investors can shy away from negative yields by buying stocks. The problem is that they are also backed up by easy money and corporate debt.

“What did you bring me, my brother?”

Demographics are changing.

Technology is shaping the investment landscape.

The future insists on being in the future.

Is there any light at the end of the tunnel?

If there is any, it looks like gold.

“Brother, I brought you some silver

I brought a little gold,

I brought a little of everything

To keep you from the gallows pole”

Naked truth #1: According to Deutsche Bank, about 15 trillion dollars in government bonds are being traded into the sub-zero territory all over the world. This represents about 25% of the entire market. We are definitely entering a new Ice Age and no one seems to care anymore.

Naked truth #2: If you think 1/4 of the entire bond market is still a small number, don’t be surprised if it reaches 50% while you’re sleeping. These sub-zero bonds more than tripled since October 2018.

While positive interest rates award patient human beings, who prefer to NOT spend today but sometime in the future, the sub-zero interest rates award the IMPATIENT ones. These fellows are paid to NOT think about their future.

The Central Bank’s ultimate goal is to stimulate banks/capitalists to lend more money instead of sitting on a pile of cash. Good for the economy and good for the stock market. Right?

No. It breeds unicorns.

According to Investopedia, a unicorn is a term that describes a privately held startup company with a value of over $1 billion. There are plenty of unicorns out there (334 total so far), mostly from the USA and China. Get the full list on Wikipedia if you feel like you have some time to spare.

This upside-down type of incentive is stimulating investors—who crave positive returns—to put their money to work in any type of project, regardless of the overall quality or profitability. Companies with a ballooned valuation that can’t show a profit for the most part. Risk vs. Return? Meh, to hell with that. Too old school. Dad joke.

Central Banks are super creative, we gotta give ’em credit for that. They are always teaching us many ways on how to create bubbles. Icy bubbles for a new era. Be prepared.

Are we ripping through the all-time highs or not?

Are those heads-of-state going full-tariffs on each other or not?

Is Britain going for a hard Brexit or not?

Is the Eurozone going to recover or not?

Is there a recession or not?

Are we in risk-on or risk-off mode?

Is the US going to throw interest rates into negative territory or not?

Are the companies going to beat earnings expectations or not?

Is Banca Monte Dei Paschi di Siena going to file for bankruptcy or not?

We don’t know. No one knows. We are tinkering into unexplored territory here. While we are more concerned about the above-cited topics, central bank geniuses are gathering inside their bunkers to discuss what is going wrong with the economy.

They have been swamping the markets with easy money, debt, and low-interest rates for decades and there is no sign of recovery. The money printing process is still on but now with the innovation of negative interest rates. What’s the rationale behind it?

We don’t know and I think the QE Forefathers don’t know it either. The only thing we can be sure is that when they find out that this is not making any sense and it’s not working, and one single individual screams FIRE!, investors are going to massively dump their assets into the market.

While nothing happens here on the surface we keep trading the weakness of the bulls and the total lack of conviction of the bears.

Everyone knows the old adage “To a hammer everything looks like a nail”, especially Central Banks.

Since New Zealand pioneered the Inflation Targeting monetary policy in 1990, shortly after adopted by Canada in 1991 and by the United Kingdom in 1992, hammers and nails are everywhere. The United States joined the party in January 2012. It’s never too late.

By definition “Inflation targeting is a central banking policy that revolves around meeting preset, publicly displayed targets for the annual rate of inflation.” (Investopedia).

Guess what’s the main tool Central Banks use for Inflation Targeting? Yes, interest rates. To them, everything looks like a nail and they have the perfect elixir.

Slow growth? Lower interest rates.

Stagnation? Lower interest rates.

Crisis of any type? Lower interest rates.

Market crashes? Lower interest rates.

Credit issues? Lower interest rates.

Any other problem such as athlete’s foot, conjunctivitis or failed marriage? Lower interest rates.

As a result, interest rates have been dropping like a bomb—or a bubble— all around the world. For us, humble traders and investors, the Central Banks’ creativity when it comes to interest rates policy is mind-boggling. Think about it for a second:

If the interest rates approach the 1% level, you think “There’s not much room left for any further cut.”

You are wrong. They cut.

“Ok, now it’s at zero levels. There’s not much room left for any further cut.”

You are wrong. They cut it into negative territory. Now that they discovered this deep underground mine, they will continue digging until the zero level looks profitable.

“What is real? How do you define ‘real’? If you’re talking about what you can feel, what you can smell, what you can taste and see, then ‘real’ is simply electrical signals interpreted by your brain.”

— “The Matrix” (1999) —

As a trader, how do you define real? Good ol’ Germany sold its first ultra-long, 30-year bond with a 0% coupon just yesterday. The entire German yield curve is in the red territory in any duration. Very suitable for conservative (?) investors.

Uber, one of the most famous unicorns in the market, with a 69.0% market share in the US, posted losses of $1 billion in the first quarter of 2019.

Speaking of unicorns, the garage days are over and billion-dollar startups are all over the place. From hospitality services to rubber boots, there are so many of them that they can’t fit inside any J. R. R. Tolkien epic high-fantasy novel. Forbes knows it all.

‘Disruptive’ geeks are obsessed with building ANNs (Artificial Neural Network) that promise to take the “buy low, sell high” to whole new levels. Your hard-earned money is now in good (cold) hands.

If the ‘real’ is looking upside down, what it means to be a contrarian?

Buying gold?

Investing in solid businesses?

Adopting simple rules to trade?

We have lots to learn with the simplicity of the rats. Their only concerns are the cheese and the cats. Being simplistic and conservative in trading is the new black now that the ‘real’ is stepping into the realms of the surreal.

What is real, anyway?

I don’t care. I’ll go with the rats.

“Let me take you down

‘Cause I’m going to Strawberry Fields

Nothing is real”

Together, Hydrogen and Helium make up 99.99% of known matter in the Universe. The very basic chemical components of everything we know and don’t know yet.

How is it possible that elementary components like H and He combine themselves into us humans, for example? Iron, Carbon, Oxygen, the formation of complex life.

By death. Death of the stars to be more precise. It is inside the furnace of a dying star that those two combine themselves into complex structures. Unimaginable temperature and pressure. The star collapses unto itself. The components are released into the ether. Free to form complex life.

Death is a necessary process.

But humans don’t like it. Personal beliefs, egoism or convenience, whatever the case is, we avoid death. That is why people like Ray Kurzweil discuss reaching human immortality by 2050 on YouTube.

Did it ever cross our minds WHY Mother Nature never granted us the gift of immortality?

Because death is a necessary process not only for the propagation of energy and chemicals but also because resources are scarce. Real economists know it by heart. How to deal with it?

Central bank geniuses are always one step ahead. Negative interest rates and abundant liquidity in oppose to a scarce one. Problem solved. Or, perhaps, unknown problems created.

Are we making humans, governments, and corporations too big to fail?

We survived as species due to the death of individuals. Are we paving our way to a massive collective failure due to the immortality of a few?

We will never know. The future will always be opaque however immortal we might become.

“Immortality

I make my journey through eternity

I keep the memory of you and me

Inside”

According to Nassim Taleb, there are three types of large corporations:

– Those about to go bankrupt.

– Those that are bankrupt and hide it.

– Those that are bankrupt and don’t know it.

Immortality seems to come in many flavours, I suppose.

There are three types of large corporations: those about to go bankrupt, those that are bankrupt and hide it, those that are bankrupt and don’t know it.

— Nassim Nicholas Taleb (@nntaleb) September 22, 2019

How to be prepared for the next Ice Age? Here’s the hardcore approach, Gin and tonic:

Fundamentals & Opportunities.

Fire and wind. Fundamentals and opportunities.

Wind feeds the fire but also puts it out. The difference between medicine and poison is the dosage.

The balance between fundamentals and opportunities drives the market. Market participants are constantly trading this dichotomy back and forth, left and right.

Investors buy good fundamentals and traders want opportunities. In a dialectical conversation, one feeds the other.

If opportunities take over for too long, fundamentals die. Without good fundamentals, opportunities are not sustainable.

In the long run, fundamentals should prevail: a robust economy, sound inflation policies, healthy employment numbers, debt under control. The problem with this flat and calm surface is that it gives a false sense of security, hiding risks, leveraging egos and positions. The lack of noise leads to a comatose state.

In the short-term, opportunities reign. They are our everyday noise, providing a trend for swing and day traders and volatility for the Theta Lovers. We need the Elons and Trumps for Twitter, Theresa May & the Brexit Stooges, Kim Jong Un & His Little Friends, China & The Black Box. However, if they blow too hard and prevail in the long run, fundamentals collapse. Opportunities killing fundamentals.

Is there a way to profit from both situations? How to kill these two birds with one stone?

It is simple: Balance. Aim for the equilibrium between wind and fire. Go long fundamentals until they change and trade the noise until it’s silent again.

You know that I would be a liar

If I was to say to you

Girl, we couldn’t get much higher

Happy New Year.

© 2019 Trading Justice. All rights reserved.