We live in a golden age for individual investors. But few realize it. Even fewer decide to take the plunge and use this reality to their advantage.

It’s a wrong we’re setting out to right with education and empowerment: We make it possible for you to fire Wall Street and take control of your investments.

Once upon a time, Wall Street was the den of fat cats and the well-connected. The cost of entry was prohibitive, and the little guy was routinely fleeced with exorbitant fees. Information didn’t come cheap, and ignorance was punished. The deck, in short, was stacked against the individual.

We no longer live in such an era.

Today, individual investors can play for free. They have unfettered access to nearly every asset class and software that allows them to make well-informed decisions and manage risk like a professional. Modern markets are for everyone, not just the big shots with big money. It has never been easier for self-starters and go-getters to fire Wall Street and take control of their financial future.

Combine the desire to captain your ship with a world-class education and a community at your back, and you’ll be amazed at what is possible. At Tackle Trading, we empower individuals like you with the information you need to #FireWallStreet and take control of your financial future.

If you want to #FireWallStreet TODAY and hire yourself as your own financial advisor, you came to the right place.

Let’s begin!

The 7 deadly forces that work AGAINST your money

Making money is easy for those willing to work, especially in 2022. The unemployment rate is below 4%, and there are a massive number of job openings.

It’s KEEPING your money and MAKING IT GROW that present a challenge.

In this section, we are going to uncover the 7 deadly forces that actively work against you in both pursuits:

- Fees

- Bad Actors

- Taxes

- Inflation

- Recessions

- Bear Markets

- Ignorance & False Beliefs

All seven seek to derail your wealth building while delaying retirement. They are what keep the everyman up at night.

Let’s take a closer look at each.

1. (Obscene & Hidden) Fees

There’s a classic investing book published over half a century ago that unveils much of the lunacy littering Wall Street. It’s titled “Where Are the Customers’ Yachts?”

The name arises from an apocryphal story about an out-of-towner visiting the New York harbor. While taking in the grand spectacle of the bankers’ yachts, he naively asks where all of the customers’ yachts were. Of course, said customers didn’t have any such luxurious watercraft because they couldn’t afford them. They were too busy being gouged by the obscene fees extracted by the Wall Street machine.

John Bogle, founder, and CEO of the Vanguard Group, once said:

“Something like 70% of the market return goes to the purveyors of the services, Wall Street if you will, and 30% goes to the fund owners.”

John Bogle

Fortunately, over the decades since, a much-needed mix of regulation, technology, and competition has shaved the egregious costs imposed upon consumers. But in many cases, they remain higher than necessary, and thus, a stumbling block to the everyman’s attempts to build wealth for retirement. Here’s the harsh truth: The more of your hard-earned money that goes to fees, the less of it you keep. Over time, even a tiny cost can compound to create a massive difference between what you should have captured and what you actually did. We’re talking about tens of thousands to hundreds of thousands of dollars in difference over a lifetime of investing.

Here’s what you can actually do about it. 👇

✅The Solution

Educated investors know how to invest directly in the markets via ultra-low-cost vehicles like Exchange Traded Funds (ETFs) and thus keep more of the growth without needing to hire an intermediary like a banker, broker, or salesman. Investing in the stock market has never been easier or cheaper, and the easiest way to improve performance is to slash fees.

Start by dumping the expensive mutual funds from your portfolio. Exchange Traded Funds, or ETFs for short, carry almost no cost. For instance, the iShares S&P 500 ETF, ticker IVV, only has an expense ratio of 0.03%. That means you capture 99.97% of whatever the S&P 500 Index’s performance.

Considered one of the greatest investors of all time, Warren Buffet, once said:

“If you invested in a very low-cost index fund you’ll do better than 90% of investors. Just pick an index like the SPY.”

Warren Buffet

2. Bad Actors

When you place your money and financial future into the hands of a third party, you open yourself up to bad actors. While most advisors and financial professionals are honest, well-meaning, and put the interests of their clients above their own, some do not. Because of ignorance, negligence, or deception, some people in the industry give poor advice and only look out for themselves. They are financial sharks. You are the food. History is replete with examples of unsuspecting investors who were duped by others.

Peter Lynch, the (mythical) manager of the Magellan Fund at Fidelity Investments once said:

“I’ve said before that an amateur who devotes a small amount of time and study should outperform 95% of the paid experts who manage mutual funds, plus have fun doing it.”

Peter Lynch

Can you avoid the sharks and take control of your own money? ABSOLUTELY! 👇

✅The Solution

Educated investors are self-directed and manage their assets. They also have enough knowledge to be able to differentiate between bad advice and good advice.

Furthermore, when dealing with third-party actors in the financial arena, always ensure they have a fiduciary responsibility to do what’s in YOUR best interest.

3. Taxes

The only sure things in life are death and taxes. And while mankind has yet to discover a way to dodge the former, there are certainly ways to minimize the latter’s impact. Not that you needed convincing, but the problem of taxes is not going away.

Indeed, given the government’s insatiable appetite for spending and the burgeoning national debt, tax rates are far more likely to rise in the future than fall. Moreover, America has a progressive tax system. As your income grows, you move into higher tax brackets, so the toll demanded by Uncle Sam will get heavier.

Can you go to Washington and schedule a personal meeting with the Congress to tell them you’d like fewer taxes? Sure you can, but I highly doubt you will be successful.

Here’s what you can actually do about it. 👇

✅The Solution

Educated investors know how to use the tax code to their advantage so they pay as little in tax as legally possible without paying expensive accountants.

For example, you can start an investing business so you can take advantage of a tax code that favors corporations over individuals.

4. Inflation

Inflation is a clear and present danger. It saps your buying power and lowers your standard of living by causing goods and services to get more expensive. If your income and assets don’t rise sufficiently to combat it, you’ll go poor slowly.

The inflation rate waxes and wanes over time, but the long-term average is 3%. That may not sound like a big deal, but it is. To wit: what cost $1 today will cost approximately $2.40 in thirty years. So here’s the question:

If you’re getting ready to retire, do you have a plan that will enable you to raise your income by nearly two and a half times over the next three decades?

If you’re a 35-year-old who wants to retire in thirty years and think you need $1 million in today’s dollars to quit working, I have bad news. At a 3% inflation rate, you’ll need $2.4 million by the time you hit age 65.

Here’s what you can actually do about it. 👇

✅The Solution

Educated investors don’t worry about whether the Federal Reserve will successfully avert currency devaluation. They know how to use cash flow and leveraged strategies that grow their wealth beyond the pace of inflation without worrying. They also invest in commodities that rise with inflation such as Gold, Oil, and Silver.

5. Recessions

Take a bird’s eye view of the global economy over the past century, and do you know what you’ll discover? It climbs consistently because of population growth, productivity increases, and inflation. But the bird’s eye view is deceiving. People don’t experience life over decades. They do so over days. So forget the bird. Pretend you’re an ant—zoom in.

The economy cycles between periods of expansion and contraction. It rises over time, but it does so on a path punctuated by occasional setbacks. Two steps forward. One step back. Three steps forward. Two steps back. It was ever thus. These contractions are called recessions and are defined by a shrinking economy. They are painful episodes characterized by job loss, falling consumer demand, and declining economic output.

The last three economic recessions in the United States occurred in 2020, 2008, and 2001. Given the sky-high inflation coursing through the economy in 2022, many speculate the next recession is on our doorstep.

And here’s what you can actually do about it. 👇

✅The Solution

Educated investors know how to use strategies that protect them during recessions and how to use these downturns to their advantage without needing to hire a financial advisor.

For example, they know how to buy Put Options as insurance to protect their portfolios during economic downturns.

6. Bear Markets

Recessions have financial consequences. They run roughshod through Wall Street, upending asset prices and throwing investors into a tizzy. In short, they create nasty bear markets where stock prices decline 20%, 30%, and sometimes even 50% from their peak. It’s no coincidence that the most significant market crashes over the past two decades occurred in 2020, 2008, and 2001. All three years hosted mega-recessions.

This year alone, more than $3 trillion were ERASED from retirement accounts due to the recent Bear Market. Were you one of these people that got wiped out?

Stocks echo the cyclical nature of the economy. The long-term advance of stock values is permanent, but it’s interrupted by temporary, yet steep, declines. Crashing equity values cause emotions to run hot and investor mistakes to multiply. The pain of seeing a massive chunk of your hard-earned money seemingly disappear during a financial panic is real. Legions of investors have blown their chances of success to smithereens by abandoning ship at the wrong time or halting investing when deals of the decade were in the offing.

Unfortunately, we don’t move the markets. We follow them. However, that doesn’t mean you can’t do something about it. 👇

✅The Solution

Educated investors know how to read a chart so they can spot when bear markets arrive and minimize risk. They also know how to trade bearish strategies that profit as the market falls.

Finally, they know how to sow seeds during a crisis for later harvest—all without hiring any Wall Street guy.

Considered by many the pioneer of day trading, Jesse Livermore, once said:

“There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Jesse Livermore

7. Ignorance & False Beliefs

And all that brings us to the seventh and final problem: financial ignorance. It’s a disease that all are born with, and, unfortunately, the world is designed to exploit it. Our educational system does a terrible job of teaching individuals how to manage and invest money. And people aren’t just harmed by things they don’t know. They’re also hurt by things that they think are true but are, in fact, false. As the old phrase goes, “It ain’t what you don’t know that gets you into trouble. It’s what you know that just ain’t so.”

Here are the most common false beliefs when it comes to investing in the stock market:

The stock market has to go up for me to make money.

Options are risky.

I need to have a lot of money to start investing.

I have to risk more money to make more money.

Investing is too hard to do by myself.

If you still believe in any of those, know this: they are preventing you from being successful.

The good news is that you can destroy false beliefs and build new, better ones. The human mind is incredibly flexible. Here’s the solution.👇

✅The Solution

Education kills ignorance while unmasking false beliefs. You can become an educated investor. You just have to take the first step, which we are going to present to you in this guide.

Notice how education plays a role in solving each problem? Knowledge is the new money. It’s the antidote.

Education is what combats these 7 deadly forces. It empowers you to take control of your money and create financial success. With it, you won’t need to trust Wall Street.

The gap between investment success and failure is not as large or treacherous as you think. It’s a set of stairs that anyone can ascend.

How to #FireWallStreet and Hire Yourself TODAY!

First, ask yourself: What has been holding you back from taking control of your money, your retirement, and your legacy?

Is it time?

Is it false beliefs?

Is it because you don’t know where to start?

Worry not. We will teach you how to #FireWallStreet and hire yourself in the upcoming FREE webinar “How to Leverage Financial Markets to Achieve Freedom”. Click on the button below to reserve your seat.

At the webinar, you will learn the 3 secrets to achieve financial success and #FireWallStreet once and for all.

Wall Street has many secrets they don’t want everyday people to know. Perhaps they want to maintain their “Oracle” status and keep you dependent on them. Maybe they just think we, the common people, don’t have the ability to learn. Maybe they just don’t want any competition.

Whatever the case, we don’t care. Here’s why.

Tackle Trading’s mission is to help self-starters and go-getters like you to achieve financial freedom through honest and affordable financial education. Period.

We teach people to take control of their finances without paying a single dime to Wall Street.

Here are the three secrets that will be revealed in the upcoming webinar:

SECRET 1: How to generate monthly income regardless of market conditions

Many people think the stock market has to go up to make money, but they are wrong.

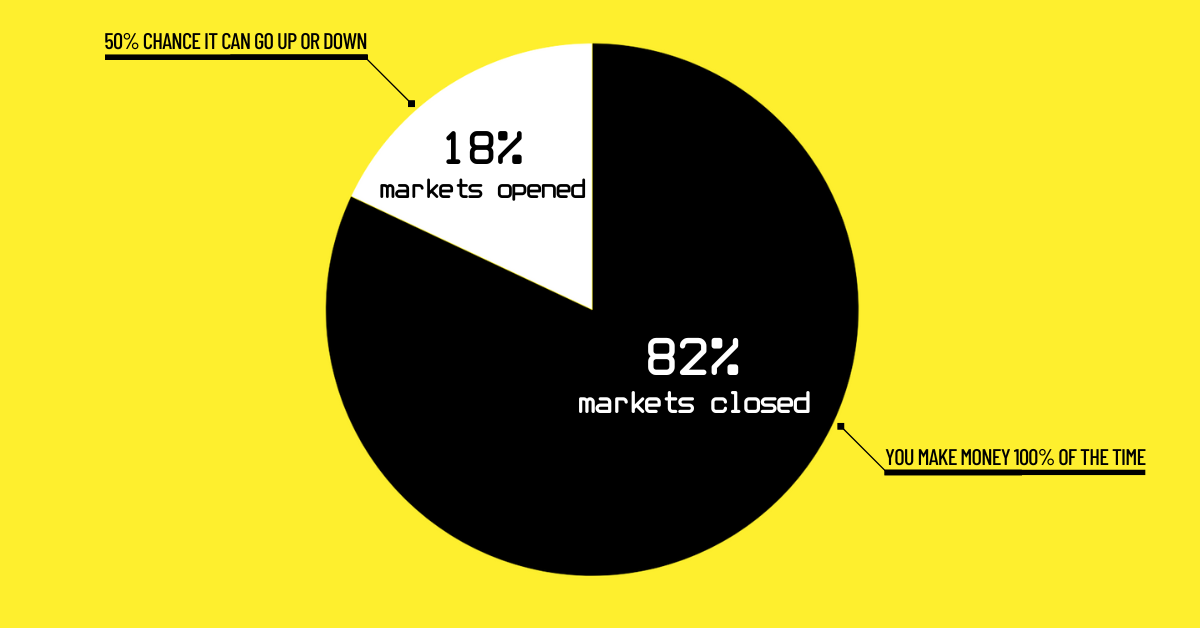

Even more shocking is that the markets are closed 82% of the time. In other words, your money is sitting there doing nothing 82% of the time! During the other 18%, when markets are open, prices can rise (you make money) or fall (you lose money).

Did you know that you can generate consistent income even when the markets are closed on weekends and holidays?

That is the power of Cash Flow. Cash Flow is King, Queen, and Country. Cash Flow is true investing. It ensures that your money is working for you. And we’re not talking about dividends or interest rates, but FAR HIGHER returns. We will show you ways to get paid even when the market is closed and start building your snowball.

As once said by Warren Buffet:

“Start early. I started building this little snowball at the top of a very long hill. The trick to have a very long hill is either starting very young or living to be very old.”

Warren Buffet

We will teach you how to make your money work for you 100% of the time without spending hours in front of a brokerage platform.

SECRET 2: How to protect your assets without hiring a financial advisor

One of Wall Street’s best-kept secrets is how to protect assets in a market crash. People have car, home, health, and even cell phone insurance. But what about their money, their legacy, their retirement?

In the end, it’s not about what you make or how much you make. It’s about what you keep and having the security of knowing that your hard-earned money is protected.

Like we said before: this year alone, more than $3 trillion was ERASED from retirement accounts. Were you one of these people that got wiped out?

We will teach you how to protect your legacy, your 401(k), and your IRA account from the next market crash. It’s simple and easy.

SECRET 3 How to achieve higher returns without risking more

Many people think that you have to risk more money to make more money, but they are wrong again. You can learn how to use leverage to your advantage.

What is leverage? Simply put, leverage is when you make more money by risking less; it’s when you trade a $200 stock for $1.

Can you see the difference?

We are going to teach you how to trade expensive stocks like Apple, Google, Amazon, and Microsoft for pennies on the dollar.

Do you see an opportunity for yourself here?

We hope you do.

And we bet you have family and friends that would benefit from this knowledge as well. Share this article with them.

You must understand how to manage your money, how to avoid Wall Street sharks, how to whip inflation, and protect yourself from the next market crash.

You don’t want to rely on a government check or the Federal Reserve’s ability to control inflation.

Many people ask “When is the best time to start investing?”

10 years ago was the best time.

But when is the second best time to do so?

TODAY!

#FireWallStreet and hire yourself now!

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.