This practical guide will show you how to start investing in three simple steps.

- Build a globally diversified stock portfolio using low-cost Exchange-Traded Funds (ETFs).

- Cash flow your portfolio with covered calls.

- Protect your portfolio with put options.

Building a properly diversified equity portfolio will ensure you get all future returns the stock market offers. These will come to you through both dividends and capital gains.

Selling covered calls will allow you to monetize your portfolio by generating cash flow. It’s like renting out your stocks.

Purchasing insurance via put options will limit your risk while protecting you from any bear markets that crop up along the way.

#1 Build › #2 Cash Flow › #3 Protect

Let’s begin!

Step 1: How to Build a Stock Portfolio

The stock market has been and will continue to be the easiest vehicle for everyday people to build wealth effortlessly. When you buy stock, you purchase equity or ownership in a business. And when you create a properly diversified stock portfolio, you acquire ownership in the largest and most well-financed companies on the planet.

There are two ways you can go about building a stock portfolio.

The hard way: Pick your own favorite companies that you think will outperform the stock market.

👍Pro: If you’re a great stock picker (or lucky), you might select the right companies that go on to deliver way better returns than buying a diversified fund.

👎Con: If you’re a poor stock picker (or unlucky), you might select companies that end up going bankrupt and otherwise deliver terrible returns.

The easy way: Buy the entire stock market via Exchange-Traded Funds (ETF).

👍Pro: This guarantees you get whatever the market is willing to give. Historically the stock market has generated better long-term returns than cash, bonds, commodities, and real estate.

👎Con: You give up the (unlikely) chance of hitting a home run.

If you find the allure of stock picking irresistible and you can’t help but try to swing for the fence, carve out a smaller percentage of your portfolio for speculation. As for the rest, take the easy, higher probability path offered by diversified exchange-traded funds.

Here’s how.

Let’s begin with a few assumptions regarding the money you’re investing.

①First, this is money you’re comfortable exposing to the stock market’s volatility

Stocks don’t behave like a bank account. They move! Sometimes dramatically so. For example, the Standard & Poor’s 500-Stock Index (a benchmark for the U.S. stock market) has declined approximately 14% annually. What’s more, roughly once every 5 to 6 years, it has fallen by about one-third (33%). Sitting through stomach-churning volatility is the price required to get the high returns offered by the stock market.

②Second, this is money you don’t need for at least a few years

Extending your holding period is the easiest way to increase your odds of profiting in the stock market. Here are the percentage of rolling periods with positive returns for the S&P 500 from 1926 to 2011 (Source: Simple Wealth, Inevitable Wealth).

- 1 year = 73.65%

- 3 year = 82.35%

- 5 year = 86.74%

- 10 year = 94.19%

- 15 year = 99.77%

- 20 year = 100%

Bottom line: the longer your money is invested, the more likely you will capture a profit.

Asset Allocation

Building a globally diversified portfolio hinges on two questions that make up what’s known as asset allocation.

- First: which funds do I buy?

- Second: what percentage of my portfolio do I place in each?

Deciding which funds to buy depends on a variety of factors, including:

- Do you want to own American companies or those domiciled in foreign countries?

- Do you want to own companies of all sizes or just industry titans?

- Do you want exposure to real estate through Real Estate Investment Trusts (REITS)?

- Do you want to build a simple portfolio with one or two funds, or would you prefer a more diversified basket of 5 to 6?

- Do you want a more aggressive portfolio or a more conservative one?

Absent education and experience, it’s hard to answer these questions. Moreover, the portfolio you start with may not be the one you end with. That’s okay. There are many websites available from fund providers that provide asset allocation recommendations depending on your risk tolerance. For example, here’s one from the world’s largest asset manager, BlackRock.

It’s an aggressive, 6-fund portfolio. Each fund tracks a different segment of the investing landscape. Four cover U.S. stocks and real estate. Two cover international stocks (IEFA, IEMG). At 0.06%, the blended expense ratio is ultra-competitive and reduces the friction of fees to nearly zero.

It’s possible to reduce an all-stock portfolio to even fewer funds if desired. American indexes like the S&P 500 are dominated by multinational companies that derive a large percentage of their revenue abroad. As such, they already give you exposure to foreign countries. Some would argue that makes the purchase of funds like IEFA and IEMG unnecessary. Thus, you might cut the portfolio from 6 to 4.

- $IVV

- $IJH

- $IJR

- $USRT

And since mid-caps (IJH) are essentially a hybrid of large- and small-caps, it’s the next easiest one to cut. In other words, you’ll capture the general performance of the middle guys through your ownership of both large and small caps. Thus, our portfolio shrinks further from 4 to 3.

- $IVV

- $IJR

- $USRT

Our next and final adjustment is borne of necessity. While the iShares funds we’ve focused on so far are second-to-none from an expense ratio perspective. They don’t have liquid options contracts available, which makes them poor vehicles to use for cash flowing and protecting our portfolio.

Regarding U.S. large-caps, no fund is better to trade options on than SPY. So let’s swap SPY for IVV.

As for U.S. small-caps, IWM boasts the most liquid options, so let’s exchange that for IJR.

REITS like USRT don’t offer much premium in their listed options, so they’re challenging to build options strategies on (which we need for cash flow and protection). While you might own REITS for diversification purposes, they’re challenging underlyings to build cash flow and protection strategies on. Thus, USRT is getting the axe.

Final all-stock, diversified portfolio: 70% SPY, 30% IWM.

Step 2: How to Cash Flow

The phrase “cash flow” can mean many things. For our purposes today, we’re defining it as “creating income from the portfolio.”

Stocks come with a built-in income feature known as dividends. These cash payments usually are paid out quarterly to shareholders and have a history of growth over time. Indeed, the S&P 500 has seen its dividend payout increase at a pace of nearly 6% annually. That alone has helped equity owners create an income stream that’s outpaced inflation.

Both SPY and IWM pay dividends. As of September 2022, SPY boasted a dividend yield of 1.52%, and IWM carried a dividend yield of 1.22%.

As lovely as the distributions are, they’re not all that large in the grand scheme of things. If you want to supercharge the income potential of your equity portfolio, you need to sell covered calls.

The structure of a covered call is simple. It has two parts. First, you buy 100 shares of stock. Then, you sell one call option. The short call obligates you to sell your stock at a set price (known as the strike price), but you get paid for limiting your upside. It’s similar to a lease option arrangement in real estate where you rent your home while also promising to sell your house at an agreed-upon price.

In the stock market, you can sell call options against SPY and IWM to generate the potential for monthly cash flow. Here’s an example using SPY.

① Step One: Buy 100 shares of SPY for $388.50 per share. That’s $38,850 in total.

② Step Two: Sell a 1-month call option with a strike price of $403 for $5 per share. That’s $500 total.

The call created $500 of potential cash flow for the next month. Compared to the $38,850 total cost of the trade, that translates into a monthly return of 1.3%, or 15% annualized. It sure beats the measly 1.2% dividend.

If you’re wondering what the catch is, it’s this: You’re limiting your profit potential in the stock above $403. Thus, you capture the next $14.50 of price appreciation (from $388.50 to $403), then any further gains are lost. Still, $14.50 in stock gains plus $5 from selling the call would net you a modest 5% return for 30 days of work. So even if SPY launches into space over the next month, you will be rewarded.

With time, you’ll discover the occasional underperformance in strong bull markets is more than made up for by the strategy’s outperformance in all other conditions. When SPY and IWM stagnate, you’ll collect monthly cash from the short calls. And when SPY and IWM decline, the call payments will help reduce the stock’s loss.

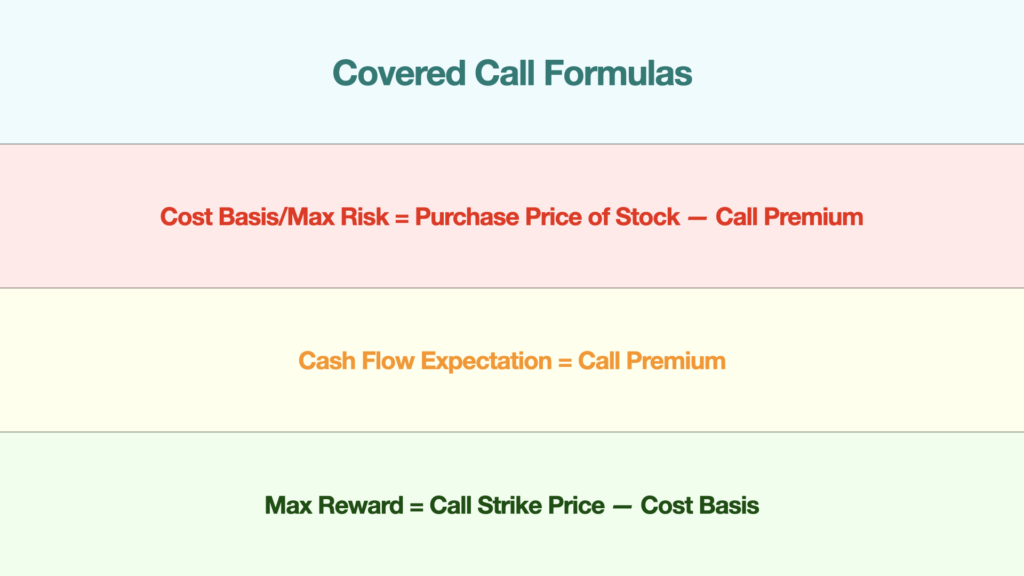

Using the accompanying Formula Table, we can calculate the trade metrics for our sample trade.

- Cost Basis/Max Risk: $388.50 – $5= $383.50

- Cash Flow Expectation: $5

- Max Reward: $403 – $383.50 = $19.50

The thought process for each number goes something like this.

- Cost Basis: The premium received from the call ($5) reduced my overall cost on the position from $388.50 to $383.50.

- Max Risk: If the stock falls to zero, I lose the $388.50 purchase price. But because the call expires worthless, I also pocket the $5 premium. All-in, my loss is $383.50.

- Max Reward: The short call requires me to sell the stock at $403. To discover the max reward is $19.50, I subtract my original cost basis of $383.50.

Call Selection

Time

The options market provides myriad call options you can sell. You will use two key variables to narrow down the list: month and strike price.

Consider selling options with around 30 days to expiration for the following two reasons:

① First, it allows you to adjust the trade each month by moving the call strike price higher or lower depending on market movement. You’ll be more adaptive to market volatility.

② Second, all options lose value as time passes, but the decay rate accelerates as you approach expiration. Thirty days is the sweet spot where you’ll fully capitalize on the decay. In the SPY example above, I used a one-month call option.

Strike Price

The call strike you select will influence how much you can make in the stock before you cap the gains. Start by selling a strike price that is above the current stock price. That way, you can profit from rising stock prices before limiting the gains. This is known as selling out-of-the-money call options. A good rule of thumb is to sell a 30-delta call option. You can use the chart to fine-tune your selection further.

There is an inherent tradeoff you need to be aware of.

- If you sell a further OTM call strike (i.e., lower delta), you will have more profit potential in the stock but less potential cash flow.

- If you sell a closer-to-the-money call strike (i.e., higher delta), you will have less profit potential in the stock but more potential cash flow.

In the sample trade above, we purchased SPY at $388.50 and sold a 30-delta call at the $403 strike to receive $5 of premium. Suppose I was less bullish for the next month and wanted to maximize cash flow over capital appreciation in the stock. Instead of selling the $403 strike, I may have sold a 40-delta call at the $398 strike for $8.

Note the difference. My cash flow potential increased from $5 to $8. But the cap in the stock decreased from $403 to $398.

Step 3: How to Protect

People grossly overestimate the long-term risk of owning stocks. Indeed, as outlined at the beginning of this article, the advance in stock values is permanent, and the declines are temporary. Time is a healing balm, fixing even the nastiest of bear markets.

Once again, Here are the percentage of rolling periods with positive returns for the S&P 500 from 1926 to 2011 (Source: Simple Wealth, Inevitable Wealth).

- 1 year = 73.65%

- 3 year = 82.35%

- 5 year = 86.74%

- 10 year = 94.19%

- 15 year = 99.77%

- 20 year = 100%

But investors are emotional creatures, prone to panic at the worst possible time. When they succumb to fear and sell their stocks during a crash, they turn what would have been a temporary drawdown into a permanent loss. The options market can help combat the urge to abandon ship.

Buying protective puts is like acquiring insurance on your portfolio. It minimizes the risk and defines the downside. It lets you keep a cool head when everyone else is losing theirs.

The Protective Put

A put option gives you the right to sell 100 shares of stock at a set price. For instance, suppose I buy 100 shares of stock at $100 while buying one $90-strike put option for $3. The put gives me the right to sell my shares at $90 even if they decline to $80, $70, or lower. In trader-speak, we say my put option is $10 out-of-the-money. To continue the insurance analogy, I have a $10 deductible that limits my loss on the stock to $10. Tack on the $3 cost of the put (your insurance premium), and your total max loss comes to $13.

What would my risk have been without the put?

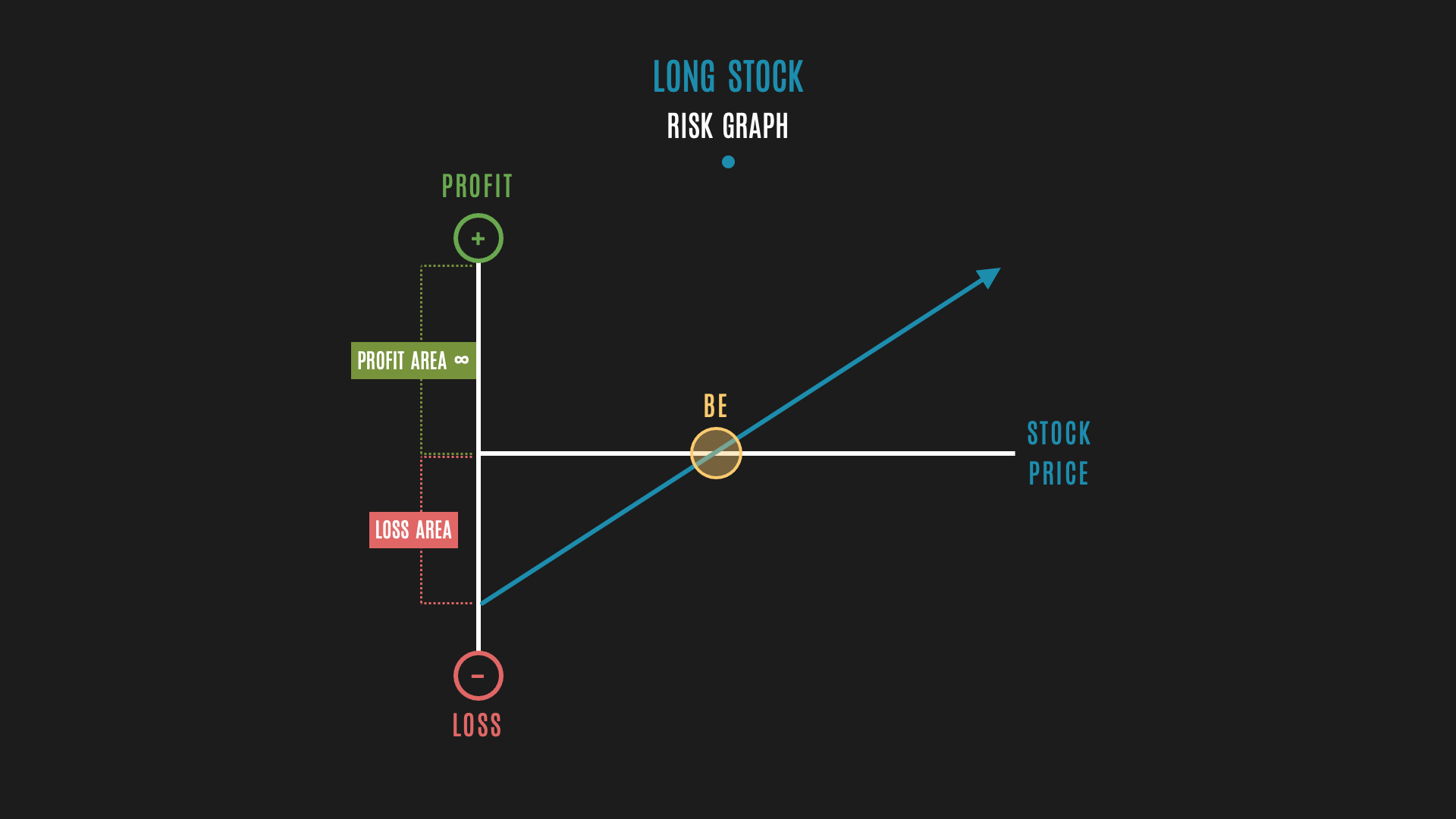

$100. Here is a risk graph or profit/loss diagram of an unprotected stock position.

Note how you have unlimited upside, but open-ended downside.

By acquiring the put option, I cut my max loss from 100% of my position value to 13%.

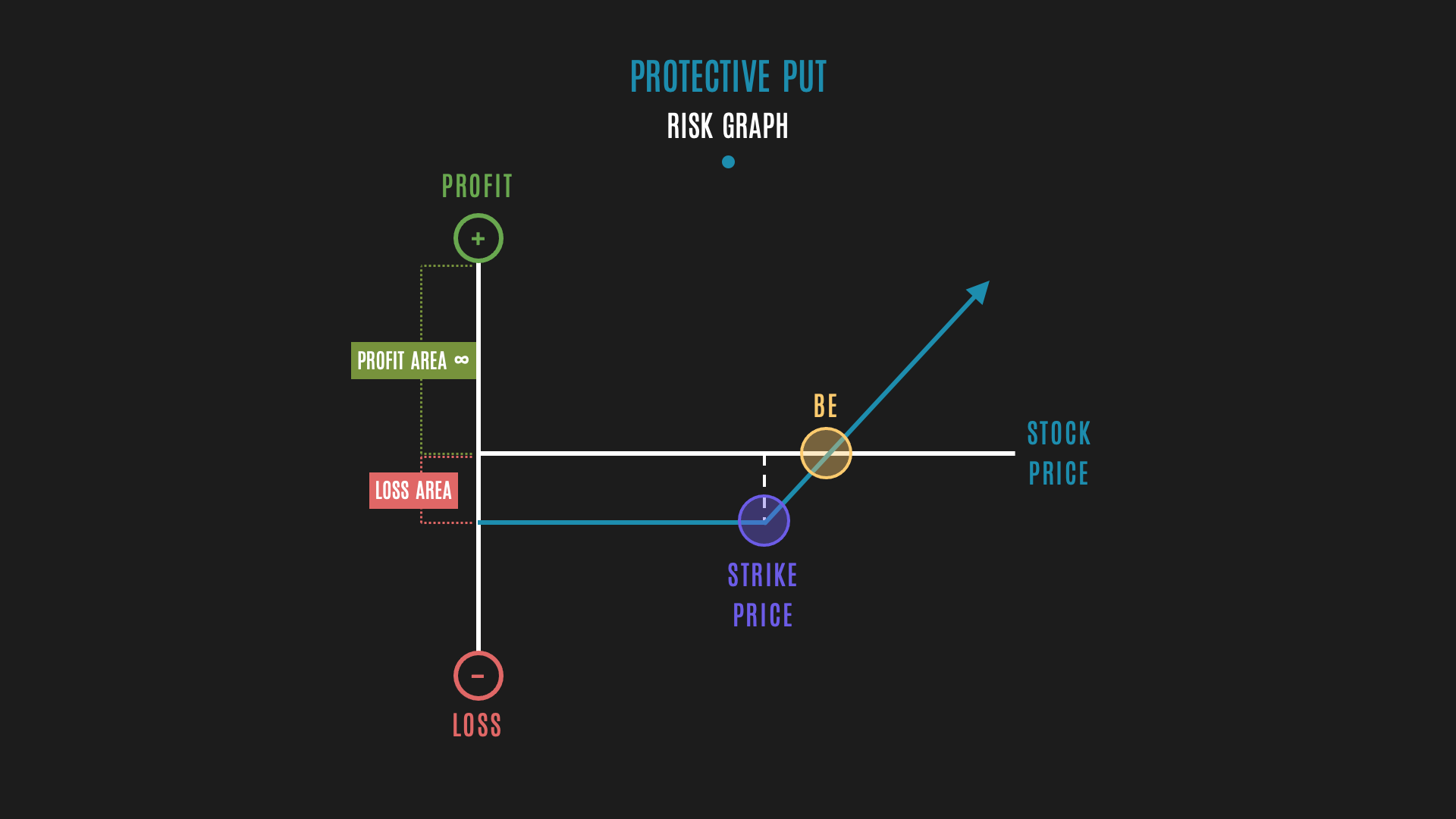

To protect our SPY/IWM portfolio, we would purchase one SPY put for every 100 SPY shares owned and one IWM put for every 100 IWM shares owned. Here is a risk graph or profit/loss diagram of a protected stock position.

Note how the downside now has a limit. With a protective put, your risk gets capped at the strike price.

Put Selection

We face the same two questions with put selection as we did with the covered call. Namely, which month and strike?

Time

If you want to carry insurance on your portfolio continuously, it’s best to buy long-term options such as one year rather than a sequence of one-month options. You won’t suffer as much from time decay, and the monthly cost will be lower.

As time passes and your one-year put approaches expiration, it will become necessary to roll it out in time to maintain exposure. Consider doing this when at least 3 to 4 months remain. That way, you avoid holding through a period when time decay inflicts the most damage.

Strike Price

The strike you choose will influence the put cost. Let’s say your stock is at $100. Puts with a strike just below $100, such as $99 or $98, are slightly out-of-the-money and will be more expensive. Think of them as a low-deductible insurance policy. Those that sit further out-of-the-money, such as $90 or $85, are cheaper. Consider them high deductible insurance policies.

A good rule of thumb is to buy a put that is 10% out-of-the-money. It keeps the cost down but still protects 90% of your investment.

As of September 2022, SPY is trading for $362. To protect a 100-share position using the above guidelines, I would buy a Sep 2023 $326-strike put option.

[1 + 2 + 3] All Together Now

Let’s review the steps to create our protected stock portfolio with cash flow.

- Build a diversified portfolio using SPY and IWM.

- Sell monthly out-of-the-money covered calls. 1 per 100 shares.

- Buy one-year, 10% out-of-the-money put options as insurance. 1 per 100 shares.

With the right education, time and experience, you will learn the best practices for managing your positions.

Get (Honest & Affordable) Financial Education Today

If you want to learn:

- How to spot what to buy and when to buy;

- How to generate passive income and;

- How to protect your portfolio…

Check out the Options Success Training Bundle. It will help you achieve financial freedom at a SUPER affordable price.

In the 5-minute video below, we walk you through what’s inside this framework for your financial success and you can decide if this is right for you or not.

If you need further information about the Options Success Bundle, such as what’s included in the bundle, and FAQ and also need to contact the sales team, click on the button below to go to the Options Success Training Bundle landing page:

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.