Wall Street is a stage hosting a varied cast of characters. Their names are the narratives that drive headlines and capture investors’ attention. Some steal the show and dominate the story for months on end. Others play minor roles and are quickly forgotten. Pay attention long enough, and you’ll discover the stage is never empty. As one actor departs, another enters to take the spotlight. Consider the handful we’ve seen just over the past year. Covid-19 gave way to economic devastation and lockdowns. Then came a bitter Presidential election and the Pfizer vaccine. The ensuing market boom gave way to reopening themes, meme stocks, and, ultimately, cries of an overvalued market.

We’re midway through 2021, and we’re now starting to see a new player steal the show – inflation. Rising prices are rippling through the economy due to several factors, including supply chain disruptions, record-setting government stimulus, accommodating monetary policy, and a pervasive thirst for spending after months of cabin fever.

Some market strategies are labeling inflation as public enemy number one. It’s the new apocalypse du jour that bears are banking will finally kill the bull market. Since you’ll be hearing a steady drumbeat of inflation-related commentary from the usual outlets, we want to provide you with a practical guide for inflation. Within, we will answer three critical questions:

- What is inflation?

- Why does it matter to me?

- How do I protect myself from it?

Download the newsletter

Click on the button below to download this month’s newsletter in PDF format:

What is Inflation?

Investopedia defines inflation as “the decline of purchasing power of a given currency over time.” It is typically measured by tracking the price of a basket of goods and services. The increase in the price or cost of the basket over time signals that a currency unit buys less than it used to. A quick way to discover the reality of inflation is to ask someone from an older generation what their cost of living used to be. What was the price of their first car or home? What did it cost to go out and eat or to buy a candy bar?

The answers will reveal that costs have risen considerably. Why? Because of inflation. Knowing the root causes of inflation is beyond the scope of this month’s message. Suffice it to say, history teaches us that it is real. Consumers’ purchasing power drops over time.

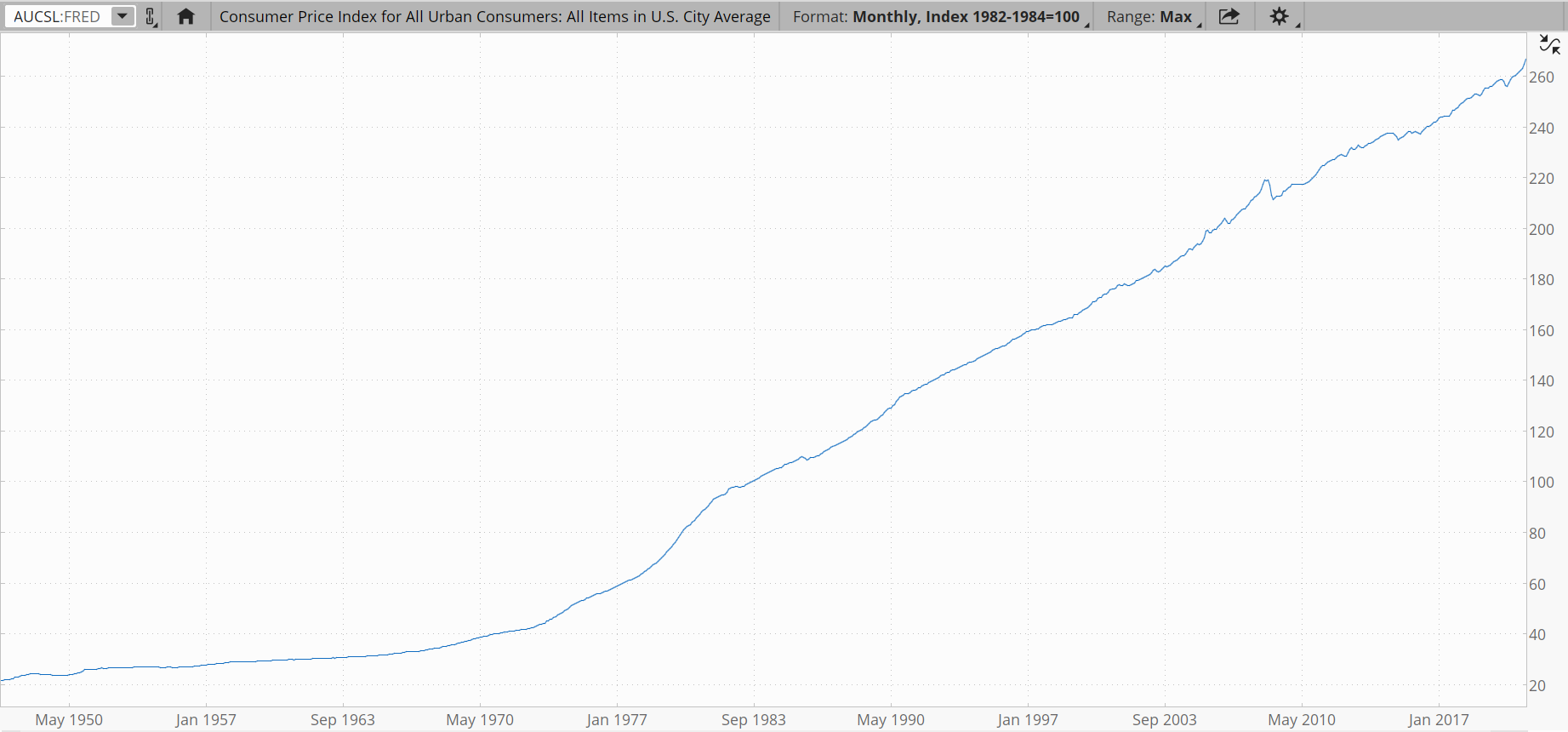

On Wall Street, the most popular inflation metric that traders talk about is the Consumer Price Index or CPI. It is designed to reflect how the cost of living changes over time by tracking how much money is required to buy a basket of goods and services. Here’s a chart tracking the value of the Index going back to 1947.

Let’s look at its change over my lifetime. In 1984 when I came wailing into the world, the CPI was at 110. Now, some 36 years later, it’s perched at 267, or roughly 2.4x higher. When I think about the changing cost of things as I’ve seen them firsthand, that seems right. It also jives with a rule of thumb I learned based on the average historical annual inflation rate of 3%.

What costs $1 in year one of a thirty-year retirement costs approximately $2.40 at the end.

Why Does it Matter to Me?

What I find interesting about inflation is that it affects people differently. While most consumers count it as a large negative, one group actually roots for inflation: borrowers. Inflation reduces debt burdens. Thirty years ago, taking out a $100k mortgage to purchase a house was a big deal. Now, it’s nothing. $100k isn’t what it used to be.

Furthermore, if you’re on a thirty-year fixed mortgage, then the last payment you make won’t hurt near as bad as the first because your income will rise over time. Though incomes don’t necessarily move in lockstep with inflation, the rising cost of living eventually drags wages higher with it. To wit: the median U.S. household income when I was born was $20,687. Now, it’s $68,400. The cost of a mortgage as a percentage of your pay falls over time.

While borrowers love inflation, savers hate it – especially the ignorant ones who are squirreling away all their acorns in a savings account with zero growth potential. Suppose you deposited $10,000 in your bank a decade ago to keep it safe. Now, ten years later, you check your account balance and smile as you see you’ve accomplished your mission. Your $10,000 is still intact. You didn’t lose a penny.

Or did you?

The True Definition of Money

In the long run, the most accurate definition of money is “purchasing power.” When you lose purchasing power, you lose money – even if the number of currency units you have doesn’t change. If your $10,000 only buys 70% of what it used to buy a decade prior, then you have indeed lost a great deal of “money.”

When you understand inflation, you discover a most depressing reality – If your money isn’t growing, then it’s shrinking. But it goes beyond that. It’s not just growth that you need, it’s sufficient growth – enough to outpace inflation. If your investment grows at 5% this year, but inflation is 6%, you still lost money on an after-inflation basis.

But Wall Street doesn’t use the term “after-inflation” much. Instead, they refer to it as the “real” return.

There are two ways to calculate the rate of return. One way doesn’t account for inflation; the other does. The first is known as the nominal return. The second is known as the real return.

Using the investment example above, the nominal return is 5%. But when adjusted for the 6% inflation rate, the real return is -1%.

Negative real returns mean you’re losing purchasing power. Let’s say our initial investment was $100, and it grew to $105. But at the same time, it now costs $106 to purchase what $100 bought one year ago. In nominal terms, I increased my investment. But in real economic terms, I’m losing purchasing power.

This underscores a big danger facing people heading into a retirement that could span thirty years. If they don’t have an investment plan where their assets create a rising income over time to keep pace with inflation, they will run out of money.

Now that we understand what inflation is and why it matters to you, we’re ready to discuss what is arguably the best part of the newsletter: how to protect yourself from it.

How Do I Protect Myself from Inflation?

Fighting inflation with your investment portfolio is simple. Just own assets that have a history of rising beyond the pace of inflation. Before the pandemic, the rate of inflation had averaged around 2% for the prior decade. But as you lengthen the lookback period, it rises to about 3%. Outpacing this average, then, requires an asset to grow beyond 3% per year.

Which of the following assets do you think has done best at this over the long run?

- Cash

- Treasury Bills

- Treasury Bonds

- Real Estate

- Gold

- Stocks

How you answer the question reveals much about your experience and how you think. Precious metals lovers will jump on gold as the answer. Those most familiar with real estate will likely point to it as the best one. Readers succumbing to recency bias might favor stocks considering their post-pandemic boom. Only the delusional would choose cash, bills, or bonds.

The good thing about this particular question is that there is a definite answer born from logic and, well, math. Feel free to argue about the first, but the second is unassailable.

So, which asset has delivered the best inflation-beating returns throughout history?

Stocks, or using their more instructive term – equities.

And it’s not even close. Here’s the math. Since 1926, according to Ibbotson Associates, the S&P 500 has grown at an average rate of 10% per year. That’s the nominal return. If you strip out the 3% inflation, then the real return is 7%. Think about that for a moment. Equity investors have grown their purchasing power more than twice as fast as inflation has taken it away.

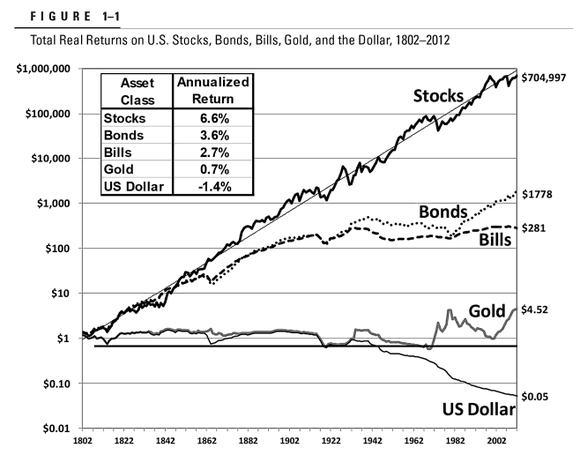

In Jeremy Siegel’s seminal work, Stocks for the Long Run, he takes the data back even further to 1802. The math works out similarly, with the real return coming out to 6.6%. Here’s an insightful chart from the book providing a side-by-side comparison of almost every asset mentioned above.

Now, here’s perhaps one of the most beautiful things about using equities as your vehicle for beating inflation – it doesn’t require any effort. All you must do is stay the course and allow the best companies on the planet to do the heavy lifting through their pricing power. Here’s how the logic goes.

First, inflation increases the cost of labor and materials.

Second, companies pass on these elevated costs to consumers by raising the price of their goods and services.

Third, revenue and earnings rise in nominal dollars.

Fourth, because of rising earnings, stock prices can increase without valuations going into orbit.

Fifth, dividend payments can also rise alongside earnings.

Notably, the earnings increase occurs even if the company doesn’t sell any more widgets than they used to. Making more money was not a byproduct of growth – it was a function of inflation.

Both rising earnings and dividends warrant further investigation.

Why Stocks Can Rise Over Time without Getting More Expensive

The terms cheap and expensive don’t just refer to a stock’s price tag. A $100 stock can be cheaper than a $20 one, for example. Most of the time, those trying to determine the relative price of a stock are using a fundamental metric called the P/E or price to earnings ratio.

Rather than looking at a stock’s price in a vacuum, we look at it relative to the company’s earnings.

If XYZ were trading for $100 and made $10 in earnings per share annually, we would say its P/E ratio is 10. Or, in other words, XYZ is trading for 10x earnings.

If ABC were trading for $20 and made $1 in earnings per share annually, we would say its P/E ratio is 20. Or, in other words, ABC is trading for 20x earnings.

So here we have a $20 stock that looks twice as expensive as a $100 stock from a valuation perspective (let’s leave growth potential out for simplicity’s sake).

Suppose due to inflation the price of every good sold by XYZ company doubled. Instead of selling widgets for $5 apiece, they now go for $10. Over the next year, their earnings rise from $10 to $20 – not because the company grew, mind you, but simply because the nominal price of widgets doubled due to inflation. At the same time, the stock price doubled from $100 to $200. What began as a $100 stock making $10 in earnings is now a $200 stock making $20.

Now for the million-dollar question: Is the stock price more expensive?

The layman may say yes because $200 is more than $100. And yet, from a valuation perspective, XYZ is still trading at 10x earnings. Nothing has changed. It’s just as expensive at $200 as it was at $100. What if over the next 50 years, thanks to inflation, the cost of these once $5 widgets continued rising until they were $100. Assuming XYZ company continued to sell the same number of devices every year, could their stock price ascend to $1000 without really becoming any more expensive?

The answer is yes. At a seemingly lofty $1,000, its stock price isn’t any richer than it was at $100.

This little case study reveals why inflation is one of the biggest drivers of long-term stock returns. It lifts earnings per share which allows stock prices to rise commensurately without sending valuations to the moon.

Importantly, this doesn’t suggest that stock prices move in lockstep with inflation or earnings, for that matter. In the short term, inflationary environments can wreak havoc on equities for a variety of reasons. But whatever storm is brought to bear by inflation concerns eventually blows itself out. Sooner or later, earnings catch up to inflation and bring stock prices along with them.

Dividends Beat the Pants Off Inflation

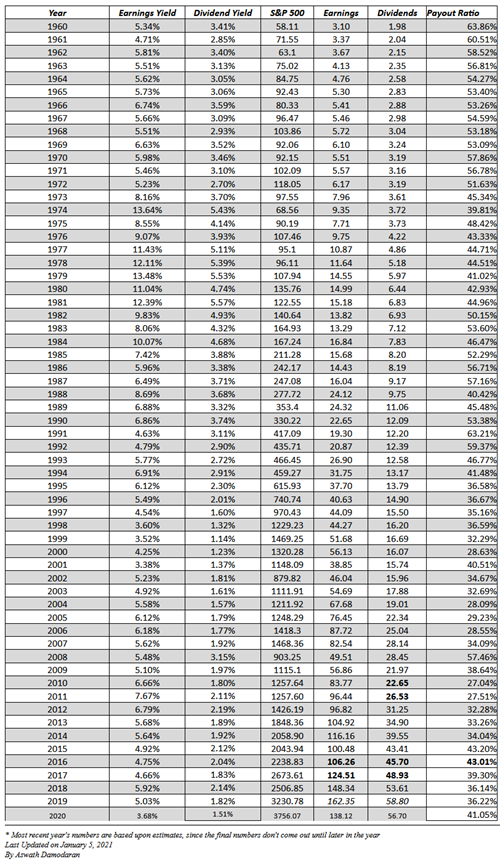

Here’s an insightful chart showing the track record of S&P 500 earnings and dividends for the past sixty years. It was created by Dr. Aswath Damodaran, professor at NYU’s Stern School of Business. Take a moment to study it, focusing on the earnings and dividends columns. You can also view it in your web browser here.

Here are a few numbers to chew on:

- In 1960, the Consumer Price Index stood at 30. Now, it’s 267, or nearly nine times higher.

- In 1960, the S&P 500 was 58. Now it’s 4,200, or 72 times higher.

- In 1960, the dividend was $1.98. This year, it’s closing in on $60, or 30 times higher.

The takeaway is clear. Through both price growth and increases in the annual cash income paid, equities have helped investors outpace inflation by a mile.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.