The stock market is a vast universe teeming with companies large and small. Some are domestic; some are foreign. Some are named after fruit (hello, Apple Inc.) and others are named after fruitcakes. Some have sweet sounding, memorable ticker symbols (EAT, CAKE, YUM) while others were poorly chosen (UGLY)🤔. Many newcomers find themselves overwhelmed by the ever-growing stable of choices. This month’s newsletter is here to help. We’re going to take a peek behind the curtain and learn just how a professional trader creates, prunes, and maintains a watchlist.

These days there are some 4,400 domestic U.S.-listed companies. Chances are you’re already familiar with the big ones like Apple Inc., Microsoft Corporation, Amazon.com, Inc., Facebook, Inc., Exxon Mobil Corp, and Alphabet Inc (the parent company of Google) just to name a few. Consider these the elephants of the financial jungle. Due to their largesse, they make the biggest impact on markets. Temper tantrums from any one of them create tremors felt across the land. Said another way, the behavior of these industry titans often sets the tone for the rest of the stock market on any given day. Positive news and price action from Apple can buoy the not just the tech sector, but the market at large. Alternatively, negative news or price action from Exxon Mobil Corp can throw a wet blanket on the entire energy space. Traders ignore the behavior of the big boys at their peril.

These days there are some 4,400 domestic U.S.-listed companies. Chances are you’re already familiar with the big ones like Apple Inc., Microsoft Corporation, Amazon.com, Inc., Facebook, Inc., Exxon Mobil Corp, and Alphabet Inc (the parent company of Google) just to name a few. Consider these the elephants of the financial jungle. Due to their largesse, they make the biggest impact on markets. Temper tantrums from any one of them create tremors felt across the land. Said another way, the behavior of these industry titans often sets the tone for the rest of the stock market on any given day. Positive news and price action from Apple can buoy the not just the tech sector, but the market at large. Alternatively, negative news or price action from Exxon Mobil Corp can throw a wet blanket on the entire energy space. Traders ignore the behavior of the big boys at their peril.

And yet, focusing solely on the largest of the large is shortsighted. After all, the elephant is merely one animal of thousands in a thriving jungle. And opportunity can strike in every single one of them. Now, if you think 4,400 companies seems like a lot, bear in mind we’re only talking about U.S.-based companies. If we broaden our scope to include all public companies on the planet, that number grows ten-fold to some 43,000 plus.

If your mind is spinning with the possibilities or if you’re paralyzed by the thought of actually sifting through such a mass of potential investments, worry not. By focusing on a few key metrics, we can narrow down the list substantially. In fact, depending on their trading style most veteran traders focus on a core list of maybe 100 to 200 companies. And that makes a seemingly unmanageable task, well, manageable.

Of all the potential metrics we could use when sifting through this mountain of choices, the indisputable champion of them all is LIQUIDITY.

.

Liquidity Reigns Supreme

In general terms, liquidity refers to how easily you can convert an asset to cash. Liquid investments can be converted to cash quickly with confidence that the value of the asset won’t change during the conversion. Illiquid investments are more difficult to convert to cash and may have a reduction in value once converted.

✅ An example of a liquid asset would be money in your checking account. You can access it at will, and its value won’t change as you take it out of the bank.

❎ An example of an illiquid asset would be your home. It takes time to sell, and there may be a significant difference between the paper value of your house and the amount you can actually sell it for.

The same definition applies to liquidity in the financial markets. It refers to how easily we can buy or sell a stock (or option) without seeing a significant change in its value during the conversion process.

Say you own a stock (or option, for that matter) that’s worth $43.25, and you want to sell it immediately. If you can exit the position quickly and capture the entire $43.25, then that particular stock would be considered extremely liquid. However, if through the process of selling you only received $43 (or, 25 cents less than its market value), then it would not be considered liquid. Obviously, the more significant the discrepancy between the market value and the actual amount you receive upon exiting the less liquid (or more illiquid) the asset is.

In a perfect world, the price movement of an asset would be a continuous stream allowing easy entry and exit. Picture an uninterrupted flow that enables all participants regardless of size to buy and sell at any price they please. Slippage (which is trader-speak for the difference between the price you expected to get filled at and the price you were filled at) would only crop up when you run too fast to the bank and encounter a well-placed banana peel.

So what makes a stock liquid?

The answer is volume or the number of shares that change hands over a specific time frame. Most traders track this on a daily price chart so consider it the number of shares that trade each day. The relationship between volume and liquidity is intuitive. The higher the trading volume, the better the liquidity.

Liquid as Water

Let’s look at two examples to illustrate. One of the most actively traded stocks is Apple Inc. And for a good reason. It’s the largest company on the planet and has a brand recognized by even the most out of touch hermit. The average daily trading volume is around 29 million shares. In case you were wondering, with a current stock price of $169, that translates into about $4.9 billion of AAPL stock changing hands each day.

As a result of the popularity, AAPL is extremely liquid. Its second-to-second price fluctuations are about as close as you can get to the continuous stream or uninterrupted flow mentioned earlier. Even in fast-moving markets traders can confidently buy the stock knowing they can unload their wares at any time right at the market price. And if they have to take a haircut it is typically only a penny or two (i.e., with the stock price at $169.23 they may have to sell at $169.22 or $169.21).

Fortunately for the more visually inclined among us, liquidity is something you can easily see. All you have to do is view a one-minute chart of the stock in question. Consider AAPL, for example. In Figure 1 below you’ll see its intraday chart. Notice how every single minute of the day has a fully formed candlestick. That means there was enough activity or fluctuation to create a high, low, open, and close for each candle. Furthermore, virtually every one-minute trading session boasted over 10 thousand shares traded. Many were in the 50 thousand to 100 thousand share range. This is precisely what a liquid stock looks like.

Figure 1: Apple Inc. (AAPL) one-minute chart

Figure 1: Apple Inc. (AAPL) one-minute chart

.

Dry as a Desert

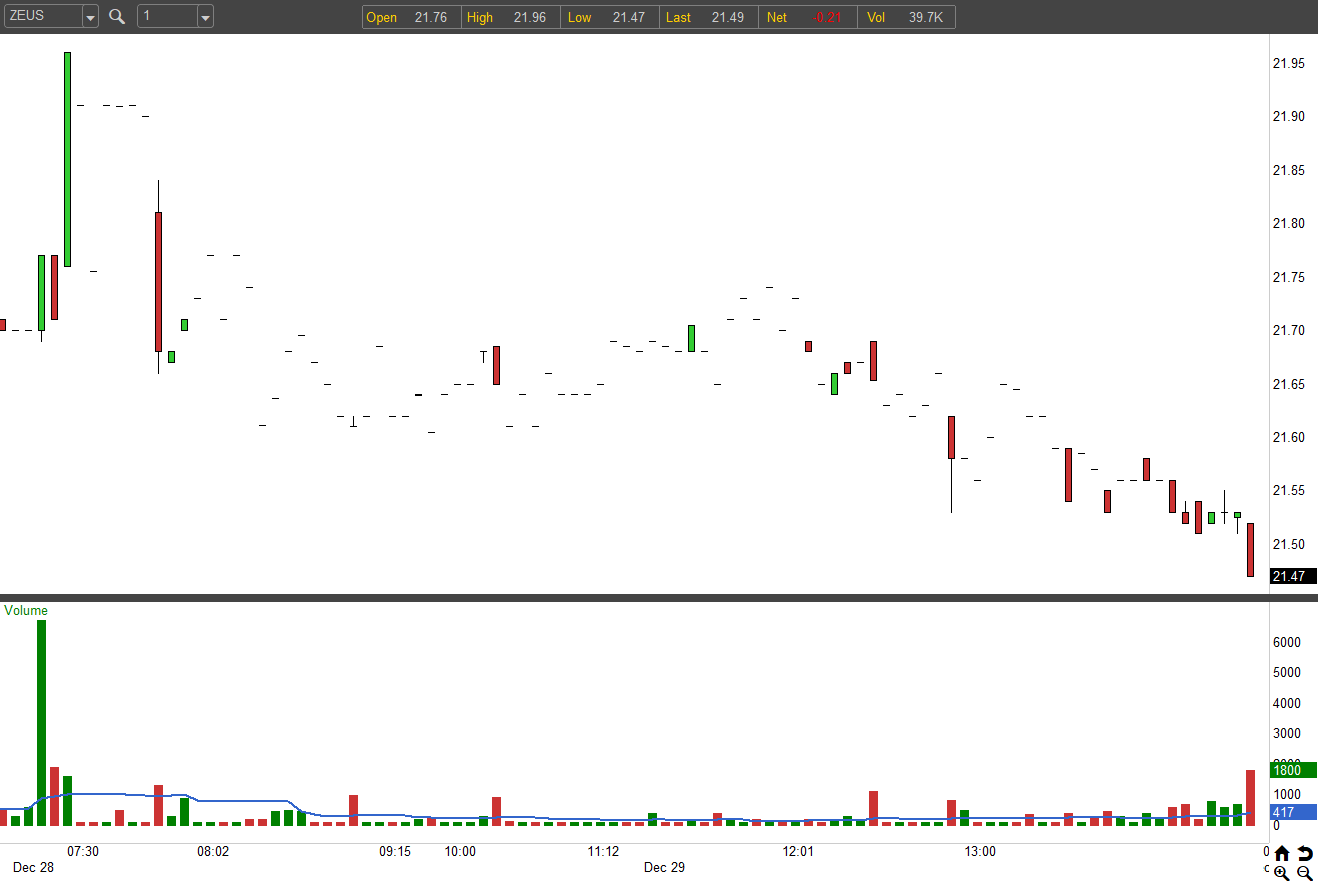

In contrast, let’s take a look at an illiquid stock. For this, we turn to Olympic Steel Inc which has one of the more interesting ticker symbols, ZEUS. Unfortunately, for all its coolness, ZEUS isn’t attracting much attention from traders. Unlike Apple Inc. stock, ZEUS has an average daily trading volume of only 100 thousand shares. With a price tag of $21.49, that translates into a mere $2.15 million of ZEUS stock changing hands each day. That’s a far cry from AAPL’s $4.9 billion!

Check out the one-minute chart of ZEUS displayed in Figure 2. Notice how few fully formed candles there are. Much of the day shows dashes which result when there isn’t enough price fluctuation to create a high or low that’s different from the open or close of each one-minute candle. The lack of variation is a byproduct of the measly volume seen throughout the day. The majority of the time ZEUS was seeing about 100 shares traded each minute. Remember, AAPL saw tens of thousands of shares change hands each minute! Note also the plethora of gaps throughout the day. Because of the illiquidity, ZEUS was bouncing around like a jackrabbit. Even a small order sent its share price jumping or falling by 10 or 15 cents.

Consider ZEUS the poster child for an illiquid stock.

Figure 2: Olympic Steel Inc (ZEUS) one-minute chart

The quickest way to sidestep the Olympic Steel’s of the world is to build a watchlist of stocks that trade at least 500k shares a day. Most brokerage accounts have scanning tools that allow you to search by volume. A ThinkorSwim scan for all stocks trading at least 500k shares each day yields 2,339 results. If you’d like to be even more discriminating, try upping the threshold to one million shares a day. That cuts the list of candidates down considerably to 1,462.

Admittedly, that’s still a significant number. To further weed out the riff-raff we suggest using a price filter.

Many novices are attracted to penny stocks and other sub-$10 stocks due to their cheap price tag. Some reason that it’s easier for a $2 stock to double to $4 than a $100 to climb to $200. Others falsely believe that buying ten shares of a cheap stock is better than buying one share of an expensive one. Both notions are false. The lion’s share of sub-$10 stocks is either highly speculative or riddled with weak fundamentals. There are simply too many legitimate opportunities in higher-priced stocks to justify playing with beaten-down, low-priced securities.

Sidestepping the cheap stuff becomes even more critical if you’re trading options because there’s not enough premium to make it worthwhile. Take Sirius XM Holdings (SIRI) which is one of the more actively traded low-priced stocks in the market. It trades over 20 million shares a day, so it has liquidity in spades. But the $5.36 price tag leaves much to be desired. Suppose I tried to sell a two-month $5 naked put. Do you know what my pay-day is? A measly 12 cents. And if you’re considering a covered call, the two-month $6 strike call only offers six cents of premium. Fuhgettaboutit!

Avoiding stocks below $5 is a no-brainer but if you’re really looking to cut down on your list, use $10. The list of stocks with at least one million daily trading volume falls from 1,462 to a more manageable 645 when we add a price filter of at least $10.

You could stop here, satisfied that you’ve narrowed down your universe of choices down from an unwieldy 4,400 potential stocks to a handy 645. But chances are you probably still find the idea of monitoring some six hundred plus tickers on a daily or weekly (or, heck, even monthly) basis to be too daunting.

We suggest one more step to get you across the finish line.

.

The Final Step

The path we’ve outlined so far is one worth traveling for all new traders. Whether you’re a long-term investor, a short-term day trader, a stock lover, or an options enthusiast, whittling down your list to the top 600 or so liquid and properly priced securities is a must. At this point how you proceed comes down to personal preference.

Those who champion Warren Buffett, Benjamin Graham and other value investing greats will probably want to view the remaining few hundred stocks through a fundamental lens. That is, pick your favorite fundamental analysis metrics (P/E ratio, sales growth, dividends, debt/equity ratio, etc…) and begin tossing out any undesirables. No need to do it by hand! Just add a few fundamental filters to your scan. Dollars to donuts you can further trim your watchlist down to a hundred stocks or whatever you define as a manageable list. Some traders can handle a watchlist of 200 stocks or more because they’re adept at using scanning tools and can analyze charts rapid-fire. Others may need to continue whittling the list down to around 50.

If you’re an options trader, then your next step should be focusing on key liquidity metrics that measure the level of options activity in these remaining 600. This is an exercise we’ve done many times by concentrating on the bid-ask spread and open interest. The tighter the bid-ask spread and the higher the open interest, the more liquid the options. If you’re focusing on the cream of the crop, if you’re intent on only trading the most liquid of all optionable stocks, then you can pare your list down to about 100 contenders.

The final route involves using technical criteria. If you’re interested in compiling a list of bullish candidates, then perhaps you can add a filter to only include stocks with a price above a long-term moving average such as the 200-day. You could flip that around if you’re seeking bearish candidates. There are myriad ways to use technical metrics. Which indicators you focus on comes down to preference.

Regardless of the combination of filters you use, the ultimate objective is to build a list of liquid stocks that carry the characteristics you’re interested in. After that, you will monitor or “watch” this list on a regular basis to identify potential trading opportunities.

What about ETFs?

Before departing (and bidding you good luck on your list building adventure), we also need to mention the role that exchange-traded funds (ETFs) should play. Remember, an ETF is a vehicle that can be bought and sold just like an individual stock. But instead of representing a share of ownership in one specific company, an ETF typically provides exposure to a basket of stocks (like the S&P 500 or the Dow Jones Industrial Average). Additionally, you can trade ETFs that track commodities, countries, sectors, currencies, and real estate. Think of the benefits offered by following a diversified watchlist of these trading vehicles. For starters, they allow you to track and trade other asset classes like bonds and commodities that often move utterly independent of the stock market. It also makes it easy to follow other countries like China, Brazil, Mexico, and Russia which may zig when the U.S. stock market zags. Another factor favoring the inclusion of ETFs is they don’t report earnings, so you don’t need to worry about significant price gaps cropping up every quarter.

The short answer to whether you should include these in your watchlist building is: YES!

While there’s nothing wrong with merely including them in the same grouping as your stocks, you might want to create a separate list for organizational purposes. There are thousands of them to choose from, but if you use similar price and volume filters to what we’ve already discussed, then you will discover there are only about 45 that offer liquid options.

To provide a jump start try checking out the Tackle 25 which is a curated list of hand selected stocks from the coaches at Tackle Trading. The lot of them are liquid and have listed options contracts.

So what are you waiting for? Get crackin’ on your list building, and you’ll be well on your way to an organized method for finding trading opportunities!