“Who would still eat this?”

— Jamie Oliver —

Humans are funny creatures. Sometimes our decision-making process is backed up by a perfect, pristine, crystal clear, flawless rationality, that would make the ancient Greek philosophers jealous and envious of our achievements here in the future. However, more often than not, we behave like we are still part of the Cnidaria phylum, thoroughly guided by a complex neurochemical mixture which production is, in turn, commanded by the billion-year-old proteins inside our DNA molecules: completely irrational, like sea anemone, rocky corals and jellyfishes.

In this June edition of the Trading Justice newsletter, we are going to be talking about impossible foods and human behavior and how it all relates, in the end, to financial education as the only viable solution.

Download the Newsletter

This June Edition of the Trading Justice newsletter is available for download in this link.

How chicken nuggets are made?

First of all, we have to answer this question as it will serve as the basis for the entire newsletter: How chicken nuggets are made? Here’s a simple way of explaining what goes inside of this exquisite delicacy.

“Typically, conventional chicken nuggets are made with mechanically separated chicken—using the bits and parts that are not sellable of a chicken carcass. Approximately, a mass-produced chicken nugget has 50% meat and the rest is fat, ground bone, blood vessels, and connective tissues. This mix does not generally taste very good or taste like chicken, so then the manufacturers add salt, sugar, starch, binders, and fillers to make it taste like palatable.”

— Jennifer Johnson, Sous-chef —

If the previous paragraph got you wondering what goes inside the most famous chicken nuggets in the world—the Chicken McNuggets—that’s perfectly fine. There is a video on YouTube from Felicia Bergström, published in 2016, that goes through the whole manufacturing process. No beaks, no feet, just meat.

Being a Veterinarian myself (a long long time ago, I should say), I’ve studied this manufacturing process in great detail and also visited and inspected plants like Tyson’s presented in the mentioned video. All as part of the learning curriculum at the University, not as a professional, I might add.

If someone asked me to bring this manufacturing process down into one single world, so they can easily understand all its complex parts and, above all, understand the reasons why we undertake such a heavy load of work to produce food, that single word would be protein. Just like in the Law of Conservation of Mass, developed by the French chemist Antoine Lavoisier, in a chemical reaction, matter is neither created nor destroyed. Humans need protein and they cannot afford losing it.

However, not all proteins are edible or palatable. We eat with our eyes and ears as well. Although extremely nutritious, no one would eat bone marrow, for example, or bone or blood vessels, for that matter. In birds and mammals, the bone marrow is responsible for the production of new blood cells and hematopoiesis, the basis of life itself. It is such an important organ in our system that humans transplant it to leukemic patients to save their lives from a dysfunctional—and therefore—destructive organ.

Blood cells and hematopoiesis = Nutrients, lots of them. Protein, vitamins, minerals, you name it. It’s all in there. But no one in their right mind would eat bone marrow.

That is why we have chicken nuggets.

R.I.P. Jamie

James Trevor Oliver is an English chef and restaurateur best known as Jamie Oliver. Way back in the early 2000s he rocked the TV world with his approachable cuisine and the way he was talking about healthy food like no one else was at that time. In 2005, he started the Feed Me Better campaign, to introduce schoolchildren to healthier foods which quickly became a smashing hit and was later backed by the government. Nowadays, looking more and more like Christopher Lambert, he continues his crusade against industrialized food, although in a more discreet way.

As stated by the Sous-chef, Jennifer Johnson, chicken nuggets are made with mechanically separated chicken, fat, ground bone, blood vessels, and connective tissues. Because it is not edible, the manufacturers add salt, sugar, starch, binders, and fillers to make it taste good.

There is this video that became kind of an underground classic on YouTube that shows the hyperactive and talkative Healthy-Food Crusader Jamie Oliver preparing chicken nuggets in front of half a dozen children. He didn’t even try to spare the little kids from the nasty details.

— “Do you want to learn a lesson that’s gonna change your life?” – He asked the little ones.

— “YEAH! YEAH! YES!” – they effusively answer back.

He then turns his back on the children and grabs a chicken carcass.

— “Who knows what this is?” – He asks, throwing the carcass over the table top.

(PLOFF!)

— “A chicken! Chicken! A Chicken!” – Kids are high with so much sugar and excitement in their blood.

Then he starts torturing the kids. It goes more or less like this:

Chicken carcass › Cut out the good pieces of meat › Carcass leftovers › Chop the carcass › (Describes the process to the halflings) › Add chicken skin (Terrifying soundtrack) › Food processor › Pink slime › Stabilizer › Flavour › Patties › Flour › Frying pan.

To the untrained spectator, it might appear disgusting. It certainly did to the kids. However, watch this:

— “Who would still eat this?”, he asks.

Much to his dismay everyone,

— EVERYONE —

would still eat this.

R.I.P. Jamie.

Impossible to eat

Going through my boring but necessary routine of reading the news, I’ve become acquainted with the Impossible Burger. The first thing that came into my mind was “This must be Tom Cruise’s burger for the newest Mission Impossible 23 sequel”.

I was wrong. The Impossible Burger is a meatless patty made by Impossible Foods, a company founded in 2011 and based on Redwood City in California. Here’s their official business idea:

Love meat? Eat meat. Impossible™ delivers all the flavor, aroma and beefiness of meat from cows. But here’s the kicker: It’s just plants doing the Impossible.

Just plants. Here are the ingredients (so far):

Water, Soy Protein Concentrate, Coconut Oil, Sunflower Oil, Natural Flavors, 2% or less of: Potato Protein, Methylcellulose, Yeast Extract, Cultured Dextrose, Food Starch Modified, Soy Leghemoglobin, Salt, Soy Protein Isolate, Mixed Tocopherols (Vitamin E), Zinc Gluconate, Thiamine Hydrochloride (Vitamin B1), Sodium Ascorbate (Vitamin C), Niacin, Pyridoxine Hydrochloride (Vitamin B6), Riboflavin (Vitamin B2), Vitamin B12.

Just plants. God only knows what half of these are. The Impossible Burger is essentially an amalgam developed by scientists in a lab somewhere in Silicon Valley.

Got stuck trying to pronounce Soy Leghemoglobin? Let me present you to Heme:

Heme is what makes meat taste like meat. It’s an essential molecule found in every living plant and animal — most abundantly in animals — and something we’ve been eating and craving since the dawn of humanity. Here at Impossible Foods, our plant-based heme is made via fermentation of genetically engineered yeast, and safety-verified by America’s top food-safety experts and peer-reviewed academic journals.

Impossible to eat. However, people seem to be liking it. As of this writing, the Impossible Foods were still not being traded publicly on the stock market.

“Jamie, get me one of those fresh-made nuggets you’ve served the kids, please. I don’t want to get back to photosynthesis. Oh, wait, is there more?”

Beyond Disgusting

In 2009, Beyond Meat was founded although many people only heard of it in 2019, due to its most-waited-and-acclaimed IPO on May 2nd.

Based in Los Angeles, California (I would never imagine), they are a producer of plant-based meat substitutes. According to the company, its products became available across the United States in 2013 and in May 2016, they released the first plant-based burger to be sold in the meat section of grocery stores.

Since its debut in the Nasdaq index, the stock rocketed from $46 to $186.46. Holy Heme!, that’s a 305% rally in a little more than a month (from the open in May 2nd to the high of June 10th). On June 11th it took a deep dive—a well-deserved retracement—closing the day at $126.04. That is some 48% loss from the high the day before.

To be fair with Jamie’s nuggets and the Impossible Meat, let me list here for you the plethora of ingredients that go inside the smashing hit Beyond Burger. Hold your nose:

Water, pea protein isolate, expeller-pressed canola oil, refined coconut oil, contains 2% or less of the following: cellulose from bamboo, methylcellulose, potato starch, natural flavor, maltodextrin, yeast extract, salt, sunflower oil, vegetable glycerin, dried yeast, gum arabic, citrus extract, ascorbic acid, beet juice extract, acetic acid, succinic acid, modified food starch, annatto.

I swear to God I read BEETLE JUICE EXTRACT on that ingredients list. This is turning out to be a very disturbing newsletter for me to write.

Tom Preston, from the Tastytrade team, wrote these lines about Beyond Meat:

Beyond Meat (BYND). I don’t get it. Well, actually I do. People like the texture of meat and BYND’s product gets close to that without killing an animal by mixing up a bunch of non-meat stuff to replicate meat and selling it at a hefty price. Even KFC is getting on board. BYND is up 128% since it’s IPO on May 2. Everybody loves it. But it ain’t eating vegetables. Vegetables are delicious. Healthy. Potent. And cheap. They are the cornerstone of my post-cardiac-adventure diet. Me? I’d rather eat peas “straight up” rather than processed into a “Beyond Burger”. Either way, all this stuff has to be farmed, and what self-respecting farmer doesn’t drive a Deere?

Let’s not get into the carbon dioxide footprint the vegan burgers leave behind. Let me proceed with the writing.

We don’t know the real intention of these people in regards to meatless burgers. Whether they are trying to bash the meat industry, make loads and loads of money selling special food for Special Millennials or trying to solve the famine issue, we will never know. One thing we can be sure, though: if they are trying to sell these plant burgers as healthy food, they are beyond dishonest. Just read the ingredients list out loud to your kids and see how many of those they recognize. Kids know what real meat and vegetables look and taste like.

You don’t have to be a scientist to realize that this is still poor quality food, marketed as meals sent from the Heavens to enlighten the lives or mortal people.

Jamie, I miss you more and more each line of this newsletter.

Chicken Nuggets + Impossible Burger + Beyond Burger

Junk + Junk + Junk = JUNK

Now we’ve reached the climax of this newsletter; I’ve saved the best for last (Kenny G is playing). Why have I been talking about a British Chef terrifying children with a gross pink slime made of chicken carcass leftovers? Why did I bash the best Vegan Burgers there are since the Prehistorical Era made by the most capable scientists in the entire Silicon Valley?

Because they remind me of one thing and one thing only: the “professionally” managed mutual funds. Think about the similarities:

- People that eat crappy food—either disguised as delicious and/or healthy—don’t care what goes inside the patties. They eat it just the same.

- People who “invest” in any of the “professionally” managed mutual funds behave the same way: they don’t care what goes inside any of them. They invest just the same.

- Junk food manufacturers and fund managers have one single job: push their unnamable assets down our throat, getting rich from charging pornographic fees for their low-quality leftovers.

- None is good, either for our health or our pockets.

Try to picture one of the Justice Brothers delivering a presentation, surrounded by grown-ups, showing to people all the junk that goes inside a mutual fund. Now, fast-forward to the end of the presentation when they effusively ask the students:

— “Who would still invest in it?”

R.I.P. Justices Bros.

The Unnamable Plethora

The Impossible Investment

Chicken nuggets or vegan burgers, pick your poison. They are just like those “professionally” managed mutual funds: a basket composed of an unnameable plethora of financial assets called “diversified holdings”. Couple them with some obscene fees and you got a disgusting mixture, worse than the pink slime. People don’t know what they are buying into, beaks and feet altogether.

Take some time to study the following (disturbing) image:

In the United State, the mutual funds’ industry is a behemoth, with trillions of dollars (TRI-TRILLIONS) under management and way more than seven heads. The list above shows you en passant the size of the industry so far. AUM means Assets Under Management. The data came from the website Visual Capitalist.

What goes inside each fund sitting inside each of the major categories, not even God knows. The last item is pretty interesting too; this is where the industry gets rich: FEES.

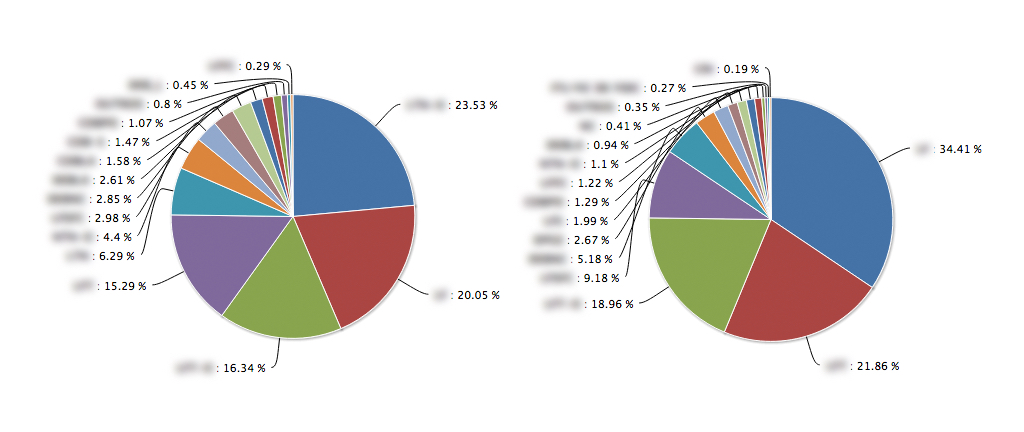

Let me show you two pie charts (shocking images!) with the current breakdown of two real-world mutual funds: Impossible Investment & Beyond Crooked (only the names were changed to preserve privacy).

Would you put your hard-earned money on one of those? Would you put the future of your family inside one of these pie charts? I can only imagine how super-professionally-managed these two mutual funds are, holding billions in assets. Impossible To Look At & Beyond Shameful. That is gross.

Call me old-fashioned but I won’t eat a product engineered by a Silicon Valley startup just as I won’t let a “professional fund manager” manage my hard-earned money. Do any of these guys have skin in the game? Don’t tell me what to do, show me your personal portfolio instead.

A tragicomedy in four acts

A personal experience

Been there, done that. Here’s my personal experience with junk investments and how I ended up working in the Financial Education world.

— ACT I: The money —

So I had this money and I wanted to make it grow. Inflation in Brazil? Always high. The currency is always crashing.

Savings. Meh.

Piggy bank. Seriously?

Stock Market. That’s gambling, my dad taught me.

Newspaper advise. No comments. I never knew someone who got rich from following the newspapers’ tips and tricks.

Real estate? Geez, they are selling houses in a favela for $200,000. I pass.

The bank account manager? Sounds like a plan.

— ACT II: In the bank —

(A gorgeous Vogue model blonde comes in, sent by the Devil himself to tempt me. My wife goes into a territory-defending mode. I start to pray.)

— Good morning. How are you?

— Nice, thanks for asking.

— Coffee?

— Yes, please.

(Lord, how much sugar is in here? I am not an ant.)

— Good?

— Delicious.

(Light conversation sets in)

— Where do you live?

— Ahm, we live in the Xxxxx neighborhood (privacy mode).

— REALLY?? I live there too! How come we’ve never met each other?

(BECAUSE GOD IS ON MY SIDE, I thought. Wife is now going into a 1-week deafening-silence mode. My coffee starts to taste sour.)

— What a coincidence.

— How can I help you?

— I got this money and I am looking for investment alternatives. Do you have something interesting I can invest in?

— I sure have. How much do you want to invest?

— All in. I got $xxxxx,xx (privacy mode).

(Manager opens the desk drawer and picks up a pile of colorful summary prospectus)

— Here. I got these mutual funds that may interest you. (shuffles the deck) This one, in particular, is very good, it delivers 110% of the benchmark.

(Hands out the prospectus to me and start making important calls speaking in gibberish as to sound important. How much is 110% of the benchmark? What is a benchmark anyway?)

— Thanks.

(4 pages each, body copy in font size 4, unreadable pie charts, who can read this s***?)

— Can I take these home so I can study them better?

— Sure.

— Thanks. Bye.

— ACT III: Courage —

(After three mugs of strong coffee)

OK, there’s bonds. Corporate and government. Not the same letter soup. And stocks. And ETFs. What are those? And mutual funds. Which one to buy? Oh, there’s allocation percentage too. Currency, gold. Gold? Who buys it nowadays? Portfolio design. How to build one? How to determine the ideal allocation for my case? What is my case, anyway?

(Brilliant idea: Google “How to invest” › About 1,220,000 results in 0.68 seconds)

Depression sets in. It was not working. I’ve decided to go out for a walk, praying to not meet the blonde.

Back home. OK, calm down. I’m going to read this blog here…

(Browse through articles)

This looks interesting. Let me read it. There is a book recommendation. Sounds interesting.

(Gets the book. Starts reading. Word: “Financial Education”)

Finally.

— ACT IV: Here I am —

“If I can’t see it, it doesn’t exist.”

There is another classic video from the undergrounds of the internet that shows a German Shepherd dog who is afraid of injection. In an attempt to not see the needle, he buries his head into the police officer arms. The video is called “The Dog Logic”.

“If I can’t see it, it doesn’t exist.”, seems to summarize the problem posed in this article. The dog logic is also the humans’ logic. We don’t see what goes inside the junk food we love or the mutual funds we invest in. We don’t want to know it either. Ignorance is bliss.

Behind such behavior, there must be a reason. Or reasonS. Many of them, perhaps. Let’s speculate a little bit using short definitions for commonly known cognitive biases:

Ostrich Effect? (to bury one’s head in the sand)

In behavioral finance, the ostrich effect is the attempt made by investors to avoid negative financial information.

Optimism Bias? (it won’t happen to me)

Optimism bias is a cognitive bias that causes someone to believe that they themselves are less likely to experience a negative event.

Choice-supportive Bias? (finds arguments to support a bad choice)

Choice-supportive bias describes the tendency to have positive attitudes about the things or ideas we choose, even when they are flawed.

Seersucker Illusion? (over-reliance on expert advice)

The Seersucker Illusion is the over-reliance on expert advice. Seersucker illusion has to do with the avoidance of responsibility. We call in “experts” to forecast when typically they have no greater chance of predicting an outcome than the rest of the population. In other words, “for every seer, there’s a sucker.”

(junk) Food for thought.

When people eagerly want something, they don’t care about the means, they just want to reach a final outcome that solves their temporary issue. “If it’s beautiful, brown, yellow, whatever color it is; if it smells good, if it looks juicy, all the sensors have come into an agreement, then let’s eat it. It doesn’t matter what goes inside. I am hungry and this solves my problem.” The same goes for investing: “I want to put my money somewhere, can’t leave it there in a checking account doing nothing, let me choose the highest ranked mutual fund in terms of ROI and dump into it. Nice, problem solved. At least I am not losing anything.”

Now, the question that never goes away:

Do you think that telling our friends and family what goes into a mutual fund will stop them from investing in it?

Of course not, you guessed it right.

The only solution to that is financial education. As traders and investors, it is our duty to start this silent revolution and help those who surround us. That is why the Trading Justice Podcast and Tackle Trading exist together, to teach the masses how to invest and trade, how to take care and control of their financial future.

Nice talking to you but I’m tired and starving. I’ll go have some chicken nuggets for lunch.

Download the Newsletter

This June Edition of the Trading Justice newsletter is available for download in this link.