I’m going to start blogging as often as I can. There are many bloggers who believe you should blog daily, to generate creativity and force yourself to get your content and ideas out there in the world. We live in a world of so much information, I have a hesitation about just putting more of it out there, but if I’m doing this work anyway, and I can share some insight with you as a reader and fan of our podcast and community, then great!

Stock markets are at or near all-time highs. Each morning, over coffee, I start with this comprehensive Tackle Trading report. Of the 4 indices, the RUT is the only one not at the top of the channel, and is, in fact, approaching its 20 period moving average. The SPX, DJIA and NDX are all range up, ready for a pullback, but one of the hardest things to do in the market is to predict a counter-trend trade. Many traders have been burnt and hurt trying to fight the trend. In last week’s Coaches Show, Coach Noah Davidson and myself discussed the Wycoff Price Cycle. The market is firmly in the overbought conditions discussed during the show. But, it’s not yet in a ‘distribution phase’

Trading in overbought conditions can be difficult. There are always strategies that are appropriate, including Naked Puts and Covered Calls along with other ‘Cash Flow’ strategies. But, when you’re at the top of the channel you can find it difficult to identify trades from a directional perspective. Breakout stocks tend to be better, as the market is running higher, and if you can find an entry on a breakout, you can still play that momentum in overall bullish conditions. Scanning my list of candidates from this week’s Scouting Reports, one viable candidate was AA.

High Base Breakouts are very common patterns to identify to trade, AA was found by Tyler Craig in the Stock Report (that you can find here) over the weekend. What I like about this setup is a very clear trigger entry, which has not been met yet, so you still have the opportunity in front of you. The earnings report is behind us, so there’s not the volatility risk of the gap. I would play this as a swing setup, and as a directional play with long stock or a long option. Something simple, low risk and self-contained with a trading plan of Stop, Entry and Target (SET Method).

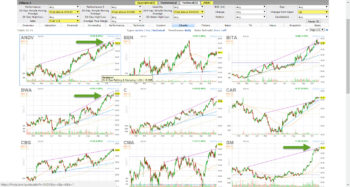

I ran a basic FINVIZ breakout scan with a few filters for higher beta, and daily upward movement, and came across some nice breakouts as well.

When looking for trades, I tend to go through this order of decision-making.

- Watch List Candidates

- Scouting Report Picks from Trading Coaches

- Scanning via Software or the Web

My Watch List is always the first place I start. The Tackle 25 and Tackle 25 ETF lists are invaluable to me to Keep It Super Simple (KISS). ON a daily basis, I will work those lists first. Then I go to the weekly Scouting Reports from Tackle Trading. Because I know the Coaching Staff there and how they find trades, I can quickly scan what they picked and make my own decisions on which ones I like. I don’t trade everything on the reports, which is the beauty of it. After that, if I still need some help finding a trade or two, then I will scan. I also have to scan if I am looking for a specialty trade like a volatlity trade, earnings trade or combination trade, which would be outside the scope of the 1st and 2nd choices on the list.

From the FinViz scan, the best candidate from my perspective was GM.

I like this setup for a swing trade or position trade entry. Swing trading generally is more technically dependent and you have to have a more deliberate management style. Position trading tends to be better for more laid back traders who want to automate the trade and simply move on. Long calls would be appropriate for speculation, or a spread in the options market. What’s nice about this setup, is that its a post earnings gap. The stock reported last night, and the movement to the upside was instant, on the Intra-day chart above you will see a fill back into the old resistance which by definition is a Kiss Hello pattern. Worth a shot. I’ll keep you posted on how it goes. If you’re buying long calls, consider the Extrinsic Value before you do.

I’m going to ride this one up the escalator….if you want to grab my hips and follow me, do it at your own risk 🙂

Regards,

Tim Justice