Compounding commands our attention for this month’s newsletter. It’s a powerful force. So powerful, in fact, that mathematical genius Albert Einstein is rumored to have said, “Compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t … pays it.” Now, whether Sir Albert is actually behind the phrase or whether it is an urban myth matters not. Wisdom is wisdom regardless of its origin.

Prepare for enlightenment because we’re going to dive deep into the world of compounding gains. First, we’ll define it. Then we’ll show examples of how compound interest works and explore the rule of 72. Finally, we’ll show how you can use the financial markets to supercharge your wealth building.

What is Compounding?

Renaissance man Benjamin Franklin quipped, “Money makes money. And the money that money makes, makes money.” Such is the nature of compounding. It is the idea that your earnings can be reinvested to generate their own earnings. And the earnings that your earnings earn can then be invested to create even more earnings. Say that ten times fast! Truly, this is a virtuous cycle.

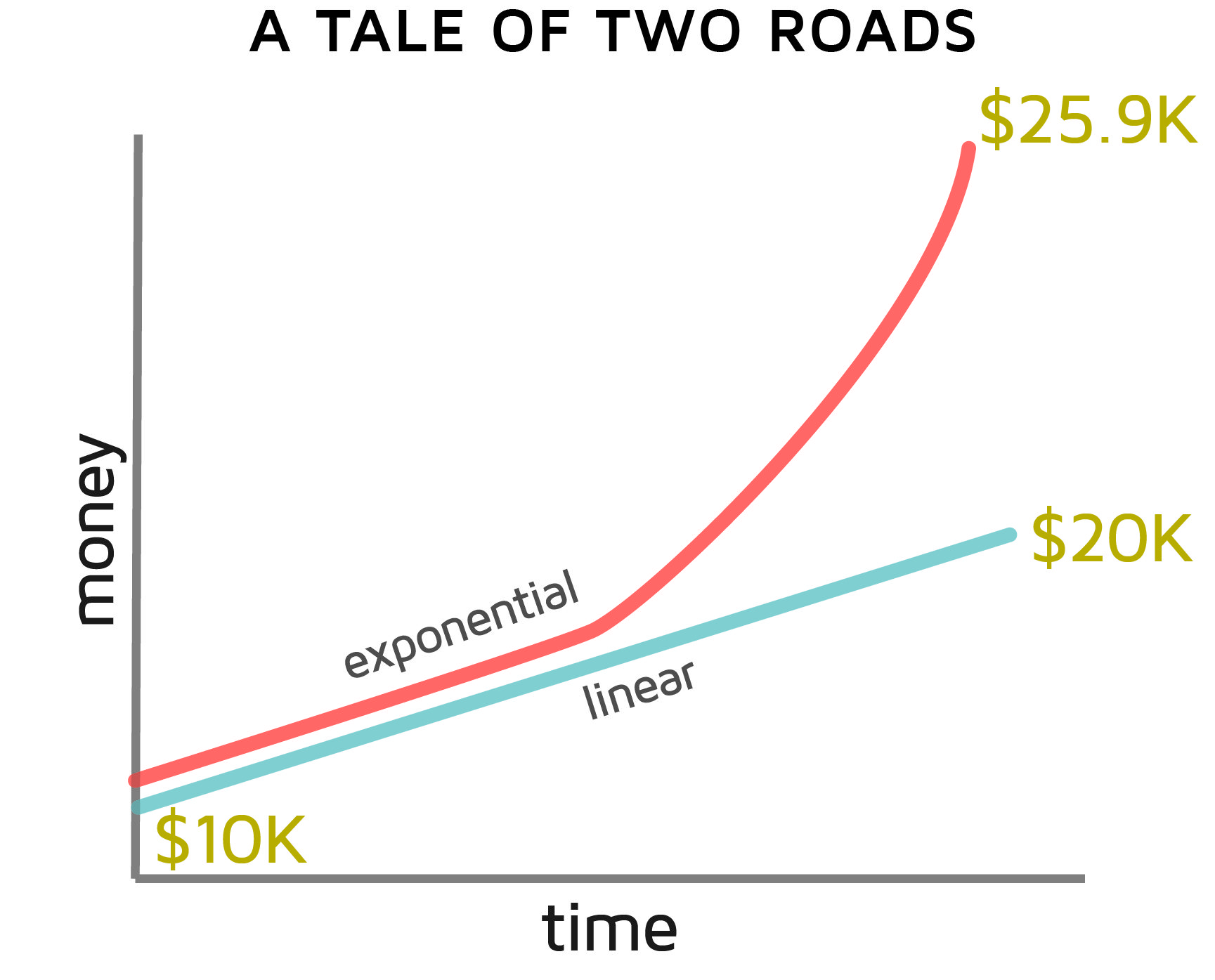

The effect of compounding is to accelerate the growth of an asset. It’s like sprinkling miracle grow on a plant. To illustrate, consider the evolution of the following pair of paths.

– The Linear Path

An investment that matures linearly plods steadily along, churning out gains at a constant rate. Suppose you placed $10,000 in an account designed to deliver a 10% return each year. Further, you are required to withdraw the gains come December 31st. If the investment operates as expected, you can bank on grabbing $1,000 of profit each year. Not bad! But the rate of profit won’t change. Since you were unable to re-invest the gains, the account will only grow by $1,000 each year. It’s steady and consistent, to be sure, but lacks the potential for explosive, hockey stick growth. Here is how your investment would behave over the next decade.

Year 1: $10,000 principle: $1,000 gain

Year 2: $10,000 principle: $1,000 gain

Year 3: $10,000 principle: $1,000 gain

Year 4: $10,000 principle: $1,000 gain

Year 5: $10,000 principle: $1,000 gain

Year 6: $10,000 principle: $1,000 gain

Year 7: $10,000 principle: $1,000 gain

Year 8: $10,000 principle: $1,000 gain

Year 9: $10,000 principle: $1,000 gain

Year 10: $10,000 principle: $1,000 gain

– The Exponential Path

Imagine instead that our $10,000 investment grew at a compounded rate of 10% annually. Rather than taking out the $1,000 profit after the first year, you re-invest it. And you continue to do so for each year after that, thus capturing not only a 10% return on the initial $10,000 principle but also from any previous profits. Here is how the first ten years stack up.

Year 1: $10,000 principle: $1,000 gain

Year 2: $11,000 principle: $1,100 gain

Year 3: $12,100 principle: $1210 gain

Year 4: $13,310 principle: $1,331 gain

Year 5: $14,641 principle: $1,464 gain

Year 6: $16,105.10 principle: $1,610.51 gain

Year 7: $17,715.61 principle: $1,772.56 gain

Year 8: $19,487.17 principle: $1,948.72 gain

Year 9: $21,435.89 principle: $2,143.59 gain

Year 10: $23,579.48 principle: $2,3587.95 gain

For the visually inclined, take a look at the accompanying “A Tale of Two Roads” graphic which shows the both growth paths.

Were we to extend the routes further into the future to years 20 or 30, the gap between them would widen tremendously with the exponential growth beating linear by a mile.

The interest or earnings from an investment can be compounded over different intervals including monthly, quarterly, semiannually or annually. Perhaps the greatest form of compounding is “continuous compounding” where interest earned immediately starts earning interest on itself. Now, let’s think about the three pre-requisites for making exponential growth work. First, and hopefully most obvious, you need to invest in an asset that generates interest (aka gains or profits). Your choices are myriad, and each possesses unique characteristics. Will you settle for the less volatile, but lower return world of savings accounts and CDs? Or will you move along the risk spectrum to more rewarding vehicles like bonds, stocks, or even options? Second, you have to re-invest the gains. This is the crux of the whole plan. You must avoid the temptation to pull out the profits generated or else your compounding ventures will end before they can begin. Third, you need time. The more time you allow compounding to work, the more significant the benefits will be. Just look at the exponential path in the graphic. Not how the parabolic stage of the ascent doesn’t begin until the later years. We’re talking ten, fifteen, twenty years and beyond.

This is why you hear any and all ministers preaching the good word of investing harping on the need to start early. The sooner you start, the sooner compounding becomes a reality in your life. If you begin at 20 years old, you can experience the twentieth year of compounding and its accompanying explosive upside on your fortieth birthday. Now, if you’re older than you’d like, if you wish you began earlier in life, then you’re in good company. There isn’t a person on the planet that doesn’t wish they started compounding from the womb. But that doesn’t matter. All that matters is you begin – now.

Back to the Future

We live in an instant gratification world. Thanks to the likes of Jeff Bezos (founder of Amazon.com) you can have anything and everything you want virtually overnight. Thanks to Jack Dorsey (founder of Twitter) you can obtain information instantaneously. Patience, it seems, is a virtue that fewer and fewer people need these days. Unless you’re an investor, that is; a seeker of that sweet compounding magic. In the world of investing patience is a prerequisite and foresight is fundamental. Without time, there is no compounding. Not many people can think one year into the future, let alone a century or two. But do you know who did? Benjamin Franklin. See if this story doesn’t instill some inspiration in those bones of yours. We nabbed this version from the book The Elements of Investing by Burton Malkiel and Charles Ellis.

“Benjamin Franklin provides us with an actual rather than a hypothetical case. When Franklin died in 1790, he left a gift of $5,000 to each of his two favorite cities, Boston and Philadelphia. He stipulated that the money was to be invested and could be paid out at two specific dates, the first 100 years and the second 200 years after the date of the gift. After 100 years, each city was allowed to withdraw $500,000 for public works projects. After 200 years, in 1991, they received the balance—which had compounded to approximately $20 million for each city. Franklin’s example teaches all of us, in a dramatic way, the power of compounding.”

What a legacy to leave behind! You too can capitalize on compounding. But if you can build a system that generates a modest return, then you don’t have to wait until your beard grows to your belly before witnessing the benefits. Let’s see just how long it takes to double your dough.

Rule of 72

We’ll start with the obvious. The higher the interest rate or growth of an investment, the more dramatic the compounding. The so-called rule of 72 provides the back-of-the-envelope math needed to calculate the time required to double an investment. All you have to do is divide 72 by the annual rate of return. For example, if you plop your money into a safe, but low-yielding asset like a Certificate of Deposit (CD) that pays 2% a year it would take approximately 36 years to double your money. Even for patient, forward-looking investors, that’s a long time. Alternatively, if you invested in the U.S. stock market and it proceeded to grow 10% a year, it would only take around 7.2 years to double your money.

To get a sense of the duration required to double investments of different returns, here’s a reference guide. We’ve included the types of investments that have historically generated some of the return thresholds:

Though returns vary and past performance is no guarantee of future results, we can get an idea of which asset classes have delivered different returns historically. Growing your money at 2% a year has been easy and only required investing in high-yield savings accounts or CDs over the years. To increase that growth to 5% you would have needed to venture into the bond market. To elevate it further has required investing in stocks.

Soaring into the double-digit annual returns is possible. But it requires an active approach built on education and well-tuned skills. The instruments and strategies used to garner such mouth-watering gains are as vast and varied as the traders who employ them. Some use options strategies like covered calls and condors. Others use futures contracts and Forex. One of many themes that ties these successful traders together is they’ve discovered how to make the markets work for them. And they’re experiencing higher compounding growth as a result.

Dividends Reinvested

A discussion on compounding wouldn’t be complete without investigating the impact of dividends. In the world of savings, investors focus on the power of compounding interest. On Wall Street, the emphasis turns to that of compounding dividends. Think of it this way – interest is to a savings account as dividends are to a stock. That is, they both provide earnings – an ongoing reward for your decision to park your cash in either investment.

The reason we go into business is to make money. If you have the opportunity to buy into a business, to become a shareholder, you typically only take the plunge if you expect the company to succeed. And, of course, as a part owner you plan to relish in the spoils. The most common method for public companies to dole out a portion of their profits to owners is through dividends. Consider it a kickback, a thank you of sorts, for being a shareholder.

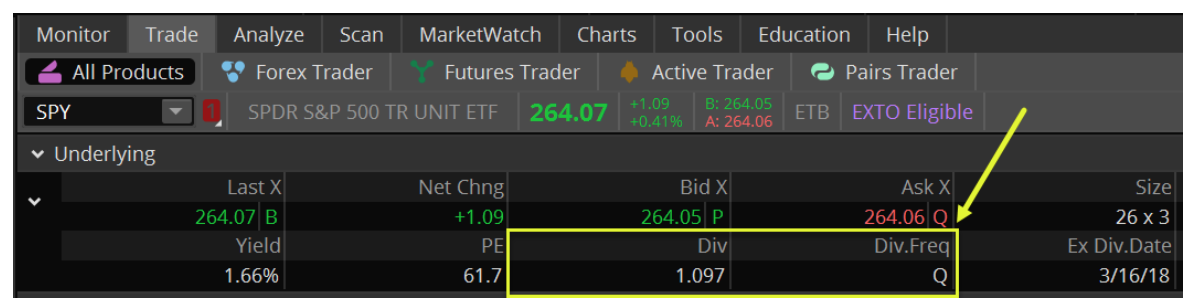

Your broker should display each company’s dividend information in their platform. Here is a screenshot of where the details are shown in ThinkorSwim.

As you can see, we are using the popular S&P 500 ETF (SPY) to illustrate. SPY currently pays a dividend of $1.097 for every share you own. If you held 100 shares of SPY, then, you would receive $109.70 every quarter, or $438.80 per year.

Seasoned investors like to talk about the dividend yield. Right now the yield for SPY is 1.66%. That number is calculated by taking the annual dividend ($4.39) divided by the share price ($264.07). Even if SPY meanders sideways over the year offering no reward by way of price appreciation you’d still receive a 1.66% return on investment in the form of dividends.

As fans of compounding, we highly recommend you reinvest those dividends. Instead of withdrawing the $438.80 each year, use it to buy additional shares. That way the next time a dividend is paid out you’ll receive even more! It may not seem like much at first, but in the long run, it will make a world of difference. Here’s an eye-popping stat we came across while reading The Intelligent Investor:

“According to Professors Elroy Dimson, Paul Marsh, and Mike Staunton of London Business School, if you had invested $1 in U.S. stocks in 1900 and spent all your dividends, your stock portfolio would have grown to $198 by 2000. But if you had reinvested all your dividends, your stock portfolio would have been worth $16,797! Far from being an afterthought, dividends are the greatest force in stock investing.”

The difference between $198 and $16,797 is astronomical and shows how compounding gains packs some serious firepower.

DRIP, DRIP, DRIP

Companies offer the ability to automate dividend reinvestments with the flip of a switch. All you have to do is enroll through your broker. Once that’s done (and it takes seconds) it won’t involve any further time or attention and will happen quietly in the background to ensure you’re compounding dividends over time. It’s known as a Dividend Re-Investment Program or DRIP. Essentially, instead of cutting you a check the company will dole out your piece of the pie in the form of additional shares. Like our compounding interest example above, this creates a virtuous cycle. As your share count increases the number of dividends you receive balloons. And as the dividends grow you will be able to buy even more shares with each reinvestment.

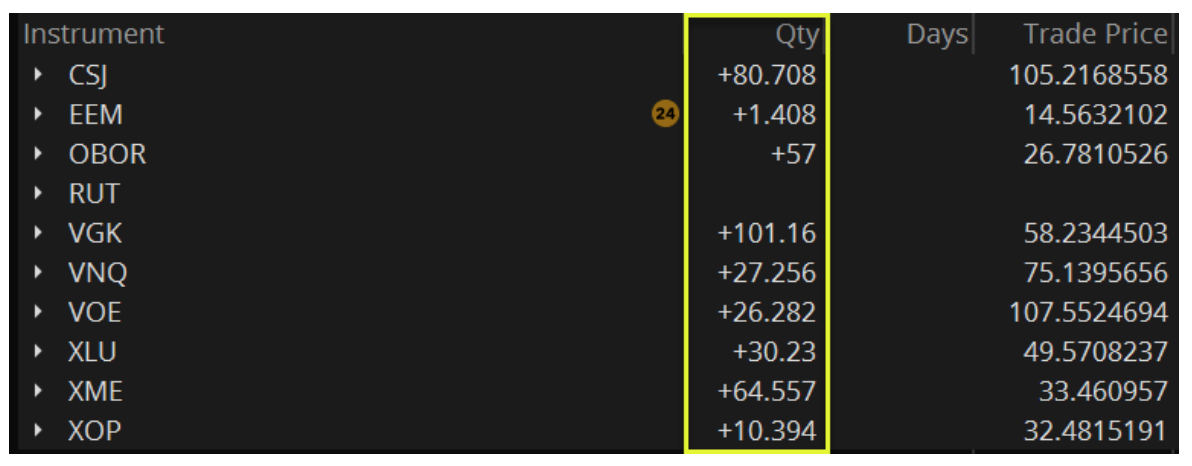

Two of the less obvious benefits of using DRIPs is the avoidance of commission and the embracing of dollar cost averaging. Even though you are purchasing more shares with each dividend payment, you aren’t charged a commission for these acquisitions. That enables 100% of the dividend to go towards acquiring stock. Normally, a fraction of what you’re investing is eaten up by transaction costs. And speaking of fractions, enrollment in a DRIP is the one instance where you can buy fractional shares. Let’s use SPY to illustrate. If we owned 100 shares of the $264.07 stock, we would receive a quarterly dividend of $109.70. That translates into roughly 0.42 shares that would be added to our account. Here is an example of a portfolio with fractional shares as shown in the quantity (QTY) column.

When you acquire shares of a stock over time, you inevitably end up paying different prices. That results in something known as dollar cost averaging. In months where the stock price is depressed your investment will buy more shares than in months where the stock is flying high. Think of this with dividend reinvestments. If SPY is perched at a lofty $264, your $109.70 quarterly dividend only buys 0.42 additional shares. But, if we experienced a bear market and SPY fell to $132, then your dividend re-investment would buy 0.83 shares!

Compounding to the MAX

Let’s recap the key points thus far.

First, compounding accelerates the growth of an asset creating exponential growth.

Second, compounding requires the re-investment of gains.

Third, for traditional investors, those gains can come in the form of interest or dividends.

For our final act, let’s spotlight how active traders can use a simple covered call strategy to supercharge their returns. Without getting too bogged down in the details, here is the basic structure of a covered call. It involves owning 100 shares of stock and selling one call option. By selling the call, you obligate yourself to sell the stock at a set price, and you get paid a premium. Think of it as being paid for a promise. It’s a promise, by the way, that you can get paid to make every single month. And that means it provides the potential for monthly cash flow and the compounding of greater gains.

Suppose we own 1,000 shares of the Emerging Markets ETF (EEM). At $46.30, the total investment value would be $46,300. The annual dividend is $1.393 and translates into a 3.01% yield. On 1,000 shares we could re-invest $1,393 to acquire another 30 shares every year. Naturally, that number would grow over time as the share count rose.

Now, here’s where the covered calls come in. Since we own 1,000 shares of stock, we can sell ten call options each month. And, each time we acquire another 100 shares through the reinvestment of dividends and compounding of gains, we can sell another contract. So, eventually we’ll be selling 11 calls, then 12, then 13, etc.

For selling these calls, we will receive a premium that, in most cases, we will be able to keep. Suppose we could capture another $300 per month (or $30 per contract) for the selling of the ten calls. That translates into another $3,600 in annual gains. Tack on the dividends and we’re looking at around $4,993 for the year. The re-investment of those gains allows the purchase of another 100 shares of stock. That, in turn, creates another $138 in dividends for the next year and another $30 per month ($330 vs. $300) from the selling of an extra call option. Rinse, wash, repeat!

The covered call is simply one of many ways active traders try to ramp their returns well into the double digits to see explosive things happen with compounding. Consider this month’s newsletter your call to action! Don’t wait any longer to bring the magic of this revolutionary concept home.