Introduction

Welcome to a basic yet hopefully comprehensive guide to Bitcoin proxies. I have a true interest in Bitcoin proxies and have done numerous trades on proxies in the last year and is an area I focus a lot of time on in my Cash Flow Viking trading lab (For more information click here). It is a world I truly love, enjoy, and hopefully will continue to profit from. But before we get into the nitty gritty of the article let’s discuss what we mean when we use the term proxy.

While there are many definitions for the word proxy when I use it, I am referring to it as “a substitute or a stand-in for something else.” The “something else” in this case is Bitcoin. From new Bitcoin ETFs, Bitcoin Miners, Crypto Exchanges to individual companies like MicroStrategy there are many “proxy” ticker symbols to get involved with in regard to the ever-growing Bitcoin universe versus investing in Bitcoin directly.

There are many that argue that one should simply invest in Bitcoin directly versus getting involved with the expanding world of Bitcoin proxies. While I find these arguments valid and compelling, I will never ignore the Bitcoin proxy universe for two reasons:

- First, I believe different proxy areas, like any trading product, can provide good opportunities at certain points when technical, fundamental, or thematic factors are in play.

- Second, I am a cash flow trader first and foremost, and last time I checked I couldn’t sell options on Bitcoin. However, I can sell options on most of the Bitcoin proxies which opens my cash flow playbook.

Whatever side of the isle you fall on here is a not-so-brief beginners guide to the world of Bitcoin proxies. Hopefully you find a few nuggets of knowledge below.

Bitcoin ETFs

Just writing those words bring me excitement. For years individuals speculated whether the SEC would ever approve a Bitcoin ETF. Bitcoin bears would often point to the fact that the United States would more likely BAN Bitcoin than have the regulatory support to approve an ETF focused on Bitcoin. Well, after years of various sponsors attempting to get approval the Securities and Exchange Commission (SEC) finally greenlighted Bitcoin futures ETFs and the first ones have started trading in recent weeks.

While in the future, ETFs may be launched that hold crypto itself, the approval the SEC has given is that the first products will track Bitcoin futures rather than the price of Bitcoin itself. SEC Chair Gary Gensler has been quoted as saying he does not see much long-term viability for cryptocurrencies and has emphasized the importance of protecting investors through regulatory oversight. One can assume that he believes a “futures-based” product satisfies the need for strong investor protections over other alternatives. Of course, one could argue you can as easily make and lose money in a futures-based product as other alternatives, but we will save that debate for another day.

I could not be more excited to have another trading tool(s) at my disposal in making my trading and investing decisions. Let’s take a quick look at the first ETF that was launched two weeks ago.

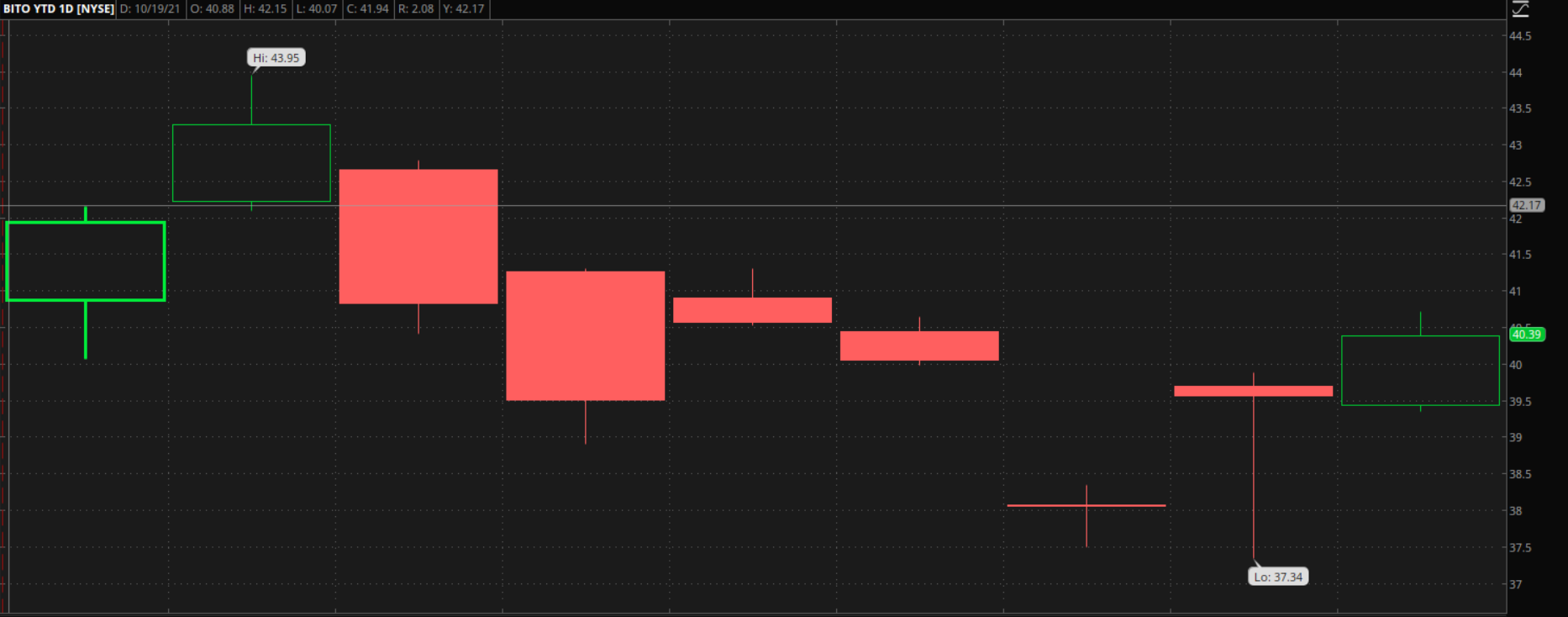

ProShares Bitcoin Strategy ETF (BITO)

While not much of a chart as it has only been trading for a few days, ProShares Bitcoin Strategy ETF (BITO) will always leave a mark in history as the first ETF the SEC gave its tacit approval of with regards to Bitcoin. In just a few days trading it already has a robust options chain with weekly options and a variety of strike prices with the liquidity decent for a trading product a few days old.

So, what are you trading when you trade BITO? Here are a few facts from ProShares website (in bold) to give you some context:

- The fund does not invest directly in Bitcoin – this means that the Exchange Traded Fund does not own any Bitcoin itself.

- The fund seeks to provide capital appreciation primarily through managed exposure to Bitcoin futures contracts – Individuals familiar with trading vehicles like USO and UNG will be familiar with this route. The ETF will own a variety of Bitcoin Futures Contracts instead to attempt to simulate the move of its fund with the Bitcoin Futures market itself. For example, as of October 22nd, 2021 the ETF held 2,133 November Bitcoin futures contracts and 1,679 October Bitcoin futures contracts. It appears that the ETF will deploy a standard approach of using front and next month future contracts. This should provide a decent “simulated” price movement for Bitcoin Futures and track the futures market up and down as long as it employees a balanced front and next month approach

- The price and performance of Bitcoin futures should be expected to differ from the current “spot” price of Bitcoin – In tracking Bitcoin versus the spot price of Bitcoin over the last year I have seen some minor deviances on any given day here but if you look at the chart over the last year you are going to see the same general pattern and the same trend and have to work hard to spot any minor temporary differences. One should be aware that there can be short-term minor deviances between the spot price and the futures market.

I am very excited for this new product and the coming ETFs that will also be launched. BITO has front running status, but I imagine eventually I will gravitate (as will most other traders) towards the one that is the most liquid as the general composition of each of this first batch of ETFs (futures based) will be relatively the same. Just because I have a new tool doesn’t mean I will go out and start pounding away at it. I will use it like any other trading instrument. Look for opportunities that align with my trading plan and investment objectives and pull out the tool when I think it is appropriate.

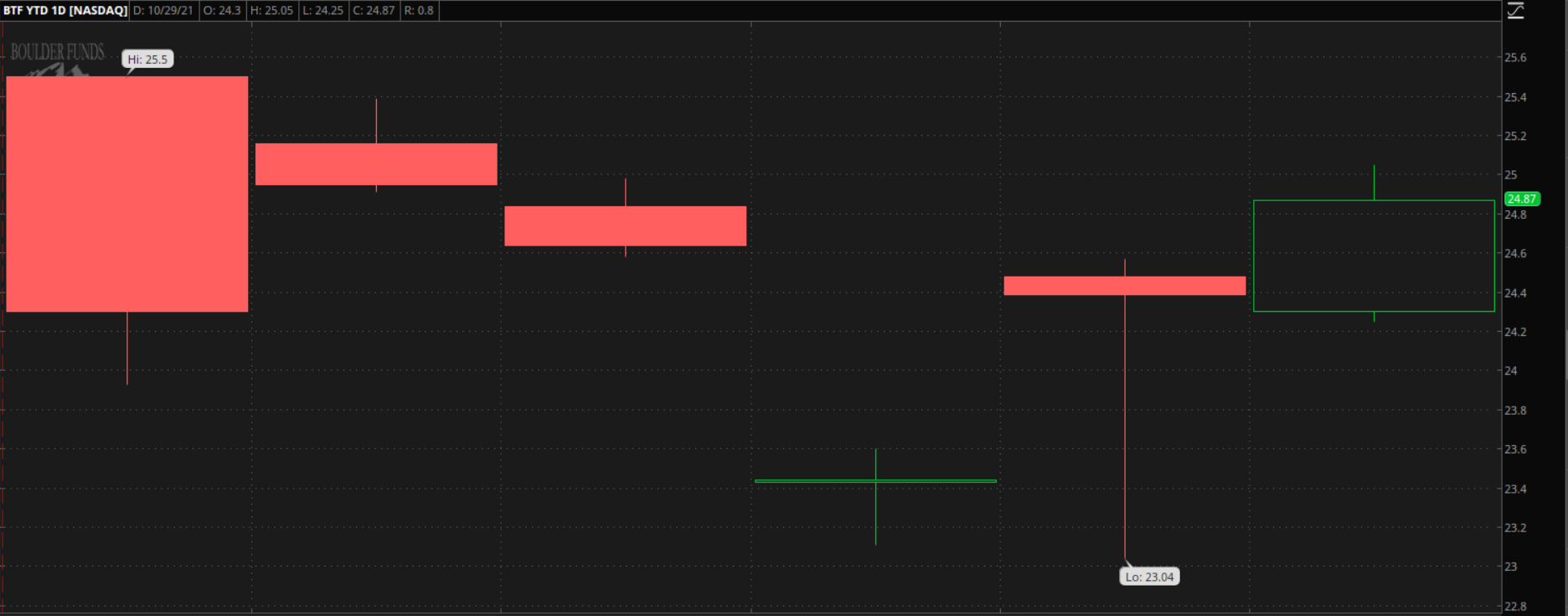

Other BITCOIN ETFs

While there is expected to be ETFs that are designed to track the spot price of Bitcoin in the future the first “wave” of ETFs approved by the SEC are expected to be futures-based products similar to BITO. Valkyrie Bitcoin Strategy ETF (BTF) is already trading and VanEck Bitcoin Strategy ETF (XBTF) is expected any day now. These certainly will not be the last.

Bitcoin Miners

One of the most popular proxy areas to trade over the last year have been the Bitcoin miners. One year ago, few traders even knew that there WERE publicly traded companies that engaged in Bitcoin mining but that has certainly changed over the last year as many of the Bitcoin miners such has MARA, RIOT and HUT are some of the most popular companies followed on retail message boards. It is easy to understand why they remain popular as other proxy trades develop. A recent monthly Bitcoin production report highlighted that Bitcoin mining production levels of publicly traded companies increased in this last quarter 82% over the previous quarter, which represents a sizeable growth rate. With crypto miners there are a few concepts, terms, and themes that a trader wanting to take their first dive into the world of Bitcoin should be aware of.

Terms to Become Familiar With

Mining

First the term mining with regards to Bitcoin is a metaphor.The mining of gold requires the proverbial pick and axe and physical effort to bring new gold into the system. Bitcoin mining on the other hand, involves the method by which crypto transactions are processed and by which new Bitcoins are put into circulation. The only method to put Bitcoin into circulation is through mining. The Bitcoin mining version of the “pick and axe” is sophisticated computer software designed to solve complex mathematical problems. The first computer to find the solution to a given problem is awarded the next block of Bitcoins, new Bitcoin is put into the system and at that point the mathematical process starts over.

Bitcoin Blocks

Suppose you are keeping a record book. That book would contain pages where you would record details of transactions correct? In the Bitcoin universe each of these pages is referred to as a block where a record of all transactions is taken place are recorded. All miners are attempting to be the first to record the entry into this long record book (block) and essentially are competing in a type of race to complete the current block. When one of the miners complete the page(block) using complex mathematical equations the next page is turned and they start working on the next block in the blockchain. The reward for being the first miner to solve the equation are Bitcoin and is the process for putting the currency into circulation.

Bitcoin Halving

At its origins the reward for solving a block was 50 Bitcoins. However every four years there is a process referred to as halving that takes place that cuts in half the number of coins that miners receive for solving a block. At the start it was 50, then 25 in 2012, 12.5 in 2016 and 6.25 in 2020 which is where we currently stand. It will occur every 210,000 blocks until the last bitcoin is mined in 2140.

Mining Difficulty

This concept refers to how difficult or relatively easy it is to solve the equation for each block.The more miners and corresponding hashpower there are in the network the more difficult it is and the fewer miners there are the easier it becomes to solve the equation for each block. The Bitcoin network aims to have one block produced every ten minutes however the more participants on the network the more likely they are to solve the block and thus,adjusting the difficulty of the equation every time 2,016 blocks are solved to balance it out at one block every ten minutes. Naturally the higher in price Bitcoin goes the more participants join the network and are all competing against each other for the limited block rewards. With more participants and the corresponding computer power the hashpower of the entire network increases accordingly and the inevitable increase in difficulty for mining any specific block.

Hashrate (Hash Power)

This is a fascinating and important fundamental concept when it comes to bitcoin mining. For beginners the important concept here is the faster the hash rate of a bitcoin miner’s network the higher the chance of solving the block and hence chance to receive bitcoin and its corresponding profits. Hash rate is measured in terms of giga hashes per second (GH/s) and tera hashes per second (TH/s). Needless to say, in order to be competitive and maintain a high Hashrate a substantial amount must be invested in computer equipment as every crypto currency mining device is going to have its own hash rate. Because of the randomness it can take millions of hashes (guesses/rolling of the dice) before the block is solved.

Pooling – Miners will sometimes join in Bitcoin mining pools and solve the blocks together and then split the rewards in proportion to the amount of computing power in the mining pool. There is a level of randomness in solving any block and pooling allows miners to reduce the randomness somewhat.

Examples of Bitcoin Miner Proxies

There are numerous Bitcoin mining companies to choose from and I wanted to highlight four North American based mining companies that also have liquid option chains and heighted interest in the Bitcoin mining trading community. While not mentioned here Argo Blockchain (ARBKF), HIVE Blockchain technologies (HIVE), Bit Digital (BTBT), Sphere 3D (ANY), The9 Limited (NCTY), Cipher Mining (CIFR) and SOS Limited (SOS) are companies that I follow.

Marathon Digital Holdings (MARA)

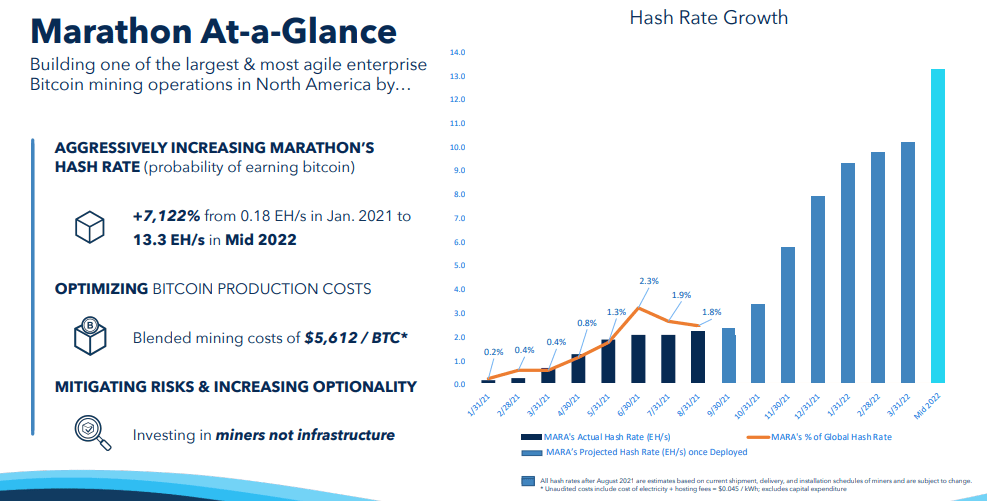

MARA’s self-proclaimed goal is to build the largest mining operation in North America at one of the lowest energy costs. Whether they are successful, remains to be seen but in my opinion, they helped mold the blueprint and transformation of how mining companies are approaching the current Bitcoin environment. Long-term fixed energy costs, rapid and aggressive deployment and purchasing of the latest state-of-the-art mining equipment (the company expects to have a total of 103,120 miners by Q1 2022) and being an originator of the “hodler” approach to Bitcoin miners not selling their Bitcoin but holding the coins instead has created a blueprint for how mining companies are currently operating. While many companies have adopted the “hodl” approach to the coins they mine MARA also at the start of the year purchased 4,812 coins and at the time MARA’s CEO said of the purchase “We also believe that holding part of our Treasury reserves in Bitcoin will be a better long-term strategy than holding US Dollars, similar to other forward-thinking companies like MicroStrategy,” said Merrick Okamoto, Marathon’s chairman & CEO. An all-in move if there ever was one. As of September 30th, its total Bitcoin balance held in reserve stood at 7,035.

Recent Production Totals

- Bitcoin Mined in Q1 2021 – 196

- Bitcoin Mined in Q2 2021 – 654

- Bitcoin Mined in July – 442

- Bitcoin Mined in August – 470

- Bitcoin Mined in September – 340

RIOT Blockchain Inc. (RIOT)

RIOT is perhaps one of the best known publicly traded companies in the world. When crypto took off in late 2020 RIOT was one of the hottest Bitcoin proxy stocks amongst retail traders in the months that followed. Its publicly stated focus in on Bitcoin through its mining operations and blockchain technology. In the ever-competitive Bitcoin hashrate arms race RIOT recently announced the development of The Whinstone facility which they claim to be the single largest Bitcoin mining and hosting facility in North America. The company plans to increase its crypto mining hashrate potentially by up to 50% through adopting 200 megawatts (MW) of immersion-cooling technology at the facility. “Based on industry data and the company’s own preliminary immersion-cooling test results, an estimated 25% increase in hash rate is expected, with an estimated potential to increase ASIC performance by as much as 50%,” RIOT said in the press release. Whether they are successful in increasing their hash rate through this innovative technology remains to be seen, but it highlights how companies are continuously attempting to get ahead of the hash rate game and traders should closely monitor which ones are successful or not. As with other mining companies RIOT employsa “hodl” strategy. As of September 30th, its total Bitcoin balance held in reserve stood at 3,534.

Recent Production Totals

- Bitcoin Mined in Q1 2021 – 491

- Bitcoin Mined in Q2 2021 – 675

- Bitcoin Mined in July – 444

- Bitcoin Mined in August – 441

- Bitcoin Mined in September – 406

Bitfarms LTD. (BITF)

Based in Canada and founded in 2017, Bitfarms is a self-proclaimed Bitcoin mining company. The company started trading on the Toronto Stock Exchange in July 2019 and on June 21, 2021 started trading on NASDAQ stock market. The company has five industrial scale facilities located in Quebec and proudly states that these facilities are 99% powered with environmentally friendly hydro power and secured with long-term power contracts. As of September 30th, its total bitcoin balance held in reserve stood at 2,312.

Recent Production Totals

- Bitcoin Mined in Q1 2021 – 598

- Bitcoin Mined in Q2 2021 –759

- Bitcoin Mined in July – 391

- Bitcoin Mined in August – 354

- Bitcoin Mined in September –305

HUT 8 Mining Corp (HUT)

Based in Canada the company mines both Bitcoin and relatively recently started mining Ethereum. The company was the first publicly traded miner on the Toronto Stock Exchange and the first Canadian miner to be listed on The Nasdaq Global Select Market. The company publicly states that it emphasizes its “hodl” strategy (yes it uses that word) and is taking steps to generate revenue to fund operating expenses to avoid selling Bitcoin. As of September 30th, its total bitcoin balance held in reserve stood at 4724.

Recent Production Totals

- Bitcoin Mined in Q1 2021 – 539

- Bitcoin Mined in Q2 2021 – 553

- Bitcoin Mined in July – 300

- Bitcoin Mined in August – 326

- Bitcoin Mined in September – 264

Fundamental Factors to Consider with Miners

The company’s hashrate compared to that of the larger network

It’s all about that hash. Successfully solving a block has been likened to finding a needle in a haystack. However, the higher a miner’s hashrate they higher the probability of finding that needle. A higher hashrate increases the chances of earning a token. It also means in pooling agreements they get a larger percentage of the reward. With technology ever expanding identifying companies that are investing in state-of-the-art technology can help you identify increases in hashrates before they occur. Companies will often publish their current hashrates and projected hashrates for investors to consider.

Costs

In evaluating miner fundamentals we always have a good idea on what the revenue has been for a company as we have known the price of Bitcoin. What we don’t know are the costs associated with mining which come down to four factors:

- Purchase Costs for the Rigs

- Electricity Costs

- Rent and depreciation of properties that hold the rigs and administrative offices

- Executive compensation and payroll costs associated with keeping the rigs running.

Average Cost of Bitcoin Production

Through energy and other costs miners will produce an average cost per Bitcoin production. Naturally the lower the number the better as lower numbers will give insight in the bottom-line profits that Bitcoin miners are able to produce.

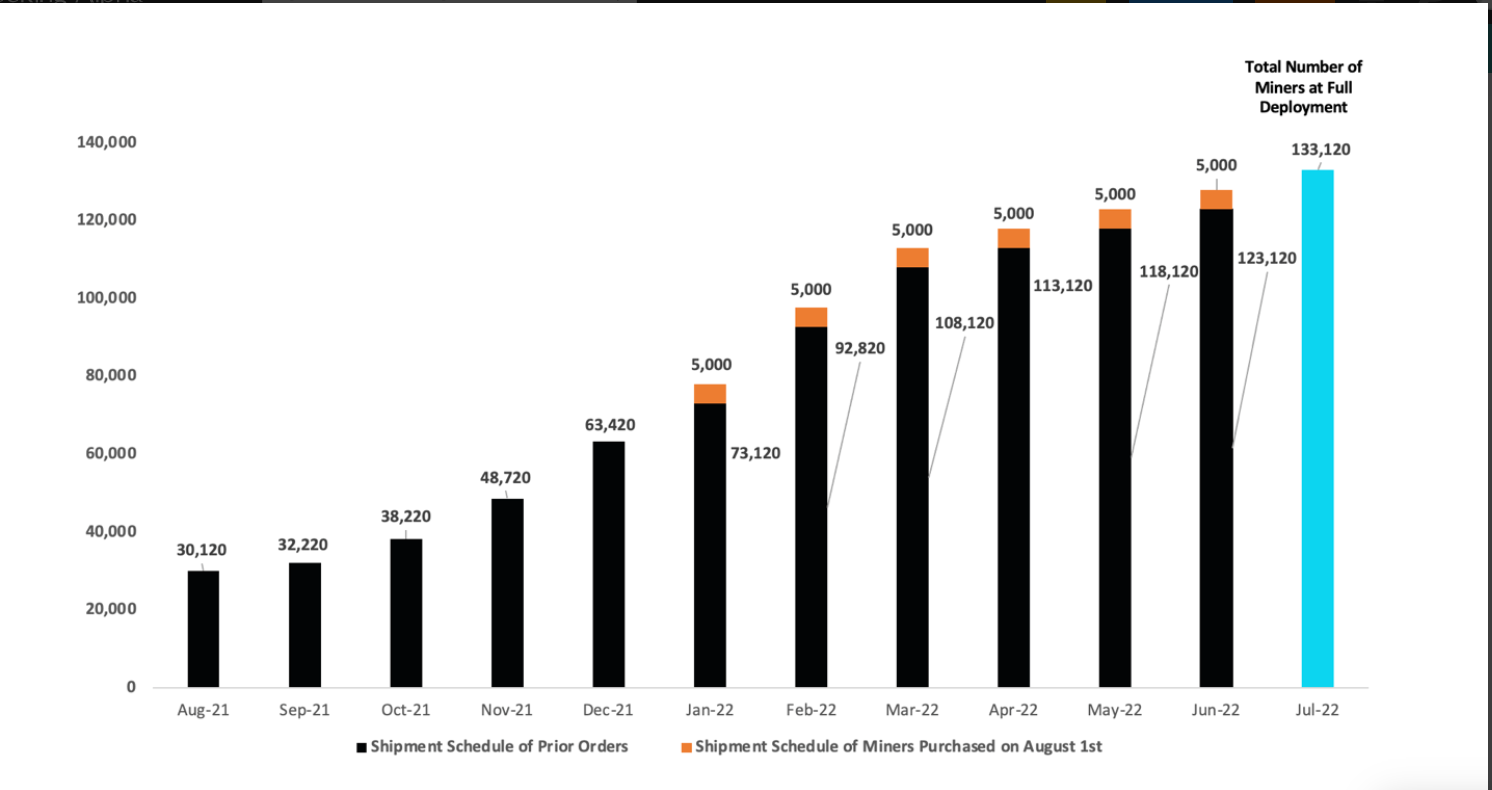

Increases in Mining Fleet

Because of production limits in conjunction with the meteoric rise in Bitcoin itself you can’t exactly go order as many new state-of-the-art miners off the shelf at Walmart as you want right now. Bitcoin miners will give you information on what they have ordered, when they will arrive and how many miners they expect to be deployed at certain dates. Such information can give you an idea of the rate of growth versus current Bitcoin production. The chart below is for MARA and their expected Bitcoin mining deployment in the coming months.

There is a risk associated with large upgrades to mining equipment in a short amount of time due to sudden technological advances, which would require significant investments to modernize a fleet.

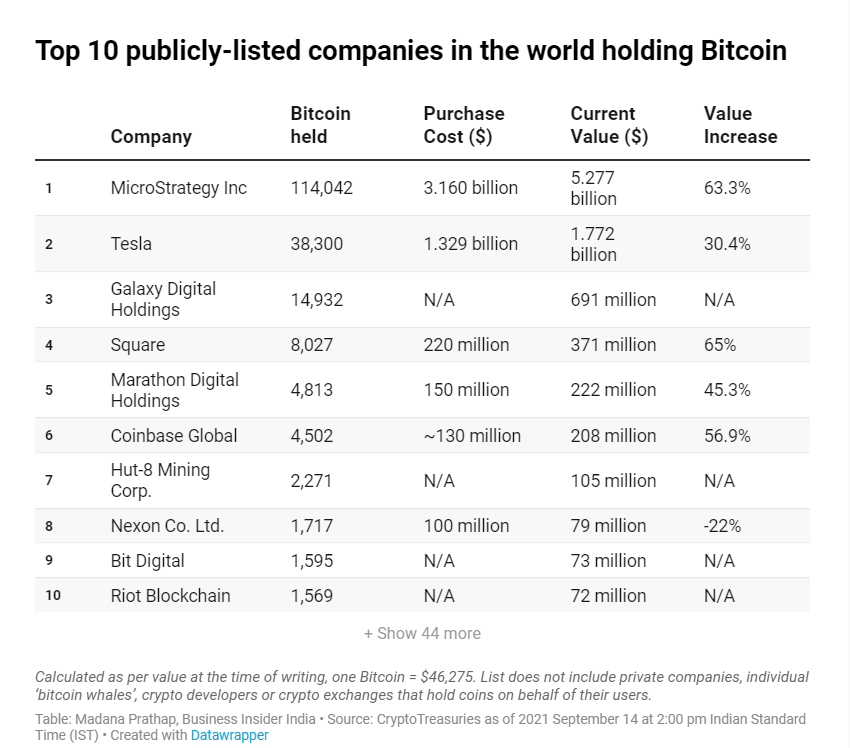

Bitcoin Holdings

Many of the Bitcoin miners have deployed a strategy where they are becoming holders of Bitcoin itself and in the process creating a Bitcoin investing fund. This strategy has the impact of producing huge swings in the “value” of a company depending on what the price of Bitcoin does. If Bitcoin “goes to the moon” then not only does the company earn more for each token they produce but the value of the Bitcoin on their balance sheets also goes up in worth. Naturally this is true for declines in price as well. Miners are starting to get represented amongst the largest companies holding Bitcoin as one can see from the table below with miners such as MARA, RIOT, Bit Digital and Hut 8 making the list.

Production Increases

while hashrate and a degree of luck will influence the amount of Bitcoin produced in any given month one can track the Bitcoin production any miner has on a given month to track progress month over month and quarter over quarter.

Themes Impacting Miners

While most of the themes surround Bitcoin itself (institutional adoption, regulation, etc.) are the most powerful themes that impact Bitcoin miners (as they influence the price of Bitcoin itself. As we have seen recently there can be themes that are generated specific to the miners. When China cracked down on Bitcoin mining within its country this was estimated to remove approximately 50% of the Bitcoin network’s total hashrate. A lower hashrate as mentioned above increases the odds for existing miners to earn tokens. This provides a potential boost to existing mining operations and can create short-term sentiment and an increase in the short-term fundamental outlook on this news. While themes involving the miners are going to dwarf in comparison to themes surrounding Bitcoin itself, they are worth keeping an eye out in case of a pop up.

While themes can be powerful, when they are backed up by numbers it can take a theme into reality. The most recent Bitcoin monthly production report showed that mining production levels in the second quarter for Bitcoin increased 82% quarter/over/quarter. While the increase in mining machines played a part the decrease of network hashrate undoubtedly helped this increase in production.

Summarizing Bearish Case Against Bitcoin Miners versus Investments in Bitcoin Itself

While current stellar margins and increased production capacity have a lot of people interested in public Bitcoin mining companies there is the other side of the argument. Because of high profit margins there are no shortage of companies attempting to get involved in the Bitcoin game. Companies that produce mining rigs are on long backorders. One can expect more and more miners to compete in the area, which will increase the hashrate and along with it the level of mining difficulty. Additionally, in future halving events the revenue at the time of the halving will effectively decrease by 50% for miners. This will occur every four years which brings into question the longevity of mining profitability if Bitcoin doesn’t enjoy strong constant price movement. Lastly, Bitcoin in its surge is attracting more eyes to the mining operations. Miners do not have any unique technology nor is there anything particularly special to the approach successful miners are employing. In the words of Warren Buffett “No Moat.” Anyone can copy and likely many will and find more innovative ways to produce Bitcoin with bigger margins at some point in the future. While there are many other arguments, I find these worth noting and contemplating before investments in Bitcoin mining companies.

Other Proxies

While I could add numerous companies to this section as I am running out of space (it’s a big crypto world out there!) let me focus on three.

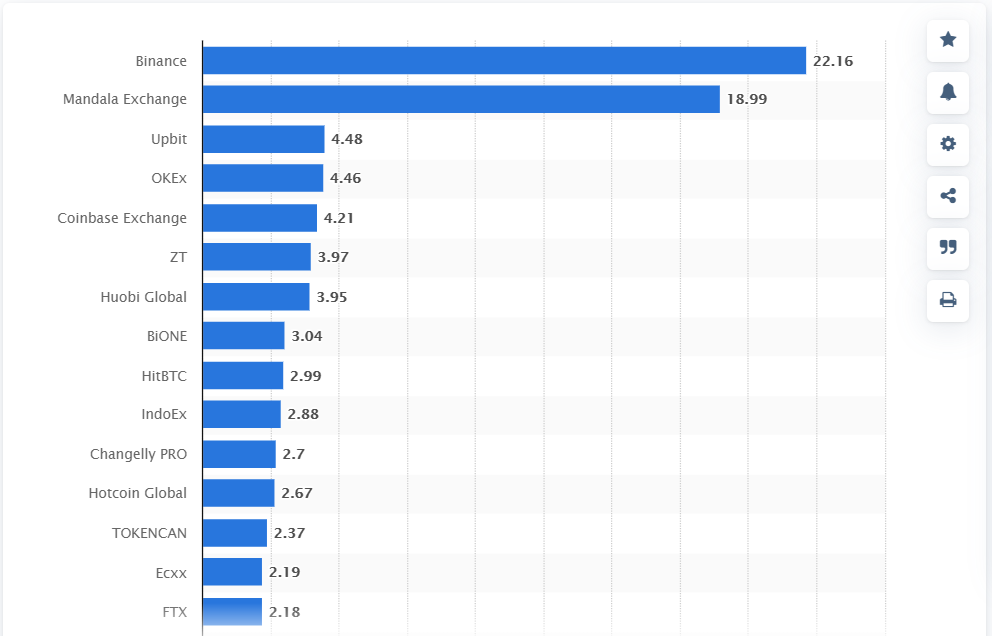

Coinbase Global Inc. (COIN)

To be fair I could probably write an entire newsletter on the potential of Coinbase and crypto currency platforms in general and it feels very out of place to list them under the “other proxies” label. Coinbase operates a cryptocurrency exchange platform and over 80% of its revenue is derived from retail user transactions where traders and investors buy and sell cryptocurrencies. Coinbase does the most volume in the United States currently and is the fifth largest crypto currency exchange by volume in the world.

The area of Crypto exchanges is a growing and highly competitive area with traditional brokers like Interactive Brokers along with companies like PayPal entering the arena where lower fees might put a dent in revenue and profits of exchanges like Coinbase. While it has started to purchase Bitcoin and hold it, COIN’s profits are not tied to rising crypto prices but rather the profits from transaction fees. There is also the potential for crypto asset marketplaces to find themselves in the SEC’s regulatory spotlight. Like I said…you could write a whole article on the subject but no proxy list would be complete without adding Coinbase to it.

Grayscale Bitcoin Trust (GBTC)

Grayscale Bitcoin Trust will forever have a place in the history of Bitcoin proxies. When Bitcoin first took off in the fall of 2020 traders scrambled to find ways to trade it and GBTC became the largest and most popular crypto option during the time. If you were watching CNBC late last year or early this year you probably saw their commercial run seemingly every five minutes. GBTC is a closed-end fund (CEF) with nearly $40 billion in assets under management at the time of the writing and as a CEF has a fixed number of shares and cannot issue new shares like an ETF. Grayscale has officially filed with the SEC to change from a SEF to an ETF so we will likelysee option chains on GBTC (which previously have not been available) when/if that is approved sometime in the future.

MicroStrategy (MSTR)

No article on Bitcoin proxies would be complete without a mention of MicroStrategy. While the company offers enterprise analytic software and services and is estimated to have over $500 million in sales in 2021 it is best known for being the publicly traded company with the largest holding of Bitcoin in the world. As of this writing they hold 114,042 Bitcoins and the CEO Michael Saylor has stated “Our point of view is being a leveraged, Bitcoin-long company” and that the company never intends to sell its Bitcoin holdings. Michael Saylor has also had some of the boldest price predictions long-term for Bitcoin predicting that Bitcoin’s market value would be $100 trillion one day (the market value for Bitcoin currently stands over one trillion) and that along that march to $100 trillion the volatility surrounding Bitcoin would fall and that “it’s going to be a stabilizing influence in the entire financial system of the 21st century.”

Conclusion

If Michael Saylor’s price prediction is even in the stratosphere of being correct you probably can’t go wrong with any of the Bitcoin proxies. However, as the saying goes “there’s many a slip ‘twist the cup and the lip” and there is no guarantee an asset goes up in price so creating your own outlook, conducting your own research and coming up with your own personalized investing plan is not only strongly recommended but is essential. While I am certainly in the “Bitcoin enthusiast” camp and lean more to the Michael Saylor side than the Charlie Munger side of the equation this article was not intended to be a recommendation for any particular security.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.

Guarino

Guarino

November 2, 2021 at 12:01 AMNeeded this, needed this so much. Learned tons