As usual, the financial media has done a tremendous job of highlighting all the problems that higher interest rates have caused. Fear is their business, and they are incredibly effective at it. Every day they regale their audience with tales of trouble.

– Mortgage rates are through the roof, and real estate is headed for an ice-cold winter!

– A 60/40 portfolio just suffered its worst year in a century!

– An out-of-control Fed is driving us into a deep recession!

– The booming U.S. dollar is destroying international markets!

Fearmongering Sampling

Rather than adding to the daily drumbeat of doom, we’re taking the more constructive road and focusing on the three benefits of higher interest rates.

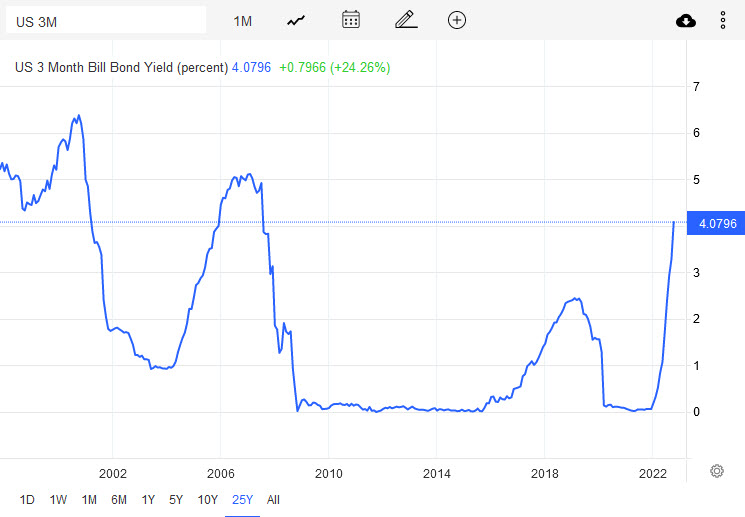

1) High interest rates allow you to get a better return on risk-free assets like Treasury Bills. Currently, 3-month Treasury bills yield over 4%, their highest return in 15 years.

2) High interest rates have made bonds much more attractive for those looking to diversify outside the stock market.

3) High interest rates have created a fire sale in the stock market. Discounts of this magnitude only arise once every five years, on average.

We’ll dive into each in greater detail below.

This isn’t the first time we’ve explored interest rates. The April 2021 newsletter was titled “A Beginner’s Guide to Interest Rates” and is a beautiful companion piece to this month’s message. Indeed, we’d consider it a primer, so if you haven’t had the immense pleasure of reading it, do so now. Here are the key points:

1) Interest rates reflect the cost of money.

2) Rates rise and fall based on inflation expectations.

3) The Fed Funds Rate is the cost of money for overnight loans for a bank and drives all other interest rates in the economy.

4) The Federal Reserve controls the Fed Funds rate and meets once every six weeks to decide its fate.

5) Bond yields reflect what the Fed Funds rate will do in the future.

6) Borrowers love low interest rates.

7) Savers love high interest rates.

What’s Going On?

Following the 2008 financial crisis, the Federal Reserve adopted easy money policies to help the economy recover. Among other things, they lowered interest rates to zero. But unlike previous attempts to jump-start America’s engine, where they lifted rates back up when economic activity returned to normal, the Fed kept its foot on the gas this time. Borrowing rates for banks remained at zero for seven years until 2015. From late 2015 to 2019, they slowly lifted rates from zero to 2.5% but quickly reversed course when the stock market through a tantrum. The pandemic gave further reason for supporting the economy, and borrowing rates ultimately returned to zero.

Low inflation allowed the Fed to maintain Zero Interest Rate Policy (ZIRP) for such a lengthy period of time. As long as price stability remained, low rates were allowable. Low inflation, then, was the enabler.

Unfortunately, the days of low inflation are gone. Thanks to the pandemic’s myriad factors, including monetary and fiscal stimulus, high inflation now reigns over the land. Though slow on the uptake, the Fed finally decided to do something about it and has been boosting interest rates to the moon in record fashion. The sharp rise in the Fed Funds Rate from zero to 4%+ (soon to be) has torpedoed every asset class. Stocks, bonds, real estate, gold – you name it. Everything is in a bear market. Pessimism is pervasive, and chicken littles now crowd the Street, squawking of doom.

Investors have a choice. They can focus on the fire and brimstone. Or, they can focus on how to use the unfortunate events to their advantage. If you’re interested in the latter, read on.

Silver Lining One: Better Returns on Risk-Free Assets

High interest rates make it so you can get a better return on risk-free assets like Treasury Bills. Currently, 3-month Treasury bills yield over 4%, their highest return in 15 years.

As a result of the Federal Reserve taking rates to zero in 2008, cash became trash. The rate of return in savings accounts, CDs, and short-term treasury bills has been paltry. If you wanted any return on your money, you had to venture out on the risk curve to bonds, real estate, stocks, or crypto.

This is the case no longer. Yields across the board have risen. Treasury bills are the gold standard for risk-free instruments on Wall Street. For the uninitiated, a Treasury bill is the same thing as a Treasury bond, only with a shorter duration. T-bills are viewed as an instrument that’s as close to risk-free as possible because the U.S. government’s odds of defaulting on its short-term debt are assumed to be zero.

The chart below shows Treasury bill yields going back to 2000. You must go back to 2007 to find the last time a 4% return was available. The fact that the chart has gone from 0% to 4% over the past year shows how rapidly the Federal Reserve has been boosting interest rates.

Some brokers might allow you to buy Treasury Bills through your brokerage account. Otherwise, you can set up an account at www.treasurydirect.gov and buy them directly from the government. They are auctioned off multiple times a month, giving you plenty of opportunity to invest new money.

If you’re wondering if it’s worth the effort to buy T-bills yourself rather than park your cash in a high-yield savings account, compare the yields. Savings accounts have increased payouts, but the rise has dramatically lagged behind what’s available in T-bills. The best rate I can find among reputable savings account providers is 2.5% (Marcus by Goldman Sachs). Meanwhile, 3-month Treasuries are yielding 4.13%. I find the 1.63% difference to be worth the extra effort of going the T-bill route.

Bottom line: rising inflation and the commensurate climb in interest rates allow you to create income without taking risks. This is a godsend for conservative investors who have been reticent to brave the stock market’s volatility.

Silver Lining Two: Bonds are More Attractive

High interest rates have made bonds much more attractive for those looking to diversify outside of equities.

This second benefit is related to the first. Zero interest rate policy didn’t just depress the yield available on cash and cash equivalents. It extinguished nearly all the income available, even in long-term bonds. Usually, long-term bonds offer higher yields than short-term bonds, so you could go out along the curve and buy longer-duration bonds to lock in a higher income stream. But the past decade was far from normal in interest rate land. In 2020, the yield on 30-year bonds hovered between 1% and 1.5%.

Pathetic! Investors were all but guaranteeing negative after-inflation returns when lending money to the government for three decades. It was a bad deal.

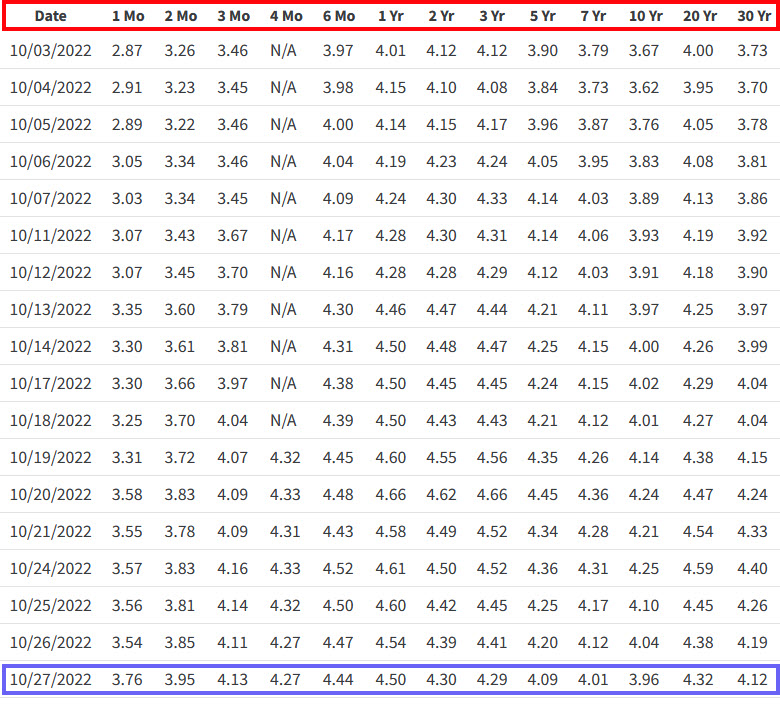

Fortunately, bonds’ payday has sweetened dramatically. 30-year yields recently approached 4.5%. Here’s the treasury yield curve chart, which shows the rates available at various maturities from one month to thirty years.

If you’re wondering why you would buy long-duration bonds when you can get the same yield on short-duration bonds, there are two answers. First, you lock in the rate for years instead of months. Say you buy a 3-month T-bill. Once it matures, you must reinvest in a new 3-month T-bill to maintain your exposure. But if interest rates decline over the next 3-months, the yield on the next T-bill will be less than the one that just matured. If the economy enters a recession over the next year or two and the Federal Reserve lowers rates, the T-bill’s yield will fall. But that won’t matter to those who bought a 10-year or 20-year bond because they’ve locked in the current 4%+ rate for a decade or two.

A second reason why an investor might want to buy a longer-term bond is that it provides more exposure to interest rate changes. And if you think that the Fed will be forced to lower interest rates over the next few years (presumably because inflation is under control and the economy slows), then long-term bond prices will rise, boosting the return to well beyond the 4% starting yield.

Bottom line: Rising rates have breathed new life into the bond market. Yields are much more attractive, and bond values have more potential upside when rates fall during the next recession.

Silver Lining Three: Stock Market on Sale

High interest rates have created a fire sale in the stock market. Discounts of this magnitude only arise once every five years, on average.

At its low this month, the S&P 500 was 27% off the highs; the Nasdaq was 38% off the peak, and the Russell 2000 was down 34%.

Never forget these two truths:

First, stocks become less risky the lower they go, not more.

Second, your instincts and the financial media make you think the opposite is true.

History teaches us that all bear markets are buying opportunities for long-term investors because they end. Every single one is temporary. This time will prove no different. Sooner or later, the stock market will have fallen enough to discount higher inflation and interest rates, even a recession. And then, stocks will recover. Bulls are born from the ashes of terrifying bear markets. While I can’t tell you when the current episode will end or how long it will last, I can tell you that if you wait for it to be over before you put money to work, you will miss the best part of the sale.

I can also tell you that with stock prices already down as much as they are, we are likely closer to the bottom than the top. Long-term investors should not fear buying now only to see stocks fall another 10% to 20%. They should fear not buying at all and missing out on the next market double that surely will come in the years ahead.

2008 was a formative experience for me. It was my first bear market, and I traded it as terribly as you might guess. One of my biggest regrets was that I was too shell-shocked to take advantage of what turned out to be the best buying opportunity of my lifetime. Fear gripped me, and I lacked the experience to realize the transitory nature of the decline. I’ve since created rules that demand I get more optimistic and put money to work during all downturns. Never again will a bear market go by without me planting seeds for future harvest.

The other critical lesson I learned was that stock picking is hard and unnecessary to succeed. Not all companies recover from each bear market. Indeed, some go bankrupt. Betting that the broad market will rebound by purchasing ETFs like SPY or IWM is a much higher probability wager than picking individual stocks.

Bottom Line: Higher interest rates are giving long-term investors a chance to buy stocks on the cheap. But it requires being willing to buy in the face of short-term uncertainty and trauma.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.