One of my all-time favorite movies is Catch Me if You Can. It’s based on the fantastic life of Frank Abagnale. He was a genius but a con man. The story was extraordinary, and the acting even better. Tom Hanks played the FBI Agent tasked with catching Frank, but it seemed he was always one step behind. Until finally, Frank’s luck ran out.

What I find fascinating and most relevant to this month’s newsletter is that Frank ultimately entered the FBI’s employ. As one of the world’s foremost experts on forgery and fraud, the government used him – a crook – to catch other crooks.

The logic makes sense. He knew, more than many, how to spot a swindler because he was one.

Do you want to know how not to blow up an account?

Blow one up.

In so doing, you will learn exactly what not to do.

Act as if you are a kamikaze trader, tasked with destroying your trading account. What would you do? What do you think are the most effective ways of lighting your cash on fire?

If you’re smart, you’ll engage in this practice using a paper money account. No sense in making the exercise more costly than necessary.

Once your cash hoard has dwindled toward zero, and you’ve explored every which way to lose money, then take time for reflection. Write down everything you did – and vow never to do it again. What strategies were worst? What practices generated the most damage? Jot them all down – and commit to doing the opposite.

This month’s newsletter is all about risk management. Within, we’ll highlight a handful of rules to follow and the best practices of veteran traders. There’s no need to learn all lessons firsthand. Do yourself a favor and learn from the stupidity of those who have come before you.

Of Lucky Ducks

Luck is ephemeral. It’s fleeting and fickle, untrustworthy, and otherwise unpredictable. It is, above all else, a short-term phenomenon. Those that can’t differentiate between luck and skill inevitably face a rude awakening. But don’t tell them that while the streak is still on! They’ll scoff and turn you away. “I can’t hear you! The money flowing into my account is too loud.”

Touché, mister lucky ducky. I shall return when your luck runs dry and your cash hoard dwindles. Whether it be tomorrow or next year, I care not. But know this. One day, likely sooner than later, it will.

Of course, these days, luck isn’t as rare as it once was. The U.S. government and the all-powerful monetary magicians at the Federal Reserve are on the side of risk assets. They’ve turned the profit spigot on full blast, and every Tom, Dick, and Harry seems to be banking coin. Ours is an age where stimulus flows freely, and the new must-have license plate is “EZ MONEY.”

The stock market is booming, especially in more economically sensitive sectors. The Russell 2000 is Wall Street’s go-to Index for tracking small-cap stocks. These are companies with a market capitalization under $2 billion. The Index just completed its best quarter in history by soaring 31.4% in the 4th quarter of 2020.

Traders must beware of the hidden destruction that awaits those who conflate luck and skill. As time passes and your number of trades increases, luck dissipates. What remains is a revelation of your skill (or lack thereof). If your trading system is robust, then profits are assured in the long run. Unfortunately, the reverse is also true. Shoddy systems and undisciplined speculators never last. They go broke or give up along the way once they’re unable to make magic strike twice.

Yo! That Equity Curve is Smooth.

Life is a journey, not a destination

Ralph Waldo Emerson

I like illustrating the benefit of risk rules through a trader’s equity curve. For the uninitiated, an equity curve is a line that plots your account value’s fluctuation over time. It tells the story of how your portfolio arrived at its current place. In other words, it’s the path you had to trod to arrive at today.

The ideal equity curve is trending higher and reflects that you’re building wealth over time. But the volatility matters too. If you have a trading system that suffers massive losses along the way, then you may quit before the inevitable recovery. Everyone has a different risk profile and temperament, but each trader must be comfortable with the typical drawdowns and volatility of whatever asset they’re holding. The following graphic plots two equity curves. Can you guess which one is preferable? The pink one exhibits high volatility. Profits come in short, fast bursts – but so do losses. The purple one plods steadily along. It’s a smoother path that places far less stress on your emotions.

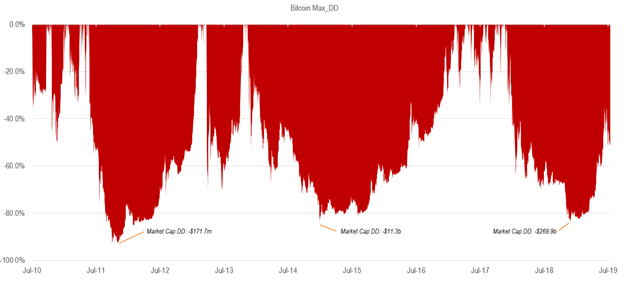

To drive the volatility point home, consider the recent history of Bitcoin. Insane drawdowns riddled its path to $40,000. Study the following graphic, which shows every correction and crash the magical cryptocurrency experienced between 2010 and 2019.

Even if you were fortunate enough to have bought bitcoin in 2010, would you have had the intestinal fortitude to stay put when your investment declined 80+% again and again and again?

Most wouldn’t.

Good risk rules keep you in the game. They smooth out your equity curve. I don’t just want to travel a path to profits. I want a pleasant route that makes it easy to stay the course. That, ultimately, is what risk rules are designed to do.

With that preamble out of the way, it’s time to unveil four of my favorite risk rules for active traders.

- Small Risk Per Trade

- Time Diversification

- Strategy Diversification

- Loss Limits

Let’s take a closer look at each.

Small Risk Per Trade

Our first rule appeals to your intuition. It’s easily digestible and satisfying on the way down. The world is full of gamblers who risked it big and lost everything. But do you ever hear about them? No! Instead, the media trumpets the rare unicorn who got lucky with his monster bet and made a mint. But, of course, they gloss over the luck part. See, it was his discerning eye, his incomparable business acumen, his penchant for superb stock picking, or some such nonsense.

Right, sure.

And yet, the public laps it up like a thirsty labrador. Worse yet, they follow suit and bet the ranch on some big idea that ends up melting their money faster than a nuke.

Professional speculators don’t allow a single bet to make or break them. They risk a small amount in each trade. The benefits are two-fold. First, it keeps the emotions in check. Consider the following quip from hedge fund manager Joe Vidich.

“Limit your size in any position so that fear does not become the prevailing instinct guiding your judgment.”

It’s easy to be a cold, calculating assassin when your trade outcome has little if any impact on your net worth and standard of living. But try taking the same detached, objective approach when your wager has the potential to gift you with six figures or steal all your wealth.

A second benefit to risking a small amount per trade is it allows you to survive losing streaks. Even the best systems suffer losses in a row. To get what a trading system is designed to give, you must weather both favorable and unfavorable winds. Traders who risk too much in each trade often give up during a losing streak, blowing their chance of recovery to smithereens in the process.

You must decide what is “small” in your case, but a common rule of thumb is to risk no more than 1% of your account in each trade.

Time Diversification

Spreading your eggs among different baskets is the classic example of diversification. But did you know you could also reduce risk by using the clock or calendar? Think back to the pair of equity curves above. The pink one is filled with large gains but outsized losses. You experience big wins, yes, but also big drawdowns. Feast or famine is your motto. In contrast, the smoother equity curve mutes your outcomes. The highs aren’t as high, but nor are the lows as low.

One surefire way to smooth out your equity curve is to spread your bets over time. Rather than entering 20 trades on the first of every month, you might place one trade per day throughout the month. In so doing, it will break up the correlation among your trades, allowing them to act more independently. Ultimately, your success would tilt toward how well you managed your positions instead of toward if you were lucky (unlucky).

You don’t have to be overly rigid about this tactic by forcing your trades to fit a pre-determined schedule. Just avoid clumping too many trade entries together. To the extent that you can spread out your bets, your equity curve will better mimic the purple one above.

Strategy Diversification

Let’s take the idea of spreading out bets one step further. Remember that your largest drawdowns will strike when all your trades are moving against you. Anything we can do, then, to reduce the correlation between trades should help minimize our portfolio volatility.

Instead of placing ten bullish bets once per day in each of the next ten days, what if I rotated between bullish, bearish, and neutral?

- Monday: Bull

- Tuesday: Bear

- Wednesday: Neutral

- Thursday: Bull

- Friday: Bear

- So on and so forth.

What are the odds that all my positions sour simultaneously? Slim to none. Like our time diversification guideline, this is a rule that requires some flexibility. Don’t force trades. The market trend will ultimately dictate whether you’re leaning bullish or bearish. Just be careful not to place too many like trades. In practice, this involves keeping tabs on your portfolio beta weighted delta. Read November’s newsletter if you need a review.

Loss Limits

When it comes to trading performance, how do you avoid having a terrible year?

Avoid having a bad quarter.

How do you avoid suffering a bad quarter?

Avoid having a bad month.

How do you do that?

Avoid having a bad week.

In all but the dumbest of cases, massive losses don’t arrive overnight. They begin as papercuts that were ignored and otherwise unattended. A bad day morphs into a bad week, a bad week into a bad month. The snowball builds until finally, you wake up one day, and your portfolio is down 50%.

Do you want a surefire way to make sure that never happens to you? Implement loss limits.

You want to allow yourself room to experience the usual ebb and flow of account fluctuation. But, when garden-variety losses turn into outsized, atypical ones – then is the time to act.

For instance, suppose I only risk 1% of my portfolio per trade. Assume further that my typical losing streak runs around 5 or 6 trades. Thus, through the normal course of trading, I will see frequent 5% to 6% hits to my account. I can’t establish a loss limit of less than that; otherwise, I risk halting my trading prematurely. In a situation like this, a limit of 8% to 9% might be more appropriate.

Another consideration is how long it would take me to recoup the loss. I don’t want to dig such a big hole that it takes me eons to climb out of. I want my equity curve to follow a path of two steps forward, one step back, three steps forward, two steps back. So on and so forth. What I don’t want is a curve that is two steps forward, ten steps back, three steps forward, seven steps back.

I think daily and weekly loss limits are too restrictive for someone who is swing or position trading. Monthly loss limits, though, are perfect. Suppose my risk per trade is 1% and the monthly loss limit is 15%. In considering whether it’s appropriate, I discover my performance only averages around a 2% return per month. Thus, it would take me 7.5 months to recoup the loss from a single bad month. That’s too long! Ideally, it should only take maybe 3 to 4 months tops to recover. Thus, an 8% monthly loss limit might be more appropriate.

We can differ on what actions to take when you hit your loss limit, but you must not increase risk. That is the minimum. At most, you could exit everything and go to cash. Most likely, you’ll do something in the middle. Close some trades, add some hedges. Get smaller so that your 8% drawdown doesn’t morph into down 20%.

Summary

Learn how to lose money, and then do the opposite. Use these risk rules. Massage and make them yours. They’re time-tested and will work together to temper your portfolio’s volatility.