This month’s newsletter provides a unique and entertaining tale of money and religion. We will unmask the gods that deliver profits and losses to traders everywhere. And divulge the differences between the being who reigns over equities and those who control derivatives. Prepare to have your understanding elevated, and your vision enhanced.

The Cult of Equity

Since the dawn of time, stock traders have practiced monotheism. Their religion worships a single God. He is the source of profits and pleasure, of losses and pain. He also exercises complete control over the entire dominion. From the first worshipers born from the Buttonwood Agreement to the modern-day believers in the far-flung regions of Asia, equity traders bow at the altar of the God of Direction. Him and him only do they serve.

But don’t mistake a single deity with a monochromatic mass of followers. There is a wide variety of colors in the cult of equity. How each believer goes about currying favor with the all-powerful differs significantly. Some seek revelation through balance sheets and income statements. They are fundamental analysts. On a side note, I’ve found them to be less fun and more anal in both personality and practice. Others, so-called technicians, find inspiration through following price. Like a witch doctor looking for signs in the bloody entrails of a freshly sacrificed fowl, these chart watchers seek signals from an odd array of indicators. Their stable of studies is ever-growing. Technicians are a curious group, never able to withstand the temptation to tinker. They’ll try anything to pierce the mind of the Direction God.

For both fundamental analysts and technicians, the aim is the same – to discover the market’s next step. And it’s not a query with many answers. In fact, it’s binary. Up or down, that is the question. Please the Direction God by getting the question right and blessings as Benjamins will fill your pocketbook. Dare to disappoint by betting wrong and losses await.

Like the deities of other mythologies, the God of Direction is known by multiple names. You may have heard him referred to as Sir Delta or Delta for short. Everything preached above regarding the God of Direction applies to Delta. They are the same.

A New Religion

For almost 200 years, monotheism flourished. From the founding of the New York Stock Exchange in 1792 until the mid-1970s, all speculators and investors, from ticker tape readers to institutional asset accumulators, gave praise to Sir Delta. He was the object of their affection, the giver of all gifts, the omnipotent being that stood between risk and reward.

And then heresy took root. Independent thinkers, mathematicians schooled in the dark arts of complex calculus and other nasty forms of number crunching, began to experiment. What started as thought exercises quickly turned into the creation of a financial Frankenstein. Ideas became theories. Theories grew into principles. Beliefs of the old religion were borrowed and expanded. Fresh, modernized doctrines emerged until a new religion was born. Only this time, one god became three.

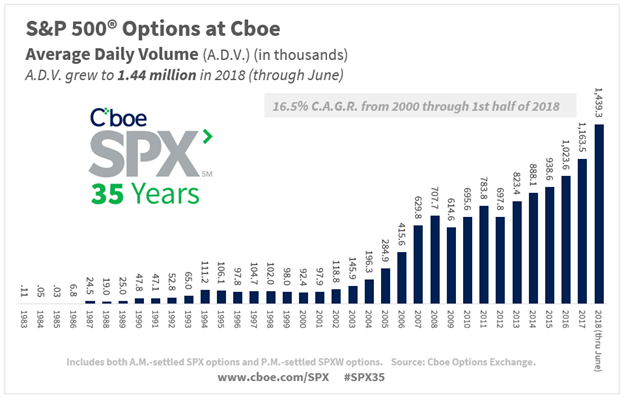

The heretics turned heroes were none other than Fisher Black, Myron Scholes, and Robert Merton. Their revolutionary efforts created what became known as the Black Scholes formula, and its accompanying pricing model eventually earned two of the three a Nobel prize in economic sciences. Not six months after their discoveries, the polytheistic religion of options was officially founded in 1973 at the Chicago Board Options Exchange (CBOE). Though other holy spots have emerged, the windy city remains the world’s largest options exchange. Traders were quick to embrace these newfound gods, commonly referred to as “the greeks.” The novelty of other deities beckoned to those tiring of Sir Delta’s simple ways. Equity trading was still immensely popular, but many decided to diversify their prayers. What began as a trickle of converts has grown to a deluge of devotees driving options trading volume to the moon.

Perhaps you are curious as to the characteristics of these strange new gods. How do they differ from Delta? What unique powers do they possess? And, maybe most importantly, how do you go about pleasing them so that you can merit their rewards? We’ll answer these tantalizing questions throughout the remainder of our newsletter.

Delta: The God of Direction

Delta is undoubtedly the most popular of the Gods for two simple reasons. First, he’s worshiped by both stock and options traders. The other two beings only exist in the options market. Second, as the God of Direction, Delta is the most potent force in virtually every trade you’ll do. He, more than anyone else, holds your fate in his hands.

Rather than tease out our cleverly crafted analogy between the greeks and gods in every facet of this month’s commentary, this is where I beg your pardon. I’m going to lay out the key characteristics of Delta, but in a much more straightforward manner than continuing the metaphor will allow.

Bullish positions have positive delta, and bearish positions have negative delta. Once you learn how to build neutral positions, you’ll discover they are delta neutral. Some traders refer to positive delta as “long delta.” For instance, “I’m long deltas in Microsoft.” Alternatively, negative delta is referred to as “short delta.” As in, “I’m short deltas in McDonald’s.”

There are six basic trades in the stock and options market. Three are bullish, and three are bearish. Said another way, three are positive delta, and three are negative.

Positive Delta (bullish) = Long stock, long calls, short puts

Negative Delta (bearish) = Short stock, long puts, short calls

There are multiple definitions of delta, but the one most relevant to today’s discussion is the “rate of change.”

Delta measures the change in a position’s value, given a $1 increase in the underlying stock.

In the equities market, just think of one share of stock as one delta. If you own 50 shares of Microsoft, then you have a +50 delta position. If Microsoft stock rises $1, you will make $50. If it falls $1, you will lose $50.

Alternatively, if you are short 75 shares of Apple, then you have a -75 delta position. If AAPL rises $1, you will lose $75. If it falls $1, you will make $75.

In the options market, it gets a little trickier because the delta for a call or put isn’t fixed, it’s variable. It can range anywhere between zero and 100 per contract, depending on if it sits in-the-money (ITM) or out-of-the-money (OTM). When the option moves ITM, the delta will rise above 50 and get closer to 100. When the option moves OTM, the delta will fall below 50 and get closer to 0.

The higher the delta, the more exposure you have. If you’re bullish on Amazon and build a +400 delta position by purchasing multiple call options, then prepare to see massive swings in your position value. Amazon moves roughly $80 per day. If Sir Delta smiles upon you and the stock rises tomorrow, you could rake in $32,000. But what if you incur the displeasure of the great God of Direction? If AMZN falls $80, you could rapidly rack-up a $32,000 loss!

Professionals pay careful attention to their deltas, both on individual trades and their entire portfolio. As you progress as a trader and begin mapping out your portfolio’s risk protocols, you will eventually create rules surrounding how much delta is appropriate.

If you’re interested in the best practices for how to please the God of Direction, I suggest diving headlong into the wonderful world of technical analysis. Its principles and patterns are used by both stock and options traders to determine the market’s next step. And, there isn’t a better place to start than last month’s newsletter, The Art of Charting.

Theta: The God of Time

Many view Sir Delta as incredibly hard to read. His mind is shrouded in mystery, making it tricky to consistently predict if he is going to lift stocks one day or smack them lower. Sure, technical analysis helps, but some still find forecasting direction taxing.

Thanks to Black, Scholes, and Merton, these disgruntled souls now have a new god to seek after, one cut from a much gentler cloth. Theta is the God of Time, and his actions are far more transparent and predictable than Delta’s. As such, there is no guesswork required. Worshippers of Sir Theta know from the get-go whether he’s helping or hurting them. They can even quantify just how many profits or losses will flow their way each day.

Let’s take a closer look at his key characteristics.

While delta is multi-faceted and boasts multiple meanings, theta does not. It’s straightforward and has a single definition:

Theta measures how much an options contract loses in value per day.

Both calls and puts lose value as time passes because they have less time to provide their owners with exposure to the stock. Contracts with six months will cost more than those with two weeks. But, eventually, that six-month contract will turn into a two week one. And so, day by day, options lose a bit of value as they approach expiration. It’s a phenomenon called time decay. Theta, then, measures the rate of time decay per day. When you purchase an option (call or put), we say that your theta is negative.

Most trading platforms show theta as a whole number if they’re displaying it “per contract.” For instance, let’s say the theta on a long call position is -10. You would be losing $10 per day. If it were -75, then you’d be losing $75 per day.

The first key point is that the God of Time always works against options buyers. He views them all as sinners, worthy of punishment.

Fortunately, Sir Theta just loves options sellers. His adoration is as reliable as the law of gravity. The money lost by options buyers goes directly into the pocket of options sellers. As such, those who sell options acquire positive theta. There are dozens of these so-called “cash flow” strategies which rely on time to generate profits. Some of the most popular are covered calls, naked puts, credit spreads, and condors. The lot of them are used by traders more interested in currying favor with Sir Theta than Sir Delta.

A side benefit to positive theta positions is they carry a higher probability of profit than when purchasing options or stock. With stock, your baseline odds are 50/50, like a coin flip. Long calls and puts are even worse. In contrast, you can use the aforementioned cash flow strategies to create a 70%, 80%, or even 90% probability of gain. It’s one of the best reasons to send offerings to Sir Theta.

Once again, you can measure the daily profit rate by viewing the theta number of your position. For instance, if you held a naked put with a theta of +25, then you would be making $25 per day. If the theta were +5, then you’d be raking in $5 per day.

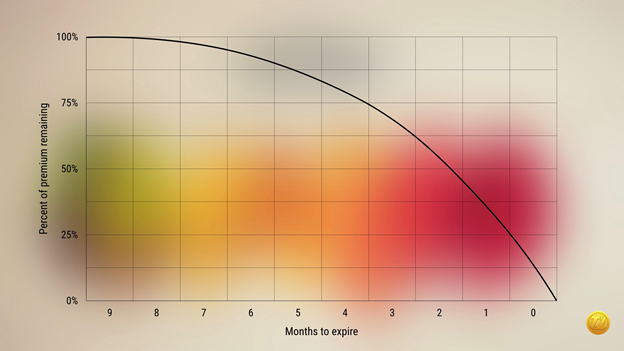

Interestingly, theta rises as expiration approaches. Said another way, the rate of time decay increases. And, it’s at an exponential rate. If we plot the rate of decay, it forms what’s known as a time decay curve.

Here’s a practical takeaway. If you find your success with directional trades to be lacking, then maybe you should explore theta plays. Sir Delta won’t miss you. If the idea of abandoning him is even remotely tempting, I’m guessing it’s because he’s been dropping bombs on your portfolio, not blessings. The God of Time is far more forgiving.

Vega: The Goddess of Volatility

The final deity of note discovered by the options founders is Vega. She’s taken on a female form for three reasons. First, she’s more complex. It takes time and requires a certain degree of sophistication to understand her wiring fully. Second, pulling profits from a Vega-based trade is more satisfying. And third, Vega trades are sexy.

Because of the complexity, discussions on Vega can get dense. We’re keeping this month’s commentary brief and high level.

Where Sir Delta was all about the direction of a stock’s movement, Madame Vega is about the magnitude of the move. Delta-centric worshippers ask, “which direction?” Vega worshippers ask, “how far?” and “how fast?” It’s all about volatility.

Just as their were two sides to delta and theta, there are two aspects to vega: positive and negative. You acquire positive vega by buying options, and negative vega by selling options. Furthermore, a trade that is positive vega is said to be “long volatility.” And a position that is negative vega is known as “short volatility.”

Vega measures how much an options value changes given a 1% increasing in implied volatility.

Suppose you buy a +20 vega call option for $400 when implied volatility is 30%. Per the definition, if implied vol rises from 30% to 31%, then the call option will increase in value by $20 to $420. Another 1% rise (from 31% to 32%) would further inflate the call premium to $440.

The most common positive vega strategies are: long calls, long puts, long straddles, long strangles, inverted butterflies, debit condors. If you find yourself deploying these types of positions, you are, to one extent or another, sensitive to Madame Vega.

As for negative vega strategies, these are the most common: short calls, naked puts, covered calls, credit spreads, iron condors.

Let’s say you enter an iron condor with a -10 vega for $100 credit when implied volatility is 40%. Remember, with an iron condor you are short the spread, so you only profit it if falls in value. If implied vol rises from 40% to 41%, then the condor will increase in value by $10 to $110. Another 1% bump to 42% would further inflate the condor value to $120. Due to your negative vega position, you are losing $10 per 1% rise in implied vol.

With the theory under our belts, let’s pivot to some practical takeaways.

Since buying options carries positive vega, it’s ideal to do so when implied volatility is low and likely to rise. A low reading in implied vol also means options are cheap. Alternatively, since selling options carries negative vega, it’s ideal to to do so when implied volatility is high. This would signal options are expensive. This is why professional traders track implied volatility as an indicator and use it to help with strategy selection. It suggests the optimal way to approach the Goddess of Volatility.

Implied Volatility Rank or “IVR” for short is my preferred study to measure volatility. It ranges between 0 and 100. Any reading below 25 signals options are cheap and/or implied vol is low. A reading above 50 means options are expensive and/or implied vol is high.

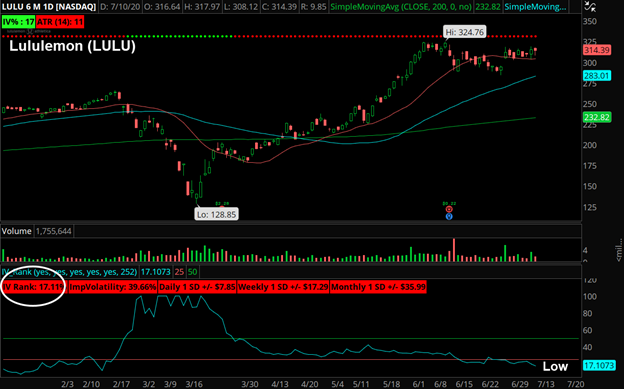

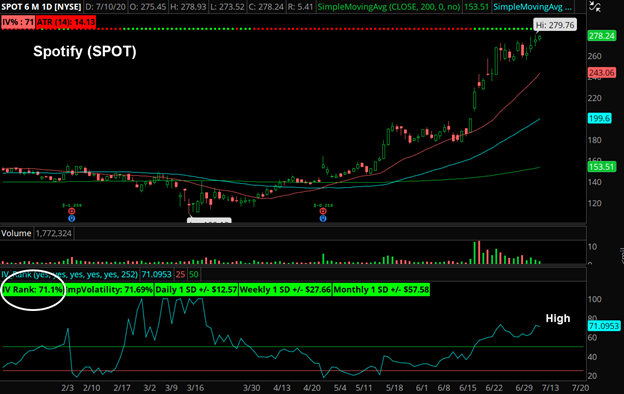

Here are a few examples:

Lululemon shares are bullish with an IVR of 17%. Because options are cheap, I’d prefer buying premium via trades like long calls or bull call spreads. Short options trades like naked puts or bull puts are less attractive.

Spotify is bullish with an IVR of 71%. Because options are expensive, I’d prefer short shorting premium via trades like naked puts or bull put spreads. Long options trades like long calls or bull calls are less attractive.

All Together Now

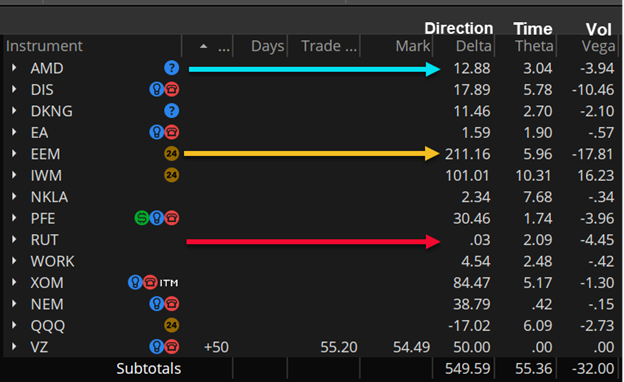

It would be nice if we could compartmentalize the Gods into separate spheres so the actions of one doesn’t impact the others. BUT WE CAN’T. They’re always influencing each others worshippers. It’s just a matter of degrees. All of your options positions will have some sensitivity to the Gods of Direction and Time, and the Goddess of Volatility. Take a look at the following position statement that displays the greeks for a variety of positions.

The first row (blue arrow) is an options trade on Advanced Micro Devices. As shown by the last three columns, Sir Delta, Sir Theta, and Madame Vega are all playing a role. Delta is gifting $12.88 per $1 increase in AMD stock. Theta is gifting $3.04 per day. And Vega is delivering $3.94 per 1% decrease in implied volatility.

The fifth row (yellow arrow) is a covered call on the Emerging Markets ETF (EEM). Delta is the largest greek by a wide margin at 211. Sure, the trade has some exposure to time decay and volatility, but it’s the stock movement that’s driving the bus. The aid of Sir Theta and Madame Vega will be insufficient to offset the wrath of Delta if EEM moves in the wrong direction.

The ninth row (red arrow) is an iron condor on the Russell 2000 Index (RUT). Delta is virtually non-existent, at 0.03. Theta is 2.09 and Vega is -4.45. Thus, it is time decay and volatility controlling whether the trade is profitable or not. This is an example of a worshipper who has abandoned Sir Delta in hopes that the God of Time and Goddess of Volatility would prove more rewarding.

With the content of this month’s missive now jostling around in your noggin, you’re officially better informed on the beings behind your trading performance. May they smile upon you.

Legal Disclaimer

Trading Justice LLC (“Trading Justice”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Trading Justice strives to make the information accurate, thorough and current, neither Trading Justice nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Trading Justice harmless from all losses, expenses, and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Trading Justice’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involve a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax, and accounting advisers, to determine whether such trading or investment is appropriate for that user.

Dennis Del Toro

Dennis Del Toro

July 13, 2020 at 10:05 PMThis was a very fun and entertaining read! Great analogies of the Greeks and how they behave as well! Awesome write up Tyler.

Tyler Craig

Tyler Craig

July 13, 2020 at 11:21 PMThanks Dennis!

Jonny W

Jonny W

July 15, 2020 at 12:40 AMWow! Tyler has done it again. Great spiritual expose on the cult of equity, and the most enlightened journey thru the Greeks I’ve read. And of course he wraps it up with some practical examples for us to learn from. Bravo Tyler!!