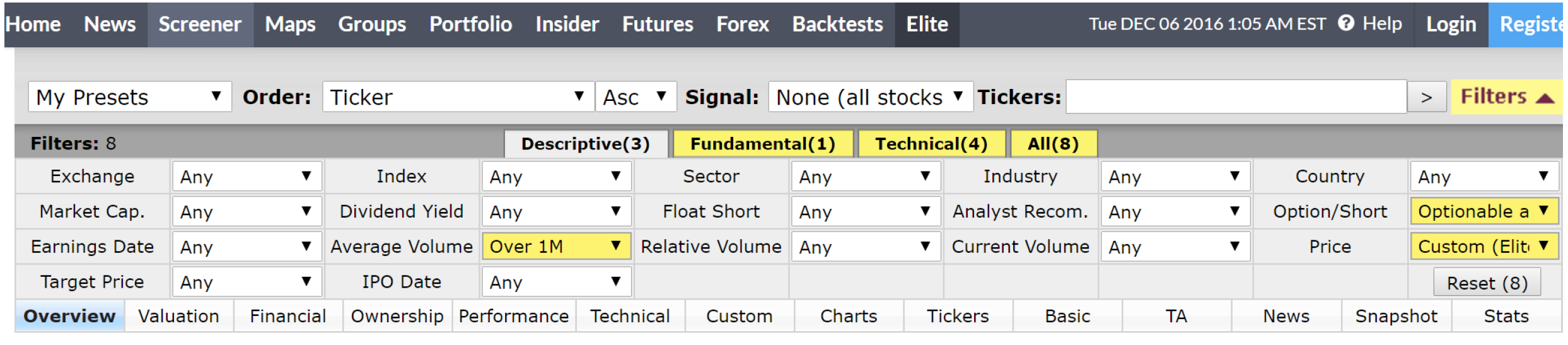

- Click on “Screener” Tab

_ - Then on the “Descriptive” Tab

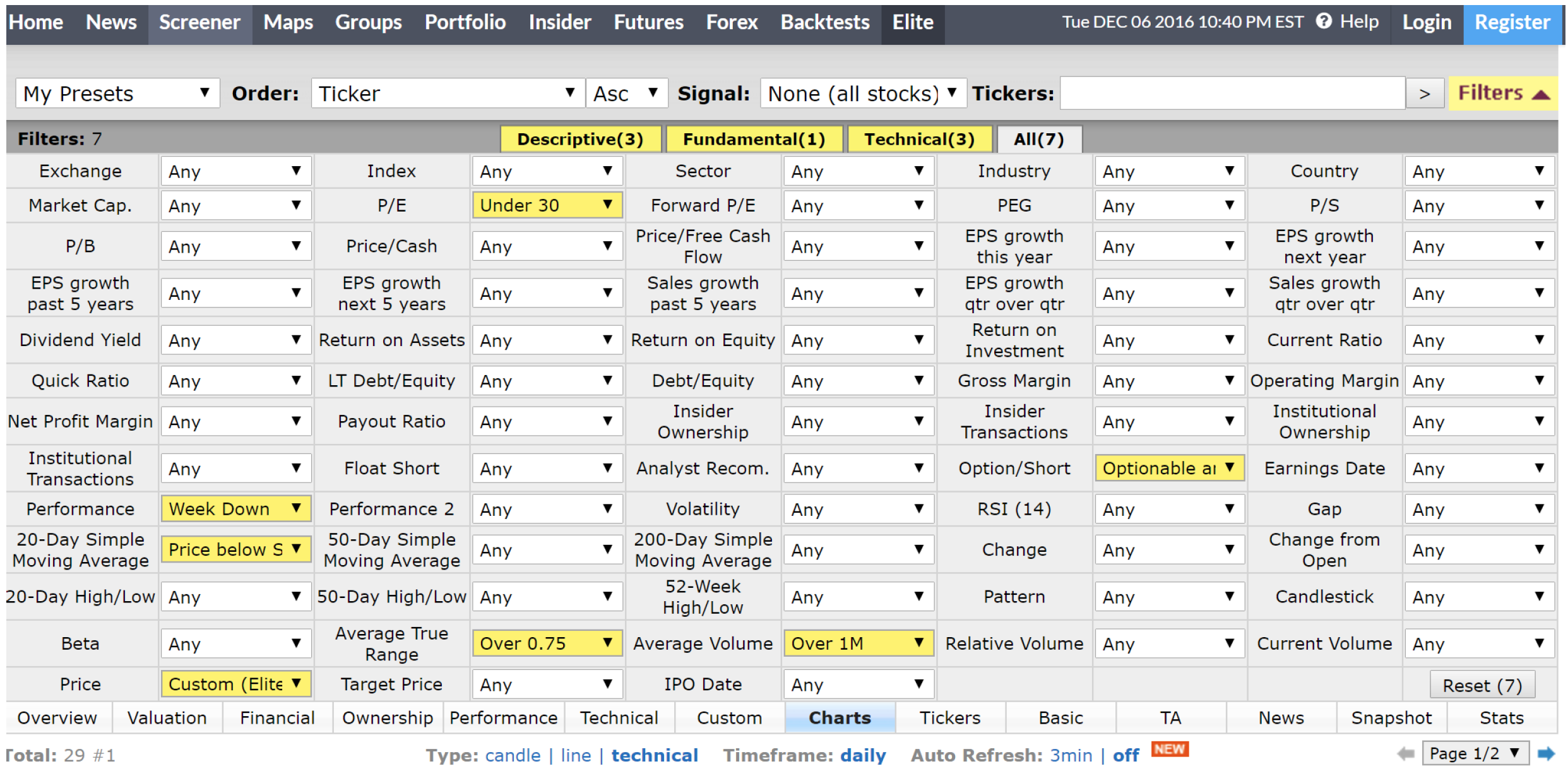

_ - Then go on the section “Average Volume” & choose *Over 1M

_ - Then go on the section “Optionable & Shortible” & choose “Optionalbe and Shortible”

_

- Then go on the “Price”, & Choose the *$10 – $50 stocks

_

_

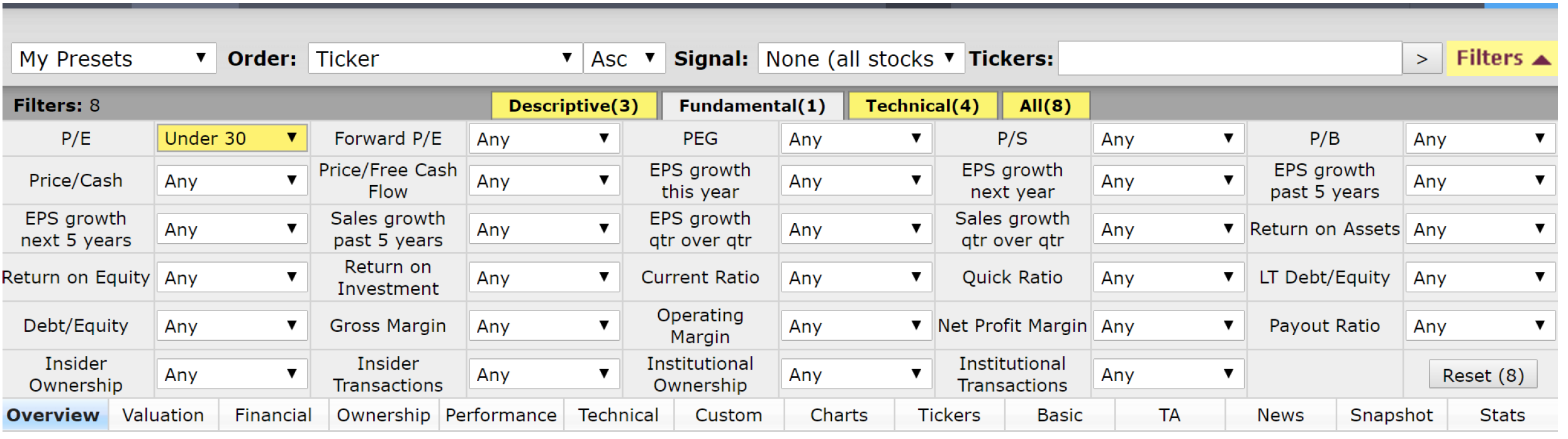

_ - Next go on the “Fundamental” Tab

_ - Go on the section “P/E”, & choose *company’s under 30

_

_

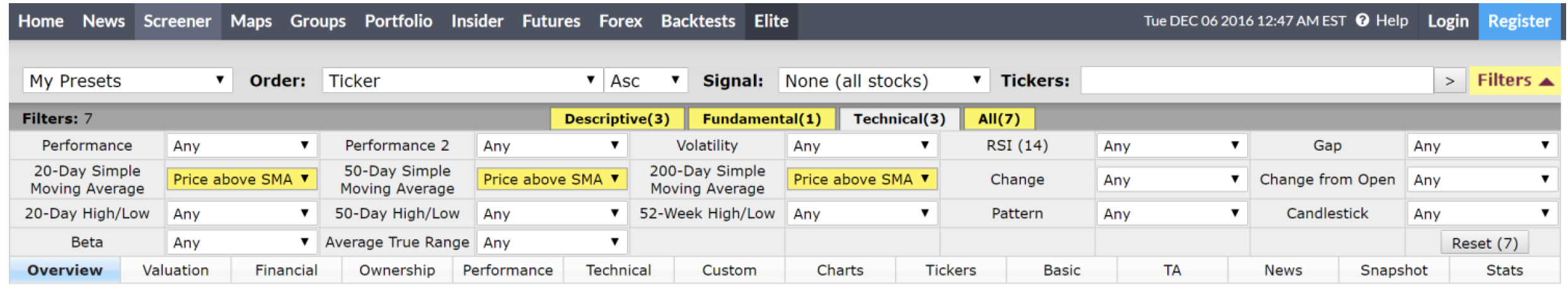

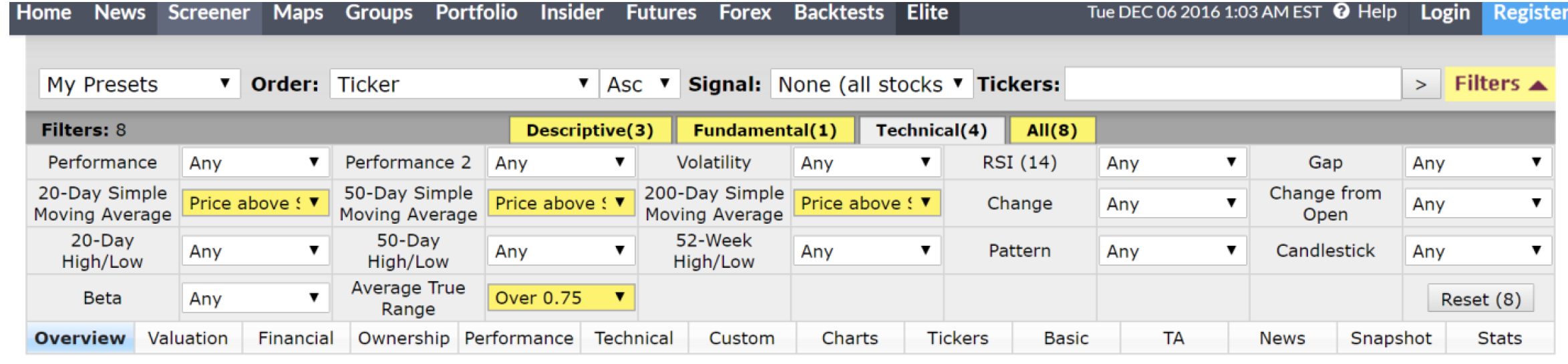

_ - Next go on the “Technical” Tab

_ - Look for the moving Average (Most common 20, 50, 200)

_ - Go on the section “20-Day Simple Moving Average”, & choose *Price above SMA20

_ - Go on the section “50-Day Simple Moving Average”, & choose *Price above SMA50

_ - Go on the section “200-Day Simple Moving Average”, & choose *Price above SMA200

_

_

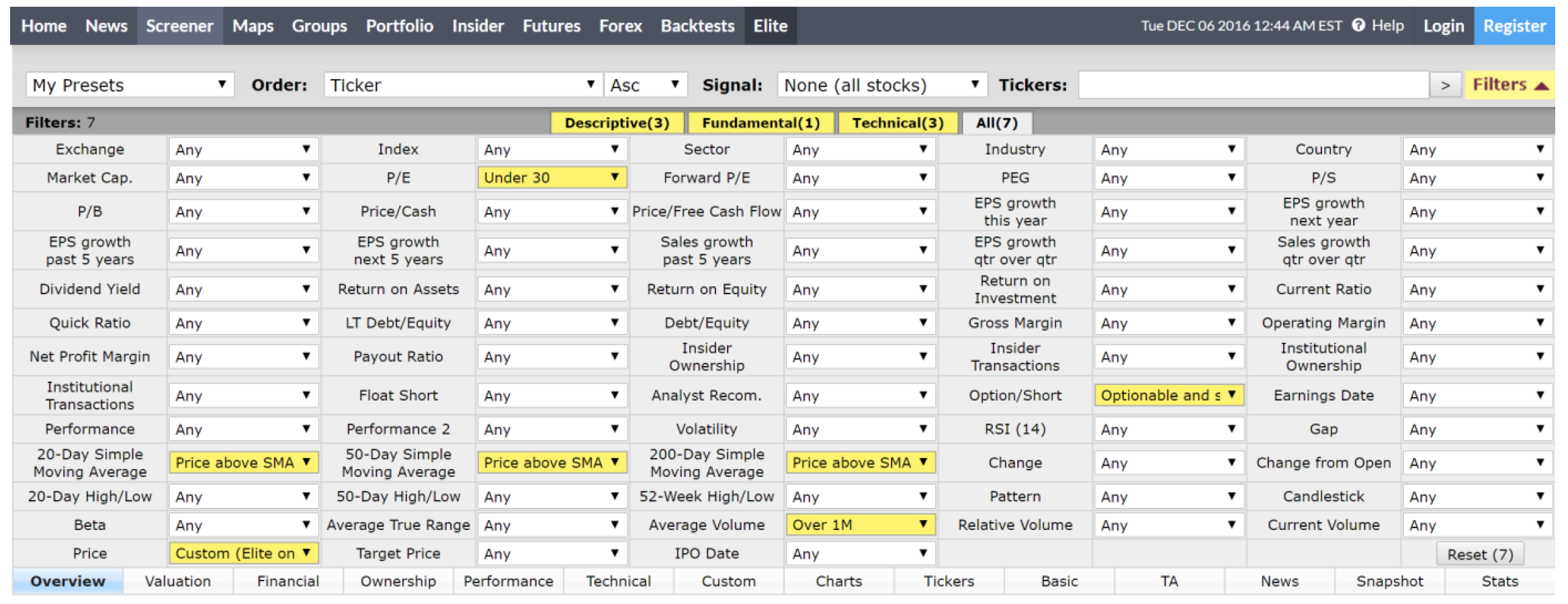

_ - Next go on the “All” Tab to check all 7 filters

_

_

_ - The only other filter that needed to be added was the ATR so go back to the “Technical” Tab

_ - Go on the section “Average True section”, & choose *Over .75

_

_

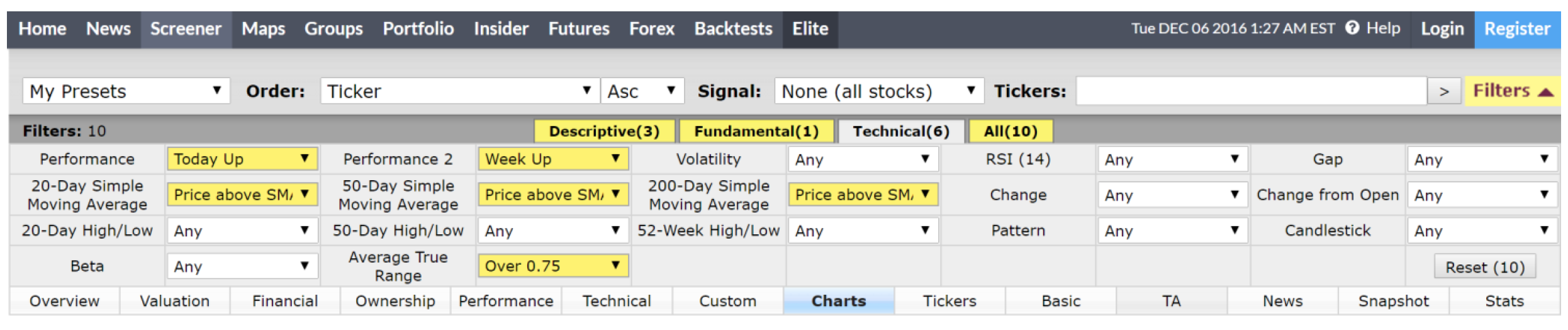

_ - *Note if the market if going braking out make sure it’s up for the *week and the *day – Go to the section “Performance”, Choose *Week Up

_ - Go to the section “Performance 2”, & choose “Today Up”

_

_

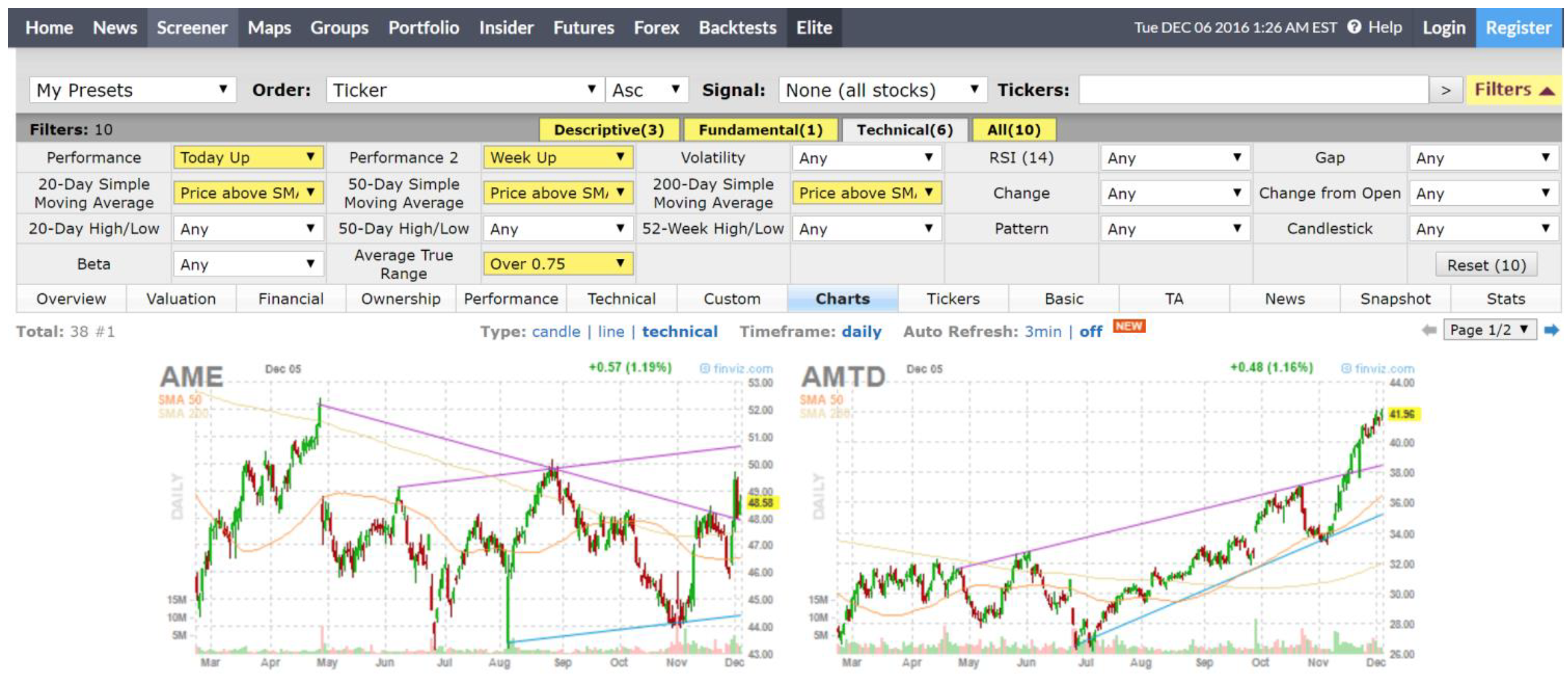

_ - Then click on the “Charts” Tab to see the charts of the companies that were filtered out How to make it Into a Pullback Scanned (Retracement)

_ _

_

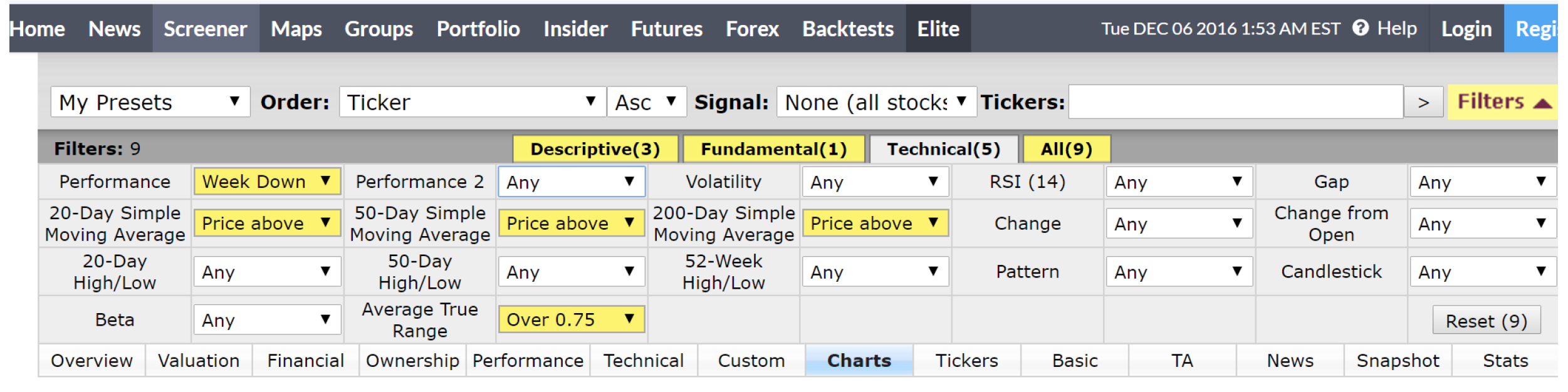

How to make it Into a Pullback Scanned (Retracement) - Go to the section “Performance” Tab, & choose “Week Down”

_ - Take out the “Today Up” How to create a Bearish scanned

_ __

__

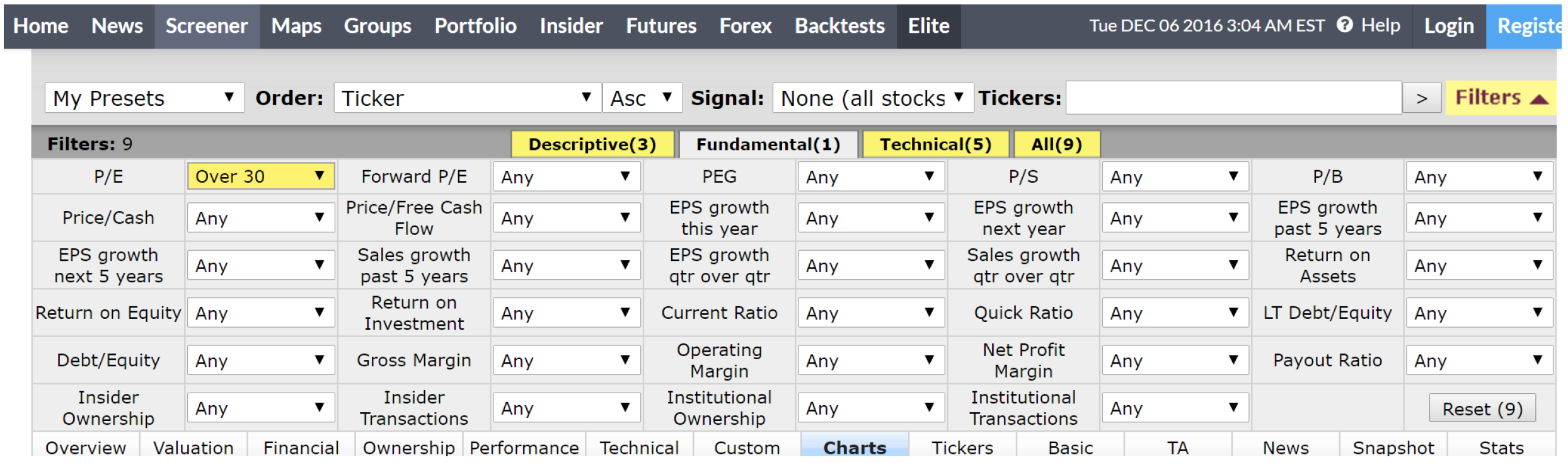

How to create a Bearish scanner - Change the fundamentals, Go on the “Fundamental” Tab – instead of undervalue companies we want overvalue companies, so on the section “P/E”, choose “Over 30”

_

_

_ - Then go to the “Technical” Tab and take out the *Moving Averages & *Performance

_ - Go on the section “20-Day Simple Moving Average”, & choose *Price below SMA20

_ - If you want to play around to see if you have different candidates, take out the SMA20 and

_ - Go on the section “50-Day Simple Moving”

_

You can also download this Step by Step PDF right HERE

KARL HOFFMANN

KARL HOFFMANN

November 3, 2017 at 11:22 PMGreat Scan!