Menu

Trading Justice Newsletter

Trading Justice Newsletter

We promise this collection won’t fall short in delivering everyday situations that teach us many valuable lessons in trading and investing. From Jazz to a bad family vacation (it happens to everyone, I suppose), to “The Little Buddha” and “The Matrix movies”, this particular collection is ripe with collective pearls of wisdom.

Ordinary situations with common people can teach you more about investing than you can imagine. A lost interview with Bruce Lee can teach you as well. Brazilian soccer too? Sure.

Without further ado, here’s what I’ve learned about investing from NON-investors.

We all know the old adage “Life is just like Jazz: it’s better if you improvise”. The problem is that there is a slight misunderstanding of what improvisation is. People usually think that improvisation happens just by throwing random notes into the musical mixture.

That is definitely not the case. In Jazz, specifically, you can improvise as long as you:

Improvisation is a technique that has to be mastered just like other musical techniques. And I can assure you that it is not an easy one to fully master.

Improvisation, for those from the outside looking in, also suffers from the iceberg effect: you get to see 2 minutes that blow you away while underneath that there are THOUSANDS of hours in solo practice, music research and studying and other THOUSANDS of hours in rehearsals spent together with the band.

That is why I don’t agree with that old adage. If you think improvisation equals randomness, then trading is not like Jazz, so, don’t improvise. But if you, like me, believe that improvisation is part of a complex system called Jazz, then trading is sure like Jazz. Don’t get fooled.

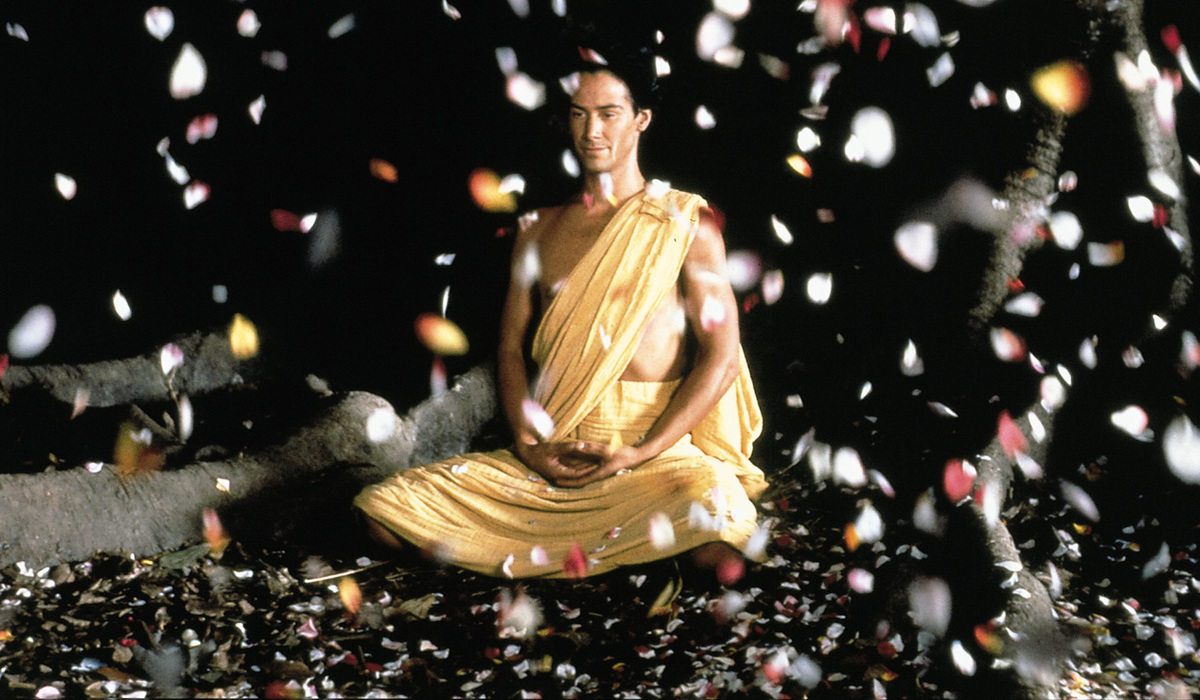

The broad markets are living in turmoil. Emerging markets too. As a consequence, many thoughts pass through my head all the time. One of them is the Buddha’s awakening scene in the 1993 movie “The Little Buddha”, directed by Bernardo Bertolucci.

Stories like Siddhartha’s enlightenment, described in the ancient scriptures, are inherently embodied with deep meaning, serving as an inspiration to us, mere mortals, through the eons.

Many successful investors used this same approach. They don’t participate in the madness. They don’t fall into this black hole of irrational behavior. This is something we as traders must aspire for. We should see this as a paradigm and drink from such wisdom.

The Bovespa Index is the benchmark index of about 60 stocks that are traded on the São Paulo Stock Exchange, the largest in Latin America. More than 50% of the Brazilian Stock Market is composed of money coming from foreign investors. Problems in other emerging countries can contaminate, leading to major sell-offs. Add to the mixture the uncertainty derived from the most awaited presidential election since the end of the military regime and you have that orange area on the chart. Investors fled from Brazil and bought US Dollars like madmen. In the end, rising above the turmoil and being the person who’s on the outside looking in has its benefits as the index is now hitting the all-time highs.

“Ignorance was destroyed; knowledge arose; darkness was destroyed; light arose.”

— ‘Somehow he is overwriting the system’s priorities.’

— ‘The human element will always be present. Compassion, fear, instinct will always interfere with the system.’

— Robocop (2014) —

We are not automated machines with AI capabilities. We are much more complex than that. Not even close to understand ourselves and we are already building machines our own images.

When a given system depends on us to execute it, we fail to deliver what it needs. We think too much, contextualize too much, hesitate too much, feel too much, analyze too much, think too much, fear too much, hope too much. No wonder why computers are so fast: they just execute the rules inside the system they were built to be running. We don’t.

But we can. Just like computers, we can run the rules without hesitation.

This is what we call the System-Thinking approach. It consists of a mindset that neutralizes our feelings and emotions. Fear, greed, hope, and despair, although part of our innate set of evolutionary capabilities, they are bad for trading systems. The System-Thinking approach brings order to this chaos, removing the (too much) human part from trading.

However, the System-Thinking approach is not a built-in functionality. We have to train it.

If we want to fly like birds we invent an aircraft. If the stars seem out of reach we invent a spaceship. If the ocean is too deep we invent a submarine. If we want to touch heavens we invent immortality. Why can’t we just pretend we are part human, part machine and run our systems without hesitation?

‘Kind of suit is this?

It’s not a… suit, Alex. It’s… it-it’s you.’

You are a guitar player. Your all-time idol is David Gilmour. Through the years you’ve collected all his records, both from Pink Floyd and his solo career. You’ve learned everything you could about his gig rig.

You’ve bought a nice Fender Stratocaster and tried as much as possible to replicate the sound of his guitars. You’ve scrutinized and practiced his licks until your fingers bled. You even got your tickets ready to go to Christie’s London to see his guitar collection. You are feeling sick for not having the funds to purchase the legendary Black Strat.

As much as you (and everyone else) have dedicated time and effort to sound like him, why are you still not the next David Gilmour?

Because his guitar is an extension of himself. The sound he gets from it, the groove, the feeling, the touch, the right bending of the strings, the way he approaches the instrument to get that sound we all love can only come from him and no one else. He hears the sounds in his head and uses the instrument to translate them into the physical world. The perfect translation came from honing and mastering the craft through the years.

You are a drummer. Try to sound like Neil Peart.

You are a saxophonist. Try to sound like John Coltrane.

You are an investor. Try to be Warren Buffett.

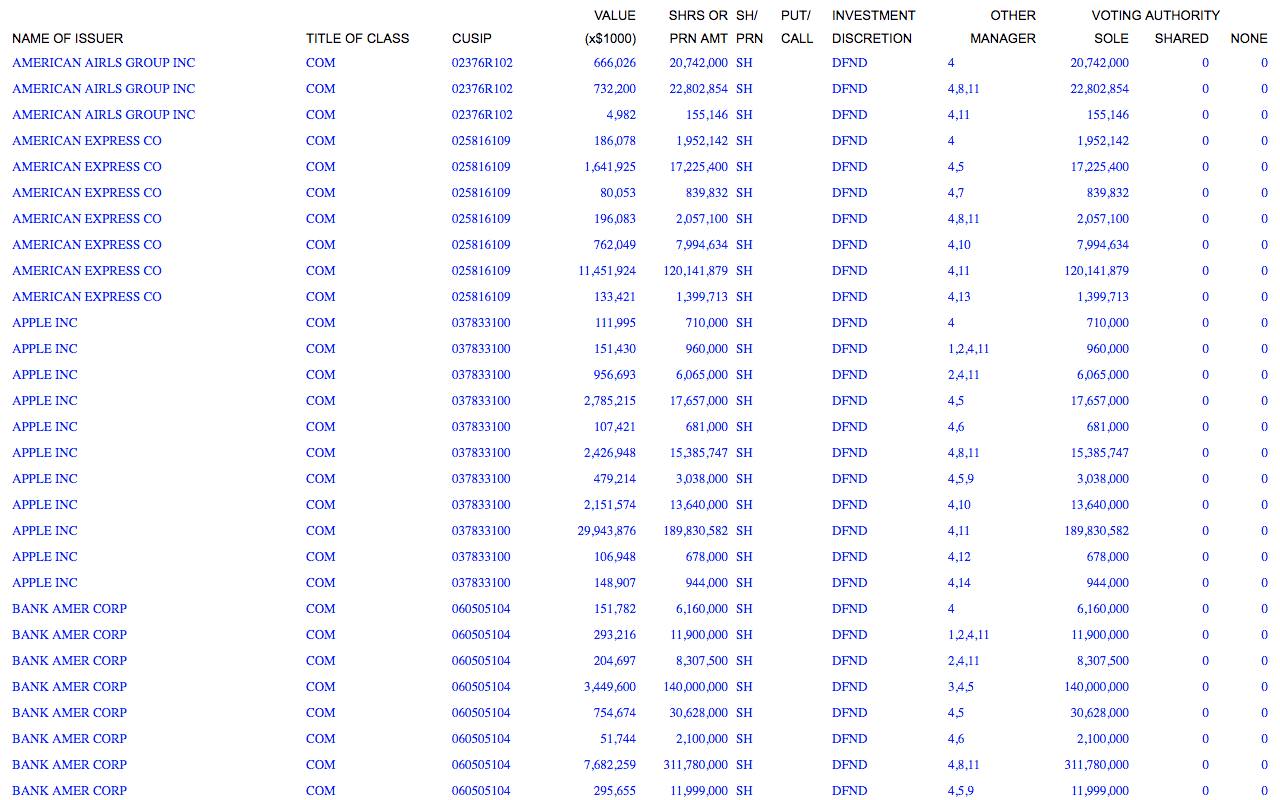

You get the point. Grabbing Buffett’s SEC filings and mirroring it won’t make you the next Warren Buffett. Learning the intrinsic value principle he uses as a base for his system like the back of your hand won’t make the Oracle himself.

Your portfolio should be an extension of yourself. Learn, hone and master the craft so you can translate what’s in your head to the physical world.

I love the Trading Justice podcast drops. It’s great to hear bits and pieces of wisdom—and humor—in no more than 2 minutes. There was this one drop in particular that had a great impact on me:

“Three reasons why military vets make great investors and entrepreneurs:

(1) Structure

(2) Discipline

(3) Ability to take the unknown step“

That is the truth in both the military and trading/investing worlds. You can’t take any necessary steps towards the unknown without structure and discipline. You can’t have discipline without structure. And in order to build structure, you have to have discipline. Try to remove one and the Trinity does not sustain itself. Clockwork.

I am not a military veteran myself but I come from a family that is mostly composed of military men, including my father and most of my mother’s side of the family. Many veterans and a few war heroes. They fought in many of the battles that took place in Brazil during the transition from Monarchy to Republic and also during World War II alongside the Allies in Italy.

Structure, discipline and the ability to take the unknown step were part of my upbringing. I’d never know they would play such an important role many years later when I decided to set up my own business and start a trading career.

“Empty your mind. Be formless, shapeless, like water. Now you put water into a cup, it becomes the cup. You put water into a bottle it becomes the bottle. You put it in a teapot, it becomes the teapot. Now water can flow or it can crash. Be water, my friend.”

— Bruce Lee interview on the Pierre Berton Show (1971) —

When it comes to trading, coherence can be a sin. The quality of being logical and consistent at all times, independently of the scenario that is developing in front of your eyes could be a deadly mistake.

You’re in love with a company and want to stuff your portfolio with some of its shares. Coca-Cola, Apple, Boeing, Berkshire, whatever corporation. You love it, you buy it. Right?

On the other hand, you hate a bunch of companies and would never hold them in your portfolio. Azul, General Electric, Facebook and so on. In fact, you would be glad to short the hell out of them. Right?

That’s when coherence becomes the 8th deadly sin. The companies you love are on a year-long bearish trend. The ones you hate are running up like hell.

Shorting a stock that’s on a bullish uptrend is a sin. Buying a stock that’s on a bearish downtrend is a sin. Trade what you see. Be water, my friend.

I grew up as a regular Brazilian kid in the 80s watching soccer games on the TV. My favorite team? Flamengo. Indisputably, they had the best soccer team at that time, winning each and every competition, each and every soccer tournament.

My all-time idol was Zico, the mythical number 10 shirt. Try a quick search on YouTube to find out who he is.

Well, long story short: every time I watched Zico playing I wanted to be a soccer player as good as he was. However, I would never go outside to play because I knew I would fail miserably in the sport (sports in general, to be honest). Remember there were no YouTube tutorials at that time. “How to play like Zico”. Forget about it.

No wonder I never learned how to play like him. Sounds logical, doesn’t it? Who’s going to learn how to play soccer by watching a soccer game? Really?

You won’t learn how to ride a bike by reading a book.

You won’t learn how to swim by cheering during the Olympic games.

You won’t learn how to play guitar by watching gigs on TV.

You won’t learn how to cook by memorizing recipes in a magazine.

How did Zico has become one of the most acclaimed soccer players in the world? Practicing and refining his skills over and over and over and over again. Replace Zico by Michael Jordan and you can apply the same rationale to basketball. Replace Michael Jordan by Peter Lynch and you get the financial markets equivalent.

Here’s the advice: Do it. Trade. Invest. Over and over again. Make money. Lose money. Get emotional so you get to know yourself better and spot your weaknesses. Control your emotions so you know how strong you are.

Most broker platforms offer you a simulated environment, there is no excuse for not doing it.

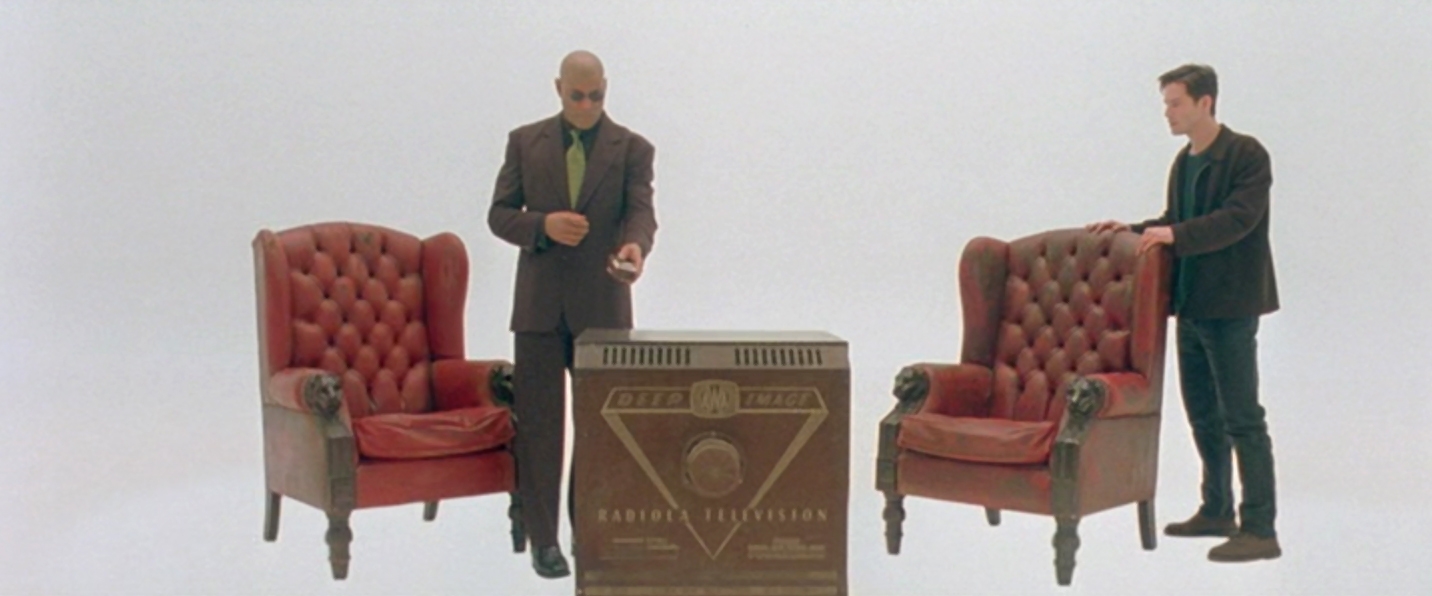

“What is real? How do you define ‘real’? If you’re talking about what you can feel, what you can smell, what you can taste and see, then ‘real’ is simply electrical signals interpreted by your brain.”

— “The Matrix” (1999) —

As a trader, how do you define real?

Good ol’ Germany sold its first ultra-long, 30-year bond with a 0% coupon just the other day (August 21st, 2019). The entire German yield curve is in the red territory in any duration. Very suitable for conservative (?) investors.

Uber, the most famous transportation network company in the world, with a 69.0% market share in the US, posted losses of $1 billion in the first quarter of 2019.

The garage days are over and billion-dollar startups are all over the place. From hospitality services to rubber boots. Forbes knows it all.

‘Disruptive’ geeks are obsessed with building ANNs (Artificial Neural Network) that promise to take the “buy low, sell high” to whole new levels. Your hard-earned money is now in good (cold) hands.

Buying gold?

Investing in solid businesses?

Adopting simple rules to trade?

We have lots to learn with the simplicity of the rats. Their only concerns are the cheese and the cats. Being simplistic and conservative in trading is the new black now that the ‘real’ is stepping into the realms of the surreal.

What is real, anyway?

I don’t care. I’ll go with the rats.

Mid August I’ve decided to follow my (really small) family on a short trip. The last time I took a week off was January 2014.

It didn’t work, as you can imagine. Four days later I was back—exhausted and poorer—while they kept on traveling. At least I drank good beer, ate good cheese, gained a few extra pounds and learned a lesson on investing.

Have you noticed how much time people spend planning their next family adventure? It can take months. A 1-week trip in August begins in January. People want to make it cost-efficient, which means, the most fun they can get for every dollar spent. The infamous budget: flights, hotels, pet shelter, passports, visas, health insurance, clothes, medications, fun for the kids, food, and alcohol for the grown-ups. Date and time for everything. Touristic spots sitting on a spreadsheet together with numbers. Mobile apps for every situation. It’s almost like people have graduated in planning excursions. Ph.D. and all.

Now, try to ask these people about their money. Net worth. Retirement. Legacy? Investments? … Anyone?

Nothing.

When it comes to money the approach is completely different. That is when a profusion of bad mindsets jump into the scene: shortcuts, ‘get rich quick’, hot tips, ‘top 10’ whatever, ‘tomorrow I’ll take a look’ etc.

Wrong priorities? Instant gratification? God knows. The fix is easy, though:

Replace ‘Fun’ for ‘Returns’.

‘Dollar spent’ for ‘Risk’.

There you go. Instead of ‘Vacation’, you have ‘Investing’. As traders, we are always seeking the best return we can possibly get for a said amount of risk.

We’ve got to teach these people that money is like a jealous lover. It seeks attention. If you don’t give it enough, it will leave you. Or at least it won’t be there when you need it.

Planning your investments, buying protection, practicing, refining and honing your trading skills, aiming for simplicity, having structure and discipline, being OK with failures, starting with a why and searching for meaning, rising above the turmoil, never improvising, adopting the System-Thinking approach, being flexible towards markets conditions and always listening to your mom, ALL these valuable lessons living silently inside common people disguised as ordinary situations.

As we continue building the Tackle Today blog, more lessons on investing from non-investor will naturally popup and will be immediately absorbed. For now, with collections #1 and #2, you had the opportunity to learn a total of seventeen of them.

We do hope they will help you with your financial education journey. We have much to learn in this life.

© 2019 Trading Justice. All rights reserved.